Macro: Americas

- The Federal Reserve did indeed raise rates as expected at the March meeting, setting the pace for three hikes this year. In the meeting minutes released in early April, the Fed also indicated that they may also change monetary policy to allow for gradual reduction of the bond stockpile bought during Quantitative Easing. Given that over half the owned $4.5 trillion debt matures in less than three years, there will be ample maturation on a monthly basis to allow for a steady, non-eventful decline. In fact, some economists estimate that such a move may require a reduction of over $1 trillion before there would any actual interest rate impact – initial market reaction notwithstanding. Reducing / eliminating reinvestment of received interest would also assist the process. This will be dragged out so expect a steady flow of news, analysis and speculation.

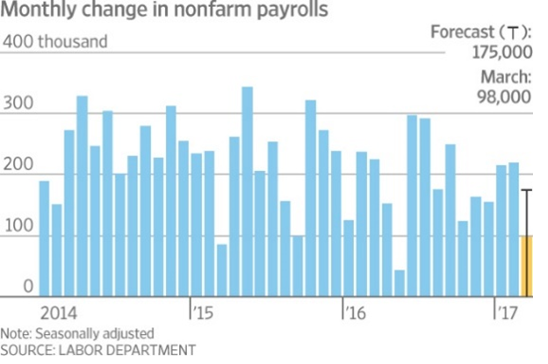

- US economic news continued as mixed but with a slightly weaker tone than last month. The Atlanta Fed lowered its Q1 GPD estimated from +1.8% to +0.6% with the latest payroll numbers. The positive but weaker-than-expected +98,000 additions in April missed expectations.

However, weather was an obvious culprit and the overall unemployment rate fell from 4.7% to 4.5%, so it seems that the result will wash out in future months. The March numbers were quite good but revised downwards (+235,000 to +219,000). Pending sales of existing homes were strong – best since 2010. Meanwhile, current participation in the SNAP program (AKA “food stamps”) is 43 million people, still not far off the 48 million person peak in 2013. That is still 15% of the US population (20% of all US households). For an economy at “full employment,” that is a lot of people. Retail locations have been shrinking, offering fewer and fewer employment opportunities. Q1 saw a surge after the Christmas shopping season failed to deliver as household names like Sears, Kmart, Payless, Radio Shack, The Limited and others looked to trim their losses or went bankrupt.

However, weather was an obvious culprit and the overall unemployment rate fell from 4.7% to 4.5%, so it seems that the result will wash out in future months. The March numbers were quite good but revised downwards (+235,000 to +219,000). Pending sales of existing homes were strong – best since 2010. Meanwhile, current participation in the SNAP program (AKA “food stamps”) is 43 million people, still not far off the 48 million person peak in 2013. That is still 15% of the US population (20% of all US households). For an economy at “full employment,” that is a lot of people. Retail locations have been shrinking, offering fewer and fewer employment opportunities. Q1 saw a surge after the Christmas shopping season failed to deliver as household names like Sears, Kmart, Payless, Radio Shack, The Limited and others looked to trim their losses or went bankrupt.  And yes, the debt ceiling issue will become a major news item in April and any Puerto Rico bailout plan cost. Given that the island commonwealth owes $2.3 billion in interest alone versus $0.4 billion in “available funds,” there is a decided mismatch between reality and fantasy.

And yes, the debt ceiling issue will become a major news item in April and any Puerto Rico bailout plan cost. Given that the island commonwealth owes $2.3 billion in interest alone versus $0.4 billion in “available funds,” there is a decided mismatch between reality and fantasy.

Macro: Europe

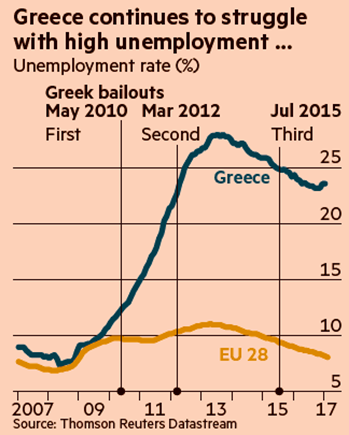

- Speaking of Greece, there is incremental resolution with the classic money up-front (to “pay” $1 billion in April and $6 billion in July) in exchange for “reforms” by 2019 and 2020. Not done yet but closer. This handy chart from the FT shows the Greek unemployment levels and yes, the curve has started to move back higher over the last few months. Yes the rest of Europe is slowly recovering as seen in that same graph (lowest unemployment rate in the last eight years in fact!).

Of the large countries, Spain and Italy seem to be making progress but France is not. Eurozone retail sales are holding up repeated gains with the most recent number of +1.8% year-on-year, extending these gains for over two years. The UK saw its unemployment rate falling to the lowest level since 1975 in the three months leading up to January (4.7%). Iceland removed its capital controls imposed from the 2008 crisis as its financial balance appears to be restored. The Dutch rejected their far-right candidate handily in their March elections, though the closely watched French elections are coming up still.

Of the large countries, Spain and Italy seem to be making progress but France is not. Eurozone retail sales are holding up repeated gains with the most recent number of +1.8% year-on-year, extending these gains for over two years. The UK saw its unemployment rate falling to the lowest level since 1975 in the three months leading up to January (4.7%). Iceland removed its capital controls imposed from the 2008 crisis as its financial balance appears to be restored. The Dutch rejected their far-right candidate handily in their March elections, though the closely watched French elections are coming up still. - Europe’s banks are still under pressure as evidenced by Germany’s DeutscheBank raising €8.5 billion in equity capital via a rights issue. Sales of €2 billion in assets and a minority ownership in its asset management business are still pending. Assuming losses have been properly accounted for and provisioned against, this should put its core capital ratio back to one comparable with its peers. But we shall see. US’ General Motors is not sticking around Europe to find out if the continent can get its house in order – it is selling its Opel and Vauxhall units to Peugeot. Expect more downsizing by Mr. Tavares who took the axe to Peugeot in 2014, though Germany and the UK unions will likely fight it every step of the way.

Macro: Asia

- While Chinese trade data was skewed due to the timing of the Lunar New Year in 2017 versus 2016 on a monthly basis, on a year-to-date basis combining January and February, both imports and exports accelerated versus Q4 2016. As the graph shows, this can be seen internally as well as volumes appear to be picking up after a tough 2016. Fixed asset investment expanded at a faster rate both year-on-year and versus Q4 2016, though nominal retail sales growth increase by a slower rate.

On the other hand, indications from the central government are for less stimulus than in the last two years, and year-on-year housing prices have come off from highs set last year. The tier one cities have begun again to curb housing loans with higher down payments and other restrictions on second homes. If there is a slowdown, how long will they stick to their rules? Corporate debt as a percentage of GDP is double that of other emerging markets – both in and out of Asia (see graph below) which again demonstrates that something is out of line with the country’s finances. In political affairs, tensions started heating up with the Philippines as President Rodrigo Duterte ordered troops to occupy islands that are also claimed by China in the disputed South China Sea. Being pushy sometimes means that others will start pushing back.

On the other hand, indications from the central government are for less stimulus than in the last two years, and year-on-year housing prices have come off from highs set last year. The tier one cities have begun again to curb housing loans with higher down payments and other restrictions on second homes. If there is a slowdown, how long will they stick to their rules? Corporate debt as a percentage of GDP is double that of other emerging markets – both in and out of Asia (see graph below) which again demonstrates that something is out of line with the country’s finances. In political affairs, tensions started heating up with the Philippines as President Rodrigo Duterte ordered troops to occupy islands that are also claimed by China in the disputed South China Sea. Being pushy sometimes means that others will start pushing back.

- In positive news, Japan grew a little bit better than expected in Q4 (+1.2% annualized versus +1.0% originally estimated) with industrial production up again year-on-year.

This month I leave you with a quote from Charlie Munger which can be applied to one’s work and investing in general: “Microeconomics is what we do and macroeconomics is what we put up with.”

Best of investing!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource

April 10, 2017

Additional information sources: BBC, Bloomberg, Deutsche Bank, Financial Times, The Guardian, JP Morgan, PVM, Reuters, South Bay Research, Wall Street Journal and Zerohedge.

a6b6b7c1c0196fad96d8ff000028cc48.png?sfvrsn=0&MaxWidth=300&MaxHeight=400&ScaleUp=true&Quality=High&Method=ResizeFitToAreaArguments&Signature=898F42671C500773C412876609783C96)