COVID-19

- Entering June, there are incremental signs of economic life amid the pandemic news. While we shall mention some historical numbers later (which look horrible), this section will mention some more recent high-frequency data. To start, in response to improving demand for air travel, American Airlines is planning to fly 55% of its domestic schedule and nearly 20% of its international schedule in July 2020 compared to the same period last year. The airline’s July systemwide capacity amounts to approximately 40% of July 2019 flying. Per the US’ Transportation Security Administration, in the last seven days of May, US airlines carried a daily average of about 305,000 customers per day,

three times the throughput seen at the average lows in April. This average however is just over 12% of the average trips seen a year ago, showing the recovery still to come. More concretely, the graph to the right shows the recovery of US trucking activity – again further to go but a more notable rebound is unfolding into the seasonal highs seen in June and July. At the fiscal level, OECD countries are passing supplemental stimulus packages. To give some select examples, Germany announced €130bn fiscal stimulus via a reduction in VAT (retail sales taxes), a direct payment to families with children and direct municipal support. South Korea added a third spending measure taking their extra spending up by $75 billion on with lending to small/mid-sized businesses and coupons to fuel personal consumption. Finally, China confirmed an additional

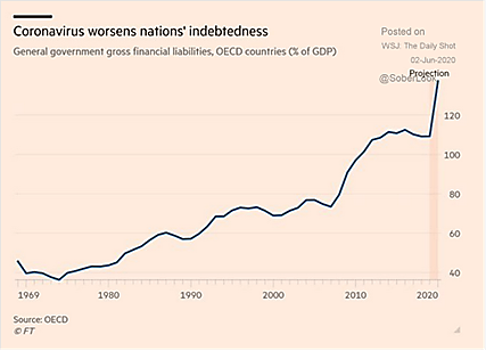

three times the throughput seen at the average lows in April. This average however is just over 12% of the average trips seen a year ago, showing the recovery still to come. More concretely, the graph to the right shows the recovery of US trucking activity – again further to go but a more notable rebound is unfolding into the seasonal highs seen in June and July. At the fiscal level, OECD countries are passing supplemental stimulus packages. To give some select examples, Germany announced €130bn fiscal stimulus via a reduction in VAT (retail sales taxes), a direct payment to families with children and direct municipal support. South Korea added a third spending measure taking their extra spending up by $75 billion on with lending to small/mid-sized businesses and coupons to fuel personal consumption. Finally, China confirmed an additional  $560 billion in business cost cuts, including tax exemptions, lower bank interest rates and waived contributions to social welfare funds as well as reduced prices for utilities such as electricity. This will be on top of $280 billion in additional fiscal spending and government bond issuances already announced. The OECD nation total is estimated to be $17 trillion of extra public debt or just under 140% of their GDP, an unprecedented level (see graph left from the FT). Emerging nations are also facing a tough time servicing debts as Moody’s estimated that emerging market defaults will match or exceed the 2009 financial crisis at 13.7% through March 2021. Given the economic importance of commodities in these markets, there could be cross-asset reverberations to the positive or negative.

$560 billion in business cost cuts, including tax exemptions, lower bank interest rates and waived contributions to social welfare funds as well as reduced prices for utilities such as electricity. This will be on top of $280 billion in additional fiscal spending and government bond issuances already announced. The OECD nation total is estimated to be $17 trillion of extra public debt or just under 140% of their GDP, an unprecedented level (see graph left from the FT). Emerging nations are also facing a tough time servicing debts as Moody’s estimated that emerging market defaults will match or exceed the 2009 financial crisis at 13.7% through March 2021. Given the economic importance of commodities in these markets, there could be cross-asset reverberations to the positive or negative.

- With Regards To The “Second Wave” of COVID-19 from the easing of restrictions, Denmark and the rest of Europe has not seen such an upswing of cases after up to seven weeks of reducing personal constraints. Iran on the other hand reported the highest number of cases in two months. Attentive observers may recall that Iran suffered a rash of high-profile cases amongst its senior leaders early in the pandemic, which in combination with the collapse of oil prices and impact of international sanctions, have devastated its economy and accelerated local inflation. Other countries, in particular Brazil, Mexico and India, have not necessarily reached the end of the “First Wave.” Regardless of country, our thoughts and prayers go out to those taken ill and we hope that they have access to proper care and recover fully.

Macro: US

- Q1 GDP was tweaked to fall at -5.0% annualized instead of the -4.8% annualized decline, and the Atlanta Fed estimated the Q2 GDP annualized decline at -55%, well below private economist estimates (which ranges from -25% down to -40%). Certainly the most recent historical numbers in April were bad – industrial production fell -11.2% month-on-month, durable goods declined -17.2% (though the core rate was a relatively modest -5.8%, about half of expectations), and retail sales were knocked down -16.4% – only non-store sales increased (i.e., on-line sales). The

monthly sales total of $403.9 billion was the lowest since 2012. However, the unemployment numbers that just came out for May surprised the markets as they fell to 13.3% from 14.7% instead of rising to the expected 19%. Nonfarm payrolls rose by 2.5 million instead of declining by 7.5 million. However, like last month, classification choices/errors/definitions skewed the numbers. We shall need further improvements in economic activity to confirm the direction. It cannot come soon enough as noted in the left graph that corporate failures accelerated to levels last seen in 2009. The list of high-profile bankruptcies included such names as Hertz, J.C. Penney, Stage Stores, Tuesday Morning and Le Pain Quotidien. The risk will be in the knock-on effects as rent payments came up short by an estimated $7.4 billion in rent for April that was not been paid, or about 45% of what’s owed. Per Bloomberg, mall operators received only 25% of their usual payments! Even mega-retailer Gap (which also owns Banana Republic and Old Navy brands) was sued over $66 million in rent non-payment. At least inflation is missing from the misery so far with core inflation (ex-food and energy) down -0.4% month-on-month and -0.8% month-on-month overall in April.

monthly sales total of $403.9 billion was the lowest since 2012. However, the unemployment numbers that just came out for May surprised the markets as they fell to 13.3% from 14.7% instead of rising to the expected 19%. Nonfarm payrolls rose by 2.5 million instead of declining by 7.5 million. However, like last month, classification choices/errors/definitions skewed the numbers. We shall need further improvements in economic activity to confirm the direction. It cannot come soon enough as noted in the left graph that corporate failures accelerated to levels last seen in 2009. The list of high-profile bankruptcies included such names as Hertz, J.C. Penney, Stage Stores, Tuesday Morning and Le Pain Quotidien. The risk will be in the knock-on effects as rent payments came up short by an estimated $7.4 billion in rent for April that was not been paid, or about 45% of what’s owed. Per Bloomberg, mall operators received only 25% of their usual payments! Even mega-retailer Gap (which also owns Banana Republic and Old Navy brands) was sued over $66 million in rent non-payment. At least inflation is missing from the misery so far with core inflation (ex-food and energy) down -0.4% month-on-month and -0.8% month-on-month overall in April.

- The Strain on State Budgets become more clear as Illinois became the first to tap the Federal Reserve’s muni support program, selling $1.2 billion in one-year notes at 3.82%, just compare that to US Treasury one-year bills at

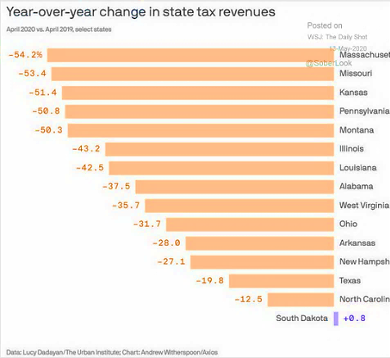

0.17% – even with Fed support! Recall that state faces $130 billion in unfunded pension liabilities. As the most indebted state, Illinois is flirting with junk status, and paying the price. New Jersey’s governor announced that state and local governments may have to fire 200,000 workers (half their employees) if $10 billion is not found. The graph on the right shows the change in revenues in selected states, underscoring the depth and breadth of the problem. On the other hand, part of the $3 trillion in federal spending will find its way into state coffers indirectly at least and also the Federal Reserve backed by the US Treasury supported the state/city bond markets to ensure low borrowing costs. This situation is far from being resolved even with a successful economic reopening. At least the US is not Argentina which achieved its ninth sovereign default after failing to make a $500 million payment on foreign debt.

0.17% – even with Fed support! Recall that state faces $130 billion in unfunded pension liabilities. As the most indebted state, Illinois is flirting with junk status, and paying the price. New Jersey’s governor announced that state and local governments may have to fire 200,000 workers (half their employees) if $10 billion is not found. The graph on the right shows the change in revenues in selected states, underscoring the depth and breadth of the problem. On the other hand, part of the $3 trillion in federal spending will find its way into state coffers indirectly at least and also the Federal Reserve backed by the US Treasury supported the state/city bond markets to ensure low borrowing costs. This situation is far from being resolved even with a successful economic reopening. At least the US is not Argentina which achieved its ninth sovereign default after failing to make a $500 million payment on foreign debt.

- There Was No Federal Reserve Meeting in May and the June meeting expectations were thought of “more work to be done” and “we are ready to help,” though there are always those chatting up a further drop to negative interest rates

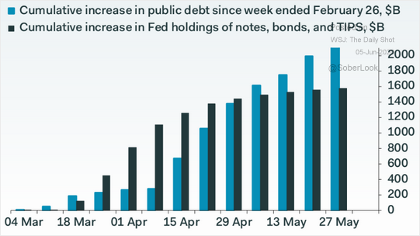

. We doubt that. The Fed began to execute on its series of debt-buying programs, though there was still plenty of capacity at the end of the month. Its balance sheet passed $7.1 trillion by the end of May, but that is a slowdown in the growth rate from April’s rate of +$1.1 trillion. May was a comparably modest +$400 billion! As the graph to the right there is a gap forming between the Fed purchases and Treasury issuance that will drive rates higher unless Powell steps in. Therefore, I expect the Fed buybacks to increase at some point in the near future. Certainly US companies were active by issuing a cumulative $1 trillion in investment grade debt since the beginning of the year – a milestone usually not reached until November.

. We doubt that. The Fed began to execute on its series of debt-buying programs, though there was still plenty of capacity at the end of the month. Its balance sheet passed $7.1 trillion by the end of May, but that is a slowdown in the growth rate from April’s rate of +$1.1 trillion. May was a comparably modest +$400 billion! As the graph to the right there is a gap forming between the Fed purchases and Treasury issuance that will drive rates higher unless Powell steps in. Therefore, I expect the Fed buybacks to increase at some point in the near future. Certainly US companies were active by issuing a cumulative $1 trillion in investment grade debt since the beginning of the year – a milestone usually not reached until November.

Macro: China

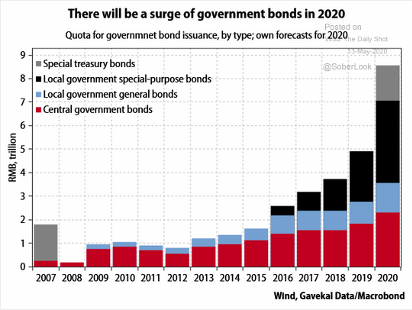

- China’s Economy Received Major Stimulus as mentioned earlier (over $800 billion) sending its total debt higher (see graph right – not just going to harp on US indebtedness). As the statistics are not openly available, estimates of

Chinese unemployment indicate that as many as 130 million people were either out of work or furloughed in the first quarter and the real unemployment rate could have hit 12% in March, according to BNP Paribas. In comparison, the official rate was 5.9% in March and 6.0% in April. Retail sales were down -7.5% year-on-year April, a recovery from down over -15%. Industrial production reportedly increased by 3.9% year-on-year, to only a little lower than a few months ago. US-China trade talk heated up as China passed a security law to expand authoritarian control over Hong Kong and a number of grain imports from the US were canceled. The UK government responded to China by offering a path to British citizenship for 300,000 pre-unification Hong Kong residents. Finally, in what may have the longest-term impact, the bankruptcy of a Chinese tech firm put into question $1.7 billion in “keep well” implicit guarantees on its foreign-issued bonds. If the government rules that these bonds are actually not guaranteed, there will be a hit to the price of $100 billion of such bonds or firms will be forced to formally pay the cost of a guarantee. In this stressful environment, will foreigners happily take the penalty?

Chinese unemployment indicate that as many as 130 million people were either out of work or furloughed in the first quarter and the real unemployment rate could have hit 12% in March, according to BNP Paribas. In comparison, the official rate was 5.9% in March and 6.0% in April. Retail sales were down -7.5% year-on-year April, a recovery from down over -15%. Industrial production reportedly increased by 3.9% year-on-year, to only a little lower than a few months ago. US-China trade talk heated up as China passed a security law to expand authoritarian control over Hong Kong and a number of grain imports from the US were canceled. The UK government responded to China by offering a path to British citizenship for 300,000 pre-unification Hong Kong residents. Finally, in what may have the longest-term impact, the bankruptcy of a Chinese tech firm put into question $1.7 billion in “keep well” implicit guarantees on its foreign-issued bonds. If the government rules that these bonds are actually not guaranteed, there will be a hit to the price of $100 billion of such bonds or firms will be forced to formally pay the cost of a guarantee. In this stressful environment, will foreigners happily take the penalty?

- Japan’s Economy Slipped Into Recession for the first time in 4½ years, shrinking for the second consecutive quarter in Q1. GDP contracted an annualized -3.4% as private consumption, capital expenditure and exports fell following a revised -7.3 decline in the Q4 2019 period. Machine tool orders were down 48.3% in April, industrial production lower by -14.4% year-on-year. South Korea’s exports were down 23.7% year-on-year and its industrial production -4.5%… I wonder when the orders from China will pick up.

Macro: Europe

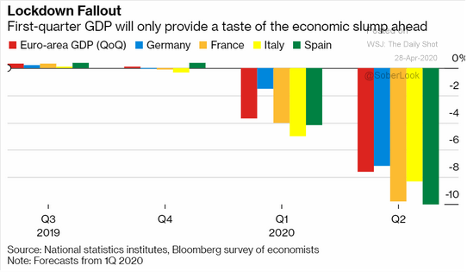

- The ECB Increased its Pandemic Emergency Purchase Program by €600 billion to €1.35 trillion. Essentially, the central bank will buy up most of the debt that will be issued by Eurozone governments this year to fund their crisis

stimulus measures. This is in addition to the other programs to buy government and corporate debt. 2020 GDP growth was lowered to -8.7%. The European Union is also trying to negotiate another €750 billion in borrowing on its own books to hand out as grants to member states to be paid for by new taxes on companies and consumers. If passed, it would be a significant expansion of federalism (centralized power) into the EU over the individual countries in the form of fiscal union. In turn this will further separate the EU from the UK. With Q2 looking like an acceleration of economic decline to around -8% for the quarter (-32% annualized) – see right – big spending is certainly in the cards. The experiment continues.

stimulus measures. This is in addition to the other programs to buy government and corporate debt. 2020 GDP growth was lowered to -8.7%. The European Union is also trying to negotiate another €750 billion in borrowing on its own books to hand out as grants to member states to be paid for by new taxes on companies and consumers. If passed, it would be a significant expansion of federalism (centralized power) into the EU over the individual countries in the form of fiscal union. In turn this will further separate the EU from the UK. With Q2 looking like an acceleration of economic decline to around -8% for the quarter (-32% annualized) – see right – big spending is certainly in the cards. The experiment continues.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource