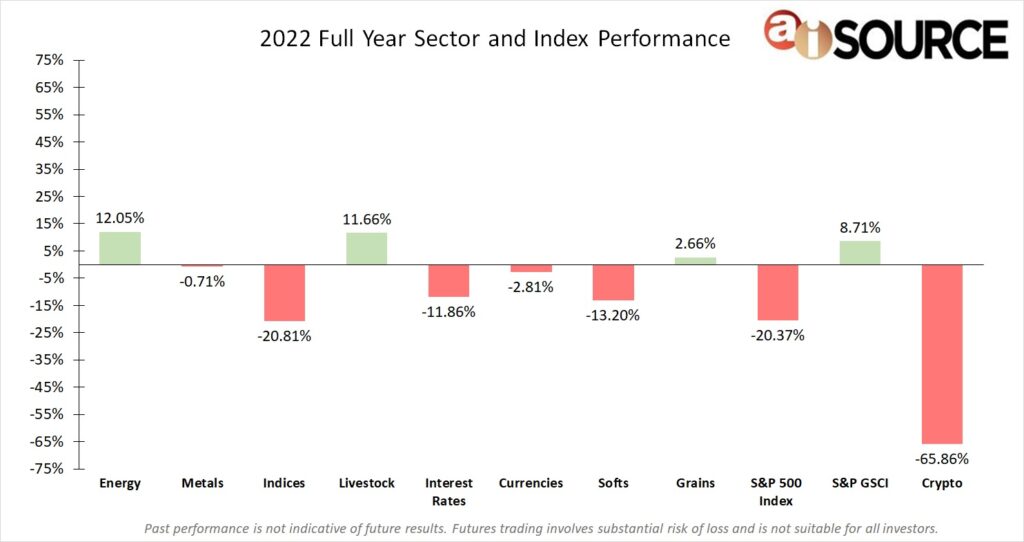

2022 ended with 40 year inflation highs and one of the toughest trading environments in over 10 years. Energy (+12.05%) and Livestock (+11.66%) were the leading sectors in 2022. Losses in Indices (-20.81%) and Softs (-13.20%) were nothing compared to the astounding loss in crypto (-65.86%). Adding insult to injury, the FTX scandal landed a further blow to an already bad year for crypto. While crypto has a history of recovery after crashes, such a recovery could take months or years.

The invasion of Ukraine has had a rippling effect through the Energy, Metal, and Grain markets. Industries cutting ties with Russia have deepend the market impact, but much of the global commodity markets have remained resilient. The U.S. and the rest of the world is still in recovery from the COVID-19 pandemic, which has caused supply disruptions and rising commodity prices. The U.S. Dollar has typically been a safe haven for investors during times of market volatility, and has strengthened considerably over 2022. However, the British Pound fell to its lowest level vs the dollar since 1985, while the yen fell to its lowest level since 1998. The Euro came out of 2022 trading at parity vs the U.S. Dollar for the first time since 2002. It will be important to closely monitor global events to see what is in store for us in 2023.

For month-to-date and year-to-date CTA rankings, please remember to visit our CTA Database. If you do not have a login and wish to register for free, please click here.

Sector & Index Performance Consists of the following:

Grains: Corn, Soybean Meal, Oats, Soybeans, Soybean Oil, Wheat, Rough Rice. Livestock: Live Cattle, Feeder Cattle, Lean Hogs. Softs: Cocoa, Orange Juice, Sugar No. 11, Random Length Lumber, Coffee, Cotton No. 2. Currencies: Euro Currency, Japanese Yen, British Pound, Canadian Dollar, Swiss Franc, US Dollar, Brazilian Real, Mexican Peso, Australian dollar. Indices: S&P 500, Mini Dow, Mini Nasdaq. Interest Rates: 30-year t-bond, 10-year t-note, 5-year t-note, Eurodollars. Metals: Gold, Silver, Copper, Platinum, Palladium. Energy: Crude Oil, Reformulated Gas, Natural Gas, Heating Oil, Denatured Fuel Ethanol. Crypto: Bitcoin and Ethereum. S&P 500 Index – All data collected from investing.com. S&P GSCI Index – data collected from us.spindices.com/indices/commodities/sp-gsci.