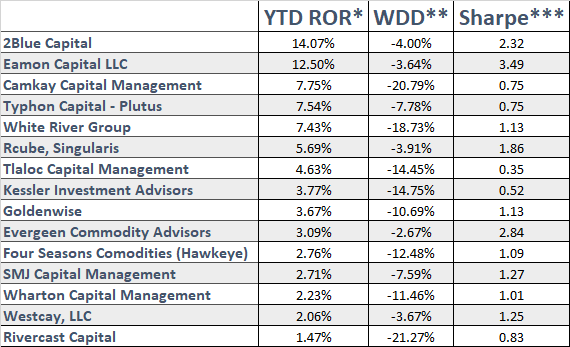

The top performing commodity trading advisors of the first half of 2017 has been a mixed bag of varying strategies, and market sector specialists. While many CTA indices are reporting negative years so far in 2017, there are many CTAs in aiSource’s pool of approved managers that are having positive performance so far, this year. Here are fifteen of the top performing CTAs so far in 2017 that are part of aiSource’s approved manager pool:

*YTD: performance through June 2017

**WDD: worst drawdown since the inception of the track record

***Sharpe: Sharpe Ratio since the inception of the track record

In a low volatility environment where most equity index strategies have struggled, 2Blue Capital,Camkay Capital, RCube Capital and Rivercast Capital are outperforming their peers. Furthermore, 2017 is shaping up to be a bounce back year for most agriculture strategies. After a sub par 2015 and 2016, agriculture traders have finally received some volatility driven opportunities this summer. CTAs, such as, Typhon’s Plutus program, Tlaloc Capital, and Four Seasons’ Hawkeye program are all doing well.

New names on this list that have done well so far in 2017 are:

- Eamon Capital: 100% systematic CTA, focused on metals, energies, and softs

- SMJ Capital: 100% systematic CTA, focused on currencies (primarily the EURO/USD pair)

- Westcay, LLC: discretionary CTA, focused on softs (primarily coffee)

If volatility continues in the grain and livestock markets, the above list should hang on to the discretionary agriculture participants. Furthermore, if volatility returns to the financial sector, there will be opportunity for some our other mangers to make the list. We will update this list at the end of the year and compare any changes with the first half.