Americas

- Economic Data for US Q4 2018 GDP came in at +2.6%, as consumption grew slightly less than forecast but business investment beat expectations. However, with the Federal government partial shut-down through January 25th, GDP for Q1 2019 is on the top of everyone’s minds. The initial reading by the Atlanta Federal Reserve is a much lower +0.5% with the bulk of private forecasts at just below +2.0%. In addition, separate from the shutdown, the debt ceiling is set to return to the forefront: the most recent legislation was passed on February 9, 2018 and suspends the limit until March 1, 2019. Historically, the Treasury created enough borrowing headroom to continue functioning normally for three to six months past that date so this will not be an immediate issue but another topic to fight over during the summer as the political season for the presidency begins. The US Federal Reserve pledged to continue its balance sheet reduction but guided the markets to expect a slower pace. Chair Powell said in congressional testimony that he was not committed to further rate increases or balance sheet decreases but expected that the Fed would stop shrinking its balance sheet at some point late this year. We will have to wait until the March 19th/20th meeting to see if there is any Fed reaction to the ongoing US government fiscal and trade issues.

- Key Economic Barometers were still muddled by the government shutdown. Employment numbers underwhelmed for February, with payrolls up only 20,000 positions, much lower

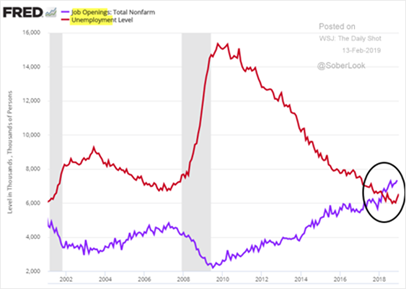

than the 180,000 expected (and the previous month was revised upward by 7,000 to 311,000). Unemployment stayed low at 3.8% and underemployment reverted back down from 8.1% to 7.3%. Average hourly earnings rose a better-than-expected +3.4%, year-on-year. Another way of viewing the data is the graph on the left which shows the Fed’s measure of job openings exceeds the officially unemployed.

than the 180,000 expected (and the previous month was revised upward by 7,000 to 311,000). Unemployment stayed low at 3.8% and underemployment reverted back down from 8.1% to 7.3%. Average hourly earnings rose a better-than-expected +3.4%, year-on-year. Another way of viewing the data is the graph on the left which shows the Fed’s measure of job openings exceeds the officially unemployed.

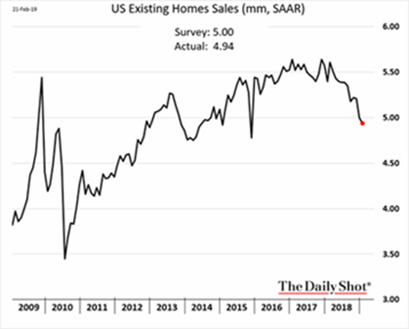

- Existing home sales fell on the weakest pace since November 2015 by -1.2% in January versus December. Mortgage rates as indicated by 30-year fixed rates have been declining from 4.8% to 4.4% which should have been supportive to sales. Inflation figures are still showing moderate levels with core inflation just over 2.1% and overall inflation at 1.5%. However, consumers are still under debt pressure – student debt in “serious delinquency” (three months overdue or more) breached $166 billion (11% of all student debt), which is square on the back of taxpayers. Seven million households are 90 days or more behind on their car payments. Credit card debt also hit a new high at the end of 2018 at $870 billion.

January US industrial production also fell -0.6%, missing a +0.1% increase, and the previous month was revised lower. Auto, defense and mining industries were blamed for the failure. Meanwhile, retail sales fell by -1.2% in December to a ten-year low, wildly missing estimates predicting a +0.1% increase. Store closings in 2019 have been increasing (up over 20% versus 2018 as of mid-February), with 4,500 slated for vacancy by the beginning of March, including brands such as Gymboree (749 locations), Gap (230), Charlotte Russe (512), Shopko (251), Sears (72), Dollar Tree (390), Payless Shoes (2,100), JCPenney (18), Victoria’s Secret (53) and Foot Locker (165). Absorbing these lost jobs will be a challenge and undoubtedly fodder for the upcoming US presidential campaigns.

January US industrial production also fell -0.6%, missing a +0.1% increase, and the previous month was revised lower. Auto, defense and mining industries were blamed for the failure. Meanwhile, retail sales fell by -1.2% in December to a ten-year low, wildly missing estimates predicting a +0.1% increase. Store closings in 2019 have been increasing (up over 20% versus 2018 as of mid-February), with 4,500 slated for vacancy by the beginning of March, including brands such as Gymboree (749 locations), Gap (230), Charlotte Russe (512), Shopko (251), Sears (72), Dollar Tree (390), Payless Shoes (2,100), JCPenney (18), Victoria’s Secret (53) and Foot Locker (165). Absorbing these lost jobs will be a challenge and undoubtedly fodder for the upcoming US presidential campaigns.

Europe

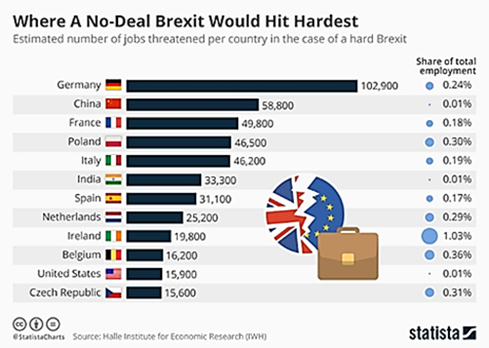

- Europe’s Distraction Continues as the Brexit standoff with the March 29th deadline loomed closer. Personally, I feel that a “hard Brexit” or no-deal result is the most likely as both sides have set conditions that appear impossible for the other to live with. Someone will otherwise have to give, and that will send shockwaves in all directions. Job loss estimates outside of the UK look pretty heavy (see graph right), which should push the EU towards a deal, one would think. Setting the politics aside, continental Europe continued to stumble as German Q4 GDP stayed the same at +0.0%, just avoiding technical recession, as exports fell -4.4% year-on-year. Eurozone

industrial production fell -4.2% year-on-year, worse than the -3.3% expected. European car sales fell for the fifth straight month, including all the big markets (Germany, France, UK, Italy and Spain).

industrial production fell -4.2% year-on-year, worse than the -3.3% expected. European car sales fell for the fifth straight month, including all the big markets (Germany, France, UK, Italy and Spain).

- With this backdrop, the ECB capitulated and went more dovish than expected at its early March meeting. Outgoing President Draghi cut the European GDP growth outlook from +1.7% to +1.1% for 2019 and announced that there would be no rate hike in 2019 versus expectations that there would be one by the end of the year. Also, he revealed a third of set of loans available to banks to promote lending to companies. If the take-up is similar to previous offerings, the amount could be as much as $400 billion but is unknown until the program starts until later this year. In addition, the term is shorter than before (i.e., two-year maturities versus four-years). While optically bullish for markets, this credit injection also seems to fall short.

Asia

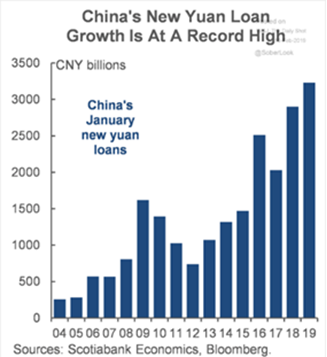

- Beijing Announced More Stimulus and lowered its GDP growth target from +6.5% to +6.0% for 2019. At the just held National People’s Congress, Premier Li Keqiang unveiled tax cuts worth $300 billion and an increase in fiscal spending by +6.5% to offset the headwinds of the US-China trade war. This is in addition to the new lending mandates by the central government that increased loans and other financing from banks by $685 billion in January which places lending to the private sector at $30 trillion (about 245% of GDP). While exports had a strong January (+9.1%), they collapsed in February by -20.7% (both year-on-year). Imports fell both months, at -1.5% and -5.2% year-on-year, respectively. This meant that the trade surplus was only $4 billion for February, much smaller than forecasts of $26 billion. The US-China trade war is not the only culprit – Japan’s exports to China fell by -17.4% year-on-year The timing of Chinese New Year caused some of the swing but the export decline caught

markets by surprise. China’s car sales continued to decline in January after the first full-year slump in more than two decades, as wholesale passenger vehicle sales fell 17.7% year-on-year to 2.02 million units. Crude oil imports for China’s independent refineries fell for the second consecutive month in February to 2.5 mbpd, though total oil imports increased to 10.2 mbpd with new refineries set to come on line this year. This stimulus prompted a strong surge in the Chinese stock market (e.g., the CSI 300 was up +25% YTD March 2nd) and it was further supported by an increased weight in the primary emerging market index compiled by MSCI. Meanwhile a state-owned company defaulted on a US-dollar bond in Hong Kong – the first offshore default in twenty years. To the market’s surprise, the central government did not bail out bondholders; is this a new policy?

markets by surprise. China’s car sales continued to decline in January after the first full-year slump in more than two decades, as wholesale passenger vehicle sales fell 17.7% year-on-year to 2.02 million units. Crude oil imports for China’s independent refineries fell for the second consecutive month in February to 2.5 mbpd, though total oil imports increased to 10.2 mbpd with new refineries set to come on line this year. This stimulus prompted a strong surge in the Chinese stock market (e.g., the CSI 300 was up +25% YTD March 2nd) and it was further supported by an increased weight in the primary emerging market index compiled by MSCI. Meanwhile a state-owned company defaulted on a US-dollar bond in Hong Kong – the first offshore default in twenty years. To the market’s surprise, the central government did not bail out bondholders; is this a new policy?

- Japan’s Q4 2018 GDP rose +0.3% for the quarter (matching expectations) and thus was 0.0% for the year. January factory output fell -3.7% month-on-month in January as exports stumbled (total exports down -8.4% with the fall in China and EU but an increase to the US). Korean exports also went lower, -11.1% year-on-year, worse than survey.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource

*Additional information sources: Bloomberg, Financial Times, JP Morgan, Reuters, SouthBay Research, Wall Street Journal and Zerohedge