Trade War Only A Symptom of Underlying Global Risks

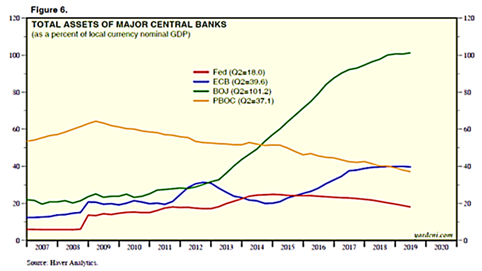

- While commodities is the overarching theme of this commentary, we recognize that the really large money flows occur in the stock and bond markets, particularly the latter. With Germany issuing 30-year debt at negative yields (yes, investors effectively lock in losses if held to maturity), Austrian 100-year bonds having doubled since issuance in 2017 (one hears of stocks doubling, but government bonds more than doubling after two years from issuance is a very odd thing!) and $17 trillion (30%) of all global bonds with negative yields (including $1 trillion of negative-yielding corporate bonds), there has been a massive amount of credit creation with little to show for it. In fact, the worst performing major economies (EU at +1.2% through Q2 year-on-year and Japan at +1.0%), have the most persistent negative rates (European Financial Stability Facility’s 10-year debt yields -0.25% and Japan’s about the same at -0.26%). The US and China have GDP growth of +2.3% and 6.2% over the same time period and positive single-digit 10-year yields. Looking at the below graph of monetary support (quantitative easing) as a percentage of GDP, it is not the US that is way overextended, but Europe and Japan (China is in between with very high

monetary stimulus but higher GDP growth slowly offsetting that leverage – barring no changes to their policies). With such questionable policies in the past, what does the future hold? More of the same it seems – lower rates, higher leverage and lower economic growth. The ECB is supposed to delve further into negative rates and start a new QE program at its September 12th The US Federal Reserve is expected to lower rates by 0.25% during its meeting on September 17th and 18th. The Chinese central bank just lowered bank reserve requirements to their lowest levels since 2007, inducing higher bank leverage. With lower (or even negative) investment returns, pensions, foundations and retirees have to cut expenditures in order to maintain their principal – or seek more from their sponsoring governments or donors. As those sources of funds also may be cutting, a vicious circle is set up with a corresponding increase in social tensions (rich versus the rest, geopolitical/economic rivalry, retirees versus workers). Is this all doom-and-gloom? No. As Ray Dalio (and others) has outlined, we got through the Great Depression and the social unrest of the 60s and 70s, there are new technologies in energy and health care, and new levels of communication and knowledge that give some time to react. And what is the best course of action? I am not sure, but the easy-to-say, hard-to-do aphorisms come to mind: “If you find yourself in a hole, stop digging” and “Insanity is doing the same thing over and over again and expecting different results.”

monetary stimulus but higher GDP growth slowly offsetting that leverage – barring no changes to their policies). With such questionable policies in the past, what does the future hold? More of the same it seems – lower rates, higher leverage and lower economic growth. The ECB is supposed to delve further into negative rates and start a new QE program at its September 12th The US Federal Reserve is expected to lower rates by 0.25% during its meeting on September 17th and 18th. The Chinese central bank just lowered bank reserve requirements to their lowest levels since 2007, inducing higher bank leverage. With lower (or even negative) investment returns, pensions, foundations and retirees have to cut expenditures in order to maintain their principal – or seek more from their sponsoring governments or donors. As those sources of funds also may be cutting, a vicious circle is set up with a corresponding increase in social tensions (rich versus the rest, geopolitical/economic rivalry, retirees versus workers). Is this all doom-and-gloom? No. As Ray Dalio (and others) has outlined, we got through the Great Depression and the social unrest of the 60s and 70s, there are new technologies in energy and health care, and new levels of communication and knowledge that give some time to react. And what is the best course of action? I am not sure, but the easy-to-say, hard-to-do aphorisms come to mind: “If you find yourself in a hole, stop digging” and “Insanity is doing the same thing over and over again and expecting different results.”

OPEC Oil Production

- rose in August as higher supply from Iraq and Nigeria outweighed restraint by top exporter Saudi Arabia and losses caused by U.S. sanctions on Iran. OPEC output reached 29.61 million barrels per day (mbpd), an increase of about 200,000 bpd. OPEC seaborne oil exports in August rose by 329,000 bpd to 22 mbpd, driven by Saudi Arabia and the UAE. Looking ahead, Saudi Arabia’s new oil minister is known for managing cutbacks and at the upcoming OPEC+ meeting on September 12th, there may be a new round or at least direct discussion. After all, higher oil prices will make the Saudi Aramco IPO more attractive! Russian oil production in August rose to 11.3 mbpd, topping the rate Moscow has pledged to cap output. Iraq hit record production figures in August with an output of 4.9 mbpd, despite the OPEC+ drive to cut production. The country is OPEC’s second-largest oil producer but is still in the process of rebuilding after its decades of fighting. Iran’s official oil exports fell further to 200,000 bpd but as discussed last month, smuggling abounds. Eleven vessels have been blacklisted by the US State Department and an estimated 10 million barrels have been illicitly transported over the last few months. China, in defiance of the US sanctions, reportedly decided to invest $280 billion in Iran’s oil industry over the next five years with another $120 billion in infrastructure investment. We suspect that will turn out better for China than their roughly $80 billion invested in Venezuela, which was sued by China in the US courts (ironic, isn’t it?) for $58 million in unpaid invoices related to Chinese construction work on updating oil blending facilities needed for export expansion. That Venezuela thinks that it can stiff its largest creditor is a sign of true desperation by Maduro’s government. Meanwhile, Venezuela’s oil exports fell in August to their lowest level in 2019, hurt by a halt in purchases by the nation’s second largest customer, China National Petroleum Corp, following tougher U.S. sanctions. Overall exports of crude and refined products by state-run oil company Petroleos de Venezuela (PDVSA) declined last month to 770,000 bpd from 992,000 bpd in July and 1.13 mbpd in June, according to revised data. On the other hand, Nigerian total output of crude and condensates rose to 2.2 mbpd in early August versus 1.9 mbpd a year ago and exports rose consummately. China is investing there too with $16 billion in pledges. The Chinese need alternative crude sources as they put a 5% tariff on US crude oil for the first time as of September 1st (along with higher tariffs on other US goods). China in August increased oil imports by +3% from July and nearly +10% higher during the first eight months of 2019 from a year earlier.

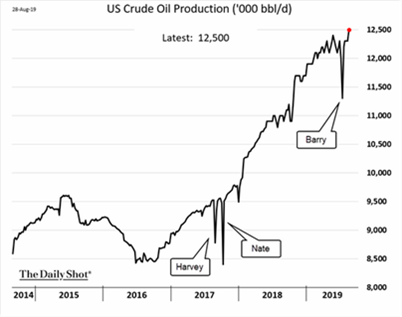

US Crude Oil

- weekly numbers indicated increased production to 12.4 mbpd of crude oil despite a continuing decline in operating drilling rigs from 770 on August 2nd to 742 on August 30th. US oil output from seven major shale formations was expected to rise by about 200,000 bpd in September, to a record 8.8 mbpd. Again, the largest forecasted change is in the Permian Basin of Texas and New Mexico, where output was expected to climb by 75,000 bpd, to a fresh peak of 4.4 mbpd. US crude oil exports have maintained a monthly level of around 3 mbpd and about 800,000 bpd in gasoline exports. A court in Nebraska affirmed an alternative route through the Midwest state for Keystone XL oil pipeline in the nearly 10-year legal fight over the Canada-to-Texas pipeline. The ruling lifts one of the last outstanding legal challenges facing the controversial project, which would ship 830,000 bpd of crude into an existing pipeline network feeding oil refineries on the Gulf Coast. Finally we note that Brazil’s production rose 200,000 bpd year-on-year as output in the Santos basin reached a record high.

Meanwhile, Oil Demand Growth Is Slowing

- as the International Energy Agency said that global oil demand has grown at its slowest pace since the financial crisis of 2008. The agency said that compared with the same month in 2018, May’s global demand this year fell by 160,000 bpd. From January to May 2019, demand rose by 520,000 bpd, making it the lowest increase for that period since 2008. This led the IEA to adjust its forecast for global demand growth for 2019 and 2020 to 1.1 and 1.3 mbpd respectively. British Petroleum is a little more pessimistic as they estimated that global oil demand is expected to grow by less than 1 mbpd in 2019.

China is Aggressively Countering Pork Deficits

- caused by African Swine Flu by granting export licenses to 25 Brazilian meatpacking plants (17 for beef exports, six for chicken, and one each for pork and donkey meat). Brazilian pork exports to China soared +48% in the first eight months of the year, according to Brazil government statistics, while beef exports to China are up +17% and chicken exports rose jumped +37%. The US is also exporting a lot of pork to China, having shipped 379 million pounds year-to-date July versus 231 the same period last year – and that is despite Chinese tariffs. These numbers make China the fourth-largest destination for US pork after Mexico, Japan and Korea. Finally, dead pigs found in some backyard farms in the Philippines tested positive for African Swine Fever, providing further evidence that the disease is slowly spreading through Asia.

Global Grains

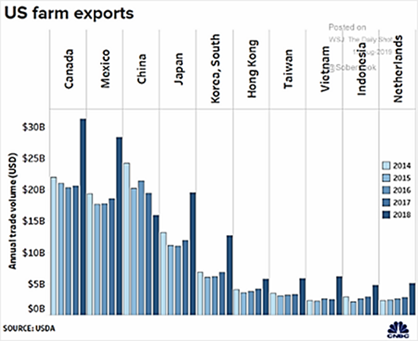

- continue to put up strong production numbers, despite rough weather in North America and Europe. For example, Ukraine’s 2019 wheat harvest may rise to 27.72 million tonnes from 24.83 million tonnes last year, with a corresponding increase in exports. Germany also was looking to harvest more wheat – up +16% versus 2018, and EU production looked to be up +12% versus last year (France forecasted the second-largest crop in its history). Brazil corn exports in August surpassed the previous monthly record posted in July and were more than double the 2.9 million tonnes shipped in the same month a year earlier. The US corn harvest will be bigger than previously forecast, according to last month’s US Agriculture Department forecast, though exports were expected to be dismal. Through August 15, 10 million tonnes of corn and soybeans have been sold to foreign buyers for shipment in 2019-20, down 55% from both a year earlier and versus the five-year average. That is the smallest amount since 2005. Last year Canada, Mexico, Japan and South Korea made up for Chinese lost trade – 2019 so far had failed do so as soybeans in on-farm storage almost doubled between June 2018 and June 2019 (70 million bushels to 135 million bushels).

Gold

- Finally, Gold prices have been moving higher, partially fueled by eminent investor Ray Dalio and record central bank purchases during the first half of 2019. Investors bought $5 billion of gold-related US ETFs in August. Lower and negative global interest rates have made the lustrous metal more attractive, as well as geopolitical desires to diversify away from USD-related assets.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource