COVID-19

Omicron Following the Script we reported on last month as the current variant’s cases appeared to peak in the US on January 11th per Reuters at 704k, and quickly fell off to 304k on February 1st. US deaths may be peaking now at under 3k, which is below the 2021 peak, but still early. Hospitalizations also have fallen in 34 of the 50 states, with some 20-30%+ lower. Meanwhile COVID data collection has been called into question with the UK’s health service announcing that up to 60% of COVID patients in hospitals are not there to be treated for the virus but are “incidental” admissions. New York state made a similar announcement in early January. Remember that the CDC halted the use of the old PCR test January 1st but unknown if 100% of the current tests differentiate between COVID and flu as directed.

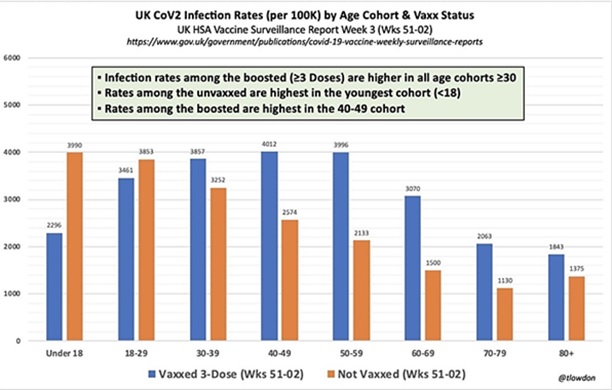

One analysis of recent UK data indicated the majority of infection rates were highest in many age cohorts among those boosted, supporting the belief that the shots offer less protection than commonly promised. In a similar vein, the US CDC on January 19th stated that having had COVID offered a stronger resistance to the disease than being vaccinated (however, we do not suggest purposely becoming ill to gain “natural immunity”), with a 29.0-fold versus a 6.2-fold improvement using California data (New York data had similar but lower multiples). Nevertheless, with 90% of hospitalized cases associated with co-morbidities (obesity, high blood pressure, etc.), the best way to avoid the worst outcomes is to have strong overall health or consider stringent medical precautions if suffering an underlying co-morbidity.

In other COVID news, European Union regulators warned that frequent Covid-19 booster shots could adversely affect the immune system and may not be feasible. Repeat booster doses every four months could eventually weaken the immune system, according to the European Medicines Agency. A new Covid-19 vaccine is being developed by Texas scientists using a decades-old conventional method that will make both production and distribution cheaper – and will not be patented. Storing the Corbevax vaccine only requires standard refrigeration, unlike the ultra-cold requirements of the mRNA drugs. Food shortages in North America risk getting worse as mandated vaccinations hit truck drivers crossing NAFTA borders – not just for Canadian truckers but also in the US and from Mexico. Finally, US overdose deaths were up strongly by mid-2021, hitting 100,000 over a twelve month period (up +29% year-on-year). The increase was seen across categories – fentanyl, overall opioids, methamphetamine and cocaine.

Macro: US

US Q4 Real GDP came in with a strong +6.9% headline, with 2021 growing 5.5%. However, beneath the headline, inventory growth was +4.9%, which is generally seen as not sustainable. In fact, Q1 GDP growth from the Atlanta Fed was estimated at +0.1%. US consumer prices year-on-year continued higher to +7.0% year-on-year in December, with more price increases expected in shipping, housing and consumer products in early 2022. This is the highest broad price increase since 1982. Core inflation likewise accelerated to +5.4% year-on-year. Shelter inflation was the highest in fourteen years, though if the Federal Reserve raises rates, then higher mortgage rates should slow or halt further increases. On the other hand, with food and energy increases seen in the commodity markets (outlined in the graph to the right that breaks down the components), inflation could bedevil consumers for most of 2022. Employment costs rose at the fastestpace since 2001 with a +4.0% increase in wages and salaries and +4.5% in overall employee costs. January employment increased more strongly than expected at +467k positions, double the highest survey number and the participation rose from 61.9% to 62.2% of the US population – a big number. Big adjustments across most months in 2021 undermined the reliability of labor data and the number of responding firms to the

Department of Labor is about half that pre-COVID (30% versus 70%). Another time bomb: the US government was not paid on $114 billion of the $1.6 trillion in student debt it owns (its largest asset) as 5.2 million borrowers were in default (a year without payment).

Fed Chair Powell Reiterated Tapering (buying fewer bonds) after the January 25th meeting with an eye to halt buying by early March and increase rates later that month (presumably at the March 15-16th meeting). After a number of Fed Governors supported consideration of even a 50-basis-point hike, interest rates increased notably, particularly at the front end of the curve. There was even discussion beginning the run-off of the Fed’s massive portfolio (i.e., halting the reinvestment of received interest and matured bonds). The main takeaway was Powell’s insistence of being “nimble” and not committing to any plan or preconceived tool. It was the most hawkish I recall a Fed Chair being in many years (more than Greenspan, Bernanke and Yellen). Recalling that the Fed owns 25% of all US Treasuries and 33% of mortgage-backed securities, one should prepare for higher moves in interest rates, for the US and globally.

Macro: Europe

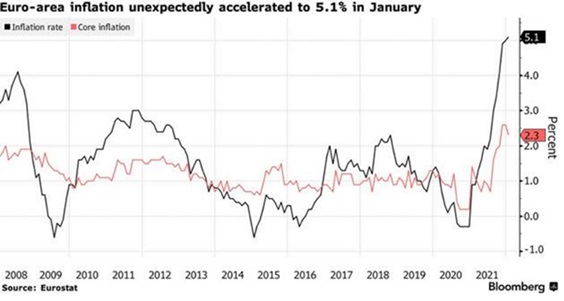

ECB and BOE Sharply Turned in their early February meetings with the Bank of England increasing rates by 25 basis -points, with four of the nine voters pushing for a more aggressive fifty-point move. Moreover, the central bank announced plans to cease all QE reinvestments and to start selling its corporate bond portfolio. The Bank also lowered their GDP forecast for 2022 to +3.5%, down from their +5% forecast in November. They also raised their inflation forecast for 2022, seeing the peak at +7.25% in April, up from their estimate of +5% in November (WSJ). The increase was due primarily to higher energy costs with the UK energy regulator limiting price increases to +54% for consumer heating. ECB President Christine Lagarde spoke more hawkish than expected at the central bank’s meeting in early February and the market quickly began pricing in interest rate increases in 2022. German five-year bonds returned to positive yields for the first time in over four years, while ten-year bund yields went positive on January 20th. Inflation was on the move, as the Eurozone saw a year-on-year producer price index up +26.2%, the largest such increase since recordkeeping started in 1996. Analogously, the graph on the right showed the increase in the EU broad consumer price index, which saw January’s inflation of +5.1% increase faster than expectations of +4.4%.

-points, with four of the nine voters pushing for a more aggressive fifty-point move. Moreover, the central bank announced plans to cease all QE reinvestments and to start selling its corporate bond portfolio. The Bank also lowered their GDP forecast for 2022 to +3.5%, down from their +5% forecast in November. They also raised their inflation forecast for 2022, seeing the peak at +7.25% in April, up from their estimate of +5% in November (WSJ). The increase was due primarily to higher energy costs with the UK energy regulator limiting price increases to +54% for consumer heating. ECB President Christine Lagarde spoke more hawkish than expected at the central bank’s meeting in early February and the market quickly began pricing in interest rate increases in 2022. German five-year bonds returned to positive yields for the first time in over four years, while ten-year bund yields went positive on January 20th. Inflation was on the move, as the Eurozone saw a year-on-year producer price index up +26.2%, the largest such increase since recordkeeping started in 1996. Analogously, the graph on the right showed the increase in the EU broad consumer price index, which saw January’s inflation of +5.1% increase faster than expectations of +4.4%.

Macro: Asia

China’s GDP Growth Slowed to +4.0% year-on-year in Q4 2021, implying a seasonally adjusted quarter growth of +1.6% and surpassing market expectations, albeit still representing a significant deceleration. Growth faced several headwinds, including weakness in the property sector, strict COVID-related restrictions, and the now-placated power crises.

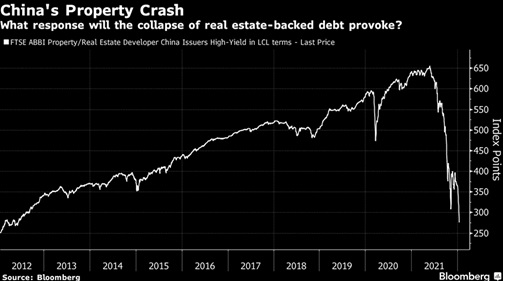

Industrial production grew by +4.3% year-on-year in December, stronger than expected, spurred by the recovery in energy production. Meanwhile, retail sales disappointed at +1.7% year-on-year in December on the COVID lockdowns. Property concerns continued as the debt index to the right indicates. December home prices fell for the fourth consecutive month. On the other hand, exports out of China rose more than expected in December to a record $340.5 billion. Likewise, the trade surplus for 2021 was a record $676 billion, although 2022 was expected to slow with the COVID restrictions. Remember that China is racing against the clock as the number of newborns in China fell for a fifth straight year to the lowest in modern Chinese history. Last year’s 10.62 million births, down from 12.02 million in 2020, barely outnumbered the 10.14 million deaths, suggesting the day may be near when China’s population starts to shrink. The working age population may have already peaked.

Japan’s Trade Also Hit Record in 2021 as the value of shipments abroad jumped +17.5% from a year ago. The gains in auto, steel and semiconductors all showed the same trend. Imports soared 41.1% with the values of crude oil, liquefied natural gas and coal all more than doubling from a year earlier. Also like China, there were signs of slowing in machine tool orders and industrial production missing expectations and versus a year-ago basis.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource