The current bull market, which is on track to celebrate its ninth birthday in March 2018, is already the second-longest stretch without a drop of at least 20% in the S&P 500 in history. With low unemployment and other signs of economic health in the United States, there is no telling how much longer the current bull market will last.

In this environment, the greatest threat to investors may not be surging valuations in equities, real estate, and other asset classes. The greatest threat, in fact, may be a growing sense of complacency among investors who continue to plow money into equities and neglect some of the basic tenets of diversification and rebalancing. While most investors understand that the current bull market won’t last forever, many have adopted an attitude of, “I’ll ride the wave for now, and then respond accordingly once volatility returns.”

This reactive approach to diversification and risk management is dangerous because it overlooks the growing risk exposures that are built into today’s market. Namely, there are two main factors that are giving investors a false sense of security about today’s equity markets:

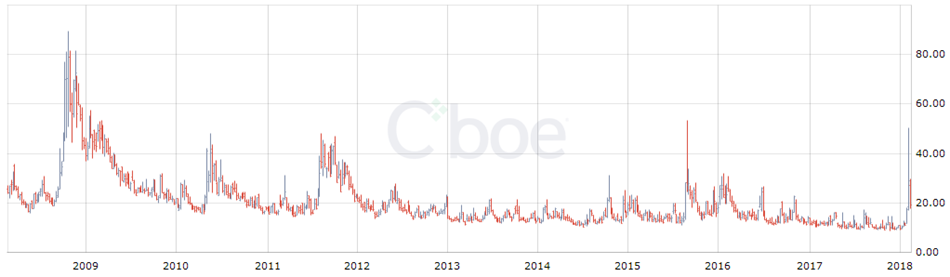

- Volatility has all but disappeared: Since the beginning of 2012, equity market volatility has been virtually nonexistent, aside from a few brief periods in late 2015 and early 2016 and the most recent spike in the first week of February 2018.. Not even outlier geopolitical events such as Brexit, Donald Trump’s surprising electoral victory, or growing tensions with North Korea have been able to wake volatility from its slumber for an extended period.

Source: CBOE

As a result, many investors have forgotten that volatility is a fact of life in equity markets. It’s not a matter of if it returns, but when. And when it does, it will create substantial trading opportunities for managers who have the ability to act nimbly to capitalize on these shifts. Furthermore, history has taught us that an extended period of low volatility combined with heightened valuations usually spells trouble for investors, and investors should be bracing for this.

- Easy-money policies are a primary driver of the bull market: The current bull market and economic expansion have been built largely on the back of unprecedented easy-money policies implemented by central banks around the world. By lowering interest rates to essentially zero (and less than zero in some cases) and injecting massive amounts of liquidity into the global economy, the U.S. Federal Reserve and its counterparts in Europe, Japan, and elsewhere, have reduced unemployment and spurred business investment. These policies also have effectively funneled money into equity markets by making fixed income and other assets classes unattractive on a relative basis.These stimulus and easy-money policies need to be unwound eventually, and central bankers hope that they can do this after local economies have enough momentum to stand on their own legs and before inflation gets out of control. This will be a very difficult balancing act—one made all the more challenging because stimulus efforts of this magnitude have never been used before so there is no playbook for how to handle such a transition. Now that the Fed has begun its program of raising interest rates and trimming is massive balance sheet, these moves could have significant and unpredictable effects across equity markets and other financial markets.

As a result of widespread complacency, many investors’ allocations to equities now far exceed their optimal allocations. This, combined with nearly a decade of rising valuations, means that the need for diversification is greater than ever. Rather than waiting for volatility to return and then reacting, investors should seek to proactively diversify risk and increase their exposure to alternative sources of return that have low correlation to equities and fixed income.

Given the unprecedented scale and scope of the stimulus efforts that are now beginning to be unwound, it is impossible to know where the opportunities will arise once volatility returns and as interest rates continue to rise. That is why we believe that managed futures strategies, which have the ability to quickly respond to opportunities through long and short positions via futures contracts across a broad range of markets, can be such a valuable source of diversification in today’s environment.

Click Here to View our Database of Non-correlated Managed Futures Strategies