COVID-19

- US Economic Activity ended on a poor note for 2020 but still looked to grow by about 9% annualized for Q4. Europe on the other hand was forecasted to decline by the same percentage per a Bloomberg survey as stricter lockdowns attempted to combat a surge in cases / hospitalizations / deaths. The US also posted higher COVID numbers but at a less dramatic rate. Vaccine rollouts began as the UK and US were early approvers (on December 2nd and 12th, respectively) with the EU lagging as its first shots of the Pfizer vaccine began to be administered on December 27th. Lack of personnel due to the holiday

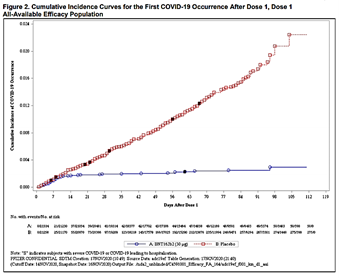

season and bad weather were blamed on the slow pace and one person in the US was arrested for purposely sabotaging doses (by leaving them outside a freezer overnight). Note that decent evidence exists that even after just the first of the two doses of the Pfizer and Moderna vaccines the effectiveness kicks in after ten days and well before the second would be administered twenty-one days later (see the basically flat blue line versus the steadily rising placebo red line with the divergence occurring at day ten). This was the data that justified the UK’s decision to not hold back doses and instead more aggressively administer shots. Note that the ten-day lag in immunity is likely attributable to the fact that it takes about that long for antibodies to be reliably induced by the vaccine (AKA “seropositivity”) and also means that only now at the beginning of January could the UK and US possibly see the impact from the first inoculations. It will not be until the end of Q1 or so that the vaccines’ impact will be broadly evident. Meanwhile, the FT reported on January 6th that China again barred the entry of a 10-member World Health Organization team investigating the origins of the coronavirus pandemic after their visas were not approved. With their latest outbreak in Hebei province locking down over eleven million people, perhaps the government still is playing fast and loose with the truth.

season and bad weather were blamed on the slow pace and one person in the US was arrested for purposely sabotaging doses (by leaving them outside a freezer overnight). Note that decent evidence exists that even after just the first of the two doses of the Pfizer and Moderna vaccines the effectiveness kicks in after ten days and well before the second would be administered twenty-one days later (see the basically flat blue line versus the steadily rising placebo red line with the divergence occurring at day ten). This was the data that justified the UK’s decision to not hold back doses and instead more aggressively administer shots. Note that the ten-day lag in immunity is likely attributable to the fact that it takes about that long for antibodies to be reliably induced by the vaccine (AKA “seropositivity”) and also means that only now at the beginning of January could the UK and US possibly see the impact from the first inoculations. It will not be until the end of Q1 or so that the vaccines’ impact will be broadly evident. Meanwhile, the FT reported on January 6th that China again barred the entry of a 10-member World Health Organization team investigating the origins of the coronavirus pandemic after their visas were not approved. With their latest outbreak in Hebei province locking down over eleven million people, perhaps the government still is playing fast and loose with the truth.

- As follow-up to last month’s graph on flu visits to US hospitals, that rate is still running at the same level (about 1.5%), well below the 6% seen last year at this time and at half the ten-year average. This means that hospital resources have been free to treat serious COVID cases. Also in relatively positive news, there has been only one influenza-associated pediatric death this season in the US which usually has about thirty by this time of the year. Our thoughts and prayers go out to those taken ill and we hope that they have access to proper care and recover fully.

Macro: US

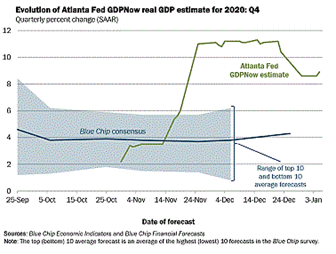

- Q4 GDP Growth of annualized +8.9% (see graph right) by the Atlanta Fed remained well above private expectations (the lower blue band). US industrial production rose for the second consecutive month, or the sixth time in the past seven months, with November’s +0.4% a little above expected and October’s

number revised upwards to +1.2%. Factory orders for both November and October followed a similar path – beating expectation and positive revisions. However, US retail sales unexpectedly fell in November (-1.1%) and October’s sales were revised lower to -0.1%. Sales of previously owned U.S. homes fell in November for the first time in six months by -2.5% m/m, suggesting that surging prices and a record-low supply are constraining red-hot demand. The median selling price was $310,800, +14.6% y/y while available inventory was -22% versus last year, the lowest point in the data which goes back to 1982. On the other hand, locked-down New York City apartments are at their cheapest in ten years at a median monthly cost of $2,743. If there is a return to offices, then this could quickly recover but that is a big “if” as the Financial Times reported that US companies are subleasing space at a pace higher than seen during the dotcom bust and the 2008 financial crisis. Cushman & Wakefield estimated that 18 million of square feet was available, almost double that of a year ago. November personal spending and income also fell, more than expected. However, automobile sales had a strong showing at 16.5 million units, close to levels seen a year earlier.

number revised upwards to +1.2%. Factory orders for both November and October followed a similar path – beating expectation and positive revisions. However, US retail sales unexpectedly fell in November (-1.1%) and October’s sales were revised lower to -0.1%. Sales of previously owned U.S. homes fell in November for the first time in six months by -2.5% m/m, suggesting that surging prices and a record-low supply are constraining red-hot demand. The median selling price was $310,800, +14.6% y/y while available inventory was -22% versus last year, the lowest point in the data which goes back to 1982. On the other hand, locked-down New York City apartments are at their cheapest in ten years at a median monthly cost of $2,743. If there is a return to offices, then this could quickly recover but that is a big “if” as the Financial Times reported that US companies are subleasing space at a pace higher than seen during the dotcom bust and the 2008 financial crisis. Cushman & Wakefield estimated that 18 million of square feet was available, almost double that of a year ago. November personal spending and income also fell, more than expected. However, automobile sales had a strong showing at 16.5 million units, close to levels seen a year earlier.

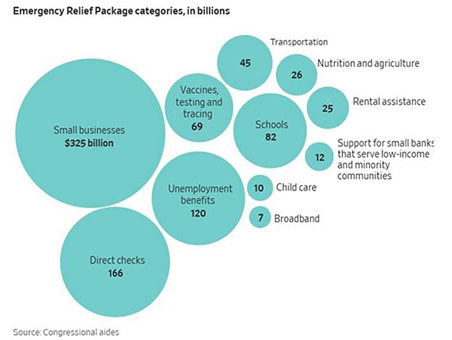

Congress Passed Another $900 Billion in COVID-related spending to stimulate the economy: $325 billion for small business support, $166 billion in direct checks / tax credits, $120 billion for unemployment benefits and the remaining to various industries, schools and vaccine-related logistics (see graph left). The Federal Reserve said it will continue to support the economy through massive monetary stimulus until it sees “substantial further progress” in employment and inflation. At their final meeting of a tumultuous year, Powell and the rest of the committee voted to maintain bond purchases of at least $120 billion and made no changes to the composition of purchases, declining to shift them toward longer-term maturities. “The Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month.” This continuation of policy underwhelmed the bond markets but I think that there will not be a material change in policy until after the start of the new Congress in 2021 and a better prognosis for additional spending. Tame inflation (+1.2% y/y with +1.6% y/y for the core rate) and room on the employment side (November clocking in at 6.7% despite populous state lockdowns) gives US Federal Reserve the flexibility to let the economy “run hot” in 2021. Their first meeting this year will be on January 26th and 27th.

Congress Passed Another $900 Billion in COVID-related spending to stimulate the economy: $325 billion for small business support, $166 billion in direct checks / tax credits, $120 billion for unemployment benefits and the remaining to various industries, schools and vaccine-related logistics (see graph left). The Federal Reserve said it will continue to support the economy through massive monetary stimulus until it sees “substantial further progress” in employment and inflation. At their final meeting of a tumultuous year, Powell and the rest of the committee voted to maintain bond purchases of at least $120 billion and made no changes to the composition of purchases, declining to shift them toward longer-term maturities. “The Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month.” This continuation of policy underwhelmed the bond markets but I think that there will not be a material change in policy until after the start of the new Congress in 2021 and a better prognosis for additional spending. Tame inflation (+1.2% y/y with +1.6% y/y for the core rate) and room on the employment side (November clocking in at 6.7% despite populous state lockdowns) gives US Federal Reserve the flexibility to let the economy “run hot” in 2021. Their first meeting this year will be on January 26th and 27th.

Macro: Asia

- China’ Recovery Held as industrial production grew by +7.0% in November from a year earlier (matching October’s +6.9% y/y) while retail sales shifted higher

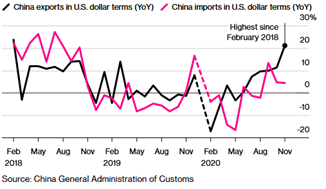

to +5.0% y/y (versus +4.2%). Chinese vehicle sales and production rose for an eighth straight month to hit 2020 highs, narrowing the y/y decline versus October. China’s exports jumped in November by the most since early 2018, pushing its trade surplus to a monthly record high and underlining how global demand for pandemic-related goods is supporting a growth rebound in the world’s second-largest economy. Chinese companies shipped $268 billion in goods in November, the most for any single month and more than +21% than the same month last year. Import growth eased to +4.5%, leaving a trade surplus of $75.4 billion — the largest going back to 1990. Tsinghua Unigroup, a key player in China’s push for self-reliance in semiconductors, defaulted on nearly $2.5 billion of domestic and international bonds in the latest instance of financial stress in China spilling over into global markets. The move came as Shandong Ruyi, China’s largest textile manufacturer, defaulted on two bonds in December, each of 1 billion CNY ($153 million). China suspended one of its top credit rating agencies, Golden Credit Rating, after a former executive was accused of taking “massive” bribes and sentenced to death as well as the former chair of Huarong Asset Management was convicted for bribery (he received $277 million over a ten-year period) and bigamy (Huh? Yeah…). With the arrest of more Hong Kong protesters in December, we can look forward to more callousness in the New Year.

to +5.0% y/y (versus +4.2%). Chinese vehicle sales and production rose for an eighth straight month to hit 2020 highs, narrowing the y/y decline versus October. China’s exports jumped in November by the most since early 2018, pushing its trade surplus to a monthly record high and underlining how global demand for pandemic-related goods is supporting a growth rebound in the world’s second-largest economy. Chinese companies shipped $268 billion in goods in November, the most for any single month and more than +21% than the same month last year. Import growth eased to +4.5%, leaving a trade surplus of $75.4 billion — the largest going back to 1990. Tsinghua Unigroup, a key player in China’s push for self-reliance in semiconductors, defaulted on nearly $2.5 billion of domestic and international bonds in the latest instance of financial stress in China spilling over into global markets. The move came as Shandong Ruyi, China’s largest textile manufacturer, defaulted on two bonds in December, each of 1 billion CNY ($153 million). China suspended one of its top credit rating agencies, Golden Credit Rating, after a former executive was accused of taking “massive” bribes and sentenced to death as well as the former chair of Huarong Asset Management was convicted for bribery (he received $277 million over a ten-year period) and bigamy (Huh? Yeah…). With the arrest of more Hong Kong protesters in December, we can look forward to more callousness in the New Year.

- Japanese Machinery Orders made big gains in November and turned positive on a y/y basis (+8.6%) while industrial output was only flat y/y. A ¥73.6 trillion ($708 billion) stimulus package announced on December 8th will lever the economy further in Q1 2021. Japanese exports in November lost ground year-on-year by -4.2%, missing expectations for a positive print, with lower shipments everywhere apart from China and South Korea. In Singapore, gross domestic product last quarter grew +2.1% on a seasonally adjusted basis compared to the previous three months, beating expectations while Taiwan’s exporters enjoyed surging orders, the most in over a decade. Export orders jumped +29.7% to a record high $57.8 billion in November, the biggest increase since May 2010.

Macro: Europe

- Europe Re-entered Lockdown as cases surged, dashing hopes for an economic recovery but markets were happy with the ECB’s expanding and extending their pandemic-related bond buying program by 40% (from €1.35 trillion to €1.85 trillion and from ending in June 2021 to March 2022). The ECB also extended to June 2022 its policy to lend at -1% to banks (paying them to borrow). With the Eurozone GDP expected to decline in Q4, money printing is operating at full speed. A double-dip recession would make any politician nervous. The EU also passed a record $2.2 trillion budget with almost half as a “pandemic relief package” financed by record offerings of EU-level debt (i.e., offered at the super-national level, not the national level). The Eurozone’s unemployment rate fell slightly to 8.4%. German factory orders, a proxy for the health of the broader European manufacturing sector, rose +2.3% m/m in November, following a +3.3% rise in October. The UK and EU came to a conclusion over Brexit with both sides claiming victory (which probably meant that the UK lost). Another mess for 2021 to sort through.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource