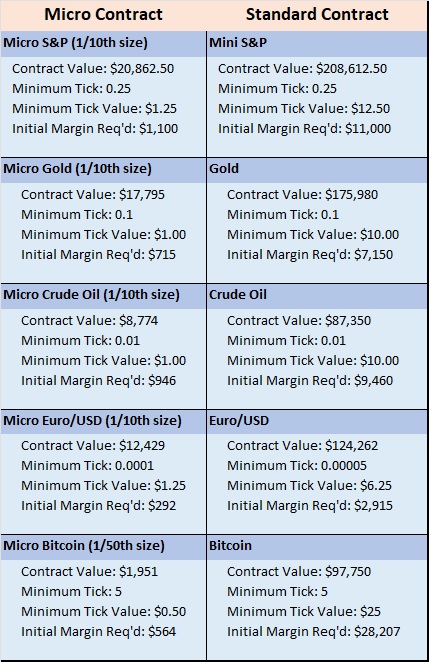

Over the last few years the CME Group has launched a bevy of micro-sized futures contracts across various market sectors. The micro-sized contracts offer access to the same market as their larger counterparts, but with smaller capital commitments and lower margin requirements. These contracts offer flexibility when trading precious metals, currencies, energies and equity indices. Below are some examples of popular micro contracts compared with their normal sized contracts and then later we discuss how these micro contracts have impacted CTA strategies.

Above you will notice we have selected the most popular micro contract within each sector (indices, metals, energies, currencies, and crypto. Most micro contracts are 1/10th of the size of the standard contract with micro bitcoin being one of the exceptions. Micro bitcoinis 1/50th the size of the standard bitcoin contract, which gives a trader exposure to 5 bitcoin. A full list of micro contracts offered by the CME can be found here: https://www.cmegroup.com/markets/microsuite.html

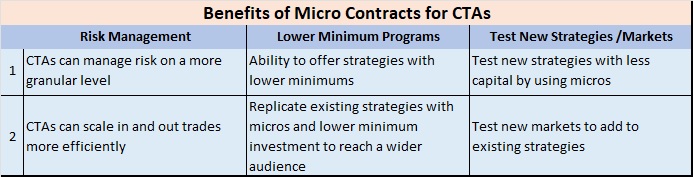

In the chart below, we discuss the benefits micro have offered CTAs:

As you can see above, micro contracts offer three main benefits:

-

Improved Risk Management

-

Ability to reach wider audience

-

Ability to improve/enhance their offerings

We are already seeing CTAs implement each of the above benefits into their operations. CTAs that were previously trading only mini and standard contracts are now adding in micros to their portfolios to add more granularity based on a client’s account size. Some CTAs have also used micros to replicate or launch brand new strategies to reach an audience that was previously out of reach. Investors that lower investment amounts now have a few more options for CTA investments than they did before. Lastly, a few CTAs are experimenting with new strategies with micro contracts as the capital requirement to do so is much lower than before.

As the CME launches more micro contracts across more markets, we expect more CTAs to start implementing them into their investment strategies.