Americas

- US Economic Data demonstrated slowing, though still positive activity. Q1 2019 GDP was revised slightly lower to +3.1% annualized growth (still excellent) while the Atlanta Fed projected Q2 at +1.4% annualized. Payrolls notably slowed in May, up +75,000 and -75,000 removed from the previous two months. Official unemployment held at the very low 3.6%

(lowest rate since 1969) and underemployment ticked lower to 7.1% from 7.3%. Year-on-year wage growth slowed slightly from +3.2% to +3.1%. The participation rate held constant at 62.8% as did the average hours per workweek. S. retail sales unexpectedly declined in April for the second time in three months (-0.2%) with existing home sales cooling for the fifth time in six months (see right), down -0.4% or the fourteenth straight year-on-year decline. Various measures of April industrial activity pointed negative: industrial production -0.5%, durable goods orders -2.1% and factory output -0.5%. Stockpiling inventories which helped Q1 GDP growth ended as higher tariffs came into effect; in other words, Q2 2019 GDP growth was front-loaded into Q1. Perhaps more concerning, the Cass Freight Index of shipment volume in the US fell -3.2% in April compared to April last year, the fifth month in a row of year-over-year declines. Finally, Ford announced global cuts of 7,000 workers of its 196,000 person workforce, with about 1,500 in the US as well as closing a UK engine plant employing 1,700 workers. Automakers globally have announced 38,000 cuts for the year, so this is not just a US phenomenon.

(lowest rate since 1969) and underemployment ticked lower to 7.1% from 7.3%. Year-on-year wage growth slowed slightly from +3.2% to +3.1%. The participation rate held constant at 62.8% as did the average hours per workweek. S. retail sales unexpectedly declined in April for the second time in three months (-0.2%) with existing home sales cooling for the fifth time in six months (see right), down -0.4% or the fourteenth straight year-on-year decline. Various measures of April industrial activity pointed negative: industrial production -0.5%, durable goods orders -2.1% and factory output -0.5%. Stockpiling inventories which helped Q1 GDP growth ended as higher tariffs came into effect; in other words, Q2 2019 GDP growth was front-loaded into Q1. Perhaps more concerning, the Cass Freight Index of shipment volume in the US fell -3.2% in April compared to April last year, the fifth month in a row of year-over-year declines. Finally, Ford announced global cuts of 7,000 workers of its 196,000 person workforce, with about 1,500 in the US as well as closing a UK engine plant employing 1,700 workers. Automakers globally have announced 38,000 cuts for the year, so this is not just a US phenomenon.

- The Fed at their April 30/May 1 meeting stated no interest rate increases or decreases in 2019, but the above information turned around the markets, leading to quick recoveries in stocks and buying in bonds. Fed Fund prices implied a 90%+ bet that rates will be cut by September and more potentially. Given Powell’s flip to the uber-dove in late December, the odds seemed correct, regardless of the reasoning or validity. Estimated company purchases of stock (buybacks) for Q1 was the second-highest on record at over $210 billion. In fiscal news, state income taxes raised more money than expected despite the limiting SALT deductions – New York, California, New Jersey and Illinois all saw windfall inflows on strong stock market and economic gains. Overall, April personal income tax collections in 28 states increased by $16.3 billion to $61.4 billion, or +36.2% year-over-year.

- US-China Trade Negotiations stayed frozen as attacks by China became more evident. China increased tariffs on $60 billion of US goods (notably not on crude oil as mentioned above but increasing the existing tariff on LNG) and threatened a blacklist of US companies and individuals to be targeted for censorship. FedEx in particular was accused by

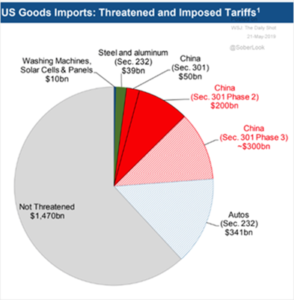

Huawei of diverting packages and is now under investigation by Beijing. The Trump administration announced a three-month temporary allowance for US firms to sell to Huawei in late May as a carrot. On the other hand, China’s threat of cutting the US off from its rare earth metal supply (80% market share), points a loaded gun against the US. The blowback from the US’ directing supply routes (including the expansion of indigenous supply), could undermine China’s position more permanently going forward, so perhaps not the best tool. Looking ahead, the IMF warned that the economic damage of the tariffs would reach 0.5% of global GDP ($455 billion), but is about 2/3rds the total trade between the two countries, so some hyperbole colored the projection. Graphically to the left, one can see the amount of tariffs would be at most on about 1/3rd of total US imports – not nothing but also not crippling as is pushed by the ne

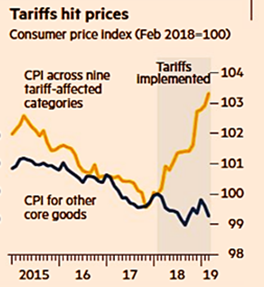

Huawei of diverting packages and is now under investigation by Beijing. The Trump administration announced a three-month temporary allowance for US firms to sell to Huawei in late May as a carrot. On the other hand, China’s threat of cutting the US off from its rare earth metal supply (80% market share), points a loaded gun against the US. The blowback from the US’ directing supply routes (including the expansion of indigenous supply), could undermine China’s position more permanently going forward, so perhaps not the best tool. Looking ahead, the IMF warned that the economic damage of the tariffs would reach 0.5% of global GDP ($455 billion), but is about 2/3rds the total trade between the two countries, so some hyperbole colored the projection. Graphically to the left, one can see the amount of tariffs would be at most on about 1/3rd of total US imports – not nothing but also not crippling as is pushed by the ne  ws. There has been an inflation effect per Goldman Sachs (see graph below right) but that should be a one-off barring additional tariffs as we have seen with similar events (e.g., the Japanese consumption tax impact) as well this is on a minority of goods and services (~$200 billion of a $20 trillion economy or 1% of GDP effected). May saw a six-month US repreive on auto and metals tariffs with Japan, the EU, Mexico and Canada as it focused on China, though a tactical spat with Mexico over immigration came and went in early June. A lot more to come.

ws. There has been an inflation effect per Goldman Sachs (see graph below right) but that should be a one-off barring additional tariffs as we have seen with similar events (e.g., the Japanese consumption tax impact) as well this is on a minority of goods and services (~$200 billion of a $20 trillion economy or 1% of GDP effected). May saw a six-month US repreive on auto and metals tariffs with Japan, the EU, Mexico and Canada as it focused on China, though a tactical spat with Mexico over immigration came and went in early June. A lot more to come.

Asia

- China’s Economy Suffered Despite Some Positives as May exports unexpectedly returned to growth (+1.1%) despite higher US tariffs, but imports fell (-8.5% year-on-year) the most in nearly three years, in a further sign of weak domestic demand. Most of concern was the fall of imported copper, given its use in construction and electrical goods manufacturing. South Bay Research noted that imported iron ore levels are flattening. Chinese food CPI rose +6.1% year-on-year led by pork (+14.4%) highlighting visible challenges to the regime.

More established metrics were showing diminished gains, even before the May tariff pressure. Chinese industrial production growth slowed to +5.4% year-on-year in April, tying the lowest level in 17 years. Retail sales rose +7.2% in April compared to the same period last year, the slowest growth since 2003 (see graph right). Industrial production slowed to +5.4% in trailing twelve-month growth – down from +8.5% in March. Overall investment slowed to +5.7% annual growth versus March’s +6.5%. April car sales fell -16.6% versus a year ago. There has

More established metrics were showing diminished gains, even before the May tariff pressure. Chinese industrial production growth slowed to +5.4% year-on-year in April, tying the lowest level in 17 years. Retail sales rose +7.2% in April compared to the same period last year, the slowest growth since 2003 (see graph right). Industrial production slowed to +5.4% in trailing twelve-month growth – down from +8.5% in March. Overall investment slowed to +5.7% annual growth versus March’s +6.5%. April car sales fell -16.6% versus a year ago. There has  been an upward trend in unsold residential units in Beijing and Shanghai (see graph left), a surprise given the country’s penchant for real estate investing. Finally, Fitch (who?) noted that China’s ratio of household debt to disposable income could exceed 100% by 2020 (yes, next year), basically equalizing Chinese indebtedness with America’s 105%. If you think that the average US citizen is limited financially, then take a closer look at China’s.

been an upward trend in unsold residential units in Beijing and Shanghai (see graph left), a surprise given the country’s penchant for real estate investing. Finally, Fitch (who?) noted that China’s ratio of household debt to disposable income could exceed 100% by 2020 (yes, next year), basically equalizing Chinese indebtedness with America’s 105%. If you think that the average US citizen is limited financially, then take a closer look at China’s.

- In Other Chinese News, investors were reminded of their lax accounting standards as Baoshang regional bank abruptly collapsed and was taken over by the government. With $23 billion in assets, the financial company is one of nineteen banks (totaling $647 billion of

assets) that still have not filed 2018 results. In recent stress tests, the Chinese central bank estimated that over 10% of banks were “extremely risky” (see right from Bloomberg). Meanwhile, Jaguar Motors announced its fourth quarterly decline in Chinese sales with a 34% decline in vehicles delivered year-on-year, regulating China to its fourth-largest market after the US, Europe and the UK. Finally, the vaunted belt-and-road global infrastructure plan continued to hit pitfalls. A recent study noted that over the last ten years, developing countries have renegotiated $50 billion over 34 loans with 24 countries resulting in fourteen write-offs, eleven deferments and refinancing for the balance. Actual losses are unknown.

assets) that still have not filed 2018 results. In recent stress tests, the Chinese central bank estimated that over 10% of banks were “extremely risky” (see right from Bloomberg). Meanwhile, Jaguar Motors announced its fourth quarterly decline in Chinese sales with a 34% decline in vehicles delivered year-on-year, regulating China to its fourth-largest market after the US, Europe and the UK. Finally, the vaunted belt-and-road global infrastructure plan continued to hit pitfalls. A recent study noted that over the last ten years, developing countries have renegotiated $50 billion over 34 loans with 24 countries resulting in fourteen write-offs, eleven deferments and refinancing for the balance. Actual losses are unknown.

Europe

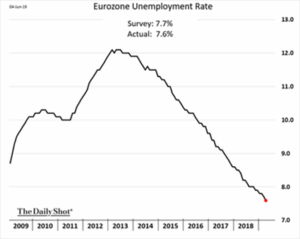

- Unemployment Continued to Fall in both Europe (see right) and in the UK (which hit the lowest level since 1975 at 3.8%), Brexit or no Brexit. With PM May out of office, the Tories will begin selecting their new leader though the final vote will not be for a few weeks. Her latest crisis is the collapse of British Steel, a direct employer of 5,000 and another related 20,000. Again, not much is better on the other side of the channel with German monthly industrial production falling -1.9% and -3.7% monthly decline in exports (worst since 2015). German monthly retail sales fell also at -2.0%, missing a growth forecast. ECB President

Mario Draghi again pushed the dovish narrative as he prepares to exit this fall. Apart from the usual verbiage, The ECB announced a new round of TLTRO, lending money to the continent’s banks at -0.3% but in more limited amounts and at a relatively higher rate of interest. A modest and indirect “tapering?” A non-decision decision? Not very reassuring!

Mario Draghi again pushed the dovish narrative as he prepares to exit this fall. Apart from the usual verbiage, The ECB announced a new round of TLTRO, lending money to the continent’s banks at -0.3% but in more limited amounts and at a relatively higher rate of interest. A modest and indirect “tapering?” A non-decision decision? Not very reassuring!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource