Best Of Times, Worst Of Times: 2014 was a year of extremes with stock markets that had bullish input did well (e.g., US up on economic news at +14.5%, Japan up on QE at +7.6%)[1] and bad for those that could not get their act together (e.g., Germany -9.3% (and the rest of Europe) was hurt on economic malaise and lack of effective QE). To no one’s surprise, Russia was the worst stock market at -42.3%. Markets highly exposed to Russia (e.g., Hungary and Austria) also fared poorly (-26.9% and -29.0%, respectively). Greece, despite its political turmoil at the end of the year, ended basically flat. The big winner was Egypt at +31.1% on a relief rally after a calmer political situation under the rule of General al-Sisi. Indonesia (+26.6%), the Philippines (+26.4%) and India (+22.6%) showed improving political and business conditions (or the promise thereof). Commodities did quite poorly overall as good supply gains and cool global demand sent the S&P GSCI Total Return and the Bloomberg Commodity Indices down by a stunning -33.1% and -17.0%, respectively. Energies led the way lower at -44.1%, but Softs (-14.6%), Agriculture (-10.7%) and Industrial Metals (-7.4%) also fell. All four sectors were generally hurt by strong supply growth into a slowing and/or stagnant global economy. Precious Metals (-4.1%) found support on its alternative currency status, and Livestock (+14.2%) was the only gainer on small cattle supply being insufficient to meet global demand. Bonds were the general beneficiary of global QE, with the US 7-10 year index up +8.8%, Japan’s +4.7% and Germany’s +13.4% and governments, banks and investors were all buyers (albeit for different reasons). Finally, the USD was the king of the large currencies, gaining against Japanese Yen (+13.7%), the Euro (+13.6%) and Pound Sterling (+6.3%) as GDP growth numbers impressed and QE dwindled to a halt (though no corresponding increase in interest rates or roll off of purchased bonds yet).

Looking ahead to 2015, the US seems again to be amongst the best of the worst. With an economy that is performing at low but positive levels, it should continue to attract capital from the rest of the world and thus be able to maintain extremely low interest rates and a lofty stock market, all else being equal. The only undertow to this tsunami of government money is the declining sovereign wealth balances of oil-producing countries as they keep their oil supply up and oil prices down. US (and Canadian) oil companies have plenty of access to capital via private equity firms so I would expect that while their stock prices will be challenged, production will not fall as quickly or as far as one may first think. Higher cost producers like Brazil and badly managed countries like Venezuela face the biggest challenges. Russia will cause problems but be limited in impact given their economic problems. Greece troubles will also be limited in scope as the EU will likely capitulate and “extend and pretend” Greek debt after their elections in January as well as include Greek bonds in ECB QE. China’s slowdown could be a wildcard but with the central government’s resources, an earthquake is not likely. Japan will likely continue its downward spiral but if it stays measured, then it will not surprise the markets.

Therefore, a muddle-through on the US economy seems likely, supporting further gains to the stock and bond markets, even if Janet Yellen follows through on raising rates. On that point, she will not raise them a lot (if at all) for a number of reasons. First, mid-2015 will be the start of the presidential political cycle and given her ideology, she will not want to raise rates and risk a slowing economy in 2016, hurting Democratic chances. Second, she wishes to keep interest rates low to allow the US government to save on interest expense and keep the deficit as low as she can for longer. Third, given the low to negative rates in other major economies, she does not have to do much, if anything, to make US rates attractive to foreign capital, thus giving her flexibility to slowly unwind the Fed balance sheet, if she wishes. Externally, the Japanese pension plan’s intention to buy foreign equities and bonds will also be supportive to US markets. In summary, I feel that the US will stay relatively alluring to financial flows, though there are causes for concern globally. It is good to be a reserve currency!

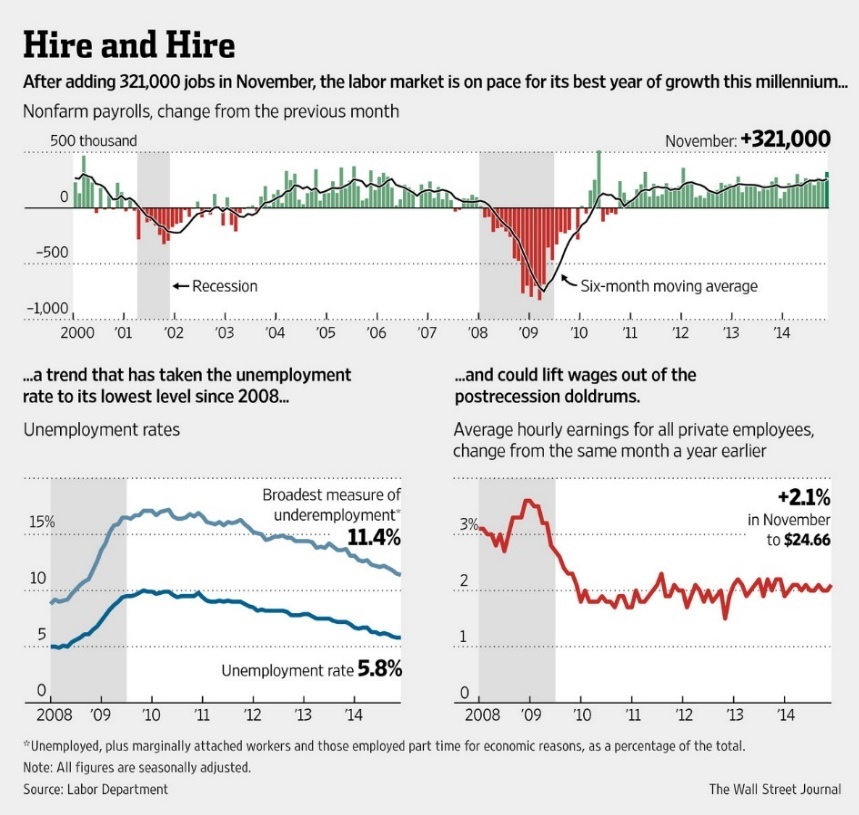

Best House On A Bad Block: The latest economic news out of the US was generally upbeat. Q3 GDP growth was revised further upwards to +5.0%, the fastest pace since 2003. While some of the modifications were questioned (e.g., the dramatic increase in medical spending) or considered one-time (i.e., military spending at the end of the budget cycle), the net result was welcome. US manufacturing output was up +1.1% in November with October’s small gain revised upward slightly. Imports for October gained as both China and Europe exports to the US picked up the pace, while US exports also moved up, though a lower amount. Falling oil, gasoline and diesel prices are now a headwind to US exports, which one may not have thought a few years ago. The cheaper gasoline ($2.30 per gallon the last week of December, a decline of 31% a year earlier), however, is expected to have a positive effect on the mix of consumer spending as well as supporting the domestic auto industry. December’s jobs report was good in the end so 2014 overall has been a decent hiring year. The unemployment rate moved to 5.6%. Wages, however, are still stagnant and pressure continues to mount on those under 25 years old as debt burdens increased in 2013 (the last year when we have data).

2003. While some of the modifications were questioned (e.g., the dramatic increase in medical spending) or considered one-time (i.e., military spending at the end of the budget cycle), the net result was welcome. US manufacturing output was up +1.1% in November with October’s small gain revised upward slightly. Imports for October gained as both China and Europe exports to the US picked up the pace, while US exports also moved up, though a lower amount. Falling oil, gasoline and diesel prices are now a headwind to US exports, which one may not have thought a few years ago. The cheaper gasoline ($2.30 per gallon the last week of December, a decline of 31% a year earlier), however, is expected to have a positive effect on the mix of consumer spending as well as supporting the domestic auto industry. December’s jobs report was good in the end so 2014 overall has been a decent hiring year. The unemployment rate moved to 5.6%. Wages, however, are still stagnant and pressure continues to mount on those under 25 years old as debt burdens increased in 2013 (the last year when we have data).

The Federal Reserve is taking this improvement in stride, keeping the low rates into 2015. While some feel that a signal came from the last meeting of the year that an increase will happen in mid-2015, the operative word from Dr. Yellen is “patience.” Inflation is still expected to be under control (both core and total) and the lowering of the inflation forecasts by the Fed members indicates the large leeway that they feel they have before needing to raise rates. With this in mind, low rates and correspondingly high asset prices seem likely in the New Year.

In South America, Venezuelan President Maduro is going hat in hand looking for money as he travels to China, Iran and other countries. Currently, the cost of his debt is about 24% and to buy CDS insurance is close to 40%. With $21 billion coming due by the end of 2016 and about that amount in currency reserves, he needed the recent pledge from China for $20 billion (awaiting details, presumably to be paid for with crude oil). Another indicator that things are bad there is that McDonalds had to stop selling french fries because they could not get the potatoes. In Argentina, the government has been adept at finding money from China and agricultural exports so until Fernandez leaves at the end of 2015, bondholders will continue to get nothing. I wonder if they will continue to have “patience.”

Pushing On A String: This familiar phrase refers to monetary policy’s inability to force events and being limited to only creating incentives for changed behavior. Europe is a fine example of this – the ECB is trying to cause inflation in the idea that it will inspire spending. Its method is to buy bonds to both lower interest rates to spur growth and inject cash into the money supply to spur inflation and accelerate spending. However, with high unemployment and structural barriers to match, there is significant slack in labor and income, and more attractive locations for firms to deploy capital. Therefore, the ECB QE policy is currently ineffective – money supply and interest rates are not constraints on growth. And what is the ECB reaction? More of the same. We have documented the failure of the new program – more money has to be repaid by February 26th under the old LTRO than has been injected by the new TLTRO. Therefore, the only course of action under Draghi’s belief system is the purchase of government debt, similar to the previous LTRO program. Since the old program did not work as money supply is (again) not the constraint, this prospective program will fail also to deliver growth and inflation. The ~€750 billion in new money will need to find a home and America is calling. In terms of timing, I think it will be after the Greek elections at the end of January as the ECB needs to decide whether it can buy Greek debt. I am sure that the ECB will get to “yes” but it may take a few months. In the end, the impact to the real economy will be modest at best, so expect the ECB to be back in these same frustrating circumstances in six to twelve months.

Slowing Reality: The Chinese Central Bank announced their GDP growth forecast for 2015 as a slower (but still strong) +7.1%, down from the 7.4% expected for 2014.  Fixed-asset investment was projected to a slower 12.8% versus 15.5% as lower industrial production growth of +7.2% in November confirmed the slowing rate. Exports rose 4.7% in November, lower than expected, and imports fell 6.7%, showing lower domestic demand. Residential property sales fell -7.9% year-on-year and inflation is the lowest in five years at 1.4%. Finally we turn to the real economic indicator, Macau gaming revenue, which is down 33% year-on-year December. With a number of new casinos due to open in 2015, the financial situation does not look auspicious! The Shanghai composite had a great 2014 – hockey-sticking up into the end of the year by 50% in USD terms… on an increase of 260% in margin debt! Just maybe a hot market? Although there are signs of tightening credit in the banking system, the central bank is adding money to bank capital to try to spur lending ($65 billion in December). Another form of QE, though too late to save property developer Kaisa which failed to pay a $52 million loan to HSBC at the end of the year. Who cares about a $53 million loan? When the firm also owes $2.5 billion in offshore debt that is last in line for repayment (on-shore debts get paid first), that is who cares. Slowing housing prices and sales have hurt Kaisa’s financial results, so this could quickly cascade in January as the chairman resigned and three big projects in Shenzhen are on hold.

Fixed-asset investment was projected to a slower 12.8% versus 15.5% as lower industrial production growth of +7.2% in November confirmed the slowing rate. Exports rose 4.7% in November, lower than expected, and imports fell 6.7%, showing lower domestic demand. Residential property sales fell -7.9% year-on-year and inflation is the lowest in five years at 1.4%. Finally we turn to the real economic indicator, Macau gaming revenue, which is down 33% year-on-year December. With a number of new casinos due to open in 2015, the financial situation does not look auspicious! The Shanghai composite had a great 2014 – hockey-sticking up into the end of the year by 50% in USD terms… on an increase of 260% in margin debt! Just maybe a hot market? Although there are signs of tightening credit in the banking system, the central bank is adding money to bank capital to try to spur lending ($65 billion in December). Another form of QE, though too late to save property developer Kaisa which failed to pay a $52 million loan to HSBC at the end of the year. Who cares about a $53 million loan? When the firm also owes $2.5 billion in offshore debt that is last in line for repayment (on-shore debts get paid first), that is who cares. Slowing housing prices and sales have hurt Kaisa’s financial results, so this could quickly cascade in January as the chairman resigned and three big projects in Shenzhen are on hold.

Japan is slower too, with the Q3 GDP growth revised downward from -1.6% to -1.9% as further fallout from the increase in the sales tax. However, Prime Minister Abe still won his December snap election at about the same level as when he was first elected, thus allowing him to restart the clock on his position. By doing so, he will remain in power for two years after the next sales tax increase instead of having to maneuver around that event. Finally, Japan too has low inflation with November marking the lowest rate in fourteen months on falling energy prices. As with the rest of world, high inflation would diminish Japan’s massive debt – however there is no relief in sight with household consumer spending down 2.5% year-on-year November and industrial production down 0.6% in October. I do not think that Japan will fall first (Italy seems more likely), but extend-and-pretend has not worked so far so I do not expect happy results.

Bargain Basement: Of course I am referring to where the market buys crude oil, which closed the year at $53.27 per barrel for WTI futures, down from $98.42 on December 31st 2013 – and that does not include the cost of carry! Not only is OPEC still pumping all it can (some countries from desire, some from need), but member Iraq (the second- highest OPEC producer) exported in December at their highest level since 1980: 2.94 million barrels per day from their production of 3.5 million barrels per day). Looking at 2015, the Kurdish region plans to continue to increase production, both to stay independent and to provide funds to fight off ISIL. Non-OPEC member Russia also hit a record in output to 10.7 million barrels per day to close out the year. In the US, the announcement of energy company cutbacks due to low prices has not yet been seen in production. The Department of Energy forecasted that production will reach 9.42 million barrels per day in May 2015, which would be the highest monthly average since November 1972. On a similar note, shale discoveries has pushed the estimated size of reserves to 36.5 billion barrels, the largest since 1975. Not even fighting in Libya that set an oil export terminal ablaze or a Keystone Pipeline vote that failed in the (Democratic) Senate could send prices back skyward. A true cut-back in US shale, Canadian oil sands or Brazilian deep water seems necessary to cause the oil price to reverse direction.

highest OPEC producer) exported in December at their highest level since 1980: 2.94 million barrels per day from their production of 3.5 million barrels per day). Looking at 2015, the Kurdish region plans to continue to increase production, both to stay independent and to provide funds to fight off ISIL. Non-OPEC member Russia also hit a record in output to 10.7 million barrels per day to close out the year. In the US, the announcement of energy company cutbacks due to low prices has not yet been seen in production. The Department of Energy forecasted that production will reach 9.42 million barrels per day in May 2015, which would be the highest monthly average since November 1972. On a similar note, shale discoveries has pushed the estimated size of reserves to 36.5 billion barrels, the largest since 1975. Not even fighting in Libya that set an oil export terminal ablaze or a Keystone Pipeline vote that failed in the (Democratic) Senate could send prices back skyward. A true cut-back in US shale, Canadian oil sands or Brazilian deep water seems necessary to cause the oil price to reverse direction.

BNP estimated that the hit to OPEC revenues would be $316 billion in 2015 assuming that production stays current and prices average $70 per barrel. The level of OPEC petrodollars that flowed into the financial markets reached a high of $500 billion in 2012 but at the above assumptions would be less than $100 billion. I would guess that at year-end prices of $53, OPEC would be withdrawing assets from the global financial system, not adding. Can prices stay that low for 2015? The Saudi oil minister, Ali al Maimi, on December 22nd said that it is not in OPEC’s interest to cut production even if the price hits $20 per barrel. From that, I conclude that the answer is Oil prices staying at or below $53 on average in 2015 is a distinct possibility. Also, such a price level will challenge renewable energy companies and electric car production and the governments that subsidize them. However, it does allow countries that subsidized energy to make fiscal reforms; Indonesia eliminated its gasoline support and cut its diesel subsidies to save $12 billion in 2015, and India is expected to save $12 billion as well by cutting oil subsidies under its next budget.

Low prices are also seen in natural gas which fell to two-year lows in December as solid production was met with relatively weak demand due to slightly warm weather.  Inventories are about at the middle for this time of year – though if production and weather stay the same, then we should start to see a large inventory for Q1, like in 2012. With the pipelines to the Northeast in place now to bring gas from the Marcellus shale, it seems that logistics are catching up with production which lowers the chances for a supply squeeze. Metals are currently in a supply crunch as iron ore prices are half the high set in 2013 and copper is at the lowest level in four-and-a-half years. In fact, iron ore prices returns went lower than crude oil in 2014 – now that is saying something! Grains fell too in 2014 as the US put out record yields and South America had good crops too. 2015 looks good for South America again though it is too early to talk about the Northern Hemisphere. Personally I would like to see more snow fall on the Midwest to fill the aquifers, but there is a lot of winter and spring to go.

Inventories are about at the middle for this time of year – though if production and weather stay the same, then we should start to see a large inventory for Q1, like in 2012. With the pipelines to the Northeast in place now to bring gas from the Marcellus shale, it seems that logistics are catching up with production which lowers the chances for a supply squeeze. Metals are currently in a supply crunch as iron ore prices are half the high set in 2013 and copper is at the lowest level in four-and-a-half years. In fact, iron ore prices returns went lower than crude oil in 2014 – now that is saying something! Grains fell too in 2014 as the US put out record yields and South America had good crops too. 2015 looks good for South America again though it is too early to talk about the Northern Hemisphere. Personally I would like to see more snow fall on the Midwest to fill the aquifers, but there is a lot of winter and spring to go.

David Burkart, CFA

Coloma Capital Futures®, LLC

Special contributor to aiSource

Additional information sources: Bloomberg, Financial Times, New York Times, South Bay Research, Wall Street Journal and Zerohedge.