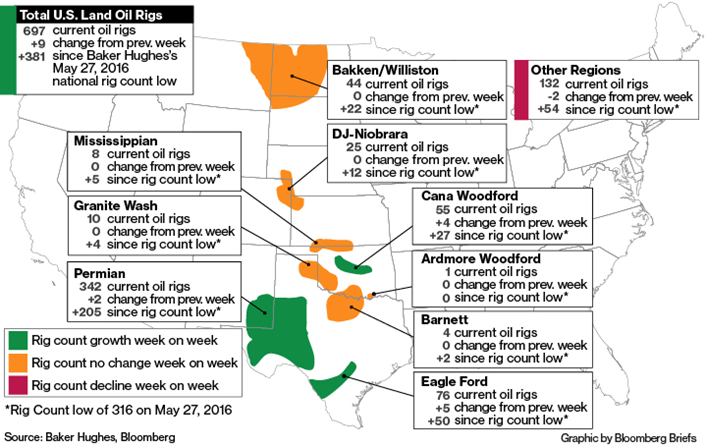

- OPEC and non-OPEC cuts are at or exceeding their stated goals as Russia finally reached its 300,000 barrels per day (bpd) target. However, their efforts have been undermined by three primary factors: expansion by OPEC producers not subject to cuts, expansion by non-OPEC producers and higher stockpiles of refined products (e.g., gasoline) that dampen the look-through demand for crude oil. Today’s featured map is from Bloomberg, showing the expansion of US rig production, which in turn has sent total US oil production to 9.3 million barrels per day (mbpd), only 0.3 mbpd below the high set in 2015.

Note that this production has been achieved with only 697 rigs, ~43% of the high set in 2015. Yes, same production, but with less than half the rigs – and the count is still increasing. US shale production for May is set for its largest monthly increase of 123,000 bpd per the EIA. Gulf of Mexico production is steadily increasing as well with offshore flows running at a record pace of 1.6 mpbd and more to come through the end of 2018. Natural gas production from shale plays is increasing along with their oil production – the Permian Basin produces 15% more natural gas than it did a year ago, the same rate of increase as its change in oil output.

Note that this production has been achieved with only 697 rigs, ~43% of the high set in 2015. Yes, same production, but with less than half the rigs – and the count is still increasing. US shale production for May is set for its largest monthly increase of 123,000 bpd per the EIA. Gulf of Mexico production is steadily increasing as well with offshore flows running at a record pace of 1.6 mpbd and more to come through the end of 2018. Natural gas production from shale plays is increasing along with their oil production – the Permian Basin produces 15% more natural gas than it did a year ago, the same rate of increase as its change in oil output. - Libya, which is not subject to OPEC restrictions, has seen their output increase to 760,000 bpd with a goal of 1.1 mbpd seen achievable with a new peace agreement between the country’s two main factions. Peace talks are also underway in Nigeria (again, in OPEC but not subject to restrictions) with now only one major (200,000 bpd) pipeline not functioning (though barge shipments are keeping some oil flowing). Two large fields (totaling over 400,000 bpd) are due to come back from maintenance over the next few months. Extending cuts at the May 25th meeting is possible but Russian companies have announced plans to expand output during the second half of 2017 so the direction is in doubt. Iran’s presidential elections on the 19th may also alter the negotiations.

- In March, Russia was the #1 crude exporter to China – followed by Angola then Saudi Arabia. China is gorging on more cheap crude than ever (9.2 mbpd average imports in Q1) as privately owned refiners have been permitted to increase oil purchases and the country has added to its strategic reserve. Refinery throughput averaged a record 11.21 mbpd in the first quarter as refiners churned out unprecedented volumes of refined products including gasoline and diesel. China expanded its global product exports as its shipments rose by nearly 25% in 1Q from the same period in 2016 to 1.06 mbpd.

- Stepping back, Saudi Arabia’s Aramco is still looking to IPO in 2H 2018 so they are banking on stronger demand in 2H 2017. Oman also is looking to sell off parts of its national energy infrastructure (primarily in chemicals and drilling) so it too wants higher oil prices. The collapse of Venezuela’s government and related oil exports is still possible as riots recently spread across the country. However, Maduro did stay current and pay $3 billion in due debts and interest. The country is still in financial trouble as in mid-April a Russian company seized a Venezuelan oil tanker in order to try to get $30 million in past-due payments. Now it is up to the courts. On the bearish side, US gasoline demand is still slowing, falling -2.4% year-on-year in the second straight monthly decline.

- In grains, Brazilian farmers should produce a record corn crop of 93.2 million tonnes this year per Reuters, above the 89.6 million tonnes expected in a previous survey. Corn output will be boosted by a record second corn crop (winter crop) seen by market analysts at 63 million tonnes. Soy production in 2016-17 is expected to reach 110.8 million tonnes compared to 106.8 million tonnes in a previous poll. Stronger-than-expected soybean yields across Argentina could more than make up for the 1 million hectares (2.47 million acres) lost to flooding and drought this season, Buenos Aires Grains Exchange said. The US crops are being planted at an average pace despite torrential rains. Russia also is poised to continue to produce and export record grain amounts this year as last year’s results put it at the top with more than 34 million tonnes exported of all grains. In comparison, just fifteen years ago, Russia was a net importer. All food exports combined make this sector the second-largest export portion (after oil and gas but greater than military products). Bigger sales than that of the AK-47? Now that is serious money.

- Brazil’s total beef exports rose in March despite a food safety scandal that caused many countries to question the quality of its meat products and impose temporary bans. Total beef exports, including fresh and processed varieties, had reached 125,000 tonnes in March, up 20 percent from February, beef exporters association ABIEC said. The world’s largest meatpacker JBS SA resumed slaughtering at six out of 10 beef processing units after sending workers on temporary leave earlier this month with another four units restarting operations on May 2. At the end of April and into early May, cattle futures extended a surge to a record and wholesale beef jumped to a 13-month high after a weekend blizzard hammered the Midwest. More than half of U.S. feedlots are located in the region hit by the massive storm that dumped more than 12 inches (30 centimeters) of snow. Cash cattle prices had seen big gains even before the storm, surging 40 percent since the middle of October as domestic and global beef demand rose. On the demand side, Trump declared success last month in gaining greater access to China for U.S. beefs suppliers after meetings with President Xi Jinping. With the storm passing, we shall see how prices react, though low weights may continue to seasonally hurt beef production for a few more weeks/months.

- Finally, in metals news, copper stockpiles jumped 25% in early May, signaling ample supplies and increasing supply from Australia and declining industrial demand from China. The sentiment spilled over to other metals, with iron ore locked limit down on China’s Dalian exchange at one point.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource

Additional information sources: BBC, Bloomberg, Financial Times, The Guardian, JP Morgan, PVM, Reuters, South Bay Research, Wall Street Journal and Zerohedge.