Macro: Americas

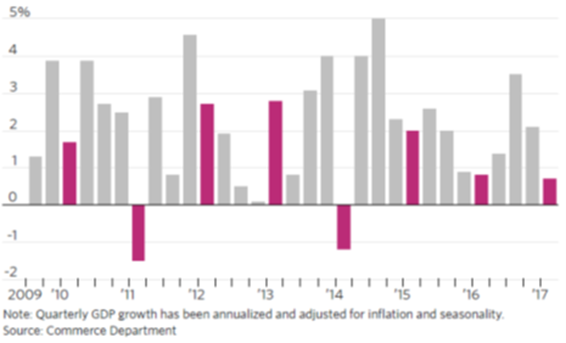

- The US economy disappointed in Q1 2017 by growing only +0.7% at an annualized rate. Q1 has been disappointing over the last five years, with growth an average of +1% versus +2.5% for the other

quarters. One can see that on the WSJ graph to the right (Q1s in purple). Consumer spending was the main culprit, missing expectations despite low gasoline prices and unemployment. Auto sales were disappointing, with a 72-day supply in inventory in March, up from 66 days in a year earlier. Business inventories overall declined and manufacturers did not replace them, hurting GDP. On the other hand, business investment did pick up, promising productivity and employment in the quarters to come. Inflation expectations moved lower to 1.8%, below the 2.0% rate that is often looked at as the marker for concern. Factory orders stayed tepid but positive. Unemployment did fall to 4.4% in April with a strong payroll increase.

quarters. One can see that on the WSJ graph to the right (Q1s in purple). Consumer spending was the main culprit, missing expectations despite low gasoline prices and unemployment. Auto sales were disappointing, with a 72-day supply in inventory in March, up from 66 days in a year earlier. Business inventories overall declined and manufacturers did not replace them, hurting GDP. On the other hand, business investment did pick up, promising productivity and employment in the quarters to come. Inflation expectations moved lower to 1.8%, below the 2.0% rate that is often looked at as the marker for concern. Factory orders stayed tepid but positive. Unemployment did fall to 4.4% in April with a strong payroll increase.

- The Federal Reserve reaffirmed at its May 2nd/3rd meeting that it is expecting to raise rates two more times this year. A little surprising given the Q1 GDP but Dr. Yellen sounded confident that the rest of the year would be on track. While there will be an update at the mid-June meeting, the timing to me seems ripe at the end of July. No word on reducing the bond stash accumulated under QE. Trump has three empty Federal Reserve positions open now and Yellen and the Vice-Chairs’ leadership positions run out next year (though they can stay on the Board for their term). Watch for policy changes as these positions are filled. With regards to the budget, Trump and Congress agreed to let the rest of the fiscal year run as normal with some minor tweaks. That means no wall (for now), no change to health care (for now), no shutdown (for now) and a small tick up in military and border security spending. Other pending legislation (e.g., health care, tax reform) may be effective at the start of the new fiscal year in September. Finally, Puerto Rico requested protection from lawsuits under PROMESA (the federal law for insolvent territories) – essentially bankruptcy as the island looks to the courts to mandate a cut to its debt burden. By how much is to be determined but the FT stated that bondholder loss estimates are as high as 80%. At $70+ billion in debt outstanding, that is about four times Detroit’s debt ($18 billion). In related news, the California Policy Center estimates that the Golden State’s cities and counties will have to double the contributions to their pension plans in order to meet their obligations – expect more taxes and/or lower services. The fiscal tension is starting to get real.

Macro: Europe

- Greece and the EU/ECB agreed to “extend and pretend” its debts with money up front to pay the €6 billion due in July and €1 billion in August in exchange for pension reforms equaling around 1% of gross domestic product in 2019, and a similar amount in 2020 from lower personal income tax exemptions. The Greek Parliament still has to draft and pass legislation putting these changes into effect (which is expected by a narrow margin). European funding is not expected to be a problem as the union’s emergency bailout fund (the EFSF) sold a record amount of debt (€8 billion of ten-year paper).

- The IMF did increase European GDP growth expectations noting the continual declines in unemployment and stronger indicators of purchasing manager activity (see right from the FT). Political risk took a tick down as the French election’s first and second rounds went as expected and the centrist Macron defeated his rivals,

including the far-right candidate, Le Pen, in the run-off. Legislative elections in June however will be just as important to the direction of the country. Fireworks erupted between the UK and EU over Brexit negotiations, which should play into the UK’s snap election on the 8th of June. PM May called the vote since it is expected to dramatically expand her majority as well as extend her leadership two years. Finally, do not expect to use Wikipedia in Turkey as Erdogan banned the website on April 29th – information is bad.

including the far-right candidate, Le Pen, in the run-off. Legislative elections in June however will be just as important to the direction of the country. Fireworks erupted between the UK and EU over Brexit negotiations, which should play into the UK’s snap election on the 8th of June. PM May called the vote since it is expected to dramatically expand her majority as well as extend her leadership two years. Finally, do not expect to use Wikipedia in Turkey as Erdogan banned the website on April 29th – information is bad.

Macro: Asia

- The IMF increased its projections for GDP growth in China and Japan for 2017 and 2018, citing a projection in exports from Asia and global trade generally. Officially, China grew at +6.9%

annualized in Q1, beating expectations. Industrial production increase by +6.8% year-on-year and retail sales kicked up to a +10.0% rate. Fixed-asset investment beat expectations (+9.2% versus +8.8%). Of course this is debt-driven, with lending growth at about 2x the GDP growth. The central bank has taken notice and has started to raise overnight rates from 2% two years ago to 2.8% at the end of April (see right from the FT). With the higher rates, the air should be let out of the frothy property markets discussed so many times before. The government also needs to crack down on related fraud – a branch manager at Minsheng Bank issued $436 million worth of “shadow debt” to individuals using fake documents to funnel money to a preferred corporate client. Who knows how much will be recovered or if the bank will stand behind the losses. Meanwhile, China’s official factory gauge declined on lower commodity prices, clouding the outlook for sustaining the past two quarters’ acceleration in economic growth. The manufacturing purchasing managers index fell to 51.2 in April from an almost five-year high of 51.8 in March, missing the median estimate of 51.7 in a Bloomberg survey and falling short of projections. Note that the measure is above 50, indicating expansion, but the trend is not confidence building.

annualized in Q1, beating expectations. Industrial production increase by +6.8% year-on-year and retail sales kicked up to a +10.0% rate. Fixed-asset investment beat expectations (+9.2% versus +8.8%). Of course this is debt-driven, with lending growth at about 2x the GDP growth. The central bank has taken notice and has started to raise overnight rates from 2% two years ago to 2.8% at the end of April (see right from the FT). With the higher rates, the air should be let out of the frothy property markets discussed so many times before. The government also needs to crack down on related fraud – a branch manager at Minsheng Bank issued $436 million worth of “shadow debt” to individuals using fake documents to funnel money to a preferred corporate client. Who knows how much will be recovered or if the bank will stand behind the losses. Meanwhile, China’s official factory gauge declined on lower commodity prices, clouding the outlook for sustaining the past two quarters’ acceleration in economic growth. The manufacturing purchasing managers index fell to 51.2 in April from an almost five-year high of 51.8 in March, missing the median estimate of 51.7 in a Bloomberg survey and falling short of projections. Note that the measure is above 50, indicating expansion, but the trend is not confidence building.

Finally, a massive one hundred kilogram gold coin worth $4.5 million was stolen from a German coin museum at the end of March. At 21 inches in diameter and 1.5 inches thick, the thieves needed a wheelbarrow to cart it away.

Best of investing!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource

Additional information sources: BBC, Bloomberg, Financial Times, The Guardian, JP Morgan, PVM, Reuters, South Bay Research, Wall Street Journal and Zerohedge.