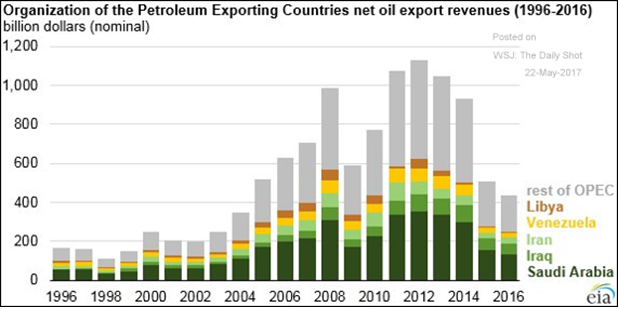

- OPEC and friends met on May 25th and while they decided to extend their production cut for another nine months into 2018, the market was disappointed that they did not cut their production level more deeply. The resulting fall in the crude oil markets was a bit of a surprise as the nine-month addition was stated a number of times in pre-meeting announcements – it was well-telegraphed. We guess that oil bulls were too hopeful as their performance this year has not been very good. The production restriction extension was undercut by the fact that Nigeria, Libya and Iran are still not subject to curbs, with Libya and Nigeria tracking to increase oil output and exports through the end of 2017. OPEC oil output actually

increased in May for the first time this year as these two countries increased production by 250,000 bpd. The biggest increase came from Nigeria, where the Forcados production stream began reloading cargoes for export. The Forcados pipeline had been mostly shut since it was bombed by militants in February 2016. In Libya, the state oil firm said output had reached 827,000 bpd, around levels last seen in 2014, though that is still half the 1.60 million bpd Libya pumped before the 2011 civil war. However, as the graph above illustrates, something has to be done to shore up OPEC’s finances. Saudi Arabia’s Aramco IPO in 2018 may be too far away.

increased in May for the first time this year as these two countries increased production by 250,000 bpd. The biggest increase came from Nigeria, where the Forcados production stream began reloading cargoes for export. The Forcados pipeline had been mostly shut since it was bombed by militants in February 2016. In Libya, the state oil firm said output had reached 827,000 bpd, around levels last seen in 2014, though that is still half the 1.60 million bpd Libya pumped before the 2011 civil war. However, as the graph above illustrates, something has to be done to shore up OPEC’s finances. Saudi Arabia’s Aramco IPO in 2018 may be too far away.

- China’s crude oil imports eased in April from March’s record high as refiners processed less oil during a heavy maintenance season, while exports of refined fuel fell by a quarter from a month earlier due to quota reductions. More specifically, it imported about 8.4 mbpd, down nearly 9 percent from March, according to data from China’s General Administration of Customs. China’s Strategic Petroleum Reserve is estimated at 46% full so on track but not hurried with regular additions seen.

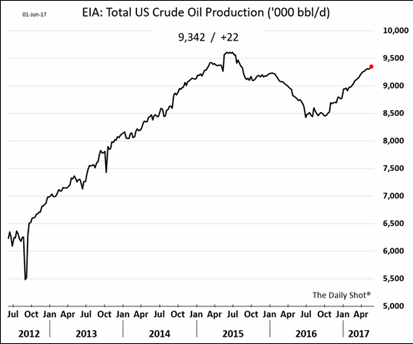

- Meanwhile, US exports of crude oil and products are increasing as production continues to tick upward. U.S. energy firms added oil rigs for a record 20th week in a row – eleven oil rigs in the period ending June 2, bringing the total count up to 733, the most since April 2015. Total US production continued upward as seen on the graph to the right with 2018 set for record production of close to 10.0 mbpd at this pace (likely in our opinion if OPEC can keep

prices above $50). Oil exports hit a new high of 1.3 mpbd in May. ExxonMobil Corp announced that it will start importing its own gasoline into Mexico before the end of the year to supply the Mobil-brand gas stations it will be opening there, pumping $300 million in the coming decade in an effort to gain a foothold in the country’s retail fuel market. Fuel product exports have already doubled versus a year ago to 2.9 mpbd in May (with total product exports also hitting highs) so it seems that gasoline and distillite demand will have support.

prices above $50). Oil exports hit a new high of 1.3 mpbd in May. ExxonMobil Corp announced that it will start importing its own gasoline into Mexico before the end of the year to supply the Mobil-brand gas stations it will be opening there, pumping $300 million in the coming decade in an effort to gain a foothold in the country’s retail fuel market. Fuel product exports have already doubled versus a year ago to 2.9 mpbd in May (with total product exports also hitting highs) so it seems that gasoline and distillite demand will have support.

- US grains keep on growing, with the corn crop basically planted (96%) and the conditions strong enough (good/excellent rated 68%, better than last week at 65%). Soybeans are 83% planted, a little ahead of last year despite the recent wet weather. Their condition will start to be rated in mid-June. Cotton too is well along (80% planted) with an uptick in condition (61% good/excellent, up from 49% last week). Brazil and Argentina are still in good shape and exports continue, despite the usual strike or two. Argentina expects a record 2017/18 wheat crop as well of about 20 million metric tons thanks to farmers’ investment in farming technology. Mexico expects to import a record amount of yellow corn from Brazil this year after its livestock producers secured lower prices in deals with suppliers on a recent visit to South America as NAFTA talks loom. While there have been hints of a breakthrough between the Trump administration and Mexico over sugar trade and potentially other agricultural products, tensions are running high between the US and its #3 agricultural export customer (after Canada and China). If the American farmer loses access to that market, then the US domestic political ramifications could get ugly.

- Brazil’s J&F, owner of the world’s largest meatpacker JBS SA, agreed to pay a record-setting 10.3 billion real ($3.2 billion) fine for its role in corruption scandals that threaten to topple President Michel Temer. Scandal has already claimed former President Dilma Rousseff though the country seems to have stopped its economic decline (for now). US meat exports have been very strong with pork exports up 17% and pork imports down 10%. Japan, Mexico and South Korea have led the way in stronger demand. Negotiations with China to expand our meat trade made progress in May to send more US beef in exchange for Chinese poultry.

- Finally, in metals news, copper stockpiles jumped 25% in early May, signaling ample supplies and increasing supply from Australia and declining industrial demand from China. Slowly tightening standards and transparency over “shadow banking” which has an outsized impact on metals prices also weighed on the sector (refined metal inventories are often used as collateral – sometimes to multiple parties simultaneously – for corporate loans).

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource