Investors often approach aiSource on the concept of high water mark and how commodity trading advisors (CTAs) calculate their fees. In short, high water mark is the highest net asset value or account value that a CTA has reached during the life of your managed futures investment. In order for the CTA manager to collect incentive fees (performance fees), they have to generate a profit in excess of the previous net asset value high, and any management fees charged. CTA managers must continue to post net asset value highs in order to collect on their incentive fee.

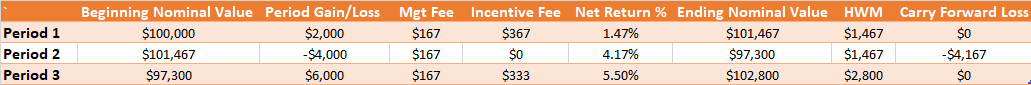

We have provided an example which you can follow that clearly outlines how to calculate the high water mark value. The following example assumes a fee structure of 2% management fee and 20% incentive fee with fees being charged on a monthly basis. Please refer to the table below:

The example below assumes a nominal account value of $100,000. Following the chart from left to right, you will notice that period 1 generated a $2,000 profit. The management fee during that period was $167 ($100,000 * 2%, divided by 12). The next column over is the incentive fee column; incentive fees are calculated by taking the profit for that period subtracting the management fee then multiplying it by the incentive fee percentage (20%). Incentive fee calculation for period 1 above is calculated as follows: ($2,000 – $167) * 20%, which equals $367. The net return for period 1 is $1,467, which is a 1.47% net return with a ending nominal value of $101,467. The high water mark value for period 1 is $1,467 and the carryforward loss is $0. Carryforward loss is what the CTA manager needs to make back, in order to collect future incentive fees.

In period 2, you will notice that there was a loss -$4,000. Obviously since this was a losing period, no incentive fees will be due. However, we still need to calculate and deduct management fees for period 2 in order to get the correct carry forward loss. As stated above, the management fees are calculated as follows, ($100,000 * 2%, divided by 12) which comes to $167. The high water mark value remains $1,467, and the carryforward loss for this period is $4,167. This simply means that the CTA manager must make back $4,167 in profits prior to collecting any incentive fees.

Period 3 had a return of $6,000. Since this return is more than the carryforward loss of $4,167 this means that incentive fees are due for this period and a new high water mark has been reached. As always, management fees needs to be calculated first. Period 3 management fees are $167, taking the profit for the period and subtracting out the management fees leaves us with $5,833. Knowing that there is a carryforward loss of -$4,167, we can subtract $5,833 from $4,167 leaving us with $1,666 which is the amount on which incentive fees are taken. Taking the same incentive fee calculation as above, we take $1,666 multiply it by 20% and we get $333. $333 is what is owed to the CTA manager for incentive fees for period 3. Since incentive fee are due for period 3, this means that the carry forward loss is $0, leaving us with a new high water mark value. The new high water mark value after period 3 is $2,800.

As you can see by following this simple example, calculating high water mark allows you to double check the fees you are paying on your investment. Many times, incentive and management fees may be calculated and debited on a quarterly basis, in which case the above example would still apply except the management fee for each period would be $501. If you have questions on any unique fee structures and how to calculate and keep track of high water mark, please contact a member of the aiSource team!