It’s no secret in the CTA investment and hedge fund space that volatility in the markets (specifically stock market and related equity index futures markets) has gone to historically low levels. Volatility was showing signs of declining beginning in the third quarter of 2016 as everyone awaited the outcome of the presidential election. The recurring theme across the investment world was that volatility would return after the election, and that if Donald Trump won, volatility could increase dramatically.

Well….the election has come and gone, and Donald Trump, the presumed catalyst to return volatility to the markets is now the next President of the United States. But, to everyone’s surprise, volatility has not returned. In fact, volatility has decreased even more than the levels we witnessed prior to the presidential election. Conversely, the S&P500 has seen a steady increase since the presidential election, and has increased close to 10% since the end of the election day.

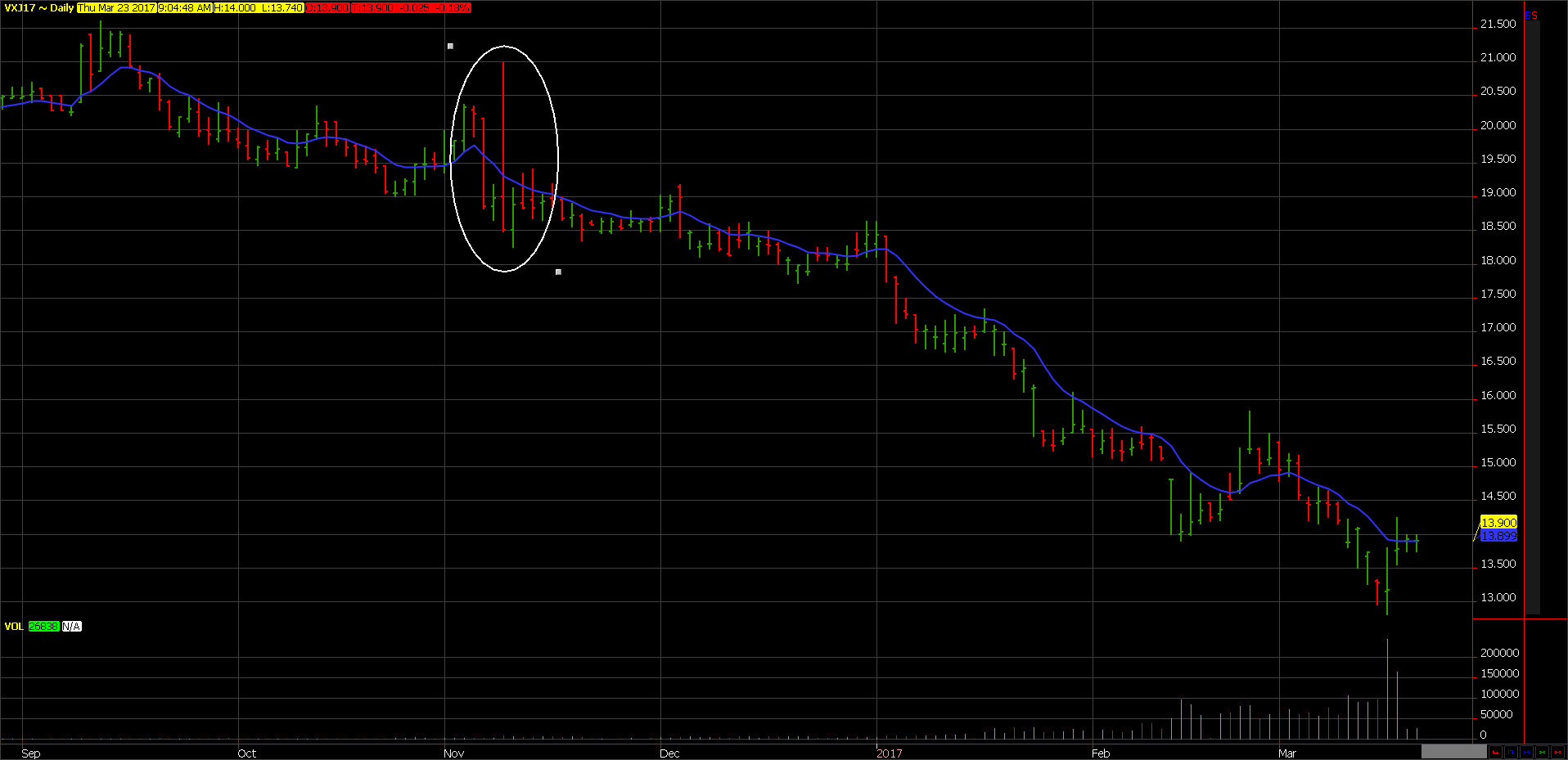

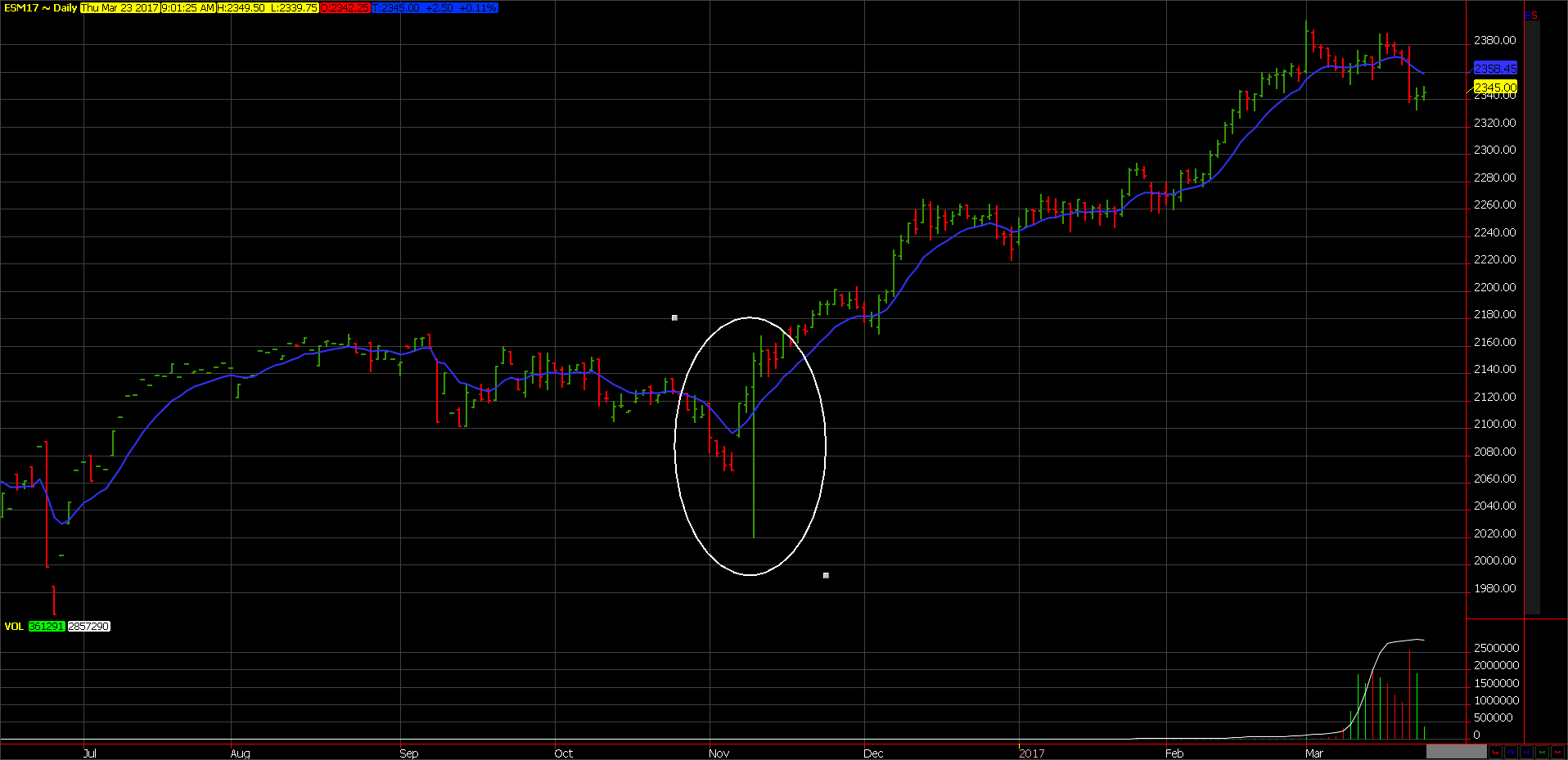

Here are the charts of the VIX futures contract and the mini S&P 500 contract. Since the two markets are almost 100% inversely proportional, you’ll notice the charts of both look inversely related.

VIX Chart

As you can see, the VIX has continued to make new lows since election night (circled in white) and the S&P has continued to make new highs; reaching all-time highs through the course. If so many market participants were waiting for volatility to return after the elections, how come it didn’t happen? Furthermore, how has volatility continued to decline since that time, and is showing no signs of coming back?

We asked this question to three CTAs that we currently allocate client capital and all of whom are familiar with volatility and equity markets. Here are their thoughts:

Coloma Capital Futures

“In conjunction with the market highs, realized market volatility has set new lows – no surprise there. Market highs generally are seen with low realized volatility. The question is why are we at market highs? Trump bump? “Dovish” Fed rate hikes? Business-friendlier Congress? At this time, there is a lot of hope that the political class will deliver on its promised goodies and that the central banks will keep the liquidity flowing with low rates / quantitative easing. Every day the market assesses whether these twin pillars still hold. We measure how long this situation can last in weeks and maybe months, though not beyond.”

-David Burkart

Click here to view Coloma Capital Futures’ performance of their Hedged Volatility Strategy

Turning Wheel Capital

“Equity markets are on an 8-year bullish run. The Trump election, which was supposed to cause a healthy correction, resulted in a 10% market rise in four months. Rates are still at historic lows and Fed moves are transparent. It just seems that the U.S. equity market will not go down. Every piece of traditionally bearish news gets shaken off and leads to new highs. Only major macroeconomic surprises, such as Brexit, cause significant down moves, but even these are short-lasted and reverse in days. Algo trading and HFT market-making activity can inherently confine volatility for long periods. Is there any reason why volatility should be at anything but historic lows? As the market’s P/E has increased, and bargains have become harder to find, there is a cap on many traders expectations of price increase. Yet, when every down move is quickly reserved, shorting seems a fool’s game. Volatility shows serial correlation, this means that a low volatility day is more likely to be followed by another low volatility day (and the same for high volatility days). Confidence (or complacency) in equity markets tends to steady other financials and commodities. It’s a lemming’s game – panic comes quickly and begets more panic, while everyone wants to stay on the good times train and can’t bear the thought of being left at the station. The fact is, though some measures of volatility show the current market at historic lows, it’s not like we haven’t seen this before – current volatility is really fairly similar to that of 1995 or 2005-6. The real question is not why we are seeing historic low volatility, but rather how and when it will end. Dow 36,000? A nasty cliff for the lemmings to go over? A bit of both? Only the shadow knows.![]() ”

”

-Ari Siegel

Click here to view the performance of Turning Wheel Capital

Soaring Pelican

“Volatility should continue, especially if the health plan fails to pass. That will mean tax reform won’t happen for at least a year. The market went up 10% starting on Nov 8 because Trump said he would take 15% off corporate taxes. Given PE’s remaining the same, it would make sense that the market would gain what the tax rate takes off. If health care, and therefore tax reform doesn’t happen, this market’s going to take back the gains. Internal debate within the republican party is causing reform from taking place. This may result in Obamacare staying in place, which could throw the nation into financial turmoil (then you’d get your volatility).”

-Sam Beckers

Click here to view the performance of Soaring Pelican

As you can see from the above opinions, the debate on the lack of volatility is split. While some believe, it is tied to fiscal and monetary policy, others believe there is more of a political narrative. Regardless, everyone is doing their best to forecast the return of volatility and position themselves to capitalize from its return.