Ukraine: Winter & Sanctions Impact

The Ukraine-Russia Conflict had no major headlines apart from Ukraine starting to receive the main battle tanks that it would require to effectively take back lost territory. The winter slog continued with the focus on the city of Bakhmut with Russia sending in some of the 300,000 recruits mobilized late last year as the situation devolved into trench warfare. Reportedly both sides have taken heavy casualties though the kill ratio would favor the Ukrainians on defense against the Russian human-wave attacks. The “bleed-them-dry” approach that was being hyped in the news would not realistically have much effect at this early stage; however, if it continues through the summer, degraded Russian unit combat capacity may be exposed to the same opportunity to the Ukrainians that saw the quick advance late last year. Strategically, the war is the Russians to lose but a lack of progress is the same as a loss. This puts the burden on Putin’s generals to go big or go home. Chinese weapons and ammunition might help tip that balance but if Ukraine can get its international supporters to add deep strike capability to interdict such shipments (for example), the bought time may be sufficient. Remember that Russia has to spend that oil export revenue on something and importing Chinese military goods would make a lot of sense to Putin. For now, until the weather clears up after the early rains, the war remains one of raw punishment.

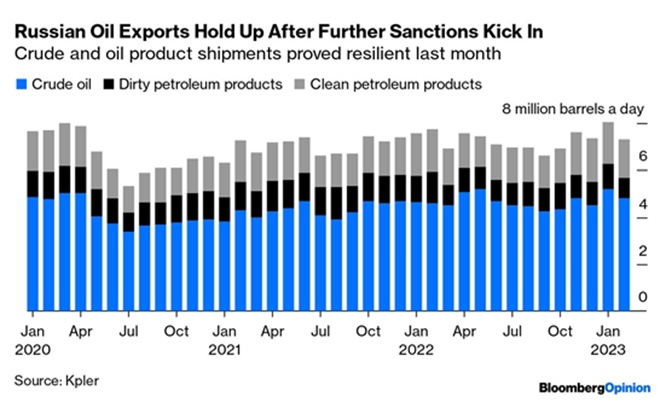

The UN-brokered Black Sea Crop-export Deal is set to expire in mid-March and Ukraine wants to extend the agreement by at least one year as well add a new eligible port to facilitate increased loading. Russia has said that an extension is only possible if the interests of its producers of agricultural products and fertilizers are taken into account in terms of unhindered access to world markets. We shall see if there can be a deal before March 18th. Meanwhile, Russia’s exports in terms of barrels per day continued unabated in February (see graph right) and Russian oil export revenues are set to rise in March as falling freight rates and strong demand pushes Russian oil prices towards a $60 per barrel Western price cap, based on Reuters’ calculations.

loading. Russia has said that an extension is only possible if the interests of its producers of agricultural products and fertilizers are taken into account in terms of unhindered access to world markets. We shall see if there can be a deal before March 18th. Meanwhile, Russia’s exports in terms of barrels per day continued unabated in February (see graph right) and Russian oil export revenues are set to rise in March as falling freight rates and strong demand pushes Russian oil prices towards a $60 per barrel Western price cap, based on Reuters’ calculations.

Macro: Asia

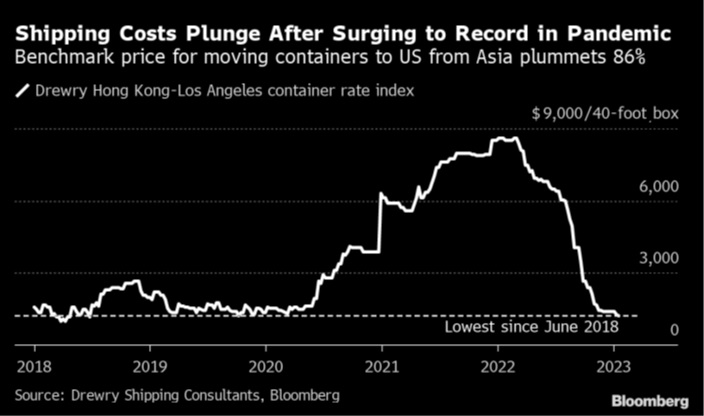

China Reopening Underway Picking Speed as the Chinese central bank injected over four trillion RNB (about $500 billion USD) ever since late last November, coinciding with the dropping of quarantine requirements for inbound travelers (though a negative test is still required) and other domestic measures. In just a few months, the Chinese have added 3-3 ½ times the amount they put in during the prior two years combined! The government’s Purchasing Manager Index (a marker for expanding or contracting economic activity) came in for February at 52.6, which is the best number since April, 2012. The private data firm Caixin came in with a reading for February’s PMI at 51.6, up from last month’s 49.2. China set a modest target for economic growth this year of around 5% on March 5th at its annual National People’s Congress, highlighted by increased spending on infrastructure and defense. Exports declined in the first two months of 2023 at -6.8% from the same time a year ago, worse than the -5.5% forecasted while imports fell by -10.2%, missing expectations of a -7.5% decrease. However, with the lower imports due to a weaker US dollar and lower commodity prices, that may not be a bad sign. In a sign of “improvement,” thirteen cities surrounding Beijing issued pollution alerts, including the industrial / steelmaking centers of Tianjin and Tangshan. The collapse in shipping costs (see graph) to the west coast removed another COVID lockdown overhang but if the US economy slows or goes into recession, it will do little good.

quarantine requirements for inbound travelers (though a negative test is still required) and other domestic measures. In just a few months, the Chinese have added 3-3 ½ times the amount they put in during the prior two years combined! The government’s Purchasing Manager Index (a marker for expanding or contracting economic activity) came in for February at 52.6, which is the best number since April, 2012. The private data firm Caixin came in with a reading for February’s PMI at 51.6, up from last month’s 49.2. China set a modest target for economic growth this year of around 5% on March 5th at its annual National People’s Congress, highlighted by increased spending on infrastructure and defense. Exports declined in the first two months of 2023 at -6.8% from the same time a year ago, worse than the -5.5% forecasted while imports fell by -10.2%, missing expectations of a -7.5% decrease. However, with the lower imports due to a weaker US dollar and lower commodity prices, that may not be a bad sign. In a sign of “improvement,” thirteen cities surrounding Beijing issued pollution alerts, including the industrial / steelmaking centers of Tianjin and Tangshan. The collapse in shipping costs (see graph) to the west coast removed another COVID lockdown overhang but if the US economy slows or goes into recession, it will do little good.

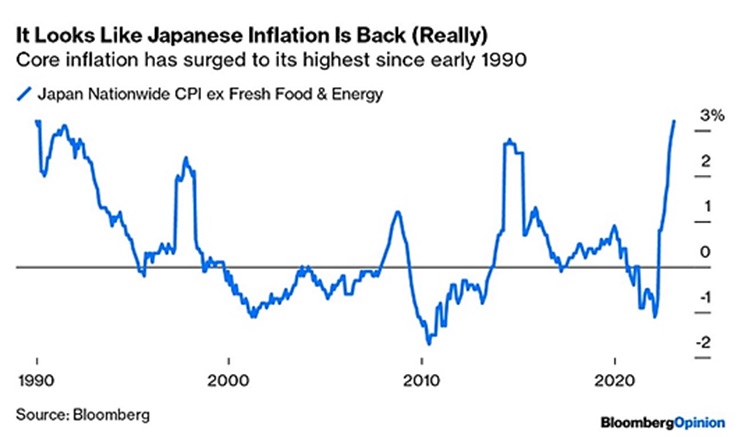

Japanese GDP Growth Missed for the last three months of 2022, increasing only an annualized +0.6%, missing +2.0% forecasts. Q1 2023 also was expected to underperform but the spending by China may limit any decline. To give an idea of how anemic Japan’s economy has performed over the last ten years, it is smaller in current U.S. dollar terms than it was when Abe took power in 2012. Complicating the situation was the changing of the Governor of the Bank of Japan. While any increase in interest rates would likely be slow and incremental because of the massive 250% government debt-to-GDP ratio, speculation swirled around what policies Kazuo Ueda will follow, particularly if the acceleration of inflation like that seen in North America and Europe continues (see graph right).

China may limit any decline. To give an idea of how anemic Japan’s economy has performed over the last ten years, it is smaller in current U.S. dollar terms than it was when Abe took power in 2012. Complicating the situation was the changing of the Governor of the Bank of Japan. While any increase in interest rates would likely be slow and incremental because of the massive 250% government debt-to-GDP ratio, speculation swirled around what policies Kazuo Ueda will follow, particularly if the acceleration of inflation like that seen in North America and Europe continues (see graph right).

Macro: US

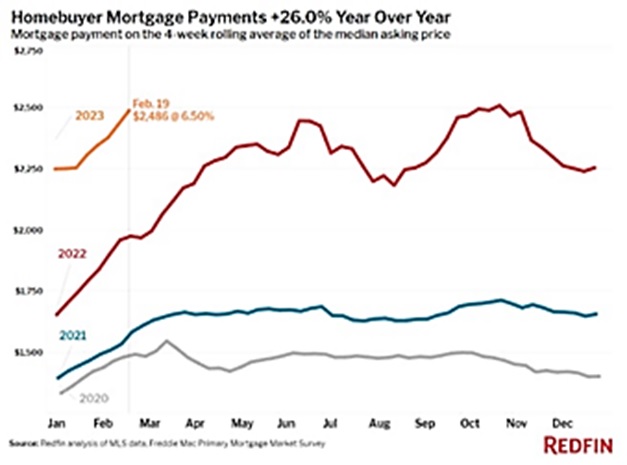

Placid Powell Kept Markets Buoyant despite repeated messages of continual interest rate hikes, though at a minimal +0.25% pace. No change to the balance sheet runoff policy (AKA “Quantitative Tightening”) though the mortgage portion was not paying down as quickly as expected as  refinances slowed due to higher interest rates. We shall see if there is a change in pitch at the March 21-22nd meeting. With low unemployment (3.4% at the January announcement), and wages still strong (private payroll company Paychex had the 12-month wage growth at +4.5%), the Fed looks locked in for a March increase. At some point, these higher interest rates will hit the consumer – housing payments continued their rise (see graph left) and credit card balances grew rapidly by $130 billion to a record $986 billion in 2022. Consumer debt across all categories totaled $16.9 trillion, up about $1.3 trillion from a year ago as balances rose across all major categories. Delinquencies also moved higher, but are still at low levels. Finally, the US federal budget deficit widened $200 billion more rapidly than forecasted to $459 billion through January, raising the risk that the Treasury will run out of cash earlier than expected due to the debt ceiling stand-off between Republicans and Democrats.

refinances slowed due to higher interest rates. We shall see if there is a change in pitch at the March 21-22nd meeting. With low unemployment (3.4% at the January announcement), and wages still strong (private payroll company Paychex had the 12-month wage growth at +4.5%), the Fed looks locked in for a March increase. At some point, these higher interest rates will hit the consumer – housing payments continued their rise (see graph left) and credit card balances grew rapidly by $130 billion to a record $986 billion in 2022. Consumer debt across all categories totaled $16.9 trillion, up about $1.3 trillion from a year ago as balances rose across all major categories. Delinquencies also moved higher, but are still at low levels. Finally, the US federal budget deficit widened $200 billion more rapidly than forecasted to $459 billion through January, raising the risk that the Treasury will run out of cash earlier than expected due to the debt ceiling stand-off between Republicans and Democrats.

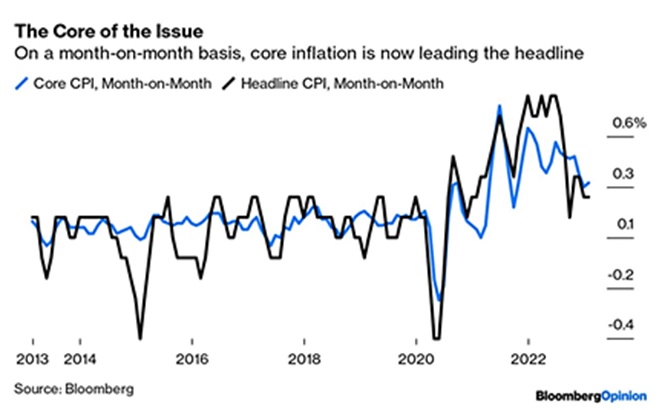

US Inflation Increased in January slightly by +0.5% to an overall rate of +6.4% for the trailing twelve months with the core rate up by +0.4% and +5.6%, respectively. Energy costs moved up +2.0% for the monthly figure, reversing the declining trend into the end of last year. Shelter costs — which are the biggest services component and make up about a third of the overall CPI index — increased +0.7% last month, the latest in a string of similar increases. As Bloomberg quipped, “core inflation is now the headline” per the graph on the right with core inflation higher than the headline number, month-on-month. Other measures also showed re-acceleration or maintaining of inflationary pressures – PPI (Producer Price Index) rose the most in over six months and the Fed-favorite PCE (Personal Consumption Expenditures) at +7.7% annualized rate for January was handily above the +2.4% annualized rate in December. Finally, with the Atlanta Fed projecting a +2.0% Q1 GDP growth (twice that of the private forecast consensus), the Fed again has no reason to halt its increases.

the biggest services component and make up about a third of the overall CPI index — increased +0.7% last month, the latest in a string of similar increases. As Bloomberg quipped, “core inflation is now the headline” per the graph on the right with core inflation higher than the headline number, month-on-month. Other measures also showed re-acceleration or maintaining of inflationary pressures – PPI (Producer Price Index) rose the most in over six months and the Fed-favorite PCE (Personal Consumption Expenditures) at +7.7% annualized rate for January was handily above the +2.4% annualized rate in December. Finally, with the Atlanta Fed projecting a +2.0% Q1 GDP growth (twice that of the private forecast consensus), the Fed again has no reason to halt its increases.

Macro: Europe

Eurozone Inflation moved lower again in February to +8.5% annualized from +8.6% annualized for January but that was higher than the +8.2% forecasted. Core inflation (ex-food and energy) increased from +5.3% to +5.6% annualized. Slower growth in energy costs helped but higher prices for goods, services and food more than offset that. The European Central Bank in reaction was expected to increase interest rates by a half-point at their March 16th meeting. Unemployment stayed constant at 6.7%. One must also watch the ECB update on its runoff of its €5 trillion ($5.4trillion) bond portfolio to see if it reached its monthly cap of €15 billion runoff between March and June on maturing debt.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource