Macro: Americas

- The Federal Reserve went into reverse on interest rate direction with multiple governors indicating that at the March meeting there will be an increase based on low unemployment rates (headline number at a low 4.8%) and steady to higher GDP growth (currently +1.8% annualized per the Atlanta Fed, on par with Q4 2016 GDP of +1.9% annualized). If this view holds, then we could actually see three interest rate hikes this year, more than I expected. Manufacturing PMIs continued to move higher, indicating greater manufacturing activity was likely over the last few months. January inflation came in higher than expected at +0.6% vs estimated +0.3%, with a slightly higher core rate (ex-food and energy) as well (+0.3% vs estimated +0.2%). Factory output increased for the fourth time in five months amid gains in machinery and chemicals production. January retail sales also beat estimates (+0.4% versus +0.1%). Negative news was found in existing home sales (-2.8% in January versus +0.6% forecasted) and durable goods ex-military and aircraft, which fell -0.4% in January.

- In the world of debt, expect more headlines over the US debt ceiling limit, which is expected to be hit in March after it became reinstated (you may remember the “sequester” and similar budget battles two years ago). The US Treasury can adjust spending through July to give Congress and the President time to negotiate but it will be very contentious given Trump’s ambitious spending promises running up against Congressional deficit hawks in the Republican Party. His military buildup, infrastructure spending, tax breaks and healthcare insurance reform all individually could be budget-busting. Do not forget that the U.S. Congress’ financial oversight board on Puerto Rico has a May deadline for a rescue plan (which undoubtedly requires a multi-billion-dollar bill for someone), student debt hit a new record last year at $1.31 trillion with 25% of them either in default or at least 90 days late on monthly payments and more than one million US consumers are at least two months behind on their car payments. With higher interest rates coming, how many people will be able to keep their heads above water?

- Finally, the latest in retail woes, J.C. Penney Co. plans to shutter as many as 140 stores (14% of their base) and two distribution centers, and relatedly trim 6,000 thousand jobs. Payless Shoes is looking to close about 1,000 stores as part of its bid to avoid bankruptcy. Talks with lenders are ongoing.

Macro: Europe

- The Greek negotiations continue to stumble along with no real end in sight – the end game is more money from the troika (the IMF keeps talking about withdrawing its participation in the next round of lending, but given how these bureaucracies are so intertwined, it seems unlikely to me). Non-performing bank loans are at 47.1% and the Greek people are again pulling cash out of banks – January saw a decline in deposits of €1.6 billion to a total of €120 billion. That may sound like a lot, but that is the amount last seen in November 2001! Officially government debt is at 177% of GDP and climbing, and a contracting GDP would not help (Q4 2016 came in at -0.4% not annualized (missing estimates of +0.4%) for a total year number of only +0.3%). The European Commission has a +2.7% growth marked for Greece in 2017 – good luck with getting half gain that looking at the 2016 rate.

- The news is not all glum as the UK’s GDP grew more than expected at +0.7% non-annualized and Germany also moved ahead at +0.4%. We reiterate that ECB Q€ is unlikely to slack this year even though inflation has moved to the highest level in four years – reaching above their target rate. Inflation is a good thing in the current central bank mantra.

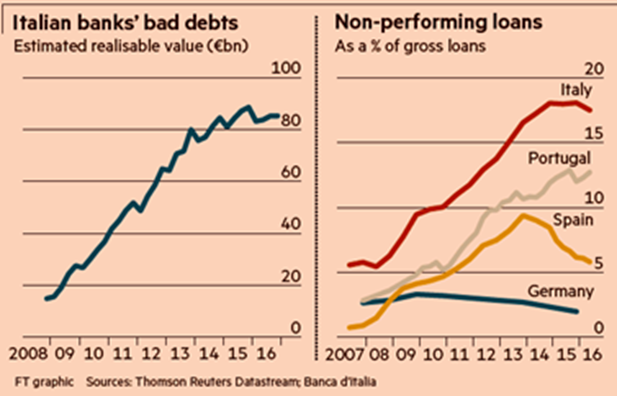

- Italy’s largest bank UniCredit raised more capital to cover its bad debt – can anyone spare €13 billion? UniCredit also sold €18 billion in bad loans to PIMCO and Fortress, price unknown. 6,500 jobs are also in the bank’s crosshairs. I think the only good news about the Italian bad bank debt situation is that it seems to not be growing any larger!

- As a reminder, the Dutch will kick off election season on March 15th with the extreme right-wing leader of the Freedom Party, Geert Wilders, in a virtual polling tie with the current Prime Minister, Mark Rutte. About 40% of the electorate have not made up their mind, however. On April 23rd, the French will be asked to choose their next president. If no outright winner is found in the first round, a run-off between the top two will be held on the 7th of May. Conservative leader Francois Fillon looks out of the race leaving the independent Macron (though he was Hollande’s economic minister) and the far-right candidate Marine Le Pen the likely contenders.

Macro: Asia

- China’s National People’s Congress is underway at the beginning of March and while more policy announcements are due to come out, a lower GDP growth target for 2017 (from 6.7% to 6.5%) made headlines. The expansion of credit is still slated to be quite large (about the size of German GDP) and some are worried about the already-existing size of on- and off-balance sheet obligations. Of course those concerns have been in place for a while as the “shadow” banking market totaled $13 trillion as of June 2016 (this includes about $3.8 trillion at banks, $6 trillion in various fund types, $2 trillion from brokerages and less than $1 trillion from insurance companies). It seems unlikely that this market will be reined in given that it is key channel for the credit expansion that central government is seeking. On the other hand, trade is picking up with January trade data showing exports and imports rose by 7.9% and 16.7% respectively from a year earlier – better than December’s numbers.

- Japan grew modestly in Q4 (+1.0% annualized) but close to expectations (+1.1%) with consumption flat for the quarter but net exports, business investment and government spending making the difference. Like with Europe, inflation indicators also ticked up with a month-on-month growth in core inflation. Unemployment ticked down to 3.0% from 3.1%. Nothing like China but more likely to beat short-term expectations than miss them.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource