- OPEC+ Reaffirmed Its Deal to increase production by 400,000 barrels per day, reaching 2 million barrels per day (mbpd) at the end of 2021. Then in May 2022, the baseline for cuts will reset higher, allowing for the UAE to produce about 500,000 bpd more (its reward for going along with the deal). With the global economy reopening halted on COVID Delta fears, prices stalled but were still at profitable levels at around $70 per barrel. OPEC in its monthly report kept its 2021 and 2022 oil demand growth forecasts unchanged from last month’s estimates. They see 2021 demand growing by 5.95 mbpd and 2022 by 3.28 mbpd. “Forecasts continue to point to a significant supply/demand deficit in H2 2021,” OPEC said, adding that “refined product prices in H2 2021 are likely to continue benefiting from a seasonal strength in transport fuels, although current high refinery run rates could dampen some of the upside in the immediate near term.” (Platts) The FT reported that Saudi Aramco is looking to raise production capacity with its windfall profits from 12 mbpd to 13 mbpd over the next few years as it expects demand to fully recover to over 100 mbpd.

- US Oil Production picked up last month to 11.5 mbpd while operating rigs jumped from 385 as of July 30th to 410 as of August 27th. As reference, this is about half the rigs operating before the pandemic but efficiency has been much higher nowadays. US oil reserves creeped lower to 426 million barrels (mb), down from 439 mb a month ago to the lowest level of the year. While usually oil reserves fall at this time of the year, on average they are about 8% higher than now. Hurricane Ida which tore through the Gulf of Mexico and Louisiana at the end of the month took about 2.2 mbpd of refining capacity off-line. This capacity started to come back very slowly as a number of power plants suffered outages. Exports and ports are also severely impacted, including sugar and grain silos and related facilities. Analysts quoted by Reuters said that it could take two-to-three weeks to restart oil producing platforms and to fully restore output at Louisiana refineries. As of midday September 6th, about 1.5 mbpd of crude production remained offline in the U.S. Gulf. There were still 5 refineries in Louisiana, with a total capacity of 1 mbpd, that were shut. The issue appeared to be less with the refinery and energy operations themselves, and more with the lack of reliable electrical power. By comparison, these outages are worse than what was seen due to Katrina.

- Biden’s Administration did announce at the end of August it would take steps to restart the federal oil and gas leasing program and plans to hold a Gulf of Mexico auction as soon as October. With the recent increase in gasoline prices, Biden called upon OPEC to increase production, to which Saudi Arabia expressed confusion as this plea was counter to his policies on fossil fuels. US supply is seen rising in the seven major shale plays in the U.S. by 49,000 bpd in September to 8.09 mbpd per EIA data. Production will thus be the highest since May 2020.

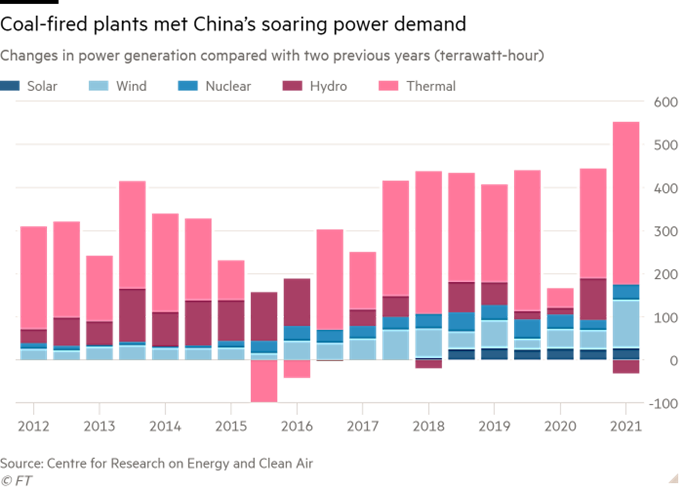

- China’s Crude Oil Imports rose to a five-month high of 44.5 million metric tons (10.5 mbpd) after private refiners were allocated new import quotas and those cargoes that were delayed by a typhoon were finally delivered. July’s average by comparison was 9.75 mbpd. Coal demand too expanded strongly as 18 steelmaking blast furnaces and 43 coal-fired power plants were announced in the first half of 2021, more than all of 2020 (see graph right for the growth in thermal coal plants). As a side note, Bloomberg reported that the US state of California will increase carbon emissions as lower water levels decrease hydropower availability in the evening hours which has to be met by firing up natural gas plants (the timing during the night precludes the use of solar, obviously).

- China Lowered Its Soybean Import Estimates in the year 2020/21 following a decline in crush margins with imports seen at 98.6 million tonnes, down 1.8 million tonnes from last month’s estimate. Importers also delayed purchases of the oilseed as the market expected prices of the new crop to fall in response to a bumper US harvest. The latest US planting numbers showed an uptick of acres for corn, wheat and soy, which would support such a view. Anecdotal evidence also told of strong crop conditions, with the latest government numbers more-or-less unchanged at 59% good/excellent for corn and 57% for soy. Ukraine’s government projected a harvest of 80.6 million tonnes of grain in 2021, a record quantity that will allow the export of 60.68 million tonnes, including 32 million tonnes of wheat and 37.1 million tonnes of corn. Ukraine exported 8.6 million tonnes of grain in the first two months of the 2021/22 July-June season versus 7.7 million at the same point a year earlier, including 4.6 million tonnes of wheat, 2.8 of barley and 1.26 of corn. Argentina’s 2021/22 soy harvest is expected at 49 million tonnes, versus the previous season’s crop to 45 million tonnes. The soy planting area was expected to fall for a sixth straight season to make room for expanding corn cultivation.

- Japan Ended 300 Years of Trading Rice Futures as the Osaka Dojima Commodity Exchange will end such trading in June 2022 when all the outstanding contracts have expired. In 1730, samurai petitioned the Tokugawa shogunate to authorize trade in rice futures at the Dojima Exchange, as it was called then. Samurai, whose wealth at the time was linked to rice, petitioned Tokugawa after prices fell to a record low in the 1720s. In granting the petition, the shogunate overturned a long-standing ban on rice futures, seen at the time as a form of gambling. Now elevated to “speculating,” futures trading has expanded globally, building on this exchange model.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource