Macro: Americas

- The Federal Reserve Acted as Expected at their September

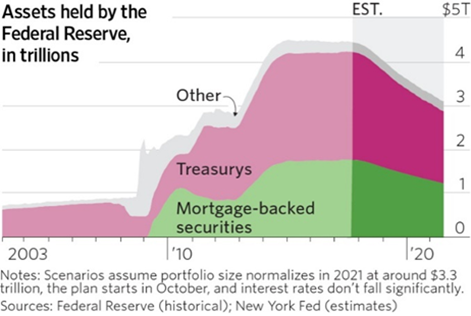

meeting with a modest start to reducing their $4.5 trillion balance sheet in Q4 2017 by not reinvesting principal and interest. The first quarter starts at $10 billion per month in non-investment and steps up to $50 billion over five quarters ($10 billion per quarter). As the WSJ graph to the right demonstrates, it will take about four years to reduce the balance sheet by $1.0 trillion so this large bond portfolio will be with us for almost a generation (assuming they stick to it – not likely in an emergency like a recession). To quote an observer, the slow manner in which the balance sheet shall be run-off was rather like “raking one’s lawn by picking up one leaf at a time.” Dr. Yellen announced that there should be a final rate hike at the December meeting with a surprising three rate increases expected by the Board in 2018. That seems a little aggressive but if the economy picks up then it could happen. Also with Yellen off the Board next year and other retirements/replacements, Trump has the opportunity to markedly change the leadership of the US central bank. Until those appointments are known and confirmed, any speculation about 2018 and beyond is pointless. In pension debt news, California’s main government employee plan cut the payments for two small utility districts by 70 to 90% as they have not been paying into the state plan. While negligible in the overall circumstance, how will these underfunded plans in worker-friendly states behave as the dollars get bigger? While no decision has been made, Puerto Rico’s portion of the hurricane relief money will put off resolving its debt crisis. Even if all of the $30 billion of estimated damage is paid for by the US government, the $74 billion in outstanding debt under bankruptcy would still be too massive for the island to handle with its poor infrastructure and overall mismanagement. Finally, Connecticut’s capital Hartford was downgraded by S&P to a rating of CC – essentially that default is certain. Loss of corporate headquarters and other ills (including unsustainable deficits at the state level) crushed the city’s budget (as well as its municipal bonds) despite the state being the richest in America on a per capita basis.

meeting with a modest start to reducing their $4.5 trillion balance sheet in Q4 2017 by not reinvesting principal and interest. The first quarter starts at $10 billion per month in non-investment and steps up to $50 billion over five quarters ($10 billion per quarter). As the WSJ graph to the right demonstrates, it will take about four years to reduce the balance sheet by $1.0 trillion so this large bond portfolio will be with us for almost a generation (assuming they stick to it – not likely in an emergency like a recession). To quote an observer, the slow manner in which the balance sheet shall be run-off was rather like “raking one’s lawn by picking up one leaf at a time.” Dr. Yellen announced that there should be a final rate hike at the December meeting with a surprising three rate increases expected by the Board in 2018. That seems a little aggressive but if the economy picks up then it could happen. Also with Yellen off the Board next year and other retirements/replacements, Trump has the opportunity to markedly change the leadership of the US central bank. Until those appointments are known and confirmed, any speculation about 2018 and beyond is pointless. In pension debt news, California’s main government employee plan cut the payments for two small utility districts by 70 to 90% as they have not been paying into the state plan. While negligible in the overall circumstance, how will these underfunded plans in worker-friendly states behave as the dollars get bigger? While no decision has been made, Puerto Rico’s portion of the hurricane relief money will put off resolving its debt crisis. Even if all of the $30 billion of estimated damage is paid for by the US government, the $74 billion in outstanding debt under bankruptcy would still be too massive for the island to handle with its poor infrastructure and overall mismanagement. Finally, Connecticut’s capital Hartford was downgraded by S&P to a rating of CC – essentially that default is certain. Loss of corporate headquarters and other ills (including unsustainable deficits at the state level) crushed the city’s budget (as well as its municipal bonds) despite the state being the richest in America on a per capita basis.

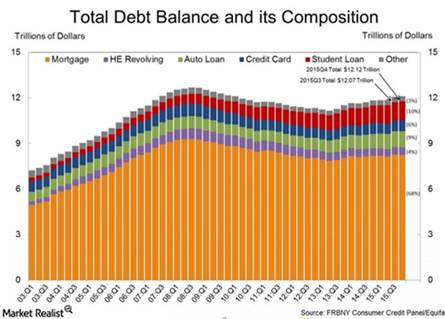

- Overall, The US is Holding Up as annualized Q2 GDP growth was revised up marginally from +3.0% to +3.1%, and Q3’s projection is at +2.7% per the Atlanta Fed – despite the damage from hurricanes Harvey and Irma. “Payday loans” data recently came out and with the low unemployment and relatively stable consumer debt, fewer Americans have turned to this high-cost debt – the percentage fell from 4.2% in 2013 to 3.4% in 2016 with 2007 (the first year of data) at 2.4%. Better but room to go. The US Census Bureau announced the highest median household income of just over $59,000 indicating an increase of +3.2% from 2015 to 2016. The poverty level fell to 12.7%, the lowest in ten years. Despite an improvement in one inequality index, it still seems at odds with the differen in wealth between the upper and lower levels of society. In other data, non-military capital goods orders excluding aircraft rose +0.9% in August (versus an estimated +0.3% gain and after climbing 1.1% the prior month). Other industrial measures for September were impacted by hurricanes so we will simply say that they were down and revisit post-recovery. Finally, while total consumer debt in dollars is still below the highs of 2009, the

proportion that is student-related continues to rise monotonically. Student loan debt is also the most likely to be 90+ days delinquent at about 11% of balances, where its been for the last four years. Auto loans, which also have been rising steadily, have seen their delinquencies turn upward during the last two years, though the percentage of balances (4%) is relatively modest still. For the record, mortgage-related debt is still the lowest at about 2.5% of balances delinquent and it still is declining slightly.

proportion that is student-related continues to rise monotonically. Student loan debt is also the most likely to be 90+ days delinquent at about 11% of balances, where its been for the last four years. Auto loans, which also have been rising steadily, have seen their delinquencies turn upward during the last two years, though the percentage of balances (4%) is relatively modest still. For the record, mortgage-related debt is still the lowest at about 2.5% of balances delinquent and it still is declining slightly.

Macro: Europe

- Europe Came Roaring Back from summer as the underlying economies performed well but the politics took a turn for the nasty. The German election did hand Merkel the expected win, in the sense of taking the most votes and seats in the Bundestag, but also handed her the challenge of how to form a government with only 1/3rd the seats and no easy way to get to a majority. The rise of the far-right voting bloc landed the nationalist AfD into the parliament with a 13% share, though it showed some signs of splintering afterwards. A governing vacuum during the next number of months in Europe’s largest economy will hamper EU or ECB policy direction. Nationalist or perhaps just separatist sentiment raised its head in Spain as Catalonia held a referendum for independence marred by a police crackdown ordered by the central government. Like the Kurds, there was no way that true independence would have resulted but the reaction by the higher powers was heavy-handed and counterproductive. We live in a time of social tension and while wisdom will prevail, it will be tested.

- But in the Meantime, the Numbers Look Okay. Unemployment in the U.K. dropped to 4.3% in the three months to the end of July, the lowest rate in 42 years. Wages, however, failed to keep pace with inflation (+2.1% versus +3.0%). The UK’s credit rating was lowered by Moody’s to Aa2 as a lagged result over PM May’s failed election and an increasing debt-to-GDP ratio of 90% in 2017. Annualized GDP growth slowed a little from +1.7% to +1.5%. However, Germany’s employment continues to improve and Portugal’s debt received an improvement by Moody’s to investment grade (to BBB-) as did Ireland’s (to A2). The IMF also made supportive sounds around Greek bank stability, cheering the market.

Macro: Asia

- China Growth a Little Less as the ruling Communist Party prepares for its five-year meeting October 18th. While Xi will undoubted preside over another triumphant year, he faces more challenges geopolitically as well as economically. A Q3 GDP increase of +6.8% (annualized) is following the script, though some of the underlying components missed expectations. Chinese industrial output in August rose 6.0% vs year ago, but the figure was below the median forecast of +6.6% (Bloomberg) and the lowest this year. Fixed Asset Investment also missed expectations (+8.2% versus +7.8%) as did Retail Sales (+10.1% versus +10.5%). The debt side we have talked about many times (e.g., last month the IMF raised the alarm that the level was “dangerous”) and perhaps it will start to have some impact as S&P lowered the country’s rating from AA- to A+ (as context, Moody’s cut their rating in May). Certainly the government has many assets domestically and abroad, but how reliable and resilient its provincial and municipal governments and old-line industrial firms are is still an open question. An example of concentration risk, Alibaba’s related money market fund, Yu’e Bao, has reached 25% of all money market assets – $211 billion – in only four years by offering more than double the 7-day interest than one-year bank deposit rates! Its money market rates are more than those offered on ten-year government bonds! Maybe, just maybe, there is some credit and / or liquidity risk buried in there which could offer an ugly surprise one day. Meanwhile the popular app WeChat has launched its own product at even a higher rate…

- Japan and Korea put up solid numbers last month with Japanese exports handily beating their forecasts (+18.1% versus +14.7% year-on-year), continuing an improving trend seen since the beginning of the year. Industrial production was also up +5.2%

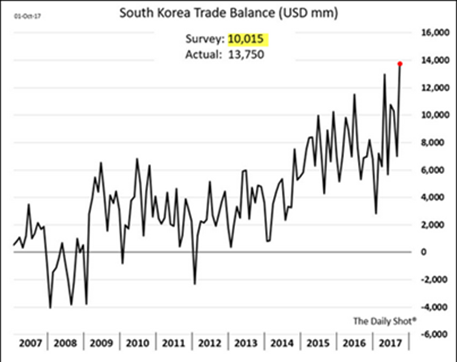

year-on-year, though shy of expectations of +5.4%. Korea put together a surprisingly high growth in its trade balance (see the right from The Daily Shot), though $2 billion in the jump in exports was related to gold exports tripling year-on-year from 22 tons to 60 tons. Under Korea’s trade agreement with India, gold is exempt from a 10% import tax, making Korea a popular location to route precious metals. This situation unfolded in July so its full ramifications are still unknown.

year-on-year, though shy of expectations of +5.4%. Korea put together a surprisingly high growth in its trade balance (see the right from The Daily Shot), though $2 billion in the jump in exports was related to gold exports tripling year-on-year from 22 tons to 60 tons. Under Korea’s trade agreement with India, gold is exempt from a 10% import tax, making Korea a popular location to route precious metals. This situation unfolded in July so its full ramifications are still unknown.

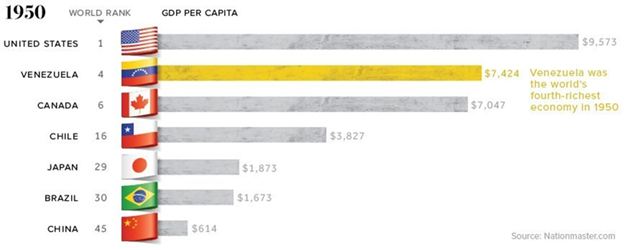

Finally, to reflect on history, we show a graph of the GDP per capita ranking of selective countries in 1950 in constant dollars. With the US and Canada undamaged from WWII, their high positions are expected though Japan at #29 only five years after WWII is quite an achievement. The surprise is Venezuela coming in at #4. An estimate for 2017 has the country coming in at #76. Essentially, the country has not moved economically in real terms for 65 years while the rest of the world has passed it by. While easy to blame Chavez and Maduro (and I do), the high was actually set in 1977 per the US Fed.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource

Additional information sources: BBC, Bloomberg, Financial Times, The Guardian, JP Morgan, PVM, Reuters, South Bay Research, Wall Street Journal and Zerohedge.