COVID-19

- The COVID Toll on Q2 GDP for the US came in -9.5% for the quarter – not good but better than the economists’ estimates which were closer to -10%. That’s the steepest annualized decline in quarterly records dating back to 1947. Personal spending, which makes up about two-thirds of GDP, also slumped the most on record. Surpassing this gut-wrenching number was the Q2 GDP loss in Europe, which fell -12.1% during the April-to-June period. Japan’s Q2 GDP loss will be announced in the middle of August and expected to fall more than -20%, the most since records were first kept in 1955. Officially China’s GDP grew in Q2 at +3.2% though other Asian exporters reported Q2 GDP losses (e.g., Singapore at about -10.5% though South Korea as down only -3.3%). You decide how much credence to put in those PRC statistics. The overall takeaway is that Q2 was bad, but expected. Q3 is looking much better and early indicators will be mentioned in future sections. Looking at the whole 2020, the IMF downwardly adjusted their global GDP forecast from -3.0% to -4.9%, primarily on lower economic expectations for the US and Europe (particularly France and Spain lowered an additional -5%(!) for the year).

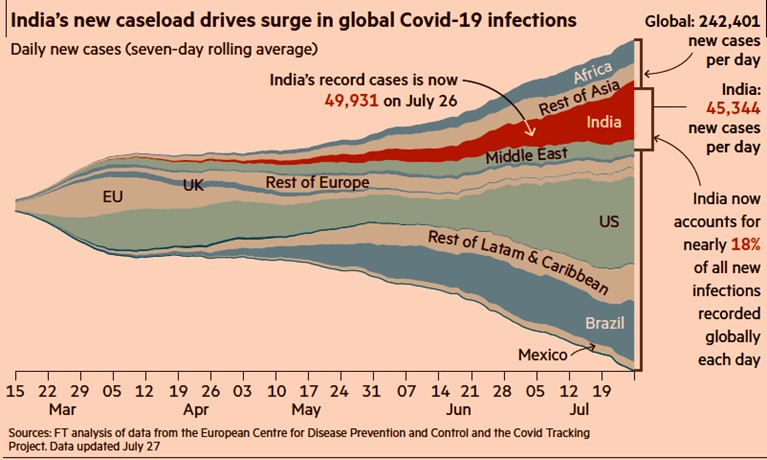

- The COVID Impact in India deserves attention as the second largest country in the world and being highlighted by the Financial Times recently with their increasing official

caseload (see graphic below). In addition, per an article at the end of July, the FT reported that a Mumbai government study estimated that 57% of residents in the poorest areas of India’s financial capital (about 40% of the population) had been infected versus 15% of the remaining districts. The official death rate is however much lower than in most countries at under 0.1% and likely not correctly calculated. Brazil at number two in terms of cases is also rising rapidly while the US is trending lower again after a bounce in the first half of July. With Asia and certain countries in Europe also reporting increases, there is clearly still a need to be mindful for the elderly and those with co-factors such as diabetes and heart disease.

caseload (see graphic below). In addition, per an article at the end of July, the FT reported that a Mumbai government study estimated that 57% of residents in the poorest areas of India’s financial capital (about 40% of the population) had been infected versus 15% of the remaining districts. The official death rate is however much lower than in most countries at under 0.1% and likely not correctly calculated. Brazil at number two in terms of cases is also rising rapidly while the US is trending lower again after a bounce in the first half of July. With Asia and certain countries in Europe also reporting increases, there is clearly still a need to be mindful for the elderly and those with co-factors such as diabetes and heart disease.

- Regardless of Country, our thoughts and prayers go out to those taken ill and we hope that they have access to proper care and recover fully.

Macro: US

- Looking Ahead to Q3 GDP, the Atlanta Federal Reserve’s current forecast is an annualized increase of +20.3% – though keep in mind it is still early in the quarter and subject to

much revision. A critical imminent factor will be the timeliness and size of the next stimulus bill which is now being negotiated in Congress. Given the uncertainty and magnitude of the amount debated (ranging from sub-$1 trillion to over $3.4 trillion), it would be foolhardy to guess the outcome. Definitely more government borrowing is queued up with Q3 forecasted at $970 billion by the US Treasury and potentially $1.2 trillion or more depending on the size of the stimulus spending. Interest rates and inflation remain low (10-year federal bonds at 0.55% yield and the twelve months ending in June CPI came in at +0.6% with a core rate of +0.2%). Supporting the increased economic expectations are retail sales (+7.5% in June as some stores and restaurants reopened, beating estimates of +5.0%), orders for durable goods (+7.3%, over the +6.9% forecast) and industrial output increased the most since 1959 by gaining +5.4%, well ahead

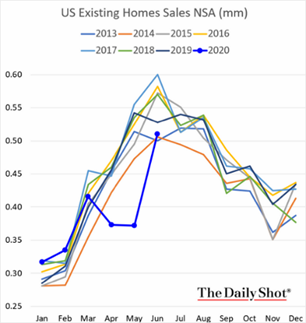

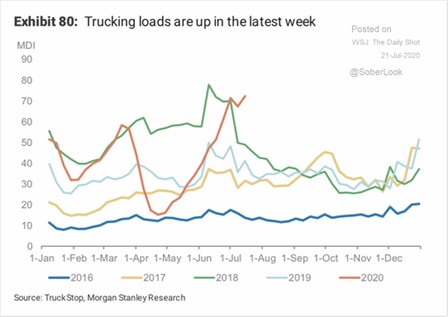

much revision. A critical imminent factor will be the timeliness and size of the next stimulus bill which is now being negotiated in Congress. Given the uncertainty and magnitude of the amount debated (ranging from sub-$1 trillion to over $3.4 trillion), it would be foolhardy to guess the outcome. Definitely more government borrowing is queued up with Q3 forecasted at $970 billion by the US Treasury and potentially $1.2 trillion or more depending on the size of the stimulus spending. Interest rates and inflation remain low (10-year federal bonds at 0.55% yield and the twelve months ending in June CPI came in at +0.6% with a core rate of +0.2%). Supporting the increased economic expectations are retail sales (+7.5% in June as some stores and restaurants reopened, beating estimates of +5.0%), orders for durable goods (+7.3%, over the +6.9% forecast) and industrial output increased the most since 1959 by gaining +5.4%, well ahead  of the +4.3% economist survey. The housing market is also doing much better than expected with the graph to the right showing that existing home sales (about 90% of housing sales) are about at seasonal norms. In terms of more frequent data, the increase in trucking loads sending goods around the country is back at the 2018 highs per the Morgan Stanley graphic to the left.

of the +4.3% economist survey. The housing market is also doing much better than expected with the graph to the right showing that existing home sales (about 90% of housing sales) are about at seasonal norms. In terms of more frequent data, the increase in trucking loads sending goods around the country is back at the 2018 highs per the Morgan Stanley graphic to the left.

- Bankruptcies of Storied Names continued with oil driller Noble Corporation entering into Chapter 11, Ascena Retail Group – corporate parent of Ann Taylor, Lane Bryant and other chains – going bankrupt (they are the second largest mall tenant after Gap so watch out for up to 1,600 store closures), California Pizza Kitchen which operated over 200 restaurants, 102-year-old women’s clothing retailer New York & Co, Tailored Brands (the owner of Men’s Wearhouse and JoS. A. Bank) and department store Lord & Taylor. Big job cuts were announced at Schlumberger (21,000 positions), American Airlines with 25,000 notices of potential furloughs, tech company LinkedIn cut 1,000 roles (6% of their workforce) and Raytheon slashed roughly 8,000 jobs in its commercial aviation businesses. State and local governments are also cutting staff and imposing pay cuts, though deep deficits have been penciled in – a dramatic example was that New York’s Metropolitan Transportation Authority will run out of money by the end of August without another federal government bailout – it will have spent already the $3.8 billion given to it in the March stimulus package. However, Chipotle Mexican Grill said it expects to hire as many as 10,000 people over the next few months as it adds more drive-through lanes for people placing digital orders so there is that good news.

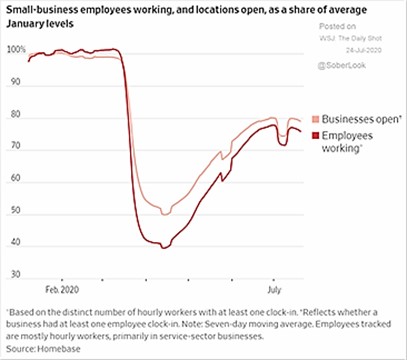

The US Federal Reserve extended its emergency lending programs through the remainder of 2020 though I would expect them to keep them going into 2021 as the Fed does not want to ruin the holiday season, especially for small businesses which are hurting badly nowadays (see graphic left). Outside the US, Argentina came to an agreement with creditors to reduce the value of their private foreign debt (of $65 billion) to about 55 cents on the dollar. Next up for the beleaguered country is to reduce or delay payments on $44 billion of IMF debt coming due in 2021 through 2023. Who is next?

The US Federal Reserve extended its emergency lending programs through the remainder of 2020 though I would expect them to keep them going into 2021 as the Fed does not want to ruin the holiday season, especially for small businesses which are hurting badly nowadays (see graphic left). Outside the US, Argentina came to an agreement with creditors to reduce the value of their private foreign debt (of $65 billion) to about 55 cents on the dollar. Next up for the beleaguered country is to reduce or delay payments on $44 billion of IMF debt coming due in 2021 through 2023. Who is next?

Macro: Asia

- China Continued to Spend at record levels in June, which pushed its Q2 GDP into positive territory as mentioned above. Retail sales were down -1.8% year-on-year in June – the fifth straight month of decline and much worse than a predicted +0.3% growth. Industrial output rose +4.8% in June from a year earlier, the third straight month of growth. Basic industries hit record production of steel, cement and crude oil refining. Vehicle sales advanced for a fourth straight month in China (+14.9%), with an easing in the coronavirus pandemic allowing buyers to gradually return to showrooms. Fixed asset investment fell a less-than-expected -3.1% in the first half from the same period in 2019. However, real estate investment growth increased by +8.5% in June, thanks to the government spending boost. Financing through loans (+14% year-on-year in June) and mortgage proceeds propelled the sector into growth, as developers benefit from lower interest rates. The unemployment rate was at 5.8% in June, down from the YTD high of 5.9% in May, although still well above that of recent years. China’s imports in June rose +2.7% from a year earlier for the first time since the coronavirus crisis paralyzed the economy, as government stimulus stoked demand for commodities, while exports, fueled by medical goods, also rose a modest amount (+0.5%).

- Not All Was Good News as Macau hotel occupancy was off the low but only at 27% versus over 90% before the pandemic. Regulators took over failed Tomorrow Holding Company, an insurer that has $171 billion in assets on its books. Bank runs at small rural banks forced authorities to step in. The US ended Hong Kong’s special status under its trade laws as well as placed sanctions on Chinese officials over their Uighur repression, and China retaliated by imposing sanctions on four US lawmakers. China also expanded their police powers in Hong Kong, prompting the FT to report that one-third of US businesses located there are looking to reduce their investment in the area. Perhaps the biggest Hong Kong news was that China moved to tax its citizens’ global income, undermining the financial hub’s appeal to thousands of bankers and other white-collar workers from the mainland. Faced with a tax rate as high as 45% (up from about 15% previously) the decision further reduces Hong Kong’s presence as a business center.

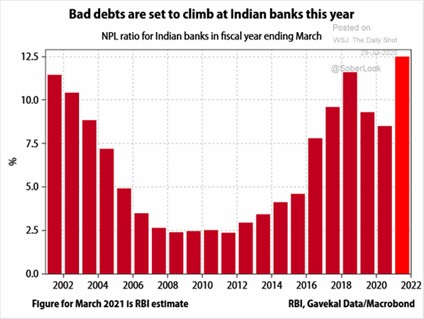

- Japan Continued to be Under Strain as Q2 GDP is expected to be lower than -20% annualized. June exports were down -26.2% year-on-year, worse than expected, industrial production fell -17.7% year-on-year but an improvement from last month, and happily retail sales held up better at down only -1.2% year-on-year and unemployment recovered a little to 2.8% from 2.9%. As perhaps expected with South Korea’s relatively small Q2 GDP decline, their industrial production returned to almost where it was a year ago. Taiwan posted a positive year-on-year industrial production number of +7.3%, well ahead of expectations. Finally we note that estimated bad debt in India looked to reach new highs – their banking system has been struggling over the last few years as the graph to the right demonstrates.

Macro: Europe

- Europe Became The Market’s Darling as EU leaders agreed on a €750 ($860) billion stimulus package to assist its faltering country-level economies via both low-cost loans and outright grants by borrowing the money in the markets (and undoubtedly supported by the ECB). However, the borrowings and disbursements will not begin until 2021, meaning that the economic impact will not directly support COVID recovery. The principal and interest on the debt will be covered by a series of new taxes ranging from non-recycled plastic to imports to financial transactions. This should allow perennial problems such as Italy and Greece to kick the can further down the road. The plan should assist banks which are expected to suffer billions in bad loan losses over the next three years. The Eurozone’s unemployment rate rose slightly in June to 7.8% from 7.7% in May and May’s industrial output was up strongly for the month (+12.4% versus April) but still down 20.9% year-on-year. Flights internally and overseas are improving, reaching 50% of normal. Finally, the ECB’s QE was very active and spent €15 billion buying nearly every new bond issued, for a record 22% share of eligible debt. Is Europe recovering? Yes, but just as GDP growth was anemic before the pandemic, there is little to suggest that a new age of prosperity is coming.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource