COVID-19

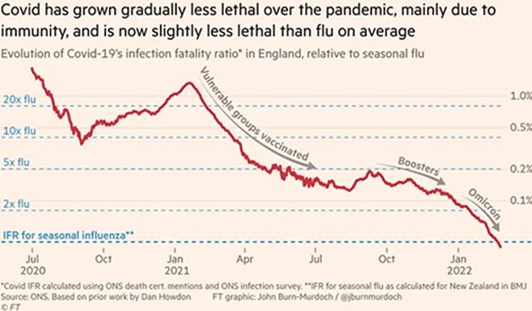

US Case Count Hit 57k as the seven-day average rose in April per the CDC with average US deaths falling to 293. Germany, by comparison was at 83k despite their much lower population though their death rate was about half. The FT reported for the first time that a COVID infection now carries les s mortality risk than a flu infection in England, “the result of widespread immunity and the emergence of a less virulent variant in Omicron” (see graphic right). Also, interestingly, a cohort study of 23.1 million residents across four Nordic countries found that the risk of myocarditis (an inflammation of the heart muscle often associated with blood clots which can lead to stroke or heart attack) was elevated in young males aged 16 to 24 years after the second dose of mRNA vaccines (Journal of the American Medical Association website, April 20th). China’s continued its mass lockdowns in multiple cities, which sent subway traffic to about half the usual level and spiked the number of ships waiting at the port of Shanghai to almost double. Demand for gasoline, diesel and aviation fuel in April was expected to slide 20% from a year earlier, equivalent to a drop in crude oil consumption of 1.2 million barrels per day (mbpd). As always, our thoughts and prayers go out to those taken ill and we hope that they have access to proper care and recover fully.

s mortality risk than a flu infection in England, “the result of widespread immunity and the emergence of a less virulent variant in Omicron” (see graphic right). Also, interestingly, a cohort study of 23.1 million residents across four Nordic countries found that the risk of myocarditis (an inflammation of the heart muscle often associated with blood clots which can lead to stroke or heart attack) was elevated in young males aged 16 to 24 years after the second dose of mRNA vaccines (Journal of the American Medical Association website, April 20th). China’s continued its mass lockdowns in multiple cities, which sent subway traffic to about half the usual level and spiked the number of ships waiting at the port of Shanghai to almost double. Demand for gasoline, diesel and aviation fuel in April was expected to slide 20% from a year earlier, equivalent to a drop in crude oil consumption of 1.2 million barrels per day (mbpd). As always, our thoughts and prayers go out to those taken ill and we hope that they have access to proper care and recover fully.

Ukraine

April Attrition as Russia built up troop concentrations in the eastern portion of Ukraine and engaged in a series of bombardments of infrastructure and cities, as well as military targets. Too early for favorable weather to conduct offensive operations, Russia made preparations and worked to spoil similar Ukrainian efforts. The diplo matic war continued in the energy sector with reports that Russia will cut off the supply of natural gas to Poland and Bulgaria, and the EU will look to halt oil imports within six months and refined products by the end of the year. No word on natural gas – Europe is still highly dependent on Russian supplies. In an example of latest oil trade conflict, Rosneft offered 47.6 million barrels of oil loading for May-June, but no bids were received. The main stumbling blocks (besides the diplomatic pressure) were 1) payment required in Rubles, 2) pre-payment (!) and 3) loadings for May-June, which would be difficult as buyers likely already scheduled much of their buying for these nearby delivery months. Also Asian refiners were reportedly shunning the Sokol grade from Russia’s Far East after sanctions were imposed on a tanker company that shipped those cargoes. The graphic to the right shows China in particular still seeks Russian oil after the invasion, with purportedly independent refiners sucking up supplies at a discount. The Kiel Institute, a German think-tank found that in March, Russian imports fell -10% and exports 5% from February, “At Russia’s three largest ports, St. Petersburg, Vladivostok, and Novorossiysk, container freight traffic has already slumped by half.” As the weather changes in the next few weeks, the war on the ground can change quickly; be ready for a long, hot summer.

matic war continued in the energy sector with reports that Russia will cut off the supply of natural gas to Poland and Bulgaria, and the EU will look to halt oil imports within six months and refined products by the end of the year. No word on natural gas – Europe is still highly dependent on Russian supplies. In an example of latest oil trade conflict, Rosneft offered 47.6 million barrels of oil loading for May-June, but no bids were received. The main stumbling blocks (besides the diplomatic pressure) were 1) payment required in Rubles, 2) pre-payment (!) and 3) loadings for May-June, which would be difficult as buyers likely already scheduled much of their buying for these nearby delivery months. Also Asian refiners were reportedly shunning the Sokol grade from Russia’s Far East after sanctions were imposed on a tanker company that shipped those cargoes. The graphic to the right shows China in particular still seeks Russian oil after the invasion, with purportedly independent refiners sucking up supplies at a discount. The Kiel Institute, a German think-tank found that in March, Russian imports fell -10% and exports 5% from February, “At Russia’s three largest ports, St. Petersburg, Vladivostok, and Novorossiysk, container freight traffic has already slumped by half.” As the weather changes in the next few weeks, the war on the ground can change quickly; be ready for a long, hot summer.

Macro: US

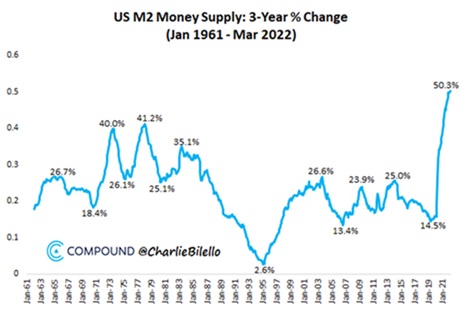

US Consumer Prices continued higher to +8.5% year-on-year in March (largest since 2005), with more price increases expected in shipping, housing and consumer products in 2022. Energy prices rose 11% from the prior month. This should be of no surprise given that the money supply (M2) over the last three years is the highest since 1960 – graph below. The only other times when money supply increased by more than 40% in a three-year period were 1973 and 1977-78. Both times were followed by high inflation, recessions (1973-75, 1980, 1981-82) and bear markets. The Federal Reserve confirmed its change of tune at its May 3rd/4th meeting, from dovish “transitory” to hawkish “tightening.” The FOMC duly hiked rates by 0.5% and announced the start of quantitative tightening in June. The initial targeted reduction in its balance sheet will be a total of $47.5 billion, rising to $95 billion after three months and with a mix of about 2/3rds Treasuries and 1/3rd mortgage-backed securities.  While these actions should raise US interest rates, the US Treasury is seasonally flush with funds due to tax receipts, which will likely temporarily delay any serious pressure for higher rates.

While these actions should raise US interest rates, the US Treasury is seasonally flush with funds due to tax receipts, which will likely temporarily delay any serious pressure for higher rates.

In Other Economic News: Unemployment held at 3.6% for April as nonfarm payrolls increased by +428k, beating estimates of +380k. Average hourly earnings rose +0.3% from March, reaching +5.5% from a year ago, but as outlined above, inflation handily outpaced these gains. A record 4.5m US workers quit the labor force in March, while the number of job openings hit a new high of 11.5m, underscoring employers’ struggles to fill positions as inflation ripples through the economy. March factory goods orders rose +2.2%, ahead of estimates of +1.2%, which will keep the employment situation hot. Gross domestic product fell at a -1.4% annualized rate in the first quarter following a +6.9% pace at the end of last year, missing the median Bloomberg survey for a +1.0% increase. The trade deficit widened to a record in March, reflecting a surge in imports as companies relied on foreign producers to meet solid domestic demand. Retail foot traffic was -10.9% lower at the end of April versus a year ago – perhaps inflation is changing consumer behavior. Pending home sales decreased -1.2% from a month earlier versus an expected -1.0% drop. Homes are getting increasingly unaffordable as rising mortgage rates strain buyers already grappling with high prices and low inventory. A gauge of mortgage applications tumbled last week to the lowest level since late 2018 as the average 30-year mortgage rate rose to 5.37%, the highest since 2009.

Macro: Europe

EU Mirrored the US With Lag as Q1 GDP was positive but missed expectations, growing +0.2% for the quarter, upheld by Germany. However, Germany’s industrial orders for March fell by -4.7% from February, missing Reuters’ estimate of -1.1%. Without Germany supporting the EU, results could turn south, fast. Inflation again moved higher to +7.5% for April, versus March’s record +7.4% and led by energy prices at +38%. Higher energy, metals and food costs are sending the EU trade balance into a tailspin as they cannot replace Russian natural gas easily, cheaply or soon. That does not mean that they will not try… as European Union plans to ban Russian crude oil imports over the next six months and refined fuels by the end of the year. The proposed ban encompasses all Russian crude oil and refined products imports shipped via seaborne and pipeline routes. Hungary and Slovakia will be granted a longer phase-out period—until the end of 2023. The proposal can still fail as all member states must agree and Hungary and Slovakia have not given their approval yet.

-4.7% from February, missing Reuters’ estimate of -1.1%. Without Germany supporting the EU, results could turn south, fast. Inflation again moved higher to +7.5% for April, versus March’s record +7.4% and led by energy prices at +38%. Higher energy, metals and food costs are sending the EU trade balance into a tailspin as they cannot replace Russian natural gas easily, cheaply or soon. That does not mean that they will not try… as European Union plans to ban Russian crude oil imports over the next six months and refined fuels by the end of the year. The proposed ban encompasses all Russian crude oil and refined products imports shipped via seaborne and pipeline routes. Hungary and Slovakia will be granted a longer phase-out period—until the end of 2023. The proposal can still fail as all member states must agree and Hungary and Slovakia have not given their approval yet.

Macro: Asia

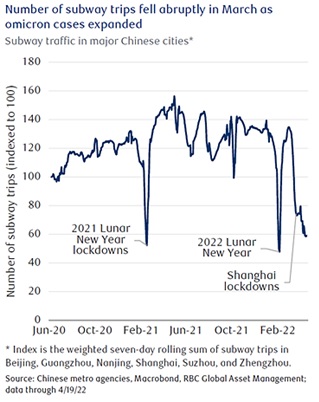

China Cracked Down Hard, strictly enforced their “COVID-Zero” policy, crashing oil demand by almost -10% and cutting the subway trips by almost half (see right). The situation was bad enough that the government “asked” institutional investors to buy equities into the falling stock market. Q1 statistics were fine: China had better than expected Q1 real GDP growth of +4.8% year-on-year. However, retail sales slumped -3.5% month-on-month in March. The surveyed urban jobless rate rose to +5.8%, and home sales by value plummeted -26.2% year-on-year. Industrial production eased from the first two months of the year but it was still up +5.0% year-on-year in March. China’s efforts to loosen monetary policy saw credit growth with banks issuing RMB3.13 trillion in new yuan loans in March, beating consensus expectations and pushing Q1 loans to a record high of RMB8.34 trillion. However, even more debt does not seem a viable long-term solution. Finally, congestion in the key ports of Shanghai, Ningbo and further north grew to 477 bulk ships carrying  commodities and 197 container ships were back-up – a +17% increase.

commodities and 197 container ships were back-up – a +17% increase.

Japan Continued to Struggle with decent machine tool orders (+30.2% year-on-year), industrial production (+0.3% month-on-month), but anemic retail sales (+0.9% year-on-year). Imports continued to surge (+31.2% from a year ago on higher oil, coal and natural gas prices), extending trade deficits into an eighth month. Gains in the value of shipments to China sharply cooled to +2.9% from +25.8% in February on the Chinese COVID crackdown. The Japanese Yen has fallen to 130 per US Dollar, a 20-year low but one that shows no sign of reversing due to Japan’s energy deficit.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource