Bitcoin futures contracts were launched at the end of 2017 by the Chicago Board of Options Exchange (CBOE) and the CME Group. Both exchanges were competing with another to be the first to offer investors the ability to trade an exchange traded bitcoin contract. On December 10th the CBOE released their version of the contract, which has a contract value of 1 Bitcoin. Just over a week later, on December 18th, the CME released their version, which has a contract value of 5 Bitcoins. Since their launch, the Bitcoin market (along with my other cryptocurrencies) has seen a major sell-off and it seems that volatility has dramatically dropped compared to levels before the futures launch. This begs the question: Did the futures market ruin Bitcoin?

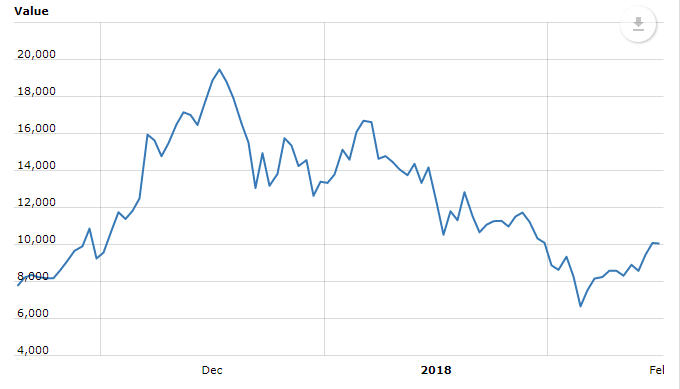

Bitcoin reached an all-time high on December 17th, 2017, reaching a value ~$19,500. A day later, when the CME launched their futures contract, Bitcoin valuation started it’s decline. Since December 18th, 2017, Bitcoin prices hit a low of ~$6,000 on February 5th, 2018:

Why has the Bitcoin price started to decline immediately following the launch of the futures contract? Did institutions begin to hedge their cash holdings? Or was the Bitcoin price rallying prior to launch in anticipation of a futures contract coming to market? Perhaps Bitcoin’s popularity was waning and lower demand was driving the price down. Whatever the reason is, the correlation to the futures launch and the decline in price is very high.

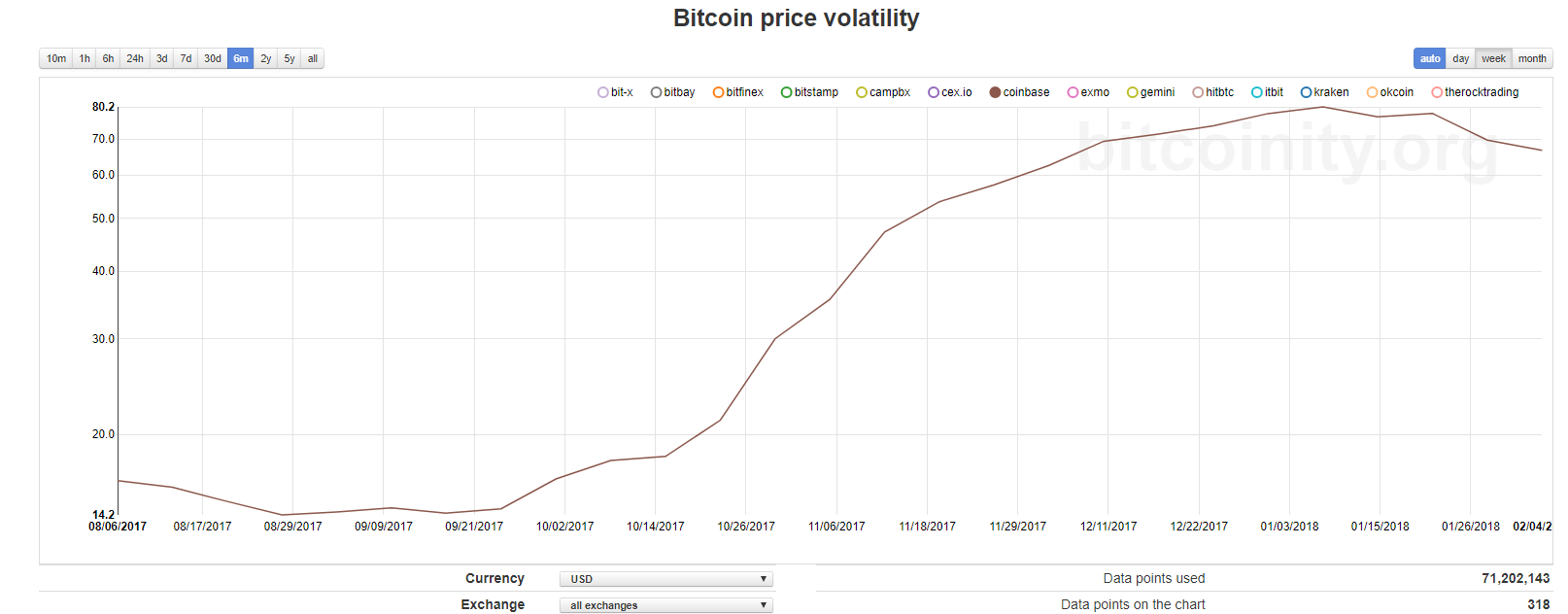

In addition to the decline in price, the overall volatility in the Bitcoin market has also leveled off since the launch of the futures contract. Here is a chart of Bitcoin price volatility as measured by Coinbase, the most reputable cryptocurrency exchange in the United States:

As you can see, the rate at which volatility was rising started to level off after the launch of the Bitcoin CBOE contract on December 10th. The leveling off in volatility turned into declining volatility soon after the start of 2018.

It would be irresponsible to say the price decline in Bitcoin is entirely due to the launch of the futures contracts. Declining prices may be due to long covering; investors looking to exit Bitcoin due to it’s all-time high valuation. Furthermore, the lower volatility could be a result of less participants and less investors rushing to buy the cryptocurrency – the rush that started early in 2017.