Commodities: Global

OPEC Production Declined Slightly, falling just under 28.9 million barrels per day (mbpd) during January (Bloomberg), still much less than the lowered quotas of 31.4 mbpd. A surprise increase from Nigeria was responsible for the improvement. OPEC+ announced no change at their January and February meetings but reserved the expectation to adjust production based on the impact of sanctions against Russia. Iran exited 2022 pumping just above 2.7 mbpd, compared with 1.9 mbpd in July 2020. At current prices, even when accounting for the discounts that Iran offers, that extra 800,000 barrels a day equals nearly $55 million a day — or about $1.6 billion a month. Iranian production is still way down from the 3.8 mbpd highs of 2017-2018. Russian state budget revenue from oil taxes declined in December to 511.7 billion roubles, the lowest since March 2021. However, total oil and gas revenues, which account for almost a half of total state budget proceeds, rose in the last month of 2022 thanks to a hike in taxes on gas giant Gazprom. January’s indications are no slowdown in Russian production of 10.9 mbpd but the IEA stuck to its forecasts of a decline of 0.5-0.7 mbpd over the course of 2023 due to sanctions.

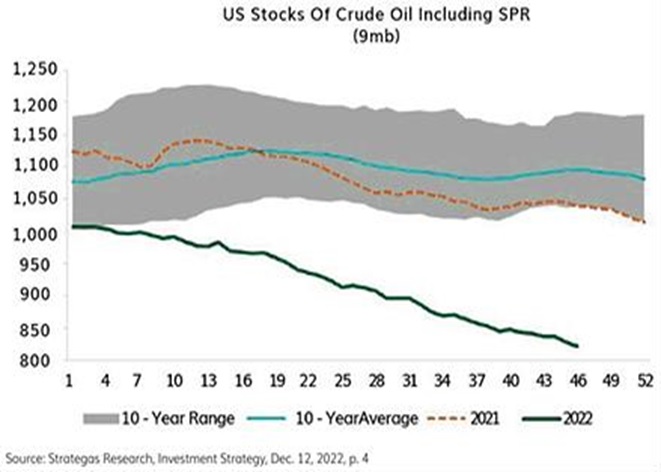

US Oil Production increased slightly to 12.2 mbpd despite companies decreasing operating oil rigs from 621 as of December 30th to 609 as of January 27th. Per AAA, US average regular gasoline prices reversed course, hitting $3.50 per gallon on January 31st, 29¢ higher from last month. The graph to the right shows the decline in US oil storage due to the Biden administration’s selling of oil to depress oil prices before the election. We shall see if he follows through on his statements to purchase oil at a future date. Looking ahead, oil output from the US’ top shale regions was due to rise by about 77,300 bpd to a record 9.38 mbpd in February. Reuters reported that US refiners will undergo double the amount of maintenance than normal at their facilities this spring due to delays in maintenance seen during the pandemic and because refiners ran more than usual to capture the high margins between oil and its products.

prices reversed course, hitting $3.50 per gallon on January 31st, 29¢ higher from last month. The graph to the right shows the decline in US oil storage due to the Biden administration’s selling of oil to depress oil prices before the election. We shall see if he follows through on his statements to purchase oil at a future date. Looking ahead, oil output from the US’ top shale regions was due to rise by about 77,300 bpd to a record 9.38 mbpd in February. Reuters reported that US refiners will undergo double the amount of maintenance than normal at their facilities this spring due to delays in maintenance seen during the pandemic and because refiners ran more than usual to capture the high margins between oil and its products.

Chinese Oil Product Exports were strong in December. China exported the most amount of diesel since March 2021: 20.9 million barrels. Likewise, gasoline exports that month equaled the record seen in October 2020 of 16.1 million barrels. Exports out of China in January may have fallen as more supply was likely kept domestically to meet Lunar New Year demand, but this would be temporary. Per Bloomberg and Platts’ surveys, Chinese oil demand was expected to rise by 0.8 mbpd to reach 16 mbpd in 2023 on COVID reopening and product production for export. In grains, China was forecasted to further boost its production of soybeans to trim its dependence on imports from countries such as Brazil and the US. The government plans to increase the planting area by about +6% to 10 million mu (667,000 hectares) in 2023 from a year earlier. Note that acreage expanded almost +22% last year. This would cause production to jump almost +24% to 20.3 million tons in the growing year ending September.

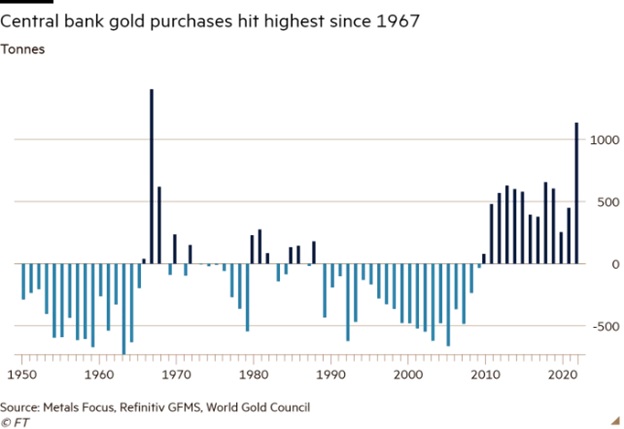

Argentina Sharply Cut its forecast for the 2022/23 soybean harvest to 37 million tonnes from a previous forecast of 49 million, as the country faces its worst drought in 60 years. The 2022/23 corn harvest estimate was likewise slashed to around 45 million tonnes, down from 55 million previously. However, Brazil’s 2022/2023 summer grain production will outgrow total storage capacity for the first time in 20 years amid expectations of a record soybean harvest. Brazil will harvest a combined 189.5 million tonnes of soybeans, corn and rice this summer, while it has total storage capacity for 187.9 million tonnes. Despite the record production expected in the current harvest, the soy volume harvested so far is approximately million tonnes, compared to almost 13 million tonnes a year ago. Corn planting was also behind but not seriously. Gold demand increased 18% in 2022 to 4,741 tonnes, the largest amount since 2011, driven by a 55-year high in central bank purchases. Turkey, China, Russia and the Middle Eastern nations led the buying spree. Demand among retail investors for bar and coins also jumped to a nine-year high in 2022.

corn harvest estimate was likewise slashed to around 45 million tonnes, down from 55 million previously. However, Brazil’s 2022/2023 summer grain production will outgrow total storage capacity for the first time in 20 years amid expectations of a record soybean harvest. Brazil will harvest a combined 189.5 million tonnes of soybeans, corn and rice this summer, while it has total storage capacity for 187.9 million tonnes. Despite the record production expected in the current harvest, the soy volume harvested so far is approximately million tonnes, compared to almost 13 million tonnes a year ago. Corn planting was also behind but not seriously. Gold demand increased 18% in 2022 to 4,741 tonnes, the largest amount since 2011, driven by a 55-year high in central bank purchases. Turkey, China, Russia and the Middle Eastern nations led the buying spree. Demand among retail investors for bar and coins also jumped to a nine-year high in 2022.

Finally, some observations to start the New Year:

Egg smuggling cases double at US-Mexico border as prices skyrocket – uncooked eggs are prohibited entry from Mexico into the US with the failure to declare agriculture items resulting in fines of up to $10,000. Outbreaks of bird flu in 2022 resulted in over 57 million US birds dying or being culled, which combined with inflation caused egg prices to more than double. The average price of a dozen large eggs was $1.93 in January 2022 but had risen to $4.25 by December, whereas South of the border the same number can cost as little as $1.20. Better than bringing in fentanyl.

On US migration patterns: New York’s population is the same as it was 20 years ago while Florida’s population has increased by 6 million. Seems the snowbirds went home to roost.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource