While trading systems and commodity trading advisors (CTAs) may seem like a similar type of investment, there are many differences between the two that make them distinct. The primary difference is that a trading system tells the investor what trades he/she should enter. It is up to the investor to follow the trading signals, and then execute those trades (sometimes an investor’s broker can handle the trade execution on the investor’s behalf through a Letter of Direction). A CTA has “power of attorney” over an investor’s separately managed account, therefore, a CTA has complete control and ability to place any trade they would like in an investor’s account (but not the ability to transfer, withdraw, or add funds). With a CTA, an investor simply has to monitor the trading and performance of their account.

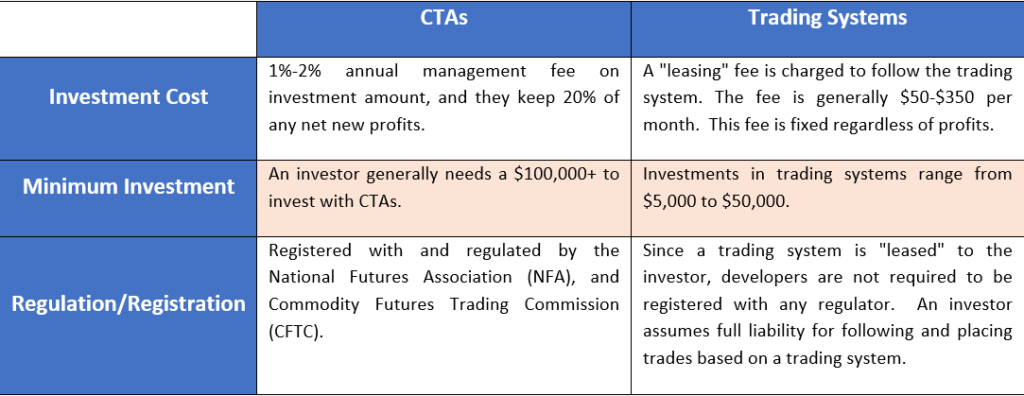

The below table highlights some key differences between commodity trading advisors and trading system:

In rare instances a trading system can also be a CTA. It is our belief at aiSource that if a trading system is really that good, then the developer of that system should put forth the time and investment to become registered as a CTA with the NFA and CFTC.

Lastly, a fully registered CTA is required to report the performance of any investment program they offered over the last five years in their disclosure document. This allows the investor to see if the CTA previously offered an investment program(s) that performed poorly and see these programs’ track record. A trading system, because they are not regulated, is not required to do the same. Therefore, if a trading system starts to do poorly, the developer can simply stop offering it, and start offering a brand new system a short time later.