Ukraine: Winter & Sanctions Impact

The Ukraine-Russia Conflict was gripped by winter, with Russia targeting electrical infrastructure and limited spoiling attacks to keep the Ukrainians from extending their gains. Russia’s additional mobilization of 300,000 recruits started to see the front but were likely waiting for spring operations. Ukraine continued to receive military aid from the US and Western Europe which could prove important to its next movements – armored vehicles and anti-drone/-missile defenses being key additions. An estimate in the press stated both sides have each had 100,000 military casualties (dead and wounded) – which is the same number in ten months that Russia received during the Afghan war (70,000-100,000) – but over nine years. At this rate, Putin’s generals need to go big or go home – so going big in 2023 is the only real option. Until the weather clears up after the early rains, however, it remains a war of wills and attrition.

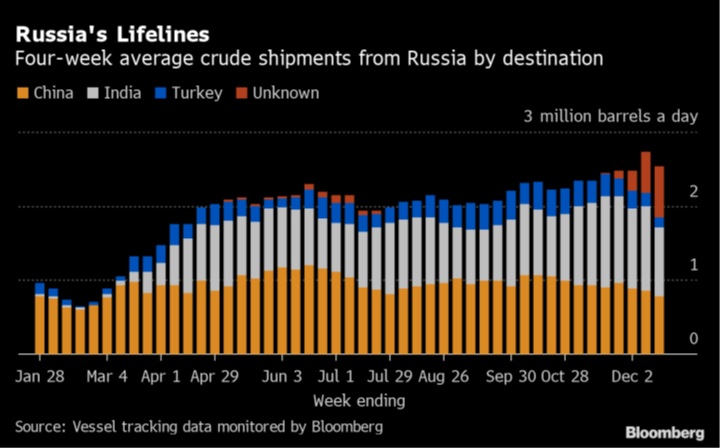

The EU Sanctions and $60 Price Cap on Russian oil went into effect in early December. Flows to Western Europe went to zero by December 16th per Bloomberg. Russia reiterated it will not sell under terms of the cap, and so far, key non-EU buyers, including China, India and Turkey, showed no signs of following it. Russia’s new challenge is that their oil tankers have to travel 1,000’s of more miles to deliver their crude, costing valuable time and money. Despite this, Bloomberg reported that three-quarters was now headed to Asia (and a growing “unknown”) as one can see on the chart to the right. Bloomberg also reported that Russia’s government revenues from crude shipments have been cut almost in half to about $70 million per week from close to $150 million in early October. Russian PM Mishustin ordered higher dividends and payments from commodity producers to offset war costs, including $2.4 billion for the resettlement of 100,000 people from eastern Ukraine (perhaps a tacit admission that Russia does not think it can hold onto those territories).

China, India and Turkey, showed no signs of following it. Russia’s new challenge is that their oil tankers have to travel 1,000’s of more miles to deliver their crude, costing valuable time and money. Despite this, Bloomberg reported that three-quarters was now headed to Asia (and a growing “unknown”) as one can see on the chart to the right. Bloomberg also reported that Russia’s government revenues from crude shipments have been cut almost in half to about $70 million per week from close to $150 million in early October. Russian PM Mishustin ordered higher dividends and payments from commodity producers to offset war costs, including $2.4 billion for the resettlement of 100,000 people from eastern Ukraine (perhaps a tacit admission that Russia does not think it can hold onto those territories).

Macro: Asia

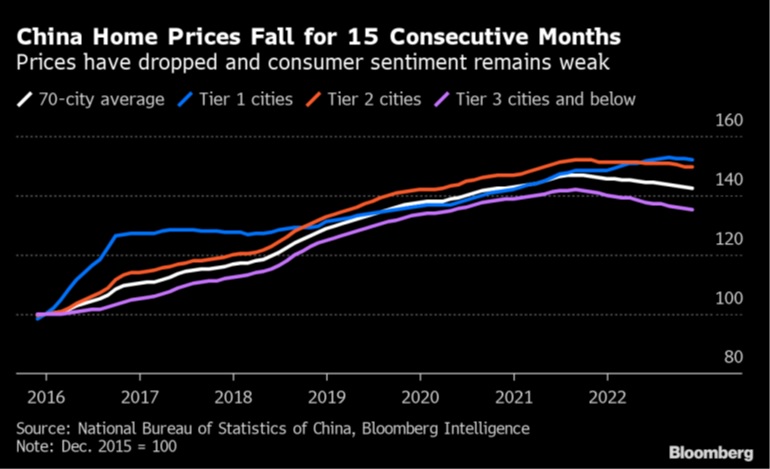

China Reopening Underway but will be a stressful few months ahead, based on case spikes in Europe and the US during winter and the spread of new variants. In early December, China removed quarantine requirements for inbound travelers (though a negative test is still required) and quarantine requirements for positive tests. Before the change of policy, November’s economic indicators were very shaky as +2.2% year-on-year industrial production growth was the lowest since April (and down on a monthly basis), while electricity generation remained extremely weak with hydropower still struggling (-14% versus twelve months prior). Retail sales dropped to -5.9% year-on-year and property data was notably weak, with fixed asset investment in real estate down -20% versus last November, home sales down -31% and new starts down -51% over the same period, which is the sharpest pace of decline on record. Total fiscal spending by all levels exceeded revenues by $1.1 trillion for the eleven months ending November, more than double the deficit last year over the same period. Tax revenue from failing real estate developers unsurprisingly fell dramatically as spending for healthcare and social welfare increased by 15% year-on-year. Finally, China‘s exports and imports shrank at a much steeper-than-expected pace in November, as feeble global and domestic demand, Covid-19-induced production disruptions and a property slump at home piled pressure on the world’s second-biggest economy. Exports contracted -8.7% in November from a year earlier, a sharper fall than the -0.3% loss in October, and marked the worst performance since February 2020. Imports were down sharply by -10.6% from a -0.7 per cent drop in October, weaker than a forecasted -6% decline. The downturn was the worst since May 2020.

Policy 180º Initially Effective as Reuters noted that road and air traffic having improved with domestic air travel up by +68% week on week. The movement of fully laden trucks in China in mid-December rose from a near-two month low in late November to close to the level of the same period in 2019. Real state is still a problem with home prices still under pressure (see graph right). A resurgent (or at least recovering) China may be enough to offset the recession / economic slowdown expected in Japan, Europe and the US like in 2009. This is a key question for the world economy – will China be an economic leader like its strong performance during the 2009 Financial Crisis or will it stumble under the lack of global demand and its debt?

the level of the same period in 2019. Real state is still a problem with home prices still under pressure (see graph right). A resurgent (or at least recovering) China may be enough to offset the recession / economic slowdown expected in Japan, Europe and the US like in 2009. This is a key question for the world economy – will China be an economic leader like its strong performance during the 2009 Financial Crisis or will it stumble under the lack of global demand and its debt?

Macro: US

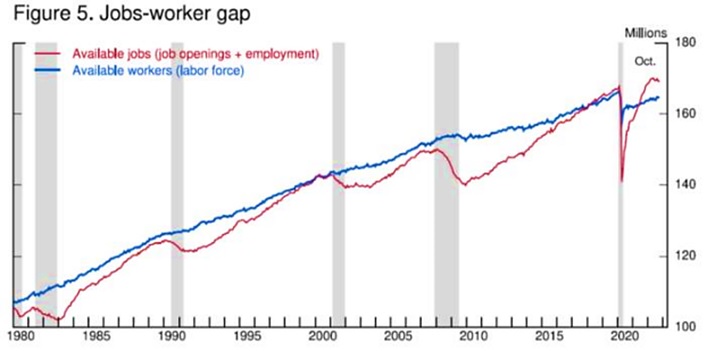

Whatever Happened To “Don’t Fight the Fed?” Despite repeated hawkish statements by Fed officials, markets were still pricing in 0.5% of rate cuts in 2H 2023. At the December meeting, the Federal Reserve continued their hawkish stance regarding interest rates  with a +0.5% increase and a reiteration by Powell that they are looking for “higher for longer.” The markets initially sold off that day but then recovered. This is also despite the pace of balance sheet decline (quantitative tightening) staying at $95 billion per month. Market valuations are weaker than the insanely strong ones of 2021 – 22 but are not cheap. The S&P 500 forward price earnings ratio is at 18, where it was in 2019. CCC junk bonds have an 11% spread over Treasuries – still about half the differentials seen in 2016 and 2020. Chair Powell harkened back to a chart (left) that he mentioned last month – that the labor supply was about 3.5 million workers short of labor demand. The latest unemployment numbers of 3.5% suggests a very strong employment situation, with underemployment back to 6.5%, the lowest since 1994. It certainly seems to me that more but lower interest rate hikes should be expected during the first half of 2023 (one to three more at +0.25%).

with a +0.5% increase and a reiteration by Powell that they are looking for “higher for longer.” The markets initially sold off that day but then recovered. This is also despite the pace of balance sheet decline (quantitative tightening) staying at $95 billion per month. Market valuations are weaker than the insanely strong ones of 2021 – 22 but are not cheap. The S&P 500 forward price earnings ratio is at 18, where it was in 2019. CCC junk bonds have an 11% spread over Treasuries – still about half the differentials seen in 2016 and 2020. Chair Powell harkened back to a chart (left) that he mentioned last month – that the labor supply was about 3.5 million workers short of labor demand. The latest unemployment numbers of 3.5% suggests a very strong employment situation, with underemployment back to 6.5%, the lowest since 1994. It certainly seems to me that more but lower interest rate hikes should be expected during the first half of 2023 (one to three more at +0.25%).

US Inflation Cooled in November by more than forecast with monthly rate of increase of +0.2% for the core and +0.1% for the overall consumer index. The 12-month rates were +6.0% and +7.1%, respectively, lower as higher increases drifted further into the past.  Other inflation measures were lower, such as the PCE, but the Atlanta Fed’s “sticky price inflation” was still at 40-year highs (right). This implies that even if inflation grinds lower, it may stay well above the Fed’s 2% target for an extended time (years) which would explain Powell’s “higher for longer” mantra. As a reminder, the roughly 65 million retirees who collect Social Security benefits in the US will get a +8.7% increase in 2023, the largest bump since 1981, to compensate for the highest inflation in decades. As a reminder on housing, an extensive quote sums it up:

Other inflation measures were lower, such as the PCE, but the Atlanta Fed’s “sticky price inflation” was still at 40-year highs (right). This implies that even if inflation grinds lower, it may stay well above the Fed’s 2% target for an extended time (years) which would explain Powell’s “higher for longer” mantra. As a reminder, the roughly 65 million retirees who collect Social Security benefits in the US will get a +8.7% increase in 2023, the largest bump since 1981, to compensate for the highest inflation in decades. As a reminder on housing, an extensive quote sums it up:

Redfin, for example, expects the median US home price to drop about 4% in 2023 to $368,000. If it happens, that will be the first annual drop since 2012. This seems like a major change. But does it matter? Redfin’s own data shows the median home price was $293,000 in February 2020, just before COVID. So even with this drop, the median home will still be 26% more expensive than it was four years ago. And 30-year fixed mortgage rates have roughly doubled in that same time. The median home price almost tripled in the last 22 years, far outpacing inflation.

About one in four millennials are living with their parents, according to a survey of 1,200 people per website PropertyManagement.com – equivalent to about 18 million people between the ages of 26 and 41. The surge in rental costs was the main reason given for the move. About 15% of millennial renters say that they’re spending more than half their after-tax income on rent, which basically means that they are not saving money for a down payment or perhaps even for retirement. Higher interest rates will put that dream off further.

Macro: Europe

Eurozone Inflation ticked down again in December to +9.2%, lower than the +9.5% forecasted. Eurostat said slower growth in energy costs was the only reason for the moderation. However, the core rate hit a new record of 5.2% (see graph right). Further rate increases were indicated by some of the ECB governors even though warmer-than-seasonal weather dampened energy costs. If one removes the energy declines, CPI without energy increased a record +7.2%, more than double the record going to back to 2002. Gross domestic product rose by +0.3% in the three months through September, slightly more than the +0.2% preliminary estimate, largely on better numbers from Germany. EU GDP was now expected to increase +0.6% in 2023, compared with an earlier forecast for a contraction of -0.1%. Governments in Europe were expected to increase bond issuance by +10% to €1.2 trillion in 2023. Germany at the end of December surprised investors by announcing it would sell roughly €300 billion in bonds in 2023 — a record and up by about €70 billion from this year. This comes as the European Central Bank steps back from its role as a voracious buyer of Eurozone government bonds, with plans to start shrinking its bond portfolio in March by €15 billion per month.

the energy declines, CPI without energy increased a record +7.2%, more than double the record going to back to 2002. Gross domestic product rose by +0.3% in the three months through September, slightly more than the +0.2% preliminary estimate, largely on better numbers from Germany. EU GDP was now expected to increase +0.6% in 2023, compared with an earlier forecast for a contraction of -0.1%. Governments in Europe were expected to increase bond issuance by +10% to €1.2 trillion in 2023. Germany at the end of December surprised investors by announcing it would sell roughly €300 billion in bonds in 2023 — a record and up by about €70 billion from this year. This comes as the European Central Bank steps back from its role as a voracious buyer of Eurozone government bonds, with plans to start shrinking its bond portfolio in March by €15 billion per month.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource