Macro: Americas

- Tough US Economics The topline number looked good: US Q1 GDP growth was further revised up to +1.4% from +1.2% annualized on quite better consumer spending while the Q2 forecast trend by the Atlanta Federal Reserve slipped lower to below 3%. Lower pending home sales missed by being down -0.8% month-on-month instead of being up 1.0% as forecasted. It was commented that first-time buyers are being priced out. Retail sales for May fell by the most in 18 months (-0.3%), the volatile durable goods index fell by the most in 18 months in May too (-1.1%) though the ex-aircraft, ex-military capital goods fell a smaller -0.2%. With auto sales for May missing expectations, there may be more to come. Finally, there wages have stayed on course for modest (+0.2%) increases despite solid hiring (+222,000 versus +178,000 estimated) that held the unemployment rate to 4.4% (an uptick from 4.3% due to a growing labor supply AKA participation rate). Inflation has stayed modest with the May core CPI up +0.1% or +1.7% year-on-year.

- Fed Normalizing As expected, Federal Reserve increased rates a quarter point at its June meeting and gave a detailed plan on reducing their balance sheet – though no start date. The starting point is a total of $10 billion per month, to increase at $10 billion per quarter and expected to reach a steady state of $50 billion per

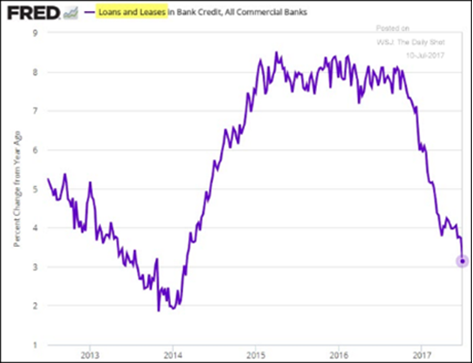

month a year later. This will reduce the $4.5 trillion balance sheet to about $2.5 in three years. This process may have less of an impact as feared: 10-year treasury bonds are trading now at 2.4% while back in 2013 when QE took the balance sheet from $2.5 trillion to $4.5 trillion the rate was around 2.6% (admittedly with some big volatility). The FOMC dot plot showed that the central bank expects another hike this year. Looking at commercial bank lending, one could interpret the graph to say that there are no opportunities to lend – at least at rates that banks would like to receive. Is the consumer tapped out? Companies too? A little early to reach an answer but wages do need to pick up if the consumer is to take leadership.

month a year later. This will reduce the $4.5 trillion balance sheet to about $2.5 in three years. This process may have less of an impact as feared: 10-year treasury bonds are trading now at 2.4% while back in 2013 when QE took the balance sheet from $2.5 trillion to $4.5 trillion the rate was around 2.6% (admittedly with some big volatility). The FOMC dot plot showed that the central bank expects another hike this year. Looking at commercial bank lending, one could interpret the graph to say that there are no opportunities to lend – at least at rates that banks would like to receive. Is the consumer tapped out? Companies too? A little early to reach an answer but wages do need to pick up if the consumer is to take leadership.

- Bad debts A flurry of credit questions swept over the markets in June. Puerto Rico’s federal oversight board voted unanimously to push the government’s electric utility into bankruptcy, threatening to impose steep losses on bondholders and insurance companies. After four years of negotiations, payments halted on $9 billion of debt as $423 million came due. The island territory has $74 billion in debts (plus $50 billion in pension liabilities) so more to come. Chicago’s school system had to pay a penalty rate of 9% interest as they ran out of money temporarily for a pension payment. The state of Illinois failed to pass a budget at first, requiring a veto override to pass spending and tax bills after two years without a budget. On June 1, S&P and Moody’s Investors Service dropped the state’s rating to one level above junk and more downgrades may come. On the tax side, individual income taxes will go to 4.95% from 3.75%, and corporate levies to 7% from 5.25%. Spending plans are to clear $8 billion of the $14 billion of unpaid bills due to vendors. We shall see. Maine and New Jersey also had temporary partial shutdowns as they both failed to pass spending legislation until after the new fiscal year. During the closure, NJ Governor Chris Christie enjoyed a sunny day by himself on an otherwise closed beach! Classy! Somewhat ironically, Argentina sold a 100-year bond while still junk-grade – $2.75 billion at 8% yield. At least their economy is recovering!

Macro: Europe

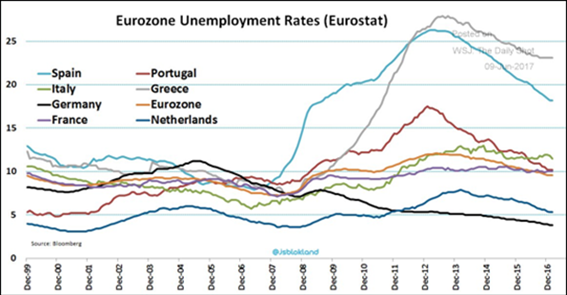

- Favorable Economic Winds The Eurozone enjoyed some decent economic news with unemployment falling to 9.3% (see graph to the right), growth in bank loans to companies has leveled off but is now above the US rate, and consumer loan growth was up +2.6% and rising.German trade data bettered expectations with exports and imports rising in April and May. Industrial production beat forecasts handily in Germany, France and Spain. Greece won a larger-than-expected payoff of €8.5 billion, enough to pay the debt due in July with a little left over. That will cover the country for the rest of the year.

- Mixed Political Results UK’s Prime Minister May lost ground in her special election, undermining confidence and her negotiation position over Brexit. The (still) new French president Macron on the other hand won a substantial majority in the French parliament (350 of 577 seats) with many members elected to the chamber for the first time. He needs 290 votes to pass legislation – an easy majority. Too bad for May that she tossed her majority. Finally, Italy received permission to bailout two mid-sized banks, putting in €5.2 billion of equity and guaranteeing €12 billion of bad loans assumed by the second-largest Italian bank, Intesa Saopaulo. Debt holders (surprising the markets) and depositors were covered completely though the equity was wiped out. 600 branches are to be closed and 3,900 employees will be let go. Monte Paschi’s restructuring was approved by the European Commission and it will include another 600 branches closed and 3,500 employees fired. The Italian government will effectively buy €28 billion of its bad debt at 20% of cost. Success politically but just more socialization of loss. Too big to fail!

Macro: Asia

- Japan Less Exciting Japan’s strong Q1 GDP initial estimate of +2.2% annualized was knocked back to +1.0% as inventories subtracted from economic growth instead of adding to it. Unemployment rose to 3.1% from 2.8% in May, generally due to an increase in the labor pool. Inflation is basically non-existent at +0.4% year-on-year. Japan’s central bank is the last one that is uber-dovish with the other major banks raising rates, tapering QE or making more hawkish noises.

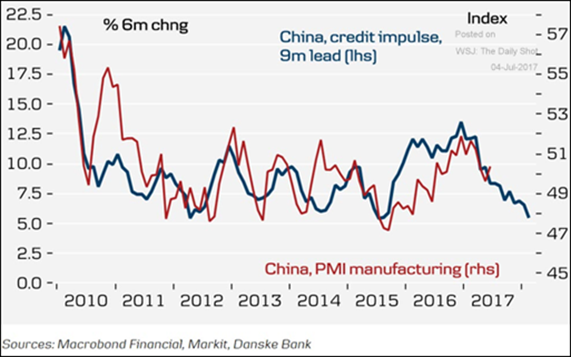

- China More Exciting To start, the economic numbers met expectations: fixed asset investment at +8.6% versus +8.8% expected, industrial production at +6.5% versus +6.3% expected and retail sales at +10.7% versus +10.6% expected. No real sign of the much-talked-about tightening of credit availability and interest rates. Some sources point to future slowing of manufacturing activity (see graph right) so we shall see if the move up is transitory. Compounding the issue potentially is the increase use of robots to cover labor shortages and a doubling of real wages over the last ten years. Will factory employment shift faster than the demographic shifts of an aging population? The primary international index providor MSCI expanded China’s weighting to include domestic shares for the first time, but only a few firms (222) and at a fraction their value (5% of market capitalization). The net impact (a year from now) should be modest and hopefully spur the government to further remove state control over boards, allow short selling and permit trading even in times of market stress. A tall order for a totalitarian government. Finally, apparently China has not lost its appetite for big investments after Venezeula as it has extended $11 billion to two Russian development banks that are under US and European sanctions. I imagine that the interest rate is attractive.

To commemorate the slow move to the normalization of global interest rates and central bank balance sheets, we turn to a riff on our favorite musical:

Best of investing!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource

Additional information sources: BBC, Bloomberg, Financial Times, The Guardian, JP Morgan, PVM, Reuters, South Bay Research, Wall Street Journal and Zerohedge.