Americas

- US Economic Data showed a slightly slowing Q2 GDP growth at +2.0% annualized, and the Atlanta branch of the Federal Reserve forecasted only a +1.5% annualized rate for Q3 on lower trade and business investment. Payrolls grew at +130,000 for August, lower than expected despite a 25,000 boost from temporary employment for the upcoming US census.

The unemployment rate stayed at 3.7%. Hourly earnings beat expectations, however (see graph right). Labor force participation (see graph left) moved higher, particularly for “prime age” employees. However, a record number of workers (about 8.4 million) have multiple jobs, the

The unemployment rate stayed at 3.7%. Hourly earnings beat expectations, however (see graph right). Labor force participation (see graph left) moved higher, particularly for “prime age” employees. However, a record number of workers (about 8.4 million) have multiple jobs, the  highest since 2000. US retail sales rose in July by the most in four months on a surge in online purchases while two regional factory surveys exceeded estimates. July industrial production missed, falling -0.2%, though looking ahead, durable goods orders increased +2.1%, handily beating the +1.2% estimate, with overall factory orders up +1.4% versus +1.0%.

highest since 2000. US retail sales rose in July by the most in four months on a surge in online purchases while two regional factory surveys exceeded estimates. July industrial production missed, falling -0.2%, though looking ahead, durable goods orders increased +2.1%, handily beating the +1.2% estimate, with overall factory orders up +1.4% versus +1.0%.

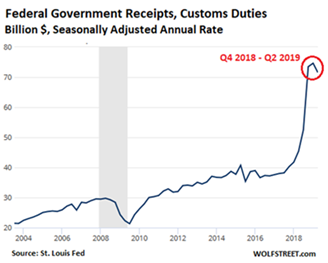

- The Federal Reserve is expected to lower interest rates further at its September 17th-18th meeting by -0.25%. The markets will more closely scrutinize Chair Powell’s answers at the press conference to glean future size and timing of the next reductions. As recently as August 23rd, Powell stated that the US economy was in a “favorable place” but faced risks from trade policy. On August 26th, China and the US mutually increased tariffs on a number of goods with the US expanding tariffs to basically all imports from China by December 15th while China increased duties from on $60 billion to $75 billion of US agricultural and industrial goods. Total US agricultural exports to China were projected to decline -6.2% from last year to $134.5 billion in fiscal year 2019. Comparatively, the US imported -16% less during the first six months of 2019 versus 2018. While tariffs are only a small part of US government revenues (about 2%) they doubled

year-over-year as dollars collected demonstrates to the left. However, American and Chinese trade officials are planning another round of negotiations in October, indicating that recent tariff hikes did not totally derail trade relations. Tariffs are not the only tool for the US as American companies indicated in surveys that they are moving at least some operations out of China to other countries or the US. Also, there have been efforts by the Trump administration to push MSCI and JPMorgan to halt the expansion of China in various equity and fixed income indices, which would limit the massive index funds sending money to Chinese markets. Finally, stricter or even simple enforcement of accounting standards, which are notoriously lax in China, can be applied to Chinese companies that either IPO in the US or buy US firms. Lower US rates and a correspondingly weaker US dollar would open the door further for Chinese influence on the US economy.

year-over-year as dollars collected demonstrates to the left. However, American and Chinese trade officials are planning another round of negotiations in October, indicating that recent tariff hikes did not totally derail trade relations. Tariffs are not the only tool for the US as American companies indicated in surveys that they are moving at least some operations out of China to other countries or the US. Also, there have been efforts by the Trump administration to push MSCI and JPMorgan to halt the expansion of China in various equity and fixed income indices, which would limit the massive index funds sending money to Chinese markets. Finally, stricter or even simple enforcement of accounting standards, which are notoriously lax in China, can be applied to Chinese companies that either IPO in the US or buy US firms. Lower US rates and a correspondingly weaker US dollar would open the door further for Chinese influence on the US economy.

Asia

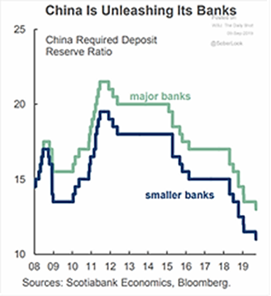

- China Continued to Stimulate the Economy by cutting the required reserves for its banks to the lowest level since 2007 (see graph right) – basically allowing banks to add more

leverage. If banks maximize their balance sheets with new loans, then theoretically this action could add $126 billion to the economy. However, Heng Feng Bank with $200 billion in assets announced that it had to be taken over by the government while another troubled bank, Bank of Jinzhou, exercised its rights to skip paying interest to international bondholders on its contingent convertible (AKA “CoCos”) US dollar denominated bonds. These special bonds (present in Europe as well) act like equity with interest payments which can be deferred or converted into common equity in an emergency. In short, good luck getting your money back.

leverage. If banks maximize their balance sheets with new loans, then theoretically this action could add $126 billion to the economy. However, Heng Feng Bank with $200 billion in assets announced that it had to be taken over by the government while another troubled bank, Bank of Jinzhou, exercised its rights to skip paying interest to international bondholders on its contingent convertible (AKA “CoCos”) US dollar denominated bonds. These special bonds (present in Europe as well) act like equity with interest payments which can be deferred or converted into common equity in an emergency. In short, good luck getting your money back.

- Chinese auditors have highlighted that many provinces (Shaanxi’s audit office being the latest) face a heavy repayment schedule for their $560

billion of official debt due in the next two-and-a-half years. In addition, the Financial Times cited concerns over a number of government guaranteed debt funds related to real estate development. An example is Qinghai Provincial Investment Group which defaulted in February on a $300 million bond due in 2020. Has China’s urbanization and infrastructure build peaked? Obviously they can spend more money building “bridges to nowhere” but the GDP gain would make these negative returning projects.

billion of official debt due in the next two-and-a-half years. In addition, the Financial Times cited concerns over a number of government guaranteed debt funds related to real estate development. An example is Qinghai Provincial Investment Group which defaulted in February on a $300 million bond due in 2020. Has China’s urbanization and infrastructure build peaked? Obviously they can spend more money building “bridges to nowhere” but the GDP gain would make these negative returning projects.

- Economically, Chinese exports unexpectedly fell in August by -1% versus last year and imports fell -5.6%. Shipments to the US fell -16% from a year earlier. July industrial output growth fell to a 17-year low, missing expectations (see graph left). Retail sales expanded +7.6%, and fixed-asset investment slowed to +5.7% in the first seven months, but all these numbers were lower than expectations. Automobile sales have started to recover but are still down -9.9% versus a year ago in August. It is not easy in China.

- Thailand Upped the Ante with China by unveiling a generous relocation package to attract foreign companies looking to move production because of the intensifying US-China trade war. The package includes tax incentives, special investment zones and changes in laws that would facilitate foreign investment, particularly from China, Japan, Taiwan and South Korea. The Thai economy grew at the lowest pace in five years in Q2. South Korea’s exports were expected to have their ninth straight monthly decline in August as trade battles and slowing economic growth worldwide raise fears of a global recession. Semiconductor sales plunged -30%, while shipments to China, the biggest buyer of South Korean goods, slid -20%. Total exports fell 12% from a month earlier. Japan’s exports declined more slowly in July than expected but still fell -1.6% year-on-year versus -2.2% forecasted.

Europe

- Brexit Battles Continue as the EU and the UK (and within the UK) try to best each other in willpower. Bascially the EU is going to try to punish the UK by not agreeing to any reasnoable deal. Therefore, the UK will either be no-deal out by October 31st (or some other date) or eventually capitulate. How this gets resolved in the UK Parliament is unknown given the nature of British democracy.

- Meanwhile, The EU Still Stumbles. German Q2 GDP growth was -0.1% with industrial production continuing to slip further negative. New orders, however did show a small rebound

so there is some hope. August’s seasonally adjusted exports rose +0.7% on the month, handily beating a Reuters poll of economists with a -0.5% drop in exports. The Eurozone as a whole grew at +0.2% quarter-on-quarter. They are not making a good case for the UK to stay!

so there is some hope. August’s seasonally adjusted exports rose +0.7% on the month, handily beating a Reuters poll of economists with a -0.5% drop in exports. The Eurozone as a whole grew at +0.2% quarter-on-quarter. They are not making a good case for the UK to stay!

- Outgoing ECB Head Mario Draghi is expected to give more stimulus at the September 12th meeting, both with lowering (already-negative) rates and buying more bonds (quantitative easing). Assuming Lagarde’s ascension to the role later this year, we expect her to continue this policy. Germany issued 30-year debt with a 0% coupon and a -0.11% yield, though the auction did not raise as much as expected. No matter – Germany is running a surplus!

A final note on the trade war is a reminder that in October China will celebrate the 70th anniversary after its founding, an event that will undoubtedly demonstrate the strength of both the country and the leader. A sluggish economy and antigovernment protests in Hong Kong are not part of that image. Unless there is a large concession by Trump, then do not expect a deal in the next few months despite the upcoming visit by Chinese officials to the US.

Finally, on a commodity note, Bloomberg reported on an audacious daylight gold robbery in Brazil – 720 kilograms (1587 pounds) worth $30 million were stolen in three minutes from a vault at the Sao Paulo airport. Video captured the thieves loading the gold bars into a truck with a forklift. “The Italian Job” next?

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource