War Impact: Ukraine’s planting estimates started to solidify as areas under corn seeding were seen at 3.8m ha, down -31% from last year while areas under soybean were increased to 1.4m ha, up +12% from 2021. The outlook for total area under spring crops was raised by +5% from a previous estimate to 13.9m ha, as northern areas became available for planting after Russian troops pulled back from the Kiev region. Meanwhile, Russia planted 3.5m hectares of spring crops so far per Interfax, compared with 3.1m hectares at the same time last year. Good weather allowed farmers to start field work 2-3 weeks earlier than usual; spring sowing is expected to cover 53.6m hectares. 97% of winter crops were in good condition, more than last year. The agricultural ministry saw the grains harvest totaling 123m tons in 2022, compared with 121.4m tons last year. China’s top offshore oil and gas producer CNOOC prepared to exit its operations in Britain, Canada and the United States because of concerns in Beijing the assets could become subject to Western sanctions. Ties between China and the West have long been strained by trade and human rights issues and the tension has grown following Russia’s invasion of Ukraine, which China has refused to condemn. The size of the assets was quite modest at around 220,000 bpd. China also reportedly was looking at general methods to maintain other overseas assets and payments in case of sanctions or SWIFT blockages.

OPEC+ Voted to Increase Production at their May 5th meeting by 432k barrels per day (bpd) during June. OPEC pumped 28.7 mbpd during April, up +0.2 mbpd but far less than current quotas. Libya’s oil production fell 500k bpd in mid-April as a wave of demonstrations blocked loadings, but was expected to be restored in early May. Iran and the US have still not struck a deal to let their oil freely come to market.

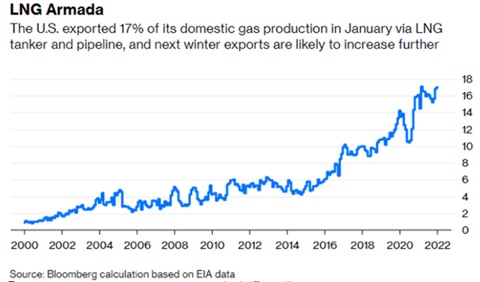

US Oil Production moved up fractionally to 11.9 mbpd during April while operating rigs moved higher from 533 as of April 1st to 552 as of April 29th. Per AAA, US average regular gasoline prices declined fractionally to $4.19 on April 30th, down from $4.22 per gallon last month. Biden unleashed a flurry of new decisions as his administration tried to stem backlash over higher gasoline prices but keep his political agenda. First, on April 19th, he restored stricter rules for new pipelines, power plants, highways and other construction projects that would require wider definitions of pollution. Biden also ordered a series of bids this fall to buy back 60 million barrels of crude for the Strategic Petroleum Reserve some time in the future after selling 180mn barrels of crude over the next six months. Will he be selling high, buying back higher? In another foreboding sign of oil scarcity, supplies at the central delivery point of Cushing, Oklahoma fell to an estimated 11% of capacity, the same as previous lows in 2018 and 2014. Meanwhile, natural gas exports continued to increase, taking a higher portion of US production as the world paid up for non-Russian supplies. Natural gas in storage hit the second-lowest level in the last ten years on a freak April ice storm that shut in Bakken production. Higher demand…lower supply… higher prices.

require wider definitions of pollution. Biden also ordered a series of bids this fall to buy back 60 million barrels of crude for the Strategic Petroleum Reserve some time in the future after selling 180mn barrels of crude over the next six months. Will he be selling high, buying back higher? In another foreboding sign of oil scarcity, supplies at the central delivery point of Cushing, Oklahoma fell to an estimated 11% of capacity, the same as previous lows in 2018 and 2014. Meanwhile, natural gas exports continued to increase, taking a higher portion of US production as the world paid up for non-Russian supplies. Natural gas in storage hit the second-lowest level in the last ten years on a freak April ice storm that shut in Bakken production. Higher demand…lower supply… higher prices.

US Crop Planting was off to a slow start as corn in the ground was 14% vs 7% last week, and 42% a year ago. Soybeans, wheat and cotton showed similar numbers as wet weather slowed planting progress. However, with sunny weather projected for mid-May, a rapid catch-up was expected. Late crops risk freezes and other weather issues late in the year, so something to watch. Brazilian crop was expected to come in below estimates due to dryness but the consultants still projected a record corn harvest because of larger acreage under plow. Argentina’s exports surged to a 6-month high in March, as prices soared for the nation’s soy, corn and wheat after Russia’s invasion of Ukraine. Chile, Ecuador and Brazil also reported record exports in March.

For fun this month, we offer up three unique finds:

“We wondered, how on earth are these fries still in this bag and how are they preserved so well?” Grace said. “My thoughts are that it was likely the salt that dried out and preserved the fries, not actual preservatives. Or at least that’s what I’m telling myself.”

https://blogs.bl.uk/digitisedmanuscripts/2022/04/postcard.html

A 2000-year-old postcard

The link says it all… beyond brilliant!

All the best in your investing! Stay healthy!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource