OPEC Production Increased Strongly to 29.6 million barrels per day (mbpd) during August (Reuters), still much less than current quotas of 33.4 mbpd. OPEC+ decreased allowances slightly at their early September meeting to signal limits on how far they would let prices fall. Libya managed to hold full production of 1.2 mbpd in August despite political violence that killed 32. Iraq also saw religious-political violence resulting in at least 22 deaths. Riots continued in Tunisia and Sri Lanka over food and fuel shortages. Rumors flew wildly around the prospects of an Iran nuclear deal, though the month ended without an announcement. Iran was reported as pressing ahead with its rollout of an upgrade to its advanced uranium enrichment program, which would seem to be counterproductive to an agreement. The September meeting saw a decrease of 100,000 bpd agreed upon despite Biden’s shuttle diplomacy to the region in the summer – between Saudi Arabia and Russia there is little incentive to lower oil prices. Besides, if there is a recession coming due to higher interest rates, less oil will be needed.

slightly at their early September meeting to signal limits on how far they would let prices fall. Libya managed to hold full production of 1.2 mbpd in August despite political violence that killed 32. Iraq also saw religious-political violence resulting in at least 22 deaths. Riots continued in Tunisia and Sri Lanka over food and fuel shortages. Rumors flew wildly around the prospects of an Iran nuclear deal, though the month ended without an announcement. Iran was reported as pressing ahead with its rollout of an upgrade to its advanced uranium enrichment program, which would seem to be counterproductive to an agreement. The September meeting saw a decrease of 100,000 bpd agreed upon despite Biden’s shuttle diplomacy to the region in the summer – between Saudi Arabia and Russia there is little incentive to lower oil prices. Besides, if there is a recession coming due to higher interest rates, less oil will be needed.

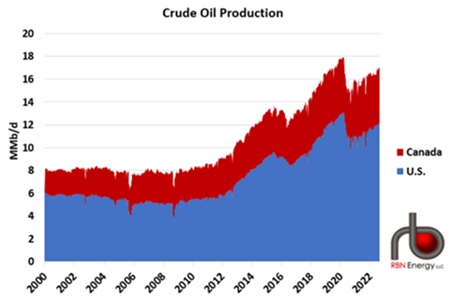

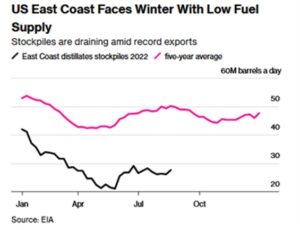

US Oil Production stayed at 12.1 mbpd as companies held operating rigs at 605 as of August 26th. As the graph above shows, the US / Canadian production is crawling back to the highs, though is about 1 mbpd short. US crude has been in  strong demand from Korean and Indian buyers which had bought 16 million barrels by mid-August for delivery largely in November. The amount of crude bought was double that seen in July. Per AAA, US average regular gasoline prices declined with the fall in oil prices, reaching $3.83 per gallon on July 31th, 38¢ lower from last month, though still almost double from the low two years ago. A lot of noise has been made over the lack of supplies in Europe, but the US too has been running with tight inventories – check out the graph to the left on heating oil – these tight supplies will keep product prices relatively high and offset any decline in crude oil. President Biden won temporary permission to once again pause energy leasing on federal lands and waters, after a US appeals court found a trial judge’s order against the moratorium too vague to review. Under the above-mentioned Inflation Reduction Act, the US government should be required to hold two auctions of oil and gas leases in the Gulf of Mexico but already that looks to be in peril as House Democrats promise to vote against the Manchin / Schumer compromise. In addition, drilling fees and royalty costs were notably increased, which should also partially discourage the oil industry. Energy prices may be falling but hard to see them reaching the pre-Biden years.

strong demand from Korean and Indian buyers which had bought 16 million barrels by mid-August for delivery largely in November. The amount of crude bought was double that seen in July. Per AAA, US average regular gasoline prices declined with the fall in oil prices, reaching $3.83 per gallon on July 31th, 38¢ lower from last month, though still almost double from the low two years ago. A lot of noise has been made over the lack of supplies in Europe, but the US too has been running with tight inventories – check out the graph to the left on heating oil – these tight supplies will keep product prices relatively high and offset any decline in crude oil. President Biden won temporary permission to once again pause energy leasing on federal lands and waters, after a US appeals court found a trial judge’s order against the moratorium too vague to review. Under the above-mentioned Inflation Reduction Act, the US government should be required to hold two auctions of oil and gas leases in the Gulf of Mexico but already that looks to be in peril as House Democrats promise to vote against the Manchin / Schumer compromise. In addition, drilling fees and royalty costs were notably increased, which should also partially discourage the oil industry. Energy prices may be falling but hard to see them reaching the pre-Biden years.

China’s Crude Oil Imports in August fell -9.4% from a year earlier, customs data showed, as outages at state-run refineries and lower operations at independent plants caused by weak margins capped buying. The world’s largest crude importer bought about 9.5 million barrels per day last month. Solar equipment modules with capacity of more than three gigawatts have been held by US customs since June over a law targeting forced labor in China’s Xinjiang region. Nine to 12 gigawatts of modules could be detained by year-end, and many top Chinese manufactures have stopped exporting to the US, according to Roth Capital.

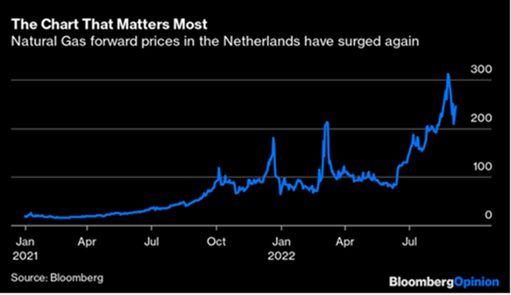

European Gas Prices Again Surged as panic over Russian supplies gripped markets and politicians warned citizens to brace for a tough winter ahead. German politicians announced that they were going to keep the last three nuclear reactors open until next year on a “stand-by” basis – which is of limited value because 1) the uranium power rods will decay anyway so not using them wastes electrical capacity and 2) unlike natural gas plants which can take as little as an hour, nuclear power plants take a day to a few days to start up depending on the pressure in the pipes (amongst other technical aspects beyond my quick web searching). Better have good weather forecasters on staff.

they were going to keep the last three nuclear reactors open until next year on a “stand-by” basis – which is of limited value because 1) the uranium power rods will decay anyway so not using them wastes electrical capacity and 2) unlike natural gas plants which can take as little as an hour, nuclear power plants take a day to a few days to start up depending on the pressure in the pipes (amongst other technical aspects beyond my quick web searching). Better have good weather forecasters on staff.

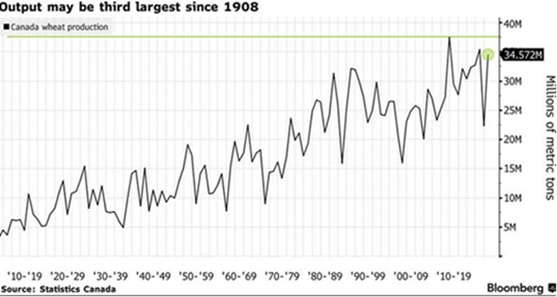

North American Crops look relatively tight on corn with the USDA last forecasting lower ending stocks due to lower yields (175.4 bushels per acre versus 177.0 the prior report), though more generous on soy (better yields at 51.9 against 51.4 bushels per acre). However, it is not all bad. Brazil is set to plant its biggest soybean crop to date, as, Brazil’s food supply and statistics agency Conab projected that harvest will grow by +21% to a record 150.4 million tonnes. Brazil is poised to produce more than 300 million tonnes of grains in 2022/2023 even as some farmers may cut fertilizer applications, agribusiness consultancy Agroconsult said. Brazil will start planting soybeans and summer corn next month in the center west, and crop conditions will likely be excellent barring unforeseen weather issues. Canadian wheat production seen +55.1% higher vs last year’s crop to reach 34.6 million tons. The yields were forecasted to rise by +41.6% to 51.1 bushels per acre and the harvested area is expected to increase by +9.4% to 24.9 million acres. IKON Commodities raised its forecast for Australia’s 2022-23 wheat crop by +6.6% to 35.8 million tons as favorable conditions boosted prospects across major growing regions in both the eastern and western grainbelts. The southern hemisphere nation would be on track for its third consecutive bumper harvest, IKON said.

prospects across major growing regions in both the eastern and western grainbelts. The southern hemisphere nation would be on track for its third consecutive bumper harvest, IKON said.

If you have an interest in geopolitics, I recommend Peter Zeihan’s new book The End of the World is Just Beginning (or watch this video) – for those too busy for either, the TL: DR is global civilization’s easy progress is behind us and accelerating aging demographics, increasing political regionalism, heightened resource competition and difficult technological implementation will make the future quality of life more challenging.

Finally, in the category of unintended consequenses, read this story on how soy-based insulation in cars may be better for the environment, but it can also attract hungry vermin:

https://www.caranddriver.com/news/a21933466/does-your-car-have-wiring-that-rodents-think-is-tasty/

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource