Covid-19

- Operation Warp Speed and the continued efforts under the new administration allowed the US to break the 2 million doses per day in early March, with 24% in the US receiving at least one dose. Johnson & Johnson’s one-shot vaccine was also approved; the firm expected to ship more than 20 million doses by the end of March and 100 million by midyear. Europe continued to lag badly at 8% vaccinated but the more aggressive UK led large countries with 32% of its population receiving at least one dose. Some interesting items not broadly covered:

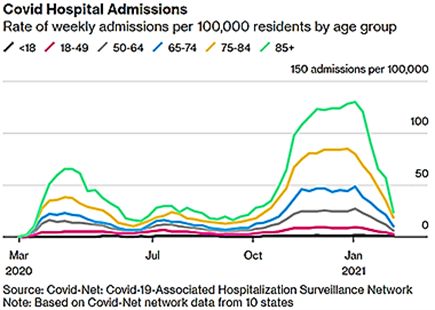

- While case count may be important, hospitalization is likely the primary cost associated with COVID. As the graph to the right shows from Bloomberg, those numbers have fortunately plummeted to summer levels.

- Canada-based researchers Skowronski and De Serres said in their letter in the New England Journal of Medicine that governments should delay administering the second dose of Pfizer’s COVID-19 vaccine, which they said had an efficacy of 92.6% after the first dose, as it was not significantly beneficial in the short term. These findings were also similar to the first-dose efficacy of 92.1% reported for Moderna’s mRNA-1273 vaccine. Israeli data also supported this conclusion.

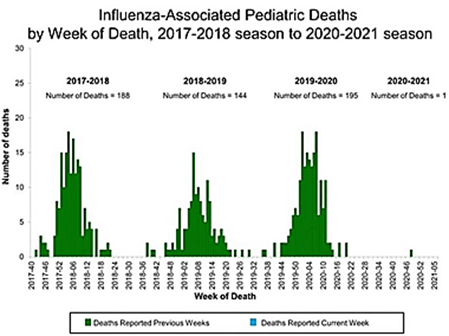

- In the 2019-20 season, there were 195 childhood deaths from the seasonal flu, one of the

worst years on record. However, this year so far there has been one loss of life (see the little green bar on the right side of this graphic). Also in terms of good news, the US CDC reported overall flu cases that required hospital visits over the last three months (during the usual flu season) at about 15-20% of the historical levels.

worst years on record. However, this year so far there has been one loss of life (see the little green bar on the right side of this graphic). Also in terms of good news, the US CDC reported overall flu cases that required hospital visits over the last three months (during the usual flu season) at about 15-20% of the historical levels. - Per some estimates, COVID vaccination spending by the US government on the three primary programs (Pfizer, Moderna and J&J) should be sufficient to cover almost 100% of the US population by the end of June. What next? Vaccine diplomacy? What will Canada, Mexico, EU, Japan, Korea, and so on give to be the first to receive the US’ surplus vaccines? How about Taiwan as a counterbalance to China? While we know little about Biden’s foreign policy priorities, how those doses are distributed could provide direct insight to which countries he considers his allies and which not (Saudi Arabia, Russia and China are probably in the latter). In contrast, the European Union blocked from export 250,000 AstraZeneca-Oxford vaccines destined for Australia. Coming after a similar conflict with the UK the month prior, the EU continued to undermine its image of fair-dealing.

- Finally per Bloomberg, COVID-related nursing home deaths were more than 1/3rd of the US COVID deaths despite them housing less than 1% of the population. Obviously many logical factors came together (age, co-morbidities, close proximity) that drove this result but it was still shocking and saddening.

- Our thoughts and prayers go out to those taken ill and we hope that they have access to proper care and recover fully.

Macro: US

- Q4 GDP Growth Marked Higher to annualized +4.1% with the Atlanta Fed looking at +10.0% for Q1 2021, which seems doable given the US’ economic improvements associated with re-openings by locked-down states. Compounding this event shift was legislative movement on $1.9 trillion in supplemental stimulus spending by the US government including direct payments to households, 85% premium coverage for health insurance for laid-off workers, extended and increased unemployment payments, vaccination and medical spending, state and local government support/bailouts, tax credits and utility coverage to low-income families, school and university grants and payments to specific industries (air travel and restaurants). More spending on infrastructure and climate grants and directives on the minimum wage look next to come. Before this additional spending, the Congressional Budget Office reported that the federal budget deficit was projected to total $2.3 trillion in the 2021 fiscal year, a drop from the previous year but still well ahead of spending prior to the pandemic. While there may be no inflation, expect higher interest rates to fund all this largesse.

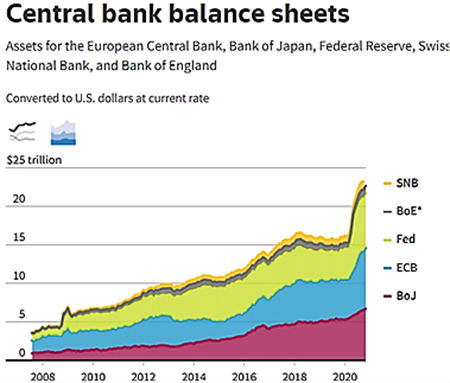

- US’ Federal Reserve said it will continue to support the economy through massive monetary

stimulus until it sees “substantial further progress” in employment and inflation. The graph to the right underscores the global glut in central bank quantitative easing, with the US arguably not the worst offender. Powell reiterated easy monetary policies late February in regular testimony to Congress and we expect more of the same at the mid-March Fed meeting. He particularly downplayed the impact of higher interest rates, which have seen 10-year bonds move to over 1.5% and 30-year debt at 2.3%. Thirty-year mortgages moved above 3% for the first time since July 2020, though they are still lower than twelve months ago. Pending home sales fell to a six-month low in January as the number of properties available were limited. Total US household debt rose +3% in 2020 to $14.56 trillion as home loans increased +5% to over $10 trillion though credit card balances fell -12% from 2019.

stimulus until it sees “substantial further progress” in employment and inflation. The graph to the right underscores the global glut in central bank quantitative easing, with the US arguably not the worst offender. Powell reiterated easy monetary policies late February in regular testimony to Congress and we expect more of the same at the mid-March Fed meeting. He particularly downplayed the impact of higher interest rates, which have seen 10-year bonds move to over 1.5% and 30-year debt at 2.3%. Thirty-year mortgages moved above 3% for the first time since July 2020, though they are still lower than twelve months ago. Pending home sales fell to a six-month low in January as the number of properties available were limited. Total US household debt rose +3% in 2020 to $14.56 trillion as home loans increased +5% to over $10 trillion though credit card balances fell -12% from 2019.

- Other US Economic News was strong as factories orders for durable goods rose by the most in six months in January (+3.4% month-on-month after an upward revision to +1.2% in December). Likewise manufacturing output rose by +1.0% for the month in January, beating a +0.7% forecast. Unemployment for February declined to 6.2% while underemployment stayed steady at 11.0%. Non-farm payrolls rose +379,000, handily beating estimates of +200.000. Bloomberg forecasted that March will look even better as absences due to bad weather were three times worse last month than the ten-year average. Retail sales surged in January by the most in seven months, beating all estimates and suggesting fresh stimulus helped spur a rebound in household demand following a weak fourth quarter. The value of overall sales increased +5.3% from the prior month after a -1.0% decline in December. Give people money and they will spend it!

Macro: Asia

- China Set A Relatively Conservative economic growth target for 2021 at +6%, below the +8.4% forecasted by economists. This seemed like an easy goal but the CCP focused on reining in debt and reducing technological dependence on the US as opposed to raw growth. Addressing the gap between the richest 20% versus poorest 20% may also be an agenda item (China’s wealthy versus poor income ratio is 10.2 times versus the US at 8.4x and Europe’s 5x). Exports jumped +60.6% in dollar terms in the January-February period from a year earlier government data showed, well above the +40% median estimate as a truncated Lunar Year holiday period kept factories open while a year ago many were shut due to COVID. Trade with the US was +81.3% higher for this two-month period

- Japanese Industrial Production rebounded by +4.2% January, compared to a -1.0% decline month-on-month in December. This was the fastest pace of sequential growth in industrial output since July of last year. Likewise, gains in Japanese exports accelerated in January, propelled by surging shipments to China (+37.5% year-on-year). The value of overseas shipments climbed 6.4% from the prior year, rising for a second month and picking up from December’s +2.0% pace. A +51% surge in exports of chip-making gear and a jump in shipments of plastics drove the gains. Q4 2020 GDP increased +12.7% quarter-on-quarter (seasonally adjusted, annualized) after a revised-down +22.7% expansion in 3Q, higher than the consensus forecast of +10.1% growth.

Macro: Europe

- UK – EU Trade Recovered to 90% of usual levels as the two entities began to normalize relations after Brexit and adopted updated COVID restrictions. German factory orders rose in January but industrial production fell for the first month in eight, showing the uncertain European recovery. German joblessness unexpectedly rose for the first time in eight months, but only marginally at +9,000, putting the total number of unemployed at 2.75 million and at a rate at 6%. Overall EU unemployment stayed the same at 7.3% in January. Perhaps there will be some excitement at the ECB meeting in mid-March.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource