- OPEC+ Reduced Their Production Cut to 7.7 million barrels per day (mbpd) from 9.7 mbpd starting in August, an implied increase of 2 mbpd at the July 15th Per a Reuters survey, compliance was effectively 100%. Certain members such as Iraq were to not fully increase production to make up for over-producing last and this year, while other members such as Libya, Venezuela and Iran were intrinsically limited due to internal strife and international sanctions. Taking this into account, the effective cuts for August were estimated at 8.2 mbps or an implied increase of 1.5 mbpd. Russian oil and gas condensate output increased to 9.9 mbpd for August to meet their expanded quota. Saudi Arabia announced the discovery of two new oil and gas fields. The state oil company outlined plans to cut capital expenditure to $25 billion or less next year, about half the amount it was originally planning on lower demand estimates for oil and products. Iran has suffered from a series of strikes in its oil and petrochemical industries over overdue wages. With oil prices so low and selling what it does produce at a further discount as it circumvents sanctions, the IMF estimated that 2020 GDP will fall -6.0%, the third annual decline in a row, along with 16% unemployment. Even wealthy and stable Kuwait announced money troubles as its finance minister told its parliament that it will not have enough cash to pay government salaries after October, assuming the same contributions to its sovereign wealth fund and the current prohibition to issue debt. A change in the law to allow borrowing of up to two years of cash needs has to be passed before bonds can be issued. The US seized four tankers hauling Iranian crude to Venezuela for violating sanctions and they are en route to Houston. Overall, the US Energy Information Agency forecasted that consumption of petroleum and liquid fuels globally will average 93.1 mbpd for all of 2020, down 8.1 mbpd from 2019, before increasing by 7.0 mbpd in 2021. We shall see.

- US Production, particularly in shale regions, battled crippling cash flow and a spike of bankruptcies due to slack North American demand keeping prices low. US operating drilling rigs stayed at 180 on August 28th versus July 31st, with a new recent low at 172 rigs in the middle of the month. Total oil output fell

into the end of the month due to Hurricane Laura closures of approximately 1.5 mbpd. 310 offshore facilities were closed temporarily (84% of Gulf production) and the refinery impact was more consequential at 2.9 mbpd offline (about 15% of total US refinery capacity). While into September there are still widespread closures and refineries off line, long-term damage from the strong winds was expected to be minimal. Domestic crude exports averaged 3.24 mbpd in July, up from 2.75 mbpd in June. China was the top destination for US oil followed by Canada. While Chinese quotas and storage is filling up, at least 12 very large crude carriers were set to load up to 25 million barrels, or almost 835,000 bpd, at the US Gulf coast for China in September per Argus. In January, China pledged to buy $18.5 billion of energy products including crude oil and natural gas over its 2017 level, implying total value of about $25 billion this year. However, its US crude purchases through June 30 amounted to $2.1 billion, leaving it a long way to go. Looking at the total US exports to China, the gap as seen below is wide and getting wider.

into the end of the month due to Hurricane Laura closures of approximately 1.5 mbpd. 310 offshore facilities were closed temporarily (84% of Gulf production) and the refinery impact was more consequential at 2.9 mbpd offline (about 15% of total US refinery capacity). While into September there are still widespread closures and refineries off line, long-term damage from the strong winds was expected to be minimal. Domestic crude exports averaged 3.24 mbpd in July, up from 2.75 mbpd in June. China was the top destination for US oil followed by Canada. While Chinese quotas and storage is filling up, at least 12 very large crude carriers were set to load up to 25 million barrels, or almost 835,000 bpd, at the US Gulf coast for China in September per Argus. In January, China pledged to buy $18.5 billion of energy products including crude oil and natural gas over its 2017 level, implying total value of about $25 billion this year. However, its US crude purchases through June 30 amounted to $2.1 billion, leaving it a long way to go. Looking at the total US exports to China, the gap as seen below is wide and getting wider.

On the Commodity Demand Side, China continued to have record levels of floating storage (oil on tankers) at about 100 million barrels. China processed 14.0 mbpd, keeping the strong flows since June. Refinery output jumped 12% y/y in July as major state plants resumed operations after maintenance overhauls. Regarding meat, China imported 832,000 tonnes of meat in August, down almost 17% from last month, although imports remain high as Beijing tries to plug a shortfall in domestic pork production. Meat imports in July had reached 998,000 tonnes, but shipments had been expected to slow as exporters suspended cargoes from plants where workers have been infected with the coronavirus, especially from Brazil. China made its largest weekly U.S. beef purchases on record towards the end of August, followed by its biggest US corn and pork deals in almost a month. China’s soybean imports from top supplier Brazil surged in July from a year ago, reaching 8.18 million tonnes, where prices have been cheap due to ample production. Brazilian soy production was revised upward by 2% to 124.5 million metric tonnes for last year and up about 6% for the current year to 133.5 million metric tonnes. The USDA is projecting a record corn crop off of record yields (15.28 billion bushels from 181.8 bushels per acre) and a strong soy crop (last at 4.43 billion bushels off of 53.3 bushels per acre). The market is pushing prices higher into early September on recent poor weather. However, with good sub-soil moisture, we suspect the crops will not be as large as the USDA is forecasting nor as tight as the market is pricing.

On the Commodity Demand Side, China continued to have record levels of floating storage (oil on tankers) at about 100 million barrels. China processed 14.0 mbpd, keeping the strong flows since June. Refinery output jumped 12% y/y in July as major state plants resumed operations after maintenance overhauls. Regarding meat, China imported 832,000 tonnes of meat in August, down almost 17% from last month, although imports remain high as Beijing tries to plug a shortfall in domestic pork production. Meat imports in July had reached 998,000 tonnes, but shipments had been expected to slow as exporters suspended cargoes from plants where workers have been infected with the coronavirus, especially from Brazil. China made its largest weekly U.S. beef purchases on record towards the end of August, followed by its biggest US corn and pork deals in almost a month. China’s soybean imports from top supplier Brazil surged in July from a year ago, reaching 8.18 million tonnes, where prices have been cheap due to ample production. Brazilian soy production was revised upward by 2% to 124.5 million metric tonnes for last year and up about 6% for the current year to 133.5 million metric tonnes. The USDA is projecting a record corn crop off of record yields (15.28 billion bushels from 181.8 bushels per acre) and a strong soy crop (last at 4.43 billion bushels off of 53.3 bushels per acre). The market is pushing prices higher into early September on recent poor weather. However, with good sub-soil moisture, we suspect the crops will not be as large as the USDA is forecasting nor as tight as the market is pricing.

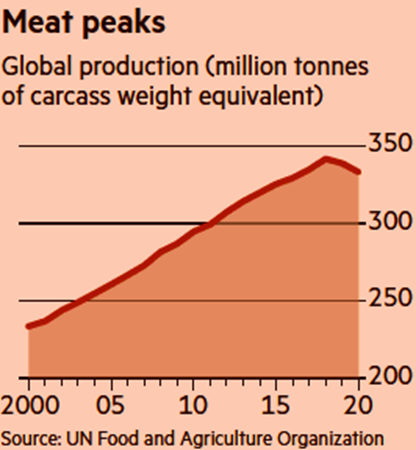

Finally, an interesting graph to end the commentary: per the FT, global production of meat fell for the first time in more than two decades last year, to under 339m tonnes. This year, output is expected to drop further, because of animal diseases, pandemic-related disruptions and the lingering effects of droughts.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource