Ben Bernanke dealt the markets a body blow with his vision to end the current round of QE – markets may be able to handle turning off QE in concept but Bernanke’s details were just too much to ignore. It took a full cohort of central bankers to reassure the markets but cracks have shown in the bull-run edifice. China on the other hand acted like a bull in such a shop, smashing aside any pretence that their central bank is not afraid to taper back the free credit that has distorted their property markets and led to industrial over-capacity. While in the US, the government is expected to bow to the banks, in China, the government is in charge – period. Europe is sadly caught in between as their economies continued to sputter, ending the month with fresh concerns in the Club Med countries. Just in time for summer. Last but not least, tensions in the Middle East accelerated, not in relatively marginal Syria but more important Turkey and Egypt as their elected leaders attempted to impose more authoritarian rule and got hit with a backlash. One day they will understand that democracy means taking into account opposing viewpoints, not just imposing the tyranny of the majority. Events are moving faster than can be reported on, so apologies if this commentary is out-of-date by the time you read it.

This is the End, Beautiful Friend: While perhaps not as dire as the Doors made it out to be, the financial markets bolted halfway to the exits before pausing as they half-digested Ben Bernanke’s QE tapering announcement. But what did he really say? Basically, as long as growth remains strong (3.0-3.5%), unemployment continues to head to 6.5% and core inflation stays at or around 2%, then he believes that the economy will have reached “escape velocity” and be self-sustaining while maintaining price stability. This relatively benign scenario indicated possible modest cuts in the amount of the $85 billion in monthly purchases by the end of 2013 with a more systematic wind-down of the purchases by the middle of 2014. Maturing bonds will have their principal and interest re-invested. In other words, the balance sheet will not shrink, but will also not expand. The fly in this ointment is that the market is 100% dependent on this buyer of last resort and a reduction of government demand may cause the gushing supply of Treasury bonds to drown the private market demand, driving up interest rates non-linearly. Higher interest rates in turn threaten to blow out government budget deficits, forcing politicians to make unpopular choices around taxes and spending. Hence the Fed appears caught between maintaining its credibility and bowing to its political and banking masters. Q1 GDP was revised down to 1.8% growth, giving Ben an opening for further monetary support and an opening for delaying the taper if he wishes. This growth rate also fits the IMF’s projections as it fears that fiscal tightening (the payroll, Obamacare, and other tax increases and sequestration that took effect in 2013) will materially slow the US economy. Guess we shall see who is correct.

Looking ahead, Bernanke’s term is up in January and the implication is that he will pull the ripcord on his golden parachute. This opening gives President Obama the opportunity to appoint a more dovish (i.e., pro-QE) Fed Chair – Summers, Geithner and Yellen have all been talked about as leading the short list. The first two were tight with the President in his first term and Yellen would be the first woman to the position as well as at the front of the line as the current Vice-Chair. I lay odds that Obama will choose her. A confirming indicator is if she has a central role at the Fed’s upcoming Jackson Hole conference in August, as Bernanke is not expected to attend. But regardless, the easy-money instincts of these three is prone to undo Bernanke’s tapering plan and even open the door to increase the rate of purchases (i.e., expand QE). That would likely re-inflate risk markets as the Federal Reserve pumps more money into the banks and US Treasury. Interestingly, central banks are not waiting around as they sold a record amount of US Treasury debt the last week of June – $32 billion. Another way to describe it is their holdings of US debt fell 1% last week. While still less than the Fed’s purchase of $45 billion for the month, it marked three weeks in June when foreign banks were net sellers. Perhaps the Fed should re-assess its promotion of buying risky assets – being the sole buyer of “risk-free” debt in a falling market is no fun. In corporate bonds, those 30-year Apple bonds issued in May for 100 cents on the dollar traded at 89.4 cents at the end of June – a 10% decline in two months – now a 4.5% yield. Hopefully those Apple watches sell like crazy.

The recent US economic news, however, was generally “not bad” – but that is a step up. Job growth came in “good enough” at +175,000 in May (recently revised to +195,000) and +195,000 in June, close to the numbers expected to match population growth.

Unemployment stayed at 7.6% though the underemployment rate (including part-time, etc.) moved up to 14.3% from 13.8%. While not exactly what the Fed would be looking for, it could meet the criteria for the tapering schedule outlined by Ben Bernanke. Supporting the idea of some healthy-esque economic activity, the US automobile sales pace reached a five-year high as Americans bought 1.4 million cars and trucks in June, 9.2% more than a year ago and at 7.7% six-month increased rate than a year ago. Lower gasoline prices are also helping – I saw a price below $4 per gallon in the Bay Area yesterday (though not in San Francisco). Home prices also have stayed on the up-tick with sales of previously owned homes rising to their highest level in three-and-a-half years. New home sales also rose, this time to the highest level in almost five years. Even Chicago saw an increase in prices! On the supply side, a drop in home repossessions reduced the numbers for sale year-on-year. However, with the shift higher in interest rates recently due to Fed tapering talk, it will be of interest to see if these numbers hold and if the investment buyers of homes will keep up their purchases. With the Fed buying $40 billion in mortgage securities every month, this 20% rise in 30-year mortgage rates will put a black eye on its portfolio (it marks its book to market periodically to determine what profits are due to the US Treasury, if any. In the past, this has been a nice boost to government finances but should not be counted on as permanent income, just like the social security “surplus”). On the other side, US industrial production came in at 51.9 in June – worse than May at 52.3 but still above 50, indicating expansion. Revised consumer spending dragged down Q1 GDP growth to +1.8% from its earlier estimate of +2.4%. However, May retail sales growth was positive at +5.6% on average for those chain stores reporting monthly figures. Q2 appears to be coming in at a better pace than Q1 – the question is whether that is good enough.

Limping Along: The latest economic news for Europe continues to worry the markets – though in this case the sell-off in bonds that hit Europe were more from the US Federal Reserve’s actions than anything new on that side of the pond. Industrial activity as measured by PMI still showed a contraction but less of one than in May. Unemployment continued at its high of 12.1% for the Euro-zone and 23% for Euro-zone youth. Car sales hit the lowest level since 1993 in May, reversing April’s modest increase and then some. Upsetting the banking sector is the passage of new rules that would push the costs primarily to the creditors and shareholders, similar to what happened in Cyprus. Of course, taxpayer bailouts are still an option under “extraordinary circumstances,” exact definition unsaid but requiring the approval of the European Commission. The main concern about Europe is the contagion from the United States on rising rates that slammed into Europe as well, resetting Germany’s ten-year bond rates from 1.2% to 1.8% for example. With their more precarious financial situations, these countries can weather higher interest payments less well than the US. Responding to this financial upset, Draghi and Carney, the new UK central banker, pledged again to keep rates low… “pleaded again” may be more accurate.

Greece had a tough month with the pull-out of Gazprom from a major privatization deal expected to raise €800 to €900 million for the beleaguered country. In a desperate move to make the budget numbers for the upcoming troika review, the government closed down the public broadcasting TV and radio stations, laying off 2700 people temporarily (the 2013 target is 4000 layoffs), with an eye to partially rehire on a “temporary” basis. Even after the restart, the expected savings are expected to be around €100 million annually. Next the highly influential international index provider, MSCI, cut Greece from its developed market index, marking the first time that a country has been demoted to emerging market status. Even in the emerging market index, it will have a tiny weighting – 0.3% – it cannot compare to the Asian powers such as China, Korea and Taiwan. Interestingly, two Middle East markets were promoted to emerging market status: Qatar and United Arab Emirates. Finally, a junior party of Greek government pulled out of the coalition in response to the layoffs mentioned above (did it think that no layoffs were going to occur?), narrowing the alliance’s parliamentary majority but also leaving the two remaining parties more able to negotiate governance. Finally as the month ended, Greece was under review for the next €10 billion payout by the troika in July. Although the government faces a €3-4 billion shortfall, I think that they will still get the money. The troika is generous in that way.

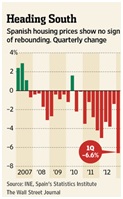

The untenable fiscal situation in Spain is expected to force the government to rein in subsidies on renewable energy by approximately 10-20%, which is expected to drive a number of solar firms out of business and hit investors and banks. With housing prices accelerating their fall in Q1 to the worst quarterly rate (-6.6%) during the financial crisis, banks and homeowners find no relief there as well.

To head off another solvency crisis, the Spanish central bank formally told lenders to limit cash dividends in order to preserve capital. Cyprus, however, needed to ask for more help from the EU as its largest lender, Bank of Cyprus, faced a cash crisis. S&P lowered Cyprus’ debt rating to SD (selective default), further jeopardizing the bailout. Portugal’s finance and foreign ministers resigned in early July as fissures erupted in the ruling coalition. However, like with Greece, the government held together, for now. France joined the privatization game as the country is on track to miss its 2013 budget deficit target, selling €738 worth of shares in its airport operator. 2014 looks to be more of the same which means more painful negotiations with the EU. The British bank Co-operative Bank went into government receivership, which wiped £1.5 billion of equity and subordinated debt from its books, with the depositors, senior bondholders and taxpayers untouched – which is how it is supposed to be. Finally, Italy may lose €8 billion on €32 billion in derivative contracts that it entered into when it joined the Euro in 1999. As with Greece, the country played with its debt and deficit figures to qualify for the currency and now is paying the price. At least the Italian government found a place to get some money – Italian fashion designers Domenico Dolce and Stefano Gabbana were fined €500 million for evading taxes. Guess I am back to buying my clothes at Target or Uniqlo. And who was in charge of the Italian Treasury when those derivatives were bought? Mr. Mario Draghi.

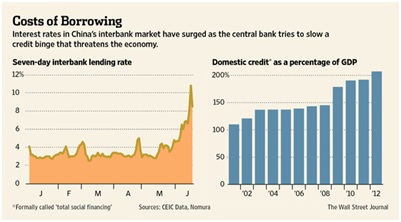

China Does Not Fool Around: If there was any doubt whether the Chinese leadership is frightened of making tough economic choices that misconception should be now put to rest when the central bank withheld funds from the financial system, forcing banks to scramble to cover overnight needs.

With bank and non-bank (“shadow bank”) dependency on short-term borrowing to finance long-term loans (sound familiar?), the loss of such daily liquidity laid bare the complacency of the Chinese financial system. Of course, the central government has more than sufficient resources to sustain the bubble, but for months banks and local lenders have been ignoring calls for reining in credit creation, particularly to the over-heated property market.

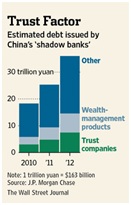

Stories about buyers circumventing the regulatory restrictions are well known – sham divorces, fake “home offices,” etc. Prices of Chinese homes are estimated to have grown 7.4% in June – the highest month-on-month increase since 2011. This insolence could not stand for long. The graphs above right outline the continued increase in credit creation and the spike in overnight rates inflicted on the market to work to correct it. We have discussed the increasing debt-to-GDP ratio a number of times in the past twelve months and will point out that 2013 credit expansion had already increased by 22% over 2012, which was 20% more than 2011 (as can be seen above). The “shadow banks” mentioned in the media have grown rapidly – see left. Think of them like those off-balance sheet special-purpose vehicles that helped blow up Citibank, Bank of America and others during the mortgage crisis. They take short-term money and buy long-term assets in a search for yield – primarily in real estate, CDOs, property companies, loans, etc. The CNY36 trillion outstanding on the left is equal to $5.8 trillion or 69% of Chinese GDP – one third of the 200%+ debt-to-GDP pictured above. Definitely enough to take action against – unlike what happened in the US and Europe who turned a blind eye to the fermenting mortgage crisis and then failed to act in a decisive manner. It looks like we may see a test of the effect of higher rates and their ability to balance the market where bureaucracy has not.

There is a high likelihood of slower economic growth with their slower credit expansion, but ideally it will be more sustainable. Industrial production has slowed, with year-on-year growth up 9.2% in May, down from 10% in January. PMI showed a tiny expansion in June (50.1) but the HSBC measure which takes into account more small- and medium-sized businesses showed a worsening contraction (48.2 in June from 49.2 in May). Subsidies were higher in 2012 than in 2011, growing 23% to CNY85.7 billion ($13.8 billion). An example of a troubled industry is steel where continued factory expansion and a slowing economy mean that capacity is roughly 20% too large already. Chinese overcapacity strains its neighbors, such as Japan, which enjoyed an export surge in May but still notched its third-largest trade deficit ever on higher imports of petroleum and communication products. I am still waiting for at least SOME Japanese nuclear power plants to come back on line…

Commodities Wrap-Up: Agriculture commodities shifted as the drought conditions from last year have become yesterday’s news. U.S. corn acreage is expected to total 97.4 million acres, the largest since 1936. While there will be dry weather scares, we expect corn supplies to largely recover from 2012. Current supplies as of June 1 totaled 2.76 billion bushels, the lowest level in sixteen years so some rationing between now and September is expected, giving South America the opportunity to step into the gap. The acreage expansion is partially due to the northern opening of traditional wheat land to corn tillage due to climate change, biotechnology and higher-than-normal corn prices. Hog prices surged in May and June, attracting trader interest to the point that the number of contracts outstanding in Lean Hogs exceeded the number against Live Cattle for the first time in the exchange’s 50-year history. Shuanghui’s pending purchase of Smithfield is a big part of the excitement with strong exports also in play. Is the buyout for cash? Not really – Shuanghui is borrowing $7 billion between the acquisition and refinancing of current debt. However, due to the high levels of leverage, an equity listing is on the table – and the whole deal may collapse in the end. This deal would be a logical potential casualty of the end of QE so they had better get it done soon. Finally to tie agriculture and Egypt and unrest together, Ethiopia is planning to dam the Nile River for electricity generation to a power-starved region. However, that would interfere with Egyptian electrical generation and irrigation – the key flooding of the Nile for local crops is threatened. The potential impact to national identity also makes this a uniquely explosive situation.

To help with Egypt’s current fuel needs, Qatar promised to pay for five shipments of natural gas starting at the end of July. Unfortunately the deal was reached in mid-June so we have to see if it is still in place. Like Egypt, fuel is highly subsidized in Indonesia. However, to try to cut back on the $20 billion in fuel subsidies that it pays every year, Indonesia announced sharp increases in gasoline (+44%) and diesel (+22%), though cash payments were made to poorer families to help ease the transition. On the other side of the spectrum, the United States grew its oil production by more than one million barrels (+14%) per day in 2012, the largest increase in the world and the largest in US history. The US also hit record exports of natural gas to Mexico, keeping energy costs down and its industries competitive, especially versus China. US gas exports to Mexico rose 19% to total 620 billion cubic feet, about 20% of that country’s consumption. A doubling of export capacity is underway, with phase one of the Romones pipeline project expected to be in operation next year. With natural gas prices down 11% in June to hit $3.56 mmbtu on a cooler summer, this seems like the right maneuver and certainly a lot smarter than much more expensive LNG facilities. These lower prices are coming on a cooler summer and despite the closing of a nuclear power plant which supplied 17% of Southern California’s power.

The collapse in Chinese demand for metals hit US coal exports as the oversupply in Asia lowered total coal shipments 31% in April. Prices are about half from the highs in 2011. Mining companies also are cutting capacity as metals prices have fallen dramatically. Everyone can imagine the tribulations of gold companies as the collapse in gold prices to the below the highest marginal production would mean halting production. However, copper and aluminum too fell to new recent lows as China demand evaporated, forcing writedowns. Newcrest wrote off A$6 billion (US$5.7 billion) and Barrick Gold laid off exploration and mine workers as its debt lost 20% of its value.

Trials also faced financial firms in the commodities business, with the potential trial of Jon Corzine, former CEO of MF Global, over the failure to supervise employees that illegally (in my opinion) transferred client funds to banks to cover losing bond positions. Finally sued by the CFTC, Corzine and his assistant treasurer (who actually made the transfers) face heavy fines (the CFTC can only bring civil charges, not criminal). Given his political connections, I would not be surprised if he beats the rap, though if there is a movement to punish bankers and the like, Corzine could be sacrificed to it. He is the target of multiple other lawsuits so a settlement is also a likely outcome to protect him from additional judgments. In other industry news, Morgan Stanley cut 10% of their commodities unit (30 positions), particularly in the European and Australian power markets. Finally, the Kansas City Board of Trade closed its physical trading pits after 137 years of open-outcry trading of grain. The original destination for hard red winter wheat trading, the small exchange was swept up by the CME, which has taken over its operations. And so, good bye.

Invest wisely!

David Burkart, CFA

Coloma Capital Futures®, LLC

Special contributor to aiSource

Additional information sources: Bloomberg, CFA Institute, Financial Times, New York Times, R.J. O’Brien, United ICAP and Wall Street Journal.

Disclaimer: Past performance is not indicative of future results. Futures trading involves substantial risk of loss. Coloma Capital Futures is registered with the NFA and CFTC under the 4.7 exemption. By no means is this newsletter offering any investment advice or suggesting to make any trade recommendations. Please consult an aiSource advisor prior to opening any managed futures accounts.