“It was the best of times, it was the worst of times / it was the age of wisdom, it was the age of foolishness.” It is hard to think of a better cliché than that one of Dickens’ to describe our world. After a 30% gain in the S&P 500 (not the highest equity market return in the world, actually) in 2013, anyone with equity exposure has to be happy, or at least relieved. On the other hand, for those without jobs or bidding against a hedge fund to buy a house, all sense of normalcy must appear vacant. New advances in biotechnology and computer technology offer the promise of a deeper understanding of the universe, but the abuse and politicalization of those same advances challenge one’s faith in humanity to make the right decisions. Best – worst – wisdom – foolishness are good lenses to close out 2013 and look ahead to 2014.

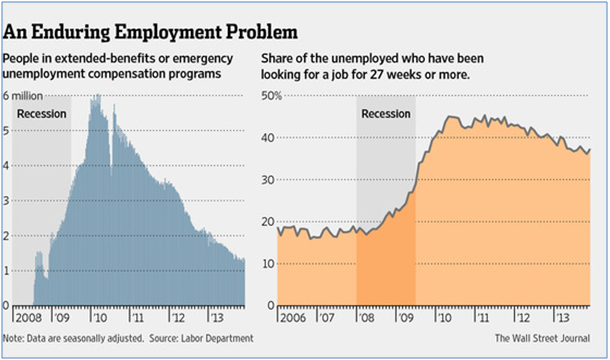

All’s Well That Ends Well: Not to be slavish to the Dickens theme, but it is fair to say that all turned out “quite okay” at the end of the year with the government finding itself with a budget, the Federal Reserve finally starting to cut back on its bond purchases, holiday retail sales slightly increasing (including on-line, of course) and US GDP growing at its fastest pace in two years. The new budget did have its usual shenanigans, with an additional $63 billion in spending (versus the sequester baseline) for 2014 and 2015 but the new taxes and cuts are largely deferred to the outer reaches of the ten-year budget cycle. No reason to take pain today when tomorrow will do! Annual spending for 2014 and 2015 will be over $1 trillion per year instead of under, barring any further changes. Of course one change is already being debated, the extension of the supplementary unemployment benefits that expired at the end of 2013.  If the program is extended (including retroactively as had the four previous extensions), then 2014 spending would increase by $25 billion. At least interest rates are still low, so there is the opportunity to pile on that incremental debt at relatively cheap cost. It has to happen quickly because there is a debt limit increase debate pending as the government will officially have to resort to “extraordinary measures” by early February, per Secretary of Treasury Lew. Given how the last debt limit fight went, we then have another six months or so of room under those conditions. So whatever will happen on this front, it will be before the elections in November. At least there is a two-year budget in place to allow Congress and the President to squabble over these matters at their leisure.

If the program is extended (including retroactively as had the four previous extensions), then 2014 spending would increase by $25 billion. At least interest rates are still low, so there is the opportunity to pile on that incremental debt at relatively cheap cost. It has to happen quickly because there is a debt limit increase debate pending as the government will officially have to resort to “extraordinary measures” by early February, per Secretary of Treasury Lew. Given how the last debt limit fight went, we then have another six months or so of room under those conditions. So whatever will happen on this front, it will be before the elections in November. At least there is a two-year budget in place to allow Congress and the President to squabble over these matters at their leisure.

The riches of the Federal Reserve, however, are not in doubt. Yes, it will stop buying $10 billion in bonds every month (split evenly between US Treasury bonds and mortgage-backed securities), but that still continues purchases of $75 billion per month. The $40 billion portion of Treasuries is about 60% of the expected deficit for the year, so QE is still suppressing interest rates, thus favoring government spending by hurting savers (or more broadly, those that are not receiving the spending). Whatever negative reaction to the decline in Fed buying was muted by the outgoing Ben Bernanke’s pledge to be committed for a longer period to ZIRP (Zero Interest Rate Policy), i.e., effectively holding near-term interest rates at zero percent. If the tapering continues, then bonds (and stocks) will have to choose between what to believe – the lessened impact of actual bond buying under reduced QE, or the ethereal promises of low interest rates as long as the eye can see. But that is a question for Janet Yellen and her successors, not Gentle Ben. Go softly into that ivory tower in the sky! We will miss your well-trimmed beard!

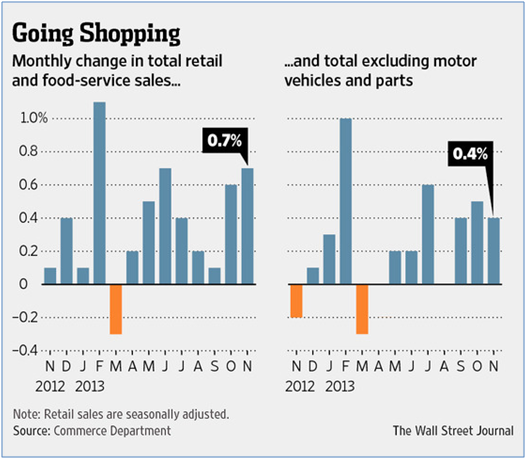

As mentioned the US economy stumbled across the 2013 finish line in decent form, though heavily wheezing. Q3 GDP came in at +4.1% after another revision up but this time on consumption, a key component. Bulls seized on this information, saying that this shows that the consumer is ready to spend and those strong inventory increases from previous GDP reports will be supportive to more spending in the near future. Factory data was positive, with the Purchasing Managers Index at 53.1, up from November, and textile jobs highlighted in the media as an area of growth. These positions are another example of re-shoring as well as direct investment by Chinese and Indian manufacturers looking for cheaper energy costs, duty avoidance and government tax breaks. They also can avoid some of the new uncertainty around the Panama Canal widening project due to be finished in 2015, where there is argument over who will pay for cost overruns.  Auto sales have recovered to the pre-crash levels and earnings as well as the mix favored trucks and SUVs, more profitable models. The bad weather in December will put a lid on the year, but expect positive spin around the “auto recovery” (N.B., thanks to the taxpayers bailing out the auto companies, particularly the lending losses which have still not been recovered). Retail sales looked fairly solid for November, but it remains to be seen what was pulled forward from December. Although the late Thanksgiving supposedly cut short the traditional shopping season, sales were already underway in November (and I saw Christmas and Hanukah decorations in stores in October!). South Bay Research noted that credit card spending remained in solid growth territory in November as well. While the December spending may have posted a modest increase overall, looking ahead, there are some headwinds in the form of higher borrowing costs as mortgages will come with additional government-mandated fees for certain types of borrowing supported by Fannie and Freddie. Interest rates also have ticked up, with the 10-year US government bond back to a 3% yield.

Auto sales have recovered to the pre-crash levels and earnings as well as the mix favored trucks and SUVs, more profitable models. The bad weather in December will put a lid on the year, but expect positive spin around the “auto recovery” (N.B., thanks to the taxpayers bailing out the auto companies, particularly the lending losses which have still not been recovered). Retail sales looked fairly solid for November, but it remains to be seen what was pulled forward from December. Although the late Thanksgiving supposedly cut short the traditional shopping season, sales were already underway in November (and I saw Christmas and Hanukah decorations in stores in October!). South Bay Research noted that credit card spending remained in solid growth territory in November as well. While the December spending may have posted a modest increase overall, looking ahead, there are some headwinds in the form of higher borrowing costs as mortgages will come with additional government-mandated fees for certain types of borrowing supported by Fannie and Freddie. Interest rates also have ticked up, with the 10-year US government bond back to a 3% yield.

EU Kicks Can Out of 2013: Despite a crummy year on many fronts, Europe managed to skate through December with no blowups. Yes, a black eye and some bruising, but the zone is ready to face 2014. Pan-Europe, one must note that the Euro-zone economy appears to have grown in December and Q4. However, it was not enough to stop Standard & Poor’s from cutting the Netherlands’ credit rating below AAA which also lowered the Euro-zone’s credit rating. Acrimonious Euro budget talks were also cited as a reason to reduce the rating. Germany’s vaunted export engine also stuttered in Q3, growing at half the originally estimated rate, which in turn knocked the Euro-zone GDP growth rate to just above 0%. Negative French export figures also weighed. France’s Peugeot is set to raise €3-4 billion from selling shares to Dongfeng, a Chinese car company, and the French government. General Motors will sell its 7% stake to private investors. Peugeot took advantage of the restructuring opportunity to write off €1.1 billion in accumulated losses. Given that the Chinese are looking for technology transfer and market access, I doubt that this will be a successful long-run ploy by the French carmaker. An interesting side possibility is that an opening in the Iranian market is unfolding with the sanction talks – after France, Iran was Peugeot’s largest market in 2011. Finally, on France, the French constitutional court permitted Hollande to tax at 75% marginal rates those earners being paid a salary over €1 million – as long as the employers were paying the tax, not the individuals. A fine point, to be sure, but obviously good enough for lawyers.

The muddling through continues in Spain, which is expected to lose €9 billion on the nationalization of NCG Banco. The failed savings bank is expected to receive only token bids given the losses in its loan portfolio. In an attempt to get back to fiscal stability, Spain is looking at reforming its pension system by tying the pension payments to life expectancy instead of inflation – longer life expectancy would mean smaller monthly payments. I suppose this could roughly link what one contributes to what one gets out of the system, unlike the current pay-as-you-go systems prevalent nowadays (including the United States). Ireland continues to make progress, with a small acceleration of sales of its banks’ bad debts. Unemployment is running under 12.5%, notably better than the 15% peak. Tax revenues collected are 4% higher than a year ago, which may or may not be enough to reduce its deficit below 3% by the EU’s deadline in 2015. Again, not today’s problem. Greece gave its banks and homeowners a Christmas gift by freezing all home foreclosures in 2014. Banks will not have to recognize the bad debt on their balance sheets as 24% of Greek mortgages (€17.4 billion) are in default and Greek real estate is still 1/3 lower from its peak. Homeowners obviously can stay in their homes rent-free. We spoke about Ukraine last month, and Putin’s blackmailing of the country to stay in the Soviet Russian sphere. In December, that came to be with Ukraine turning its back on two treaties with the EU in exchange for $15 billion in loans and cash, and discounted natural gas prices from Russia. Or should I say President Vicktor Yanukovych took a bribe (or was allowed to keep his life) in exchange for such a deal. Now the question is how useful is Putin’s purchase – Yanukovych is up for reelection in 2015. In company news, defense giant EADS is to cut 5,800 positions over the next three years in reflection of lower European defense spending and corporate restructuring. Half the redundancies will be from Germany, one-third from France and the rest from Spain and the UK. Finally, Iceland jailed two bankers for five years as punishment for their role in the bankruptcy of the country with popping of the asset bubble a few years ago. Not only has Iceland brought criminal charges against the top bankers but also the losses were put to the banks’ creditors rather than taxpayers. I think that this was the only country that followed this sensible route. Hopefully the rest of us will get it right next time.

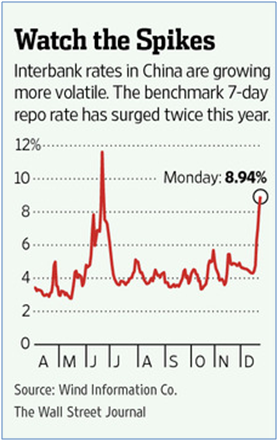

Asia Ready to Get Past Tough 2013: China ended the year trying to figure itself out of its economic slowdown amidst revelations about its larger and larger debt burdens.  The increase in interest rates that we mentioned last month spiked in December as a liquidity squeeze in smaller banks (ones that are more commonly associated with “shadow lending”) depleted their overnight capital. Some point to the failure of Liansheng Resources Group, a coal mining concern that is unable to repay even a portion of its Rmb30 billion ($4.5 billion) in loans that are coming due, as the trigger. A heavy borrower on the unofficial market, the money went to, amongst other things, an $11 million wedding for the CEO’s daughter in 2012. Not exactly to build “shareholder value.” With the Peoples Bank of China (PBOC) having to inject Rmb300 billion ($50 billion), confidence has been rattled in the country’s financial system. Perhaps anticipating the need to push out those final loans before any regulatory crackdown, Chinese banks lent Rmb624 billion ($103 billion) in November, 20% higher than in October’s frenetic pace. With the average company debt-to-equity of 110% (US is 53%) per the IMF, these issues will not go away.

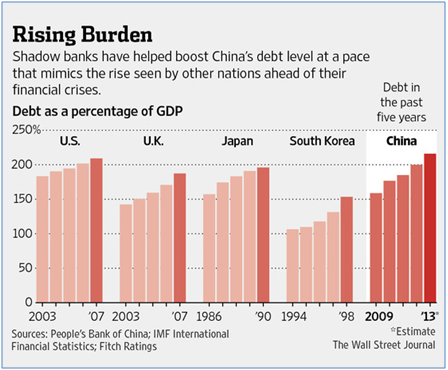

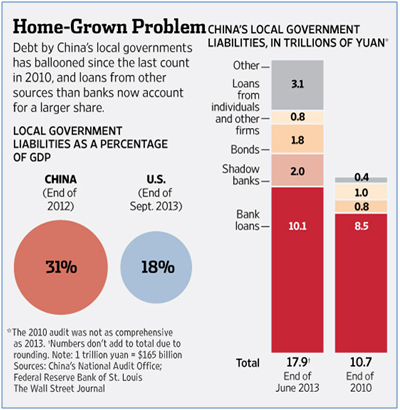

The increase in interest rates that we mentioned last month spiked in December as a liquidity squeeze in smaller banks (ones that are more commonly associated with “shadow lending”) depleted their overnight capital. Some point to the failure of Liansheng Resources Group, a coal mining concern that is unable to repay even a portion of its Rmb30 billion ($4.5 billion) in loans that are coming due, as the trigger. A heavy borrower on the unofficial market, the money went to, amongst other things, an $11 million wedding for the CEO’s daughter in 2012. Not exactly to build “shareholder value.” With the Peoples Bank of China (PBOC) having to inject Rmb300 billion ($50 billion), confidence has been rattled in the country’s financial system. Perhaps anticipating the need to push out those final loans before any regulatory crackdown, Chinese banks lent Rmb624 billion ($103 billion) in November, 20% higher than in October’s frenetic pace. With the average company debt-to-equity of 110% (US is 53%) per the IMF, these issues will not go away.  On a related basis, the government-mandated survey to figure out much municipal debt exists came back at the end of the year to show that within three years, the amount of debt increased by about 70% to about $3 trillion (see next page). More alarmingly, half the debt is set to come due by the end of 2014. Even if it can be rolled over, at what rate? If there is a central government bailout, doesn’t that just set the scene for the next bubble? With the recent spike in rates, is the PBOC sending a signal to rein in lending? China’s cabinet delivered rules to tighten shadow bank regulation at the beginning of 2014. Will the rules go far enough or too far? And if it is already too late, can the market be kept stable for more prudent borrowers? More interesting to me is the gradual dispelling of the myth that China has a lot of “extra” wealth that it can spend heedlessly. In fact, it appears more and more that the so-called surplus has already been spent! And if not now, then within twenty years, the number of retired elderly is expected to double to 340 million – more than the current US population! The pension system is like the US with a pay-as-you-go approach that depends on sufficient current workers to cover the liabilities. The US currently has 2.8 workers per Social Security beneficiary with that ratio projected to fall to 2.1 by 2033. China during that time is expected to go from 5:1 to 2.5:1. With the US already contributing less into its $2.7 trillion pension fund due to a rise in outgoing payments, China’s $110 billion equivalent plan looks dramatically underfunded, especially given its larger population. But that is a problem for the future – kick the can down the road!

On a related basis, the government-mandated survey to figure out much municipal debt exists came back at the end of the year to show that within three years, the amount of debt increased by about 70% to about $3 trillion (see next page). More alarmingly, half the debt is set to come due by the end of 2014. Even if it can be rolled over, at what rate? If there is a central government bailout, doesn’t that just set the scene for the next bubble? With the recent spike in rates, is the PBOC sending a signal to rein in lending? China’s cabinet delivered rules to tighten shadow bank regulation at the beginning of 2014. Will the rules go far enough or too far? And if it is already too late, can the market be kept stable for more prudent borrowers? More interesting to me is the gradual dispelling of the myth that China has a lot of “extra” wealth that it can spend heedlessly. In fact, it appears more and more that the so-called surplus has already been spent! And if not now, then within twenty years, the number of retired elderly is expected to double to 340 million – more than the current US population! The pension system is like the US with a pay-as-you-go approach that depends on sufficient current workers to cover the liabilities. The US currently has 2.8 workers per Social Security beneficiary with that ratio projected to fall to 2.1 by 2033. China during that time is expected to go from 5:1 to 2.5:1. With the US already contributing less into its $2.7 trillion pension fund due to a rise in outgoing payments, China’s $110 billion equivalent plan looks dramatically underfunded, especially given its larger population. But that is a problem for the future – kick the can down the road!

Therefore, we do not believe that China is going to collapse tomorrow (though Soros may differ per his recent speeches) as GPD growth is still going to be 7.0-7.5% (love central planning) for 2014. November exports were strong, increasing 12.7% from a year earlier, and overall, the trade surplus posted its highest number in almost five years. November retail sales also topped expectations, rising 13.7% year-on-year. On the other hand, non-Chinese companies are slowing hiring or outright cutting staff. Some of the decisions appear to be reactions to regulatory issues (e.g., pharmaceutical companies that have been caught in scandals) but apparently the slowing economy has hit revenue and profits. The recent ban on new cash into Bitcoins probably is not related. Perhaps the largest confidence killer has been the discovery that luxury spicy donkey meat was adulterated with fox meat in Walmart’s eastern China stores.

Japan too may be seeing the effect of “Abenomics” wear off as the Japanese central bank’s QE policy appears to be losing its effect on the economy. Q3 annualized GDP was lowered from +1.9% to +1.1%, a sharp deceleration from 4% annualized rate during the first half of 2013. Exports have increased on the weaker Yen, but the acceleration to buy goods before prices increase may have already occurred. In India, bad loans are making headlines there as nonperforming borrowings have continued to increase, hitting 4.2% of total loans in September and projected to reach 5.7% in early 2014. Another BRIC about to crumble?

Commodities Finale: Cold weather started to hit in late December, driving up Natural Gas prices into highs not seen since the summer. While the coldest weather did not hit until January, the anticipation of the need for heat had its price impact at the end of 2013. While dramatic, we have seen this type of freeze before. In fact, futures prices in early January have already fallen 40-50 cents (roughly 10%) from their December peaks. Despite paying for the best weather services, I suppose traders can still be taken by surprise. Crude Oil has been pushed around by a number of developments. Libya is undergoing a low-grade revolution as factions aligned against the central government are blocking oil fields and ports in exchange for autonomy and/or money. When oil is flowing, the price goes down, but when the rebels assert themselves, the price shoots back up. Heading south, Nigeria’s central bank announced that it believes that $50 billion is missing from the Nigerian oil company since 2012 that should have been remitted to it. To the further East, the Kurds are looking to further build out their oil infrastructure for export as a new pipeline to Turkey went on-line. Of course, the central Iraqi government does not recognize the deal, raising tensions in that part of the world (aside from the continuous news in Syria and Iran and Egypt and…). However, in North America, supply appears to be robust into the reasonable future. Mexico passed reforms to allow for foreign exploration of its oil and gas resources as PEMEX has utterly failed to maintain, let alone grow, production. There are still hurdles but the sacred monopoly of PEMEX has been chipped away at. Also the US Energy Information Administration projected that US production will come close to its all-time record in three years, a remarkable recovery for a depleting resource.

One reads about the industrial impact of available oil and gas, about re-shoring, etc. One under-recognized impact is the strong competitive position the low-cost energy is having in the chemical business, particularly in relation to the formidable European companies. The American Chemistry Council predicts that US chemical exports will rise 45% over the next five years. As recent as 2011, the US was a net importer of chemical products, but low energy costs have shifted the balance. The European plants are announcing plant closures and layoffs (e.g. Lanxess in Germany closing 1,000 synthetic rubber positions by 2015). Asian firms will compete in low-cost commodity chemicals but they continue to upgrade, again squeezing Europe.

In food news, Tyson chicken is looking to operate its own farms to avoid local crops and food safety issues in China. With US chicken consumption at 94 pounds per year and China at only 22 pounds, Tyson is looking to capitalize on the faster growth in the poultry market over the pork market – a bit of a surprise in such a pork-loving country. Cargill also is making these investments in not just farms and land, but also infrastructure for clean water, roads and electricity. As beef and pork maintain their high prices, cheaper chicken appears to be crossing the road. Hopefully Smithfield will not have problems exporting pork to their new owners.

Invest wisely!

David Burkart, CFA

January 10, 2013

Coloma Capital Futures®, LLC

Special contributor to aiSource

Additional information sources: Bloomberg, Financial Times, South Bay Research, United ICAP and Wall Street Journal.