COVID-19

- Operation Warp Speed and the continued efforts under the new administration pushed US vaccine distribution to 58% of the total population given at least one dose with the EU

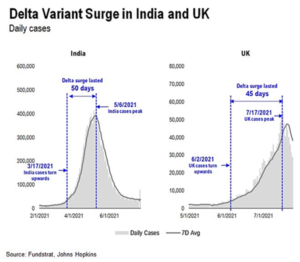

the same at 59% with China claiming 60% and India 27%. While the Delta variant gets many breathless headlines, the graphs of the UK and India right demonstrated the relatively short time period of its impact. The US was about thirty days through this upswing and running at about 1/3rd the peak seven-day case-per-million average seen in January (273 cases per day versus 751 back then). Hopefully this timing will result in the peak reached in mid-August and on the downswing by the end of the month. Looking at the seven-day average of attributable deaths, the rate was 414 as of August 3rd, as compared to an average daily death rate of over 3,000 back in January which, while saddening, is a favorable comparison.

the same at 59% with China claiming 60% and India 27%. While the Delta variant gets many breathless headlines, the graphs of the UK and India right demonstrated the relatively short time period of its impact. The US was about thirty days through this upswing and running at about 1/3rd the peak seven-day case-per-million average seen in January (273 cases per day versus 751 back then). Hopefully this timing will result in the peak reached in mid-August and on the downswing by the end of the month. Looking at the seven-day average of attributable deaths, the rate was 414 as of August 3rd, as compared to an average daily death rate of over 3,000 back in January which, while saddening, is a favorable comparison.

- Also, we should not forget Sweden – that “crazy” country that did not lock down… Their early July data showed that their case count increased to the low 3,000s from 1,500 but the death rate remained the same at one or two people per week. Their vaccination rate is only slightly higher than the US and EU with 61% receiving at least one dose. Again, the Delta variant should be expected to increase these numbers but hopefully just slightly and temporarily. According to the UN 2021 World Happiness Report (yes, there is such a thing), Sweden was the sixth happiest country in the world, so they certainly are doing something right in general and during COVID.

- Our thoughts and prayers go out to those taken ill and we hope that they have access to proper care and recover fully.

United States

- Q2 GDP Growth Strong but Disappointed at +6.5% annualized, widely missing Bloomberg’s survey of economists who called for a +8.4% increase. Personal consumption, the biggest part of the economy, advanced an annualized +11.8%, exceeding forecasts but other categories severely missed. The report showed the saving rate dropped to 10.9% in the second quarter from 20.8%, indicating Americans spent cash built up during the pandemic. This also implied that the Fed had a good basis for calling inflation “transitory” despite June’s

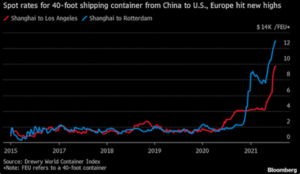

scary headline number of +0.9% month-on-month, almost double the consensus forecast at +0.5% (core inflation was also +0.9% versus +0.6% consensus). With high energy prices, shipping costs (see right), and more government stimulus coming in, this “transitory” label may also be transitory. As an example, the price of wooden pallets used in shipping are up about 1/3rd in 2021, underscoring that price hikes are showing up in all sorts of places. However, economic growth indicators were supportive – e.g., core capital goods orders, a barometer of business investment that excludes aircraft and military hardware, increased +0.5% for a second month in a row. Factory orders overall were much stronger at +1.5% versus +1.0% expected. Realized industrial production was up +0.4% in June, missing expectations, however. Unemployment was a solid improvement, falling to 5.4% from 5.9% on a gain of 943,000 jobs, handily beating expectations. Sales of previously owned U.S. homes rose for the first time in five months in June as housing inventory improved by +1.4%, though median prices stayed high at $363,000, up 23.4% from a year ago. Finally, retail sales rose unexpectedly in June, reflecting fairly broad gains across spending categories and wrapping up a solid quarter for household demand. The value of overall retail purchases advanced +0.6% following a downwardly revised -1.7% drop in May.

scary headline number of +0.9% month-on-month, almost double the consensus forecast at +0.5% (core inflation was also +0.9% versus +0.6% consensus). With high energy prices, shipping costs (see right), and more government stimulus coming in, this “transitory” label may also be transitory. As an example, the price of wooden pallets used in shipping are up about 1/3rd in 2021, underscoring that price hikes are showing up in all sorts of places. However, economic growth indicators were supportive – e.g., core capital goods orders, a barometer of business investment that excludes aircraft and military hardware, increased +0.5% for a second month in a row. Factory orders overall were much stronger at +1.5% versus +1.0% expected. Realized industrial production was up +0.4% in June, missing expectations, however. Unemployment was a solid improvement, falling to 5.4% from 5.9% on a gain of 943,000 jobs, handily beating expectations. Sales of previously owned U.S. homes rose for the first time in five months in June as housing inventory improved by +1.4%, though median prices stayed high at $363,000, up 23.4% from a year ago. Finally, retail sales rose unexpectedly in June, reflecting fairly broad gains across spending categories and wrapping up a solid quarter for household demand. The value of overall retail purchases advanced +0.6% following a downwardly revised -1.7% drop in May.

- Inflation Made Headlines But Fed Not Worried as Powell confirmed that the Fed is still talking about when to start tapering. This says to me that such a move would be a 2022 event. Coming up is their Jackson Hole conference for global central bankers to meet (live or virtually) and the next Fed meeting is not until late September, so not likely to see a significant announcement for a month or two.

- Government Spending Spree Continuing with the US Senate poised to pass a $1.1 trillion spending bill funded by COVID money, new taxes and “efficiency gains” that will direct about $400 billion to roads, power grids, rail, broadband water and mass transit. Another $200 billion is for electrical vehicle research and “clean energy.” Most impactful to everyday Americans will be provisions requiring that new cars would have to 1) include breathalyzers or similar technologies to force drivers to pass an alcohol test every time they want to start the car (p. 1068) and 2) begin the testing of monitoring and reporting the miles driven by the automobile as preparation for a carbon tax based on vehicle usage (p. 508). Note that the spending would be over five years but the revenue to pay for it would be counted over ten years – the usual government accounting sleight of hand. After this bill is voted on (and presumably passed), then Biden and Democrats can force through via simple majority vote a “reconciliation” spending bill that could be in the $2.5 – $3 trillion range that would address their social and climate-change agenda. The related taxes and funding have not been discussed. And then comes the budget and debt ceiling votes with a $1.8 trillion deficit (which, to be fair, would include the above bills). Spending other people’s money is hard work!

Asia

- Chinese Q2 GDP Grew +1.3% Quarterly (+5.3% Annualized), up from +0.4% in Q1 (+1.6% annualized) showing that the country was still limited by the global economic slowdown. Q3 started on the wrong foot with the spreading of the Delta variant reportedly causing the government to impose new travel restrictions that could affect up to fifteen provinces and municipalities. Massive flooding in the industrial center of Zhengzhou killed a number of people and disrupted production at the Foxconn iPhone factory there. The usual numbers looked good: industrial output rose +8.3% in June from a year earlier, beating the median estimate of +7.9%. Retail sales expanded +12.1% in June; median forecast was +10.8%. These results were an incremental decline from May. The jobless rate was unchanged at 5% at the end of June. The government continued to face failing companies – property developer Sichuan Languang defaulted on a $139 million bond payment, threatening cross-defaults to another $1 billion in company debt. Property developer Evergrande Group fought off a liquidity crisis that threatened $301 billion in liabilities that saw their 2025 US dollar bond fell to 54c from par and its stock fell 25% in two days. Finally, six provinces committed $17 billion to bail out their local state-owned companies – you can decide if that would restore your confidence in investing in China.

- Japanese Industrial Production Continued Higher, hitting +6.2% month-on-month in June, almost reversing the -6.5% hit in May. Good numbers were seen in core machine orders (+7.8% in May versus +0.4% in April for the month) and exports (+48.6% year-on-year in June) with shipments to the US leading the way (off obviously an artificially low basis). Korea, on the other hand, missed their Q2 GDP growth expectations (+0.7% in Q2 for the quarter versus +1.7% in Q1)

Europe

Eurozone GDP Grew +2.0% (+8.3% Annualized), better than the +1.5% expected. Italy, Spain and Portugal were among the outperformers with growth of +2.7%, +2.8% and +4.9%, respectively. In terms of major numbers, German June factory orders rose +4.1% month-on-month, handily beating the estimate at +2.0%. The European Central Bank held monetary policy steady, but tweaked its guidance to reflect its recently-hiked inflation target. Similar to the US, the EU saw headline inflation (+2.2%) higher than expectations (+2.0%) but similarly determined that these effects to be “transitory” and easing in the second half of 2021. On this basis, ECB recommitted to purchasing €1.85 trillion ($2.2 trillion) of bonds until March 2022. Interest rates were also left unchanged, with the rate on the main deposit facility remaining at -0.5%, the benchmark refinancing rate at 0% and the marginal lending facility at 0.25%. In short, no economic growth was expected without massive monetary and fiscal stimulus.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource