COVID-19

- Operation Warp Speed and the continued efforts under the new administration pushed US vaccine distribution incrementally higher to 62% of the total population given at least one dose with the EU similar at 65% with China claiming 74% and India 38% (which is a big leap higher). With boosters being rolled out, does this mean that the “true vaccinated” people will start falling?

- Delta Variant Impact may be slowing in the US (see graphs right), but hard to say definitively. The bigger news was at the end of July when the CDC announced that both the vaccinated and un-vaccinated carried essentially equal viral loads, meaning that assuming equal “shedding,” the risk of transmission is about the same. During August, a few reports came out that a relatively high number of vaccinated people required hospitalization. On 8/31/21, Bloomberg cited the New York Times as “recently reported that in a limited number of states that do such reporting, 12% to 24% of people hospitalized for Covid-19 are fully vaccinated.” Independently, recent Israeli data said 59% of their hospitalized were fully vaccinated. Icelandic data followed in the same vein. These results may depend on which vaccine is prevalent as Israel was basically all Pfizer while the US was a mix. It would be interesting to know if there is any relationship.

- CDC Hospital Data showed that just over 90% of those in care have at least one co-morbidity (hypertension (58% of those hospitalized), obesity (50%), etc.) which underscored the need for basic health. By reference, the CDC labeled just over 42% of Americans as obese. Children in hospital care also have a preponderance of at least one co-morbidity though it is much lower at just over 50%. Child hospitalizations have risen from 0.8% of child cases to 0.9% for the week ending 8/26/21 per the American Academy of Pediatrics, and from 2.0% to 2.3% of all hospitalizations. This increase in hospitalizations combined with the above uncertainty over the efficacy of the vaccines for long-term treatment reminded us to focus on our fundamental health via diet and exercise in order to avoid co-morbidities and put us in the best place to battle any disease.

- Our thoughts and prayers go out to those taken ill and we hope that they have access to proper care and recover fully.

Macro: US

- Q3 GDP Growth was cut almost in half from +6.3% annualized down to +3.7% annualized due to much lower forecasts from third-quarter real personal consumption expenditures growth and third-quarter real gross private domestic investment growth. August employment numbers also disappointed and net exports were also expected to decline more

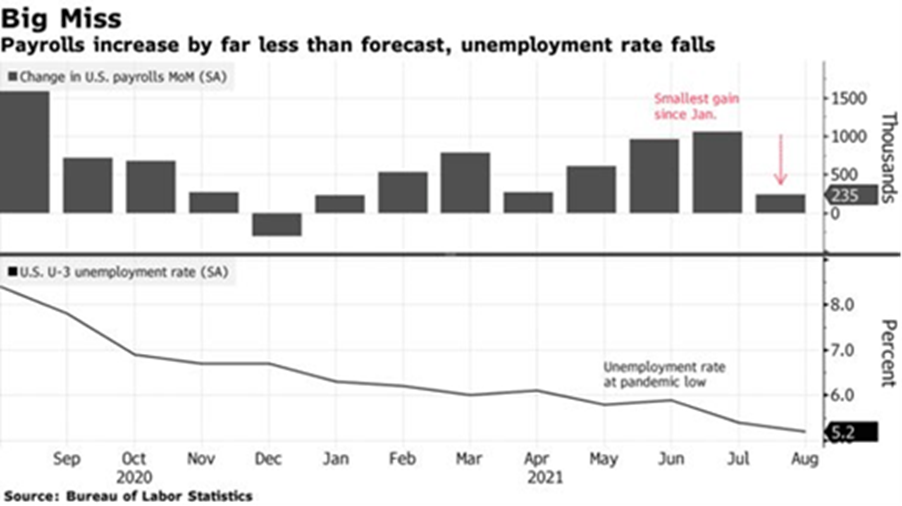

heavily. Q2 GDP growth was adjusted fractionally to +6.6%. The unemployment percentage fell from July’s 5.4% to 5.2%, but the underlying employment figures were mixed as the JOLTS report showed 10 million job openings (the most in the last twenty years), but payrolls increased only +235,000 for August. This was a big miss from July which had a gain of over one million jobs which all can be seen in the graphic on the right. The clue may be in the labor participation rate of 65+ year-olds which fell from 28% down to 23% during the pandemic (about one million people) – they could be taking early retirement or are perhaps the most likely to collect the extra unemployment payments that expired on September 6th. We shall have to see if they are forced to re-enter the workforce. US industrial production surprised on the upside in July, despite the ongoing supply chain challenges. At +6.6% y/y, industrial output is now just -0.2% below the pre-pandemic level. Retail sales data though disappointed as sales in July fell by -1.1% m/m versus a forecasted drop of -0.3%. OpenTable data for August showed that seated dining activity has fallen -10% below pre-Covid-19 levels; at the end of July, it was -3%. CEO Debby Soo stated that “we see a pronounced decline in late July and August.”

heavily. Q2 GDP growth was adjusted fractionally to +6.6%. The unemployment percentage fell from July’s 5.4% to 5.2%, but the underlying employment figures were mixed as the JOLTS report showed 10 million job openings (the most in the last twenty years), but payrolls increased only +235,000 for August. This was a big miss from July which had a gain of over one million jobs which all can be seen in the graphic on the right. The clue may be in the labor participation rate of 65+ year-olds which fell from 28% down to 23% during the pandemic (about one million people) – they could be taking early retirement or are perhaps the most likely to collect the extra unemployment payments that expired on September 6th. We shall have to see if they are forced to re-enter the workforce. US industrial production surprised on the upside in July, despite the ongoing supply chain challenges. At +6.6% y/y, industrial output is now just -0.2% below the pre-pandemic level. Retail sales data though disappointed as sales in July fell by -1.1% m/m versus a forecasted drop of -0.3%. OpenTable data for August showed that seated dining activity has fallen -10% below pre-Covid-19 levels; at the end of July, it was -3%. CEO Debby Soo stated that “we see a pronounced decline in late July and August.”

- Inflation Made Headlines But Fed Still Not Worried as Powell confirmed at the Fed’s Jackson Hole conference for central bankers with his “dovish taper” comments. While the

financial markets took tapering to start in November 2021, to me that would be when he would announce it and action not until 2022. Certainly the above employment miss would cause the Fed to be more prone to delay a taper. The market also saw a more modest month-on-month increase in consumer prices as the CPI increased +0.5% from June and +5.4% from a year ago and the core was +0.3% m/m and +4.3% y/y. Shipping problems still exist as the graph (left) on waiting ships remained at recent highs. On the other hand, ships stuck in China began moving as dockworker quarantines expired.

financial markets took tapering to start in November 2021, to me that would be when he would announce it and action not until 2022. Certainly the above employment miss would cause the Fed to be more prone to delay a taper. The market also saw a more modest month-on-month increase in consumer prices as the CPI increased +0.5% from June and +5.4% from a year ago and the core was +0.3% m/m and +4.3% y/y. Shipping problems still exist as the graph (left) on waiting ships remained at recent highs. On the other hand, ships stuck in China began moving as dockworker quarantines expired.

- Government Spending Spree Continuing with the US Senate passing a $1.1 trillion spending bill funded by COVID money, new taxes and “efficiency gains” that will direct about $400 billion to roads, power grids, rail, broadband, water and mass transit. Another $200 billion is for electrical vehicle research and “clean energy.” Biden and Democrats then agreed in general on an additional $3.5 trillion social and climate-change spending plan, although that has been held up on arguing over the specifics. Sweeping tax hikes were part of the concept, which is repulsive to most lawmakers. Bloomberg already began reporting on a tax shelter that those with over $5 million in liquid assets could use called “private placement life insurance.” Finally, we cannot forget about the budget and debt ceiling votes with a $1.8 trillion deficit (which, to be fair, would include their proportion of the above disbursements). Spending other people’s money is hard work!

Macro: Asia

- Chinese Q3 GDP Was Downgraded as the rise of the Delta variant caused the government to close tourist sites, call off cultural events and cancel flights. Nomura Holdings Inc. lowered its projection for annualized Q3 growth to +5.1% from +6.4% previously and +4.4% expansion for Q4, down from +5.3%. Goldman Sachs also expected a hit but only about half that level and cited greater uncertainty over Delta’s impact (i.e., it may not be significant). Exports offered a mixed view, with China’s goods exports up +19.3% y/y in US dollar terms in July, significantly slower than the +32.2% jump in in June. However, August saw a reversal higher to +25.6% y/y. For July, retail sales rose +8.5% y/y vs median estimate of +10.9%, industrial production increased +6.4% y/y vs median estimate of +7.9% and fixed assets investment climbed +10.3% y/y in Jan-July vs median estimate of +11.3%. Unemployment rate rose to 5.1% from 5.0% in June. We won’t know August’s numbers until mid-September.

- Property developer Evergrande Group again faced troubles as trading in its bonds was suspended on September 7th after falling 20% in one day and Moody’s downgraded the company for a third time since June. The firm has been battling a liquidity crisis that threatened $301 billion in liabilities, and it suspended interest payments on banks loans and privately-placed debt on September 8th. Guangzhou R&F, another property company, also saw their bonds down 20% from a day earlier to about 60% of par. Moody’s estimated that Guangzhou R&F did not have enough cash to cover its debt repayments in the next year and a half, meaning it would need to rely on “new financing or asset sales” to stay in business. Fantasia Group, a third property firm, saw its bonds sink down to 78% of par. Can China absorb these losses? Certainly, in the short term at least. The question is whether these losses will metastasize to other companies or local government finances.

- Japanese Q2 GDP Grew +0.3% Q/Q (faster than expected), but still has to make up for a -0.9% q/q contraction in Q1. COVID lockdowns were cited. Japan’s export recovery showed signs of peaking in July, with shipments to China and Europe losing strength – growing +37% y/y versus +39.4% expected. Industrial production fell -1.5% in July from the previous month, with weakness concentrated in automobile electrical machinery, and electronics equipment. At least the issue seemed to be more with semiconductor supply versus external demand. Taiwan also missed their July industrial production forecast (+13.9% y/y versus +17.6% expected) for similar reasons.

Macro: Europe

- Eurozone Q2 GDP Grew +2.2%, better than the +2.0% first estimate. German July industrial production beat estimates (+1.0 m/m versus +0.8%) and overall GDP for Q2 also improved versus the first estimate (+1.6% q/q versus +1.5% q/q). The European Central Bank held monetary policy steady, but tweaked its guidance to reflect its recently-hiked inflation target. August’s jump in the Eurozone’s harmonized index of consumer prices to 3% y/y was up from 2.2% in July. Consumer prices have not risen this fast in the 19-country bloc since November 2011. Like the US, the EU stated that they plan to let inflation “run hot.” The EU reached a milestone with their aggressive bond-buying program which sent yields on Eurozone junk bonds below inflation for the first time. Negative-real-yielding high-risk bonds should be a major red flag for markets but the ECB seemed to take it as normal.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource