- OPEC+ Reduced Their Production Cut to 7.7 million barrels per day (mbpd) from 9.7 mbpd starting in August, an implied increase of 2 mbpd at the July 15th Certain members such as Iraq were to not fully increase production to make up for over-producing last and this year, while other members such as Libya, Venezuela and Iran were intrinsically limited due to internal strife and international sanctions. Taking this into account, the effective cuts for August were estimated at 8.2 mbps or an implied increase of 1.5 mbpd. Russian oil and gas condensate output increased to 9.8 mbpd on August 1st and 2nd from 9.4 mbpd in July, already taking advantage of their expanded quota. Iraq announced that it would produce 400,000 bpd below its 3.8 mbpd current cut quota in August and September to compensate for exceeding its limit

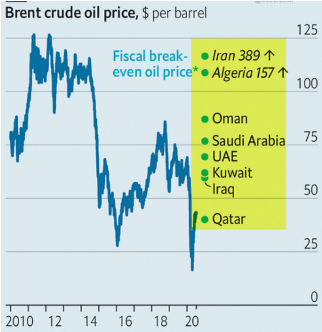

in May, June and July. This means that for those two months, Iraq will produce 1.25 mbpd below their pre-cut quota. Confusing OPEC+ production calculations further, JBC Energy noted that OPEC output rose 1.2 mbpd before the end of July as Saudi Arabia and other Gulf members ended their voluntary extra supply curbs that were in addition to the OPEC+ deal. Finally, The Economist estimated the required oil price for OPEC members to break even in their government spending (see right) – needless-to-say, is a lot higher than the current $40 per barrel. In short, OPEC+ has the capacity to produce a lot more but are still trying to manage overall production to maintain prices.

in May, June and July. This means that for those two months, Iraq will produce 1.25 mbpd below their pre-cut quota. Confusing OPEC+ production calculations further, JBC Energy noted that OPEC output rose 1.2 mbpd before the end of July as Saudi Arabia and other Gulf members ended their voluntary extra supply curbs that were in addition to the OPEC+ deal. Finally, The Economist estimated the required oil price for OPEC members to break even in their government spending (see right) – needless-to-say, is a lot higher than the current $40 per barrel. In short, OPEC+ has the capacity to produce a lot more but are still trying to manage overall production to maintain prices.

- US Production, particularly in shale regions, battled crippling cash flow and a spike of bankruptcies due to slack North American demand keeping prices low. US operating drilling rigs continued to fall slightly from 185 on July 3rd to 180 on July 31st, setting a new recent low. However total oil output ticked up to 11.1 mbpd. It is too soon to say that the drilling rig count stabilized but there seemed to be light at the end of the tunnel. Drilled (but) UnCompleted wells (DUCs) held to record levels, though a little lower than in May. These indicate potential production on a demand recovery as they require minimal capital and labor to bring on-line. Energy-related bankruptcies accelerated, claiming

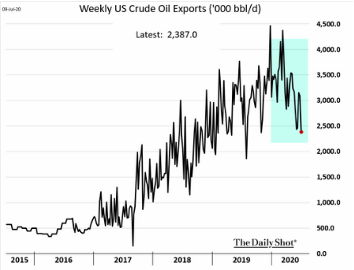

the names of Noble, Denbury Resources and California Resources. Meanwhile, large energy companies continued massive asset write-downs: Chevron Corp at $5.6 billion, mirroring those in recent days at Total, Royal Dutch Shell and Eni, and an anticipated BP write-down of up to $17.5 billion. Marathon Oil sold 3,900 Speedway gas stations to 7-Eleven for $21 billion and closed two refineries to conserve cash. Weekly crude exports as seen to the right came in at about 2.4 mbpd in July, off the highs of last year but quite respectable with the pandemic. The US increased oil supply to Europe in July for the first month since May, making up for output cuts from OPEC+ members, shipping around 1 mbpd (half of US exports). Finally, US oil exports to China reached almost 1 mbpd in July, and were expected to repeat in August.

the names of Noble, Denbury Resources and California Resources. Meanwhile, large energy companies continued massive asset write-downs: Chevron Corp at $5.6 billion, mirroring those in recent days at Total, Royal Dutch Shell and Eni, and an anticipated BP write-down of up to $17.5 billion. Marathon Oil sold 3,900 Speedway gas stations to 7-Eleven for $21 billion and closed two refineries to conserve cash. Weekly crude exports as seen to the right came in at about 2.4 mbpd in July, off the highs of last year but quite respectable with the pandemic. The US increased oil supply to Europe in July for the first month since May, making up for output cuts from OPEC+ members, shipping around 1 mbpd (half of US exports). Finally, US oil exports to China reached almost 1 mbpd in July, and were expected to repeat in August.

- On the Demand Side, China continued to gorge on oil with imports hitting a record 12.9 mbpd on with strategic reserve buying and bargain hunting (+1.0 mbpd month-on-month). Daily crude oil throughput in June climbed +9% from a year ago, hitting the highest level on record, as refiners ramped up processing on healthy margins amid a recovery in demand for gasoline and diesel. China processed 14.1 mbpd, up from 13.6 mbpd in May, beating the previous record set in December last year.

- China Needs Food as evidenced by its imports. For example, their customs data indicated that buyers imported 4.75 million tonnes of meat including offal in the first six months of the year, up +73.5% on the same period a year ago. The country still suffered under its deadly (to hogs) African Swine Fever, which continued to weigh on domestic pork production. Second-quarter pork output fell -4.7% compared with the same period a year ago to 9.6 million tonnes, according to Reuters that showed a 19.1% drop for the first six months of the year. While some of those meat products came from the US, Brazilian firms are the primary beneficiaries with a projected +33% rise of pork exports, to up to 1 million tonnes this year. Looking at grains, US crop conditions looked very healthy with the USDA rating 73% of the country’s corn and soybean crops in good-to-excellent condition at the end of July. The potential for weather impact is diminishing rapidly. China has already booked enough of the new crop of corn that would make corn exports the second-highest on record if shipped. Brazil’s upcoming soy crop is projected to increase +8% to 132.6 million tons with a small increase in exports and corn too is expected to increase slightly. The US will continue to face strong South American competition. Finally, Kentucky Fried Chicken announced plans to add 3D-printed chicken nuggets with lab-grown meat to its menu. YUM[1]

[1] https://mashable.com/article/kfc-3d-printed-chicken-nuggets/ Note that Yum! Brands operates the KFC franchises.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource