Commodities: Global

OPEC Oil Production Rose in February led by a further recovery in Nigerian supply per Reuters. Output rose by 0.150 million barrels per day (mbpd) to just under 29.0 mbpd, but still was below available quotas. Russian oil export revenues were set to rise in March as falling freight rates and strong demand pushed Russian oil prices towards the $60 per barrel Western price cap, challenging the view that the mechanism was increasing pressure on Moscow. Russia said it will cut oil output by 500,000 bpd in March (the equivalent of 5% of January’s output), following through on a threat to retaliate against Western sanctions. The move may amplify the turmoil in a market that has otherwise taken in its stride the EU bans on most seaborne imports of Russian oil. At the end of February, Russia ceased the flow of oil to Poland via the Druzhba pipeline, which had not been under sanctions. The small amount (58,000 bpd) could be replaced from other shipments – the announcement came the day after Poland delivered its first Leopard tanks to Ukraine.

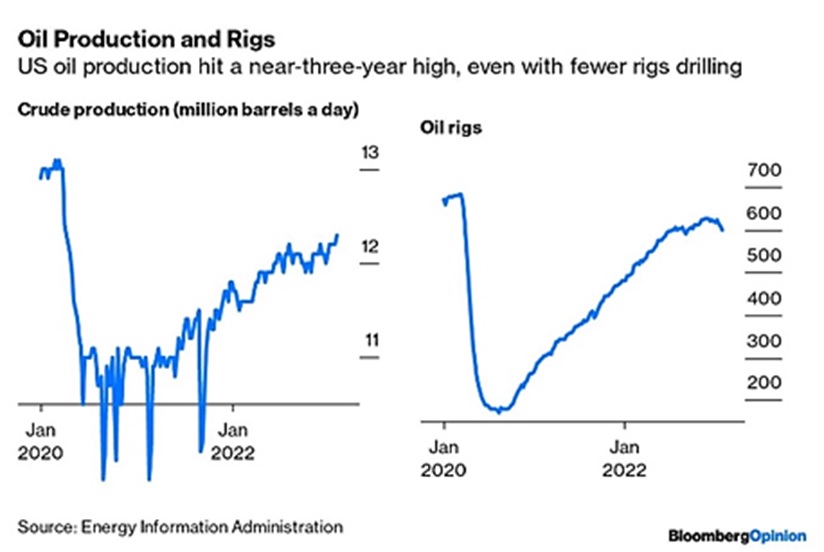

US Oil Production Increased again slightly to 12.3 mbpd despite companies decreasing operating oil rigs from 609 as of January 27th to 600 as of February 24th. Per AAA, US average regular gasoline prices declined, hitting $3.36 per gallon on February 28st, 14¢ lower from last month. The US experienced higher natural gas supplies which are now running above the five-year average despite the severe cold at the end of February. The Biden administration will sell 26 million more barrels of crude oil from the Strategic Petroleum Reserve, with deliveries estimated to happen between April and June to comply with a law passed in 2015. This will put the SPR at 345 million barrels, half of its high of 727 million barrels reached in 2009. The Financial Times reported that employment in the oil and gas industry has fallen from ~6% a year ago to under 2% in December as roughnecks (as an example) in the state of New Mexico – which produces more oil now than the country of Mexico – saw their wages climb from $18-20 back then to over $27 now. Maybe not boom times but still strong.

five-year average despite the severe cold at the end of February. The Biden administration will sell 26 million more barrels of crude oil from the Strategic Petroleum Reserve, with deliveries estimated to happen between April and June to comply with a law passed in 2015. This will put the SPR at 345 million barrels, half of its high of 727 million barrels reached in 2009. The Financial Times reported that employment in the oil and gas industry has fallen from ~6% a year ago to under 2% in December as roughnecks (as an example) in the state of New Mexico – which produces more oil now than the country of Mexico – saw their wages climb from $18-20 back then to over $27 now. Maybe not boom times but still strong.

Chinese Oil Imports fell by -1.3% to 10.4 mbpd in the first 2 months of the year versus 2022’s level of 10.5 mbpd. However imports are expected to rise as high as 11.8 bpd as two new refineries open with a combined capacity of 0.52 mbpd. In other green news (sarcasm font), China approved the construction of another 106 gigawatts of coal-fired power capacity in 2022, four times higher than a year earlier and the highest since 2015, driven by energy security considerations. Over the year, 50 GW of coal power capacity went into construction across the country, up by more than half compared to the previous year. In grains, China, the world’s biggest corn importer, is back with a significant purchase of US grain after prices tumbled in late February with additional usual purchases of soybeans. However, China was forecasted to import less corn in the upcoming season at 18 million tons in 2022-23, from 21.9 million a year earlier per US Department of Agriculture.

highest since 2015, driven by energy security considerations. Over the year, 50 GW of coal power capacity went into construction across the country, up by more than half compared to the previous year. In grains, China, the world’s biggest corn importer, is back with a significant purchase of US grain after prices tumbled in late February with additional usual purchases of soybeans. However, China was forecasted to import less corn in the upcoming season at 18 million tons in 2022-23, from 21.9 million a year earlier per US Department of Agriculture.

Argentina Sharply Cut its forecast for the 2022/23 soybean harvest from 37 million tonnes to 33.5 million tonnes as the country faces  its worst drought in 60 years. The 2022/23 corn harvest estimate was likewise slashed to around 45 million tonnes, down from 55 million previously. However, American farmers were projected to plant more corn, soybeans and wheat this spring with Russia’s war in Ukraine keeping crop prices high and supplies tight. Plantings of corn, will rise to 91 million acres, the most since 2021, according to the US Department of Agriculture’s first outlook of the year. Farmers also will plant 87.5 million acres of soybeans and 49.5 million acres of wheat. Meanwhile, cotton plantings are set to decline by almost 21% to 10.9 million acres. In Brazil, 76% of the soybean crop had been harvested in the key growing area of Mato Grosso, ahead of the 5 year average of 71% and just slightly behind last year, when only 78% of the crop had been harvested. 73% of the safrinha corn crop had been planted in Mato

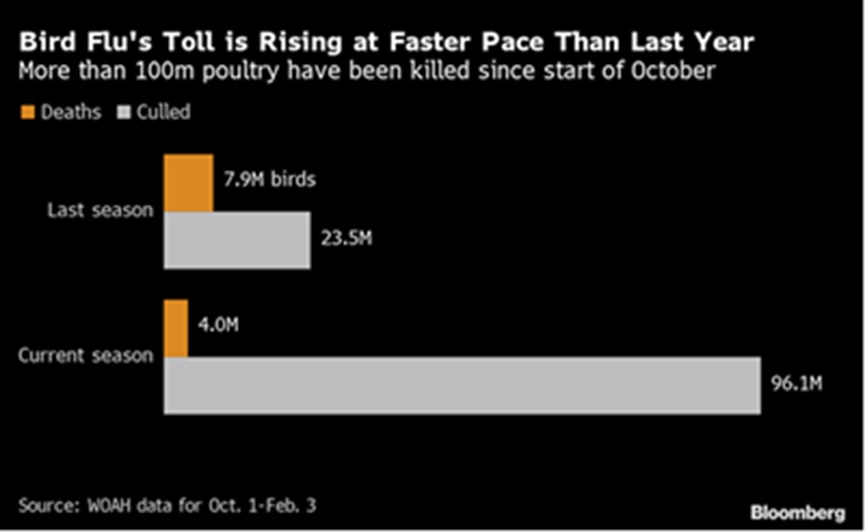

its worst drought in 60 years. The 2022/23 corn harvest estimate was likewise slashed to around 45 million tonnes, down from 55 million previously. However, American farmers were projected to plant more corn, soybeans and wheat this spring with Russia’s war in Ukraine keeping crop prices high and supplies tight. Plantings of corn, will rise to 91 million acres, the most since 2021, according to the US Department of Agriculture’s first outlook of the year. Farmers also will plant 87.5 million acres of soybeans and 49.5 million acres of wheat. Meanwhile, cotton plantings are set to decline by almost 21% to 10.9 million acres. In Brazil, 76% of the soybean crop had been harvested in the key growing area of Mato Grosso, ahead of the 5 year average of 71% and just slightly behind last year, when only 78% of the crop had been harvested. 73% of the safrinha corn crop had been planted in Mato Grosso, behind the 5 year average of 79% and last year, when 83% of the crop had been planted. Rains have been good so Brazil and the US may make up for Argentina in this season. Finally for those of you wanting relief from high egg and chicken prices, that does not look likely per the slaughter that is underway to counter bird flu (see right).

Grosso, behind the 5 year average of 79% and last year, when 83% of the crop had been planted. Rains have been good so Brazil and the US may make up for Argentina in this season. Finally for those of you wanting relief from high egg and chicken prices, that does not look likely per the slaughter that is underway to counter bird flu (see right).

In science news (link here), a fossil fruit from California shows ancestors of coffee and potatoes survived the cataclysm that killed the dinosaurs – at least we shall have the energy to rebuild after the next apocalypse!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource