Ukraine: Grain, Natural Gas & Sanctions Impact

Ukraine Launched Limited Counter-offensives with some high profile partisan attacks. While these efforts cannot take much back in the way of territory, limited offensive military capacity (remember that Ukraine is about 1/3rd the population of Russia at 45m versus 145m) precludes most anything but a war of wills strategically and logistical attrition tactically. Russia too is following a similar playbook though centered on artillery, Stalin’s “God of War,” and civilian centers. Strangely enough, Russia had to go to North Korea to buy rockets and artillery shells – strange because it meant that 1) Russia’s military industry cannot make enough for their own weapons and 2) they do not want to or cannot get enough from the Chinese (the Chinese/North Koreans use Soviet/Russian-based weapons platforms).

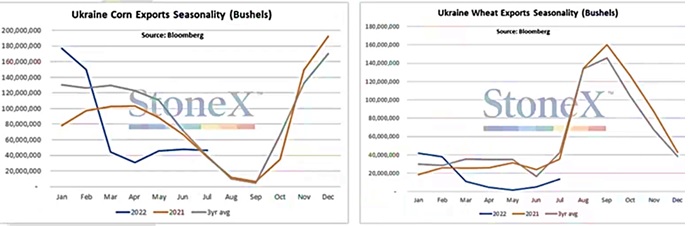

Ukraine’s Black Sea Ports Open to limited grain exports under a UN/Turkey-brokered deal between the warring parties. Last reported, 61 cargo ships carrying around 1.5 million tonnes (MT) of food had sailed. While a positive result for those starving in the Middle East and Africa, before the war, Ukraine regularly shipped 5-6 million tons of grain per month. Exports were forecasted to reach 6-6.5 MT in October at the current rate. One of the indirect effects of the war is that China has had to scramble for corn supplies, eventually agreeing to temporarily waive phytosanitary standards on Brazilian corn to replace Ukrainian supplies (which was 30% of Chinese corn imports pre-war). Meanwhile Ukraine is struggling to find storage for its grain harvest, lacking space for between 10m-15m MT – “significant” areas of corn will be delayed harvest to winter due to lack of storage per Bloomberg.

European Gas Pipeline Imports declined to zero on the Nord Stream One pipeline as Russia first claimed technical problems but finally came out and said directly that supplies will not resume in full until the “collective west” lifts sanctions and starts Nord Stream Two deliveries. The announcement came just hours after G7 nations announced efforts to introduce a price cap on Russian oil exports. Russia still supplied gas to former Eastern Bloc Europe (Hungary, Slovakia and the Czech Republic) through Ukraine via the Druzhba pipeline that remained open despite the invasion, but it was operating only at 50% capacity. The TurkStream pipeline also still operated but it has limited services to Southern Europe.

Bloomberg Published Internal Kremlin Memo showing two core scenarios of continued contraction in the Russian economy next year due to sanctions with the economy not returning to the 2022 level until after a decade or so. The Russian government reportedly confirmed the report separately. The longer the sanctions continue, the greater the impact – some examples: 1) 95% of passenger volume is carried on foreign-made planes and the lack of access to imported spare parts could lead the fleet to shrink as they go out of service and 2) machinery: only 30% of machine tools are Russian-made and local industry doesn’t have the capacity to cover rising demand. If there is a global recession on top of this projection, even Chinese demand could falter and may not return quickly. China’s monthly imports from Russia were up 49% y/y to $10bn, mainly in the form of fossil fuels but China’s zero-tolerance COVID policy and massive debt overhang is wreaking havoc on Chinese GDP.

Emerging Market Debt

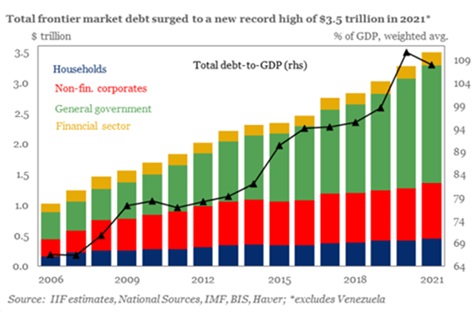

Emerging Market Debt Crisis is unfolding as a quarter-trillion dollar pile of distressed debt is threatening to drag the developing world into a cascade of defaults. As the graph to the right shows, the smallest, least developed “frontier” governments have gorged on relatively low-cost debt, much of it variable rate (from 15% to 30% over that same timeframe per the World Bank), and thus primed for default as global rates rose. This affects not just Ukraine’s debt as being basically unpayable by its government, but also Sri Lanka

stopping paying its foreign debt this year as skyrocketing food and fuel costs led to protests and political chaos and Russian debt repayments were blocked by sanctions. Zambia just asked for $8.4 billion in reduced payments over the next three years from its lenders (Chinese Belt/Road funding and private bondholders). In people terms, about 900 million (about 12% of the world’s population) could face hunger and political instability very quickly. Per the numbers, $237 billion due to foreign bondholders in emerging market notes traded in distress (10% more interest yield than US Treasuries). That added up to almost a fifth — or about 17% — of the $1.4 trillion emerging-market sovereign debt denominated in dollars, euros or yen, according to Bloomberg. While no one is calling for defaults in major players like China, India, Mexico or Brazil, recall that the 1997 financial crisis that started in Thailand swept through Asia, Latin America and Eastern Europe and hit Long-Term Capital Management (anyone remember that hedge fund which required a Federal Reserve organized bailout?). Meanwhile Chinese property developers faced a rollover of $13 billion in foreign bond payments during the second half of 2022… Evergrande having already failed to come up with a plan for its portion. Will contagion again be a thing?

stopping paying its foreign debt this year as skyrocketing food and fuel costs led to protests and political chaos and Russian debt repayments were blocked by sanctions. Zambia just asked for $8.4 billion in reduced payments over the next three years from its lenders (Chinese Belt/Road funding and private bondholders). In people terms, about 900 million (about 12% of the world’s population) could face hunger and political instability very quickly. Per the numbers, $237 billion due to foreign bondholders in emerging market notes traded in distress (10% more interest yield than US Treasuries). That added up to almost a fifth — or about 17% — of the $1.4 trillion emerging-market sovereign debt denominated in dollars, euros or yen, according to Bloomberg. While no one is calling for defaults in major players like China, India, Mexico or Brazil, recall that the 1997 financial crisis that started in Thailand swept through Asia, Latin America and Eastern Europe and hit Long-Term Capital Management (anyone remember that hedge fund which required a Federal Reserve organized bailout?). Meanwhile Chinese property developers faced a rollover of $13 billion in foreign bond payments during the second half of 2022… Evergrande having already failed to come up with a plan for its portion. Will contagion again be a thing?

Macro: China

Basically, China is in Trouble. China may be the second-largest economy but its debt growth from 150% of GDP to over 325% from 2000 to 2021 while its population arguably peaked at 1.4 billion in 2021 could half to 730 million by 2030 – per one forecast published by the Lancet (the UK’s leading medical journal) – see graphic right. Given working-age adults provide most of the savings that can be borrowed, the shift seen in the population cones both higher and thinner from 2000 to 2050 outlined an intergenerational train wreck. By 2020, there was a 12% fall in weddings to 8.1 million registered marriages. Fewer weddings, fewer children – the number of children born in China fell to 10.6 million in 2021 – lower than during the Great Famine instigated by Mao’s Great Leap Forward policies when the population was “only” 654 million (see graph below). With debt and demographics working inexorably against the Chinese Communist Party, the last factor of disease (or rather the reaction to the disease) undermined addressing the above .

1.4 billion in 2021 could half to 730 million by 2030 – per one forecast published by the Lancet (the UK’s leading medical journal) – see graphic right. Given working-age adults provide most of the savings that can be borrowed, the shift seen in the population cones both higher and thinner from 2000 to 2050 outlined an intergenerational train wreck. By 2020, there was a 12% fall in weddings to 8.1 million registered marriages. Fewer weddings, fewer children – the number of children born in China fell to 10.6 million in 2021 – lower than during the Great Famine instigated by Mao’s Great Leap Forward policies when the population was “only” 654 million (see graph below). With debt and demographics working inexorably against the Chinese Communist Party, the last factor of disease (or rather the reaction to the disease) undermined addressing the above .

COVID Lockdowns continued to hamper GDP growth with new cities being placed under strict quarantine: Zhuoshou – only 700,000 people but a commuter city to Beijing, Chengdu – 21 million citizens and Sichuan’s capital, Guiyang – 6.1 million inhabitants, Guizhou’s capital and headquarters of Geely Automobile, and Shenzhen – 17.5’s million residents and technology /manufacturing hub. The impact was seen in only a +0.4% Q2 GDP expansion from a year ago (quarter only, not annualized), its worst economic performance since the start of the coronavirus pandemic and well below the +1.2% expected for the quarter. China imposed power rationing due to low water levels in hydroelectric dams, prolonging economic disruption from the country’s driest summer in decades. The power restrictions forced the closure of factories across southwestern China. The hits showed in the numbers. Chinese refinery output fell in July to its lowest amount since March 2020, averaging 12.5 million barrels per day, down -8.8% from year ago level. Retail sales grew by +2.7% in July from a year ago but that’s well below the +5% growth forecasted by Reuters, and down from growth of +3.1% in June. Industrial production rose by +3.8%, also missing expectations for +4.6% growth and a drop from the prior month’s +3.9% increase. Home sales fell -29% year-over-year, deteriorating from -23% annually in June. Unemployment amongst 16-24 year olds rose to 19.9% from 19.3%. Restless youth? Or just lying flat (aka quiet quitters)?

Macro: US / Europe

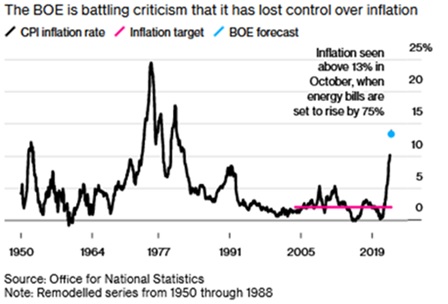

Consumer Price Inflation continued at high levels as Euro-area inflation accelerated to another all-time high of +9.1% from a year ago in August. The UK government said consumer prices were +10.1% higher in July than a year earlier, up from +9.4% in June, highest in more than four decades with more to come per the Bank of England (see right). German inflation accelerated to a 40-year high of +8.8% over the twelve months ending August and the Bundesbank said that it expects to see +10% this autumn. The US came in at a relatively tame +8.5% with some arguing that the peak was in but others pointed to higher labor compensation (+5.7% in Q2 versus +4.4% in Q1 but -4.4% after taking inflation into account). While the European troubles with energy prices are well known (Britons are bracing for +80% increase in energy bills and EU natural gas prices are close to highs), the amount of overdue utility payments in the US continued to press high levels (chart left), affecting 1 in 6 homes. Unemployment in both zones remained low with the Eurozone jobless number below 11 million people, an all-time low of 6.6% of the workforce. The US

prices were +10.1% higher in July than a year earlier, up from +9.4% in June, highest in more than four decades with more to come per the Bank of England (see right). German inflation accelerated to a 40-year high of +8.8% over the twelve months ending August and the Bundesbank said that it expects to see +10% this autumn. The US came in at a relatively tame +8.5% with some arguing that the peak was in but others pointed to higher labor compensation (+5.7% in Q2 versus +4.4% in Q1 but -4.4% after taking inflation into account). While the European troubles with energy prices are well known (Britons are bracing for +80% increase in energy bills and EU natural gas prices are close to highs), the amount of overdue utility payments in the US continued to press high levels (chart left), affecting 1 in 6 homes. Unemployment in both zones remained low with the Eurozone jobless number below 11 million people, an all-time low of 6.6% of the workforce. The US  saw an uptick of unemployment to 3.7%, but that was affected by an increase in the participation rate (i.e., more people officially looked for work). US payroll increases continued at a healthy rate (+315,000 in August versus +300,000 expected). People working hard but still falling behind.

saw an uptick of unemployment to 3.7%, but that was affected by an increase in the participation rate (i.e., more people officially looked for work). US payroll increases continued at a healthy rate (+315,000 in August versus +300,000 expected). People working hard but still falling behind.

High Inflation and Low Unemployment give central banks room to run with higher rates as evidenced by the verbiage coming out of the central bank conference at Jackson Hole. Chair Powell delivered a concentrated blast of hawkishness, knowing full well the impacts on the economy, “”While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain… We are taking forceful and rapid steps to moderate demand so that it comes into better alignment with supply, and to keep inflation expectations anchored. We will keep at it until we are confident the job is done.” ECB officials read from a similar script, raising the prospect of an unprecedented three-quarter point hike at their meeting in September (which was followed through on). US and European money markets reacted by placing 65%+ chances on 75 basis point hikes at their respective September meetings (versus a 50 basis point move). Meanwhile governments continued their hyper-spending with the US’ $1 trillion deficit receiving two new spending programs: the $437 billion “Inflation Reduction Act” (a name right out of Orwell’s 1984 if there ever was) and the $605 billion – $1 trillion Student Debt Forgiveness plan, costs depending on the details of the Income-Driven Repayment program (numbers per the non-partisan Penn Wharton Budget Model). The non-partisan Committee for a Responsible Federal Budget estimated that the Student Debt Forgiveness plan by itself will boost inflation by 15 to 27 basis points over the next year and put upward pressure on tuition costs – lucky students… and parents.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource