OPEC Production Increased to 29.0 million barrels per day (mbpd) during July, less than current quotas but shrinking the chronic underproduction deficit. Adding in Russia and the other OPEC+ members, output increased by 527,000 bpd, led by Russia. Kazakhstan saw production fall by -317,000 bpd due to field maintenance. Libya’s production was basically half its potential due to ongoing political strife but a deal struck should allow oil to flow again to maximum capacity in August (1.2 mbpd). The August meeting saw only a token increase of 100,000 bpd agreed upon despite Biden’s shuttle diplomacy to the region. OPEC’s latest 2023 forecast showed that it expects (hopes?) that demand will exceed its maximum capacity as India and China press forward with economic activity. If so, then oil should revisit the $100 level, if not higher by the end of this year / early next year. Looking further ahead, Saudi Prince Mohammed bin Salman announced during Biden’s trip that the Kingdom will increase its maximum capacity to 13 mbpd by 2027… but that would be its absolute maximum. Has peak oil finally arrived on the near horizon?

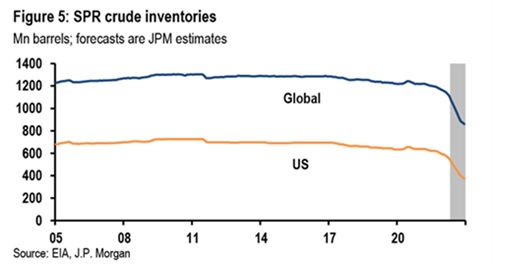

US Oil Production inched lower to 12.1 mbpd during July although companies expanded operating rigs from 595 as of July 1st to 605 as of July 29th. Per AAA, US average regular gasoline prices declined with the fall in oil prices, reaching $4.21 per gallon on July 31th, 63¢ lower from last month, though still double from the low two years ago. California ended July close to  $5.50/gallon, down the same amount as the national average. High gasoline prices were expected to continue as US refining capacity is down about 1 mbpd from the beginning of the pandemic (about 5% of capacity) with an additional 0.7 mbpd of capacity expected to be close by the end of 2023. More barrels were slated to be sold by the Biden administration – the graph right shows the change in global and US SPR levels. The Biden administration put out the idea of asking Congress to budget for buying oil to refill the strategic petroleum reserve after the current budget year – if accepted, that would begin as soon as October 2023. We shall see.

$5.50/gallon, down the same amount as the national average. High gasoline prices were expected to continue as US refining capacity is down about 1 mbpd from the beginning of the pandemic (about 5% of capacity) with an additional 0.7 mbpd of capacity expected to be close by the end of 2023. More barrels were slated to be sold by the Biden administration – the graph right shows the change in global and US SPR levels. The Biden administration put out the idea of asking Congress to budget for buying oil to refill the strategic petroleum reserve after the current budget year – if accepted, that would begin as soon as October 2023. We shall see.

China’s Refinery Throughput in June shrank nearly -10% from a year earlier, with output for the first half of the year down -6% in the first annual decline for the period since at least 2011. Crude throughput last month was 13.4 mbpd, according to data from the National Bureau of Statistics. Japan hopes to restart four more nuclear reactors in time to avert any power crunch during this winter, which would bring their total active reactors to nine and cover about 10% of Japan’s power consumption. Another five are licensed to produce power but are currently down for maintenance and seven others have been cleared to resume operations pending upgrades. Japan has thirty-three reactor sites. European Union lawmakers voted to uphold a ban on new combustion engine cars from 2035, though a final law needs to be negotiated. They would have to build a lot more electrical generation which seems like difficult challenge given their dependence on Russian natural gas and reticence to build nuclear power plants. Green-hungry California also faces that same timeline and challenge with current blackouts and nuclear plant shutdowns.

North American Crop Conditions were shaky though there was improvement in the good-excellent categories at the end of the month as decent rain revived crops. The latest forecasts had more improvements expected, although more rainfall will likely still be needed to completely end dryness concerns. Above normal temperatures were expected over the next 15 days, although not extreme heat. Demand for US soybeans is falling as bumper crops in South America eat into US export prospects, the US government said. Brazil may start exporting corn to China before the end of this year, per Agriculture Ministry officials, who are in talks with China. Brazil was also expected to harvest a record wheat crop of 9 million tons (USDA @ 8.5 mmt) in 2022, with growers sowing the largest area in the past 32 years. China reaped with a +1% year-on-year growth in total summer grain output, reaching 147.4 million tonnes in this year’s harvest, up 1.4 million tonnes from last year. The European Commission lowered its monthly forecast for this year’s corn harvest by -8%, or 5.9 million tonnes for a total crop of 65.8 million tonnes compared with 71.7 million forecast in late June and 72.7 million harvested last year. The Ukrainian harvest has begun with total acreage at 20-30% lower than last year, depending on the crop.

If you have an interest in geopolitics, I recommend Peter Zeihan’s new book The End of the World is Just Beginning (or watch this video) – for those too busy for either, the TL: DR is global civilization’s easy progress is behind us and accelerating aging demographics, increasing political regionalism, heightened resource competition and difficult technological implementation will make the future and quality of life more challenging.

Finally, for fun, we present a story on fussy Japanese penguins who rejected cheaper fish from their zookeepers who were trying to cut costs – if only we could eat so well! https://www.dailymail.co.uk/news/article-10990887/Video-shows-penguins-refusing-cheaper-fish-rising-inflation-forces-Japanese-aquarium-cut-costs.html

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource