COVID-19

US Case Count Upticked to 116k as the seven-day average rose in June per the CDC with seven-day average US deaths falling to 273. Per Walgreens’s COVID-19 tracker

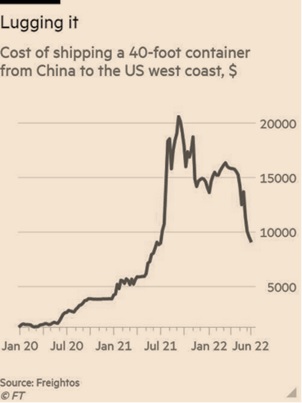

(c lick here for the link) below, Omicron still infected a higher proportion of those that had received shots versus those that had not had any (75k total tests, overall 32% positivity rate with 28% for unvaccinated and 38% for three doses received over 5 months ago). China stayed focused on lockdowns, with the city of Xian the latest in early July (home to 13 million people). Shanghai (25 million residents) remained under various restrictions due to ongoing cases. Fortunately, the port congestion issues that plagued China over the last number of months declined dramatically, sending container costs lower (see graphic right). However, with their “zero-COVID” policy still in place, expect China-related supply-chain flare-ups.

lick here for the link) below, Omicron still infected a higher proportion of those that had received shots versus those that had not had any (75k total tests, overall 32% positivity rate with 28% for unvaccinated and 38% for three doses received over 5 months ago). China stayed focused on lockdowns, with the city of Xian the latest in early July (home to 13 million people). Shanghai (25 million residents) remained under various restrictions due to ongoing cases. Fortunately, the port congestion issues that plagued China over the last number of months declined dramatically, sending container costs lower (see graphic right). However, with their “zero-COVID” policy still in place, expect China-related supply-chain flare-ups.

Our thoughts and prayers go out to those taken ill and we hope that they have access to proper care and recover fully.

Ukraine

Russia Made Inroads in June as bombardments of infrastructure, cities and military targets forced Ukrainian retreats. While withdrawals had been made in good order, summer weather should add to Russian offensive pressure. Foreign-supplied heavy weaponry (tanks, missile systems and artillery) slowly made their way into Ukraine but too soon to judge effectiveness. With good weather, the war on the ground can change quickly; be ready for a long, hot summer.

US and EU Leaders had discussions with regards to a price cap on Russian crude oil, which would be basically impossible to enforce. India in  particular has been benefiting from the importing, blending and exporting of Russian discounted crude oil. Russia’s shipped crude exports over June 1-15 rose by 0.68 million barrels per day (mbpd) to average about 3.88 mbpd, according to shipping analytics provider Kpler. The latest export flows put Russia’s seaborne crude exports at the highest since May 2019. Reuters reiterated Chinese interest in Russian crude oil this year which the graph to the right showed about doubled that of 2021.

particular has been benefiting from the importing, blending and exporting of Russian discounted crude oil. Russia’s shipped crude exports over June 1-15 rose by 0.68 million barrels per day (mbpd) to average about 3.88 mbpd, according to shipping analytics provider Kpler. The latest export flows put Russia’s seaborne crude exports at the highest since May 2019. Reuters reiterated Chinese interest in Russian crude oil this year which the graph to the right showed about doubled that of 2021.

Macro: US

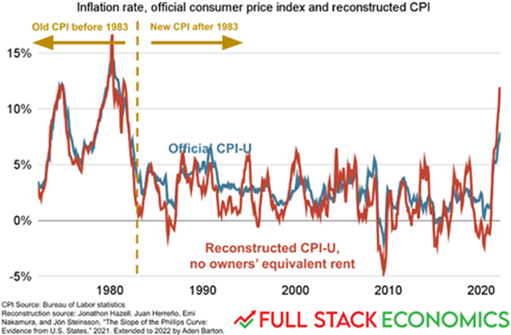

US Consumer Price Inflation jumped to +8.6% year-on-year in May, beating expectations of +8.3% and reaching the highest level since December 1981. Over the past 12 months, the so-called “food at home” index was up +12%, the largest such increase since April 1979. A commentator noted that “shelter (the single biggest component of CPI at 33

% of the index) inflation was being wildly understated (+5.5% year-on-year CPI increase) with rents up +15.4% over the last year and home prices up a record +20.6%. Which means that the true inflation rate is much higher than +8.6%.” This view was reiterated by former Treasury Secretary Lawrence Summers with the added statement that a recession is “almost inevitable.” Looking at the housing component by using the previous methodology (changed in 1983), the “red-line” inflation is rapidly approaching those bad old days of the late 1970s… will Powell be able to channel his inner Volker and raise rates correspondingly? Producer price inflation (which feeds into consumer price inflation) also rose strongly, as headline PPI grew at +0.8% month-on-month for a +10.8% year over year growth, just shy of 10.9% forecast.

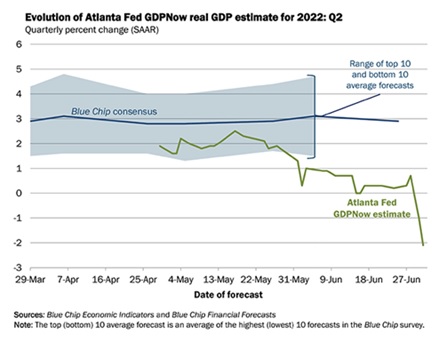

Recession Already Here according to the unofficial heuristic that two negative quarters define a recession as the Atlanta Fed projected a -2.1% annualized decline for Q2 as of July 1st (see graphic left), compounding the -1.6% annualized decline for Q1. However, with unemployment still low at 3.6% in May, and strong employment metrics still in place (e.g., the recent JOLTS job opening indicator and +372k in non-farm payrolls), an official NBER recession announcement would be delayed (never been a recession declared without a loss of employment per Reuters). Factory and durable goods orders also were strong in May (the most recent public data). Based on these and Fed Chair Powell’s recent statements, one should expect an increase of +0.5-0.75% in the target rate at the upcoming July 25-26th meeting. We also should hear an update on the slow run-off of the Federal Reserve’s balance sheet. Given the small percentage monthly decline versus the total balance sheet, my guess is that it may take several months if not until 2023 before this factor has a material impact on bonds and risk assets (e.g., equities, real estate).

Macro: Europe

ECB Announced Their Q€ End but they are in no hurry as they plan to stop buying government and corporate bonds at the end of June and begin

the first rate hikes in July (+0.25%) and September (+0.5%). Something but behind the curve. Looking at the consumer inflation graph to the right, zero-percent short-term rates are well behind their year-on-year +8.6% inflation. The ECB blames Europe’s woes on a post-lockdown spike in energy costs that snowballed when Russia attacked Ukraine. Core inflation, excluding energy and food, fell fractionally to 3.7%. The challenge will be keeping the peripheral interest rates in line with the core (e.g., profligate Italy (150% government debt to GDP) and Greece (175%) in line with circumspect Germany (70%) and Netherlands (60%)) as investors hesitate to own debt/deficit-heavy countries. The energy crisis more concretely threatened the EU with Germany’s top union official saying entire industries could collapse due to Russia’s natural-gas cuts. Germany posted its first monthly trade deficit in over 30 years in May as the price of its oil and gas imports soared in the wake of Russia’s war in Ukraine. Added to the higher import costs was a slowdown in exports. The Nord Stream pipeline supplying Europe will shut from July 11-21 for maintenance amid fears that supplies will not resume (Business insider). Even within Europe, energy supplies came under attack as Norway warned that gas exports to the UK that also supply mainland Europe could be shut off in early July if a workers’ strike escalates, affecting up to 40% of all UK demand and 25% of total European gas. The impact can be clearly seen in the graph to the right. The UK economy shrank in April at the sharpest pace in more than a year as gross domestic product fell -0.3% from March as inflation hit 9.1% year-on-year in May.

Macro: Asia

China’s Trade Rebounded in May as Covid-19-related bottlenecks in production and logistics cleared up. Exports in US dollar terms grew +16.9% in May from a year earlier, accelerating from April’s +3.9% increase while imports rose +4.1% after staying unchanged in the previous month. However, macro headwinds remained and exporters have reported a drop in orders as global consumer demand cools and as spending transitions from goods to services. Industrial production unexpectedly grew +0.7% year-on-year in May, compared to expectations for a -0.7% drop. Retail sales fell -6.7% for the past twelve months ending in May, after dropping -11.1% in April, pointing to still weak consumers during ongoing COVID restrictions and the deteriorating labor market. In May, the jobless rate for those aged 16-24 reached 18.4%, representing a record high. Bloomberg reported that many economists now expect Beijing to miss its +5.5% GDP growth goal for the year, with a projection of +4.2% in 2022. Shimao Group Holdings Ltd.’s global creditors are gearing up to organize themselves after the luxury builder defaulted on a $1 billion dollar bond due in early July, underscoring the continued struggles of the key real estate sector. In reaction to its economic woes, China’s Ministry of Finance is considering allowing local governments to sell 1.5 trillion yuan ($220 billion) of special bonds in the second half of this year, an unprecedented acceleration of infrastructure funding aimed at shoring up the country’s beleaguered economy. Such borrowing and spending usually does not begin until the beginning of January. Meanwhile, industrial output in Japan dropped -1.5% on a monthly basis in April, more than the preliminary reading of -1.3%.

Between China, Japan, US and Europe, global stagflation is still on the table.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource