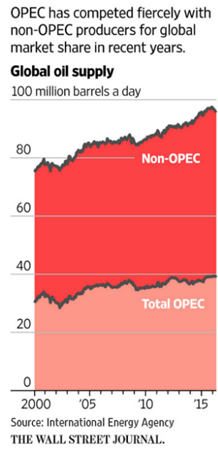

Regardless of one’s political alignment, deficit spending looks to be on the horizon (though Trump still has to get a debt ceiling increase through Congress by March 2017 as the limit was suspended until then by the 2015 budget negotiations). With the Federal Reserve all-but-certain to raise rates at their December 13-14 meeting, are we stepping off into a new economic regime? OPEC (including non-OPEC members such as Russia) has negotiated production cuts with the intent to save their budgets. If successful (a big if), these cuts could incidentally reignite some kind of inflation in the rest of the world – though central banks and governments would likely support that. Of course, effective cartel behavior rarely lasts long – but Saudi Arabia needs for it to just last long enough to max out the value of its Aramco IPO (difficult as not likely until 2018). Closer to now, the US GDP is looking chipper, with annualized Q3 upgraded to +3.2% from +2.9% and annualized Q4 is projected to be +2.9% per the Atlanta Fed. 2017 promises to be quite interesting. Meanwhile, Draghi and the ECB came out with their update to their QE program to extend it after it expires at the end of March until the end of 2017, though at a lower purchase rate. While Austria rejected its right-wing contender for its presidency (and thus reaffirmed their interest in close EU ties), Italy rejected a referendum to simplify their government (thus reducing certainty that they can afford to stay in the EU). Economic projections by the European Commission reduced Europe’s expected annualized GDP growth from +2.0% to +1.7% for 2016 with 2017 coming in at even slower growth at +1.5% (down from +1.8%). All is not lost however as Eurozone unemployment fell to 9.8%, the lowest level since July 2009. Asia was relatively quiet with Chinese stats more or less holding steady though Japan posted a good Q3 GDP number. Laying low is probably wise at this time. OPEC did announce a set of production cuts at its November meeting, causing oil to jump $4 higher that day with an additional $2 of buying the next few days to $51.68 on December 2nd. Though the December 2017 contract at $55 is still shy of the OPEC goal of $60, the higher prices are already sparking a response by a grateful US shale industry. Non-OPEC members such as Mexico, Brazil and Russia – even if they also agree to cut some production – are better off today than a month ago. Of course now is time to speculate how much cheating will occur. Rest assured that there will be no let-up in the fighting in the Middle East and Ukraine is not happy either with a more capable Russia. 2017 will be an interesting year.

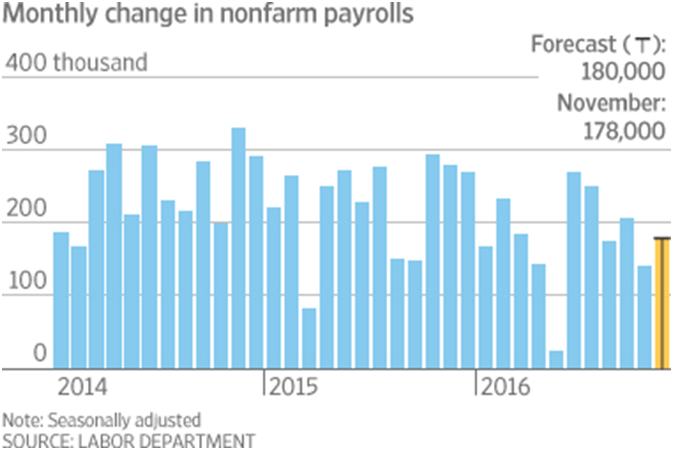

Happy Holidays: Greater-than-first-estimated household purchases adjusted the annualized US Q3 GDP higher (from +2.9% to +3.2%), bolstered by higher than calculated wages and salaries. Net exports were also increased slightly. However, corporate spending was revised lower. It seems that all will be well into the New Year. As mentioned, Atlanta branch of the Federal Reserve is also projecting a solid annualized +2.9% Q4 GDP increase, though that number has bounced around a bit. Employment figures continued along the same path as the last number of months, and the unemployment figure dropped suddenly to 4.6% partially due to the number of workers declining on a net basis (i.e., the participation rate of the working-age population fell from 62.8% to 62.7%). The revisions to previous months were negligible. Although the numbers are small, the number of multiple job holders increased to levels last seen around the financial crisis in 2009. Do not want to make too much of this but it fits the perception that more people have to hold multiple jobs to get the pay that they need – but have to work without benefits and with the added friction of additional commuting. Something to watch. These two factors – economic growth and low unemployment – have opened the door wide open for a Fed increase in rates at their December 13-14th meeting. Not guaranteed of course, but highly likely.

dropped suddenly to 4.6% partially due to the number of workers declining on a net basis (i.e., the participation rate of the working-age population fell from 62.8% to 62.7%). The revisions to previous months were negligible. Although the numbers are small, the number of multiple job holders increased to levels last seen around the financial crisis in 2009. Do not want to make too much of this but it fits the perception that more people have to hold multiple jobs to get the pay that they need – but have to work without benefits and with the added friction of additional commuting. Something to watch. These two factors – economic growth and low unemployment – have opened the door wide open for a Fed increase in rates at their December 13-14th meeting. Not guaranteed of course, but highly likely.

The other US economic news was generally positive as well – October’s existing home sales increased to the highest rate since February 2007 and median prices were 6% higher nationally. The month’s retail sales ex-autos figure was up +0.8% versus a forecasted +0.6%. October industrial output missed expectations (+0.0% versus +0.2%) although manufacturing increased +0.2%. Stronger coal output and a marked increase in oil and gas drilling was offset by lower electricity usage. The durable goods orders index rose +4.8%, beating the +1.7% expectation as aircraft shipments skewed the numbers. The core non-defense, ex-aircraft orders was up +0.4%, a solid performance. On the other hand, General Motors announced 2,000 jobs cut at two plants that make small cars, following similar statements by other auto manufacturers such as Ford. Will Trump/Pence save these jobs like they did at an air conditioning plant? The basic challenge is that industrial efficiencies have made it possible for fewer people to produce more goods (see graph to the right). Yes, globalization (making goods abroad and then importing them) is also occurring but the US is simply making more with less. Good for consumers, not so good for line workers. At least with OPEC’s production cuts, one should expect further pick-up in US shale drilling and pipe work over the next few months or quarters. Then we will have a better view as to Trump/Republican Congress’ policies.

electricity usage. The durable goods orders index rose +4.8%, beating the +1.7% expectation as aircraft shipments skewed the numbers. The core non-defense, ex-aircraft orders was up +0.4%, a solid performance. On the other hand, General Motors announced 2,000 jobs cut at two plants that make small cars, following similar statements by other auto manufacturers such as Ford. Will Trump/Pence save these jobs like they did at an air conditioning plant? The basic challenge is that industrial efficiencies have made it possible for fewer people to produce more goods (see graph to the right). Yes, globalization (making goods abroad and then importing them) is also occurring but the US is simply making more with less. Good for consumers, not so good for line workers. At least with OPEC’s production cuts, one should expect further pick-up in US shale drilling and pipe work over the next few months or quarters. Then we will have a better view as to Trump/Republican Congress’ policies.

Grasping for the Finish Line: Europe continued to make only limited economic progress, with quarterly Q3 GDP growth increasing +0.3%. Italy and the Netherlands outperformed and offset the worse-than-expected +0.2% from Germany. Germany’s industrial production flat lining (see graph to the right) did not help. The emissions scandal that rocked Volkswagen became more real as the automaker announced 30,000 expected job openings over the next four years would not be filled. No firings but no growth either. VW employs 624,000 currently. Greek year-on-year GDP beat forecasts (+1.8% versus +1.4%) and the country’s bonds improved as some EU members and the Obama administration are rumoured to support some

only limited economic progress, with quarterly Q3 GDP growth increasing +0.3%. Italy and the Netherlands outperformed and offset the worse-than-expected +0.2% from Germany. Germany’s industrial production flat lining (see graph to the right) did not help. The emissions scandal that rocked Volkswagen became more real as the automaker announced 30,000 expected job openings over the next four years would not be filled. No firings but no growth either. VW employs 624,000 currently. Greek year-on-year GDP beat forecasts (+1.8% versus +1.4%) and the country’s bonds improved as some EU members and the Obama administration are rumoured to support some  debt forgiveness. Europe’s unemployment rate finally returned to single-digit levels (9.8%) in October with Germany holding at 4.1% and weak performers Spain and Greece both improving (though still high at 19.2% and 23.4%, respectively). The UK jobless rate fell to an eleven-year low of 4.8% over the third quarter of 2016, with average hourly earnings higher by +2.4% over the same period. Core UK retail sales posted a strong increase of +7.6% year-on-year, handily beating expectations of +5.4% (see left). The forecasted negative economic impact of Brexit seems to be missing so far. The Euro-area Purchasing Managers’ Index for manufacturing and services rose to 54.1 in November, according to IHS Markit, the strongest level in 11 months. In Germany, composite PMI slipped slightly to 54.9, remaining well in

debt forgiveness. Europe’s unemployment rate finally returned to single-digit levels (9.8%) in October with Germany holding at 4.1% and weak performers Spain and Greece both improving (though still high at 19.2% and 23.4%, respectively). The UK jobless rate fell to an eleven-year low of 4.8% over the third quarter of 2016, with average hourly earnings higher by +2.4% over the same period. Core UK retail sales posted a strong increase of +7.6% year-on-year, handily beating expectations of +5.4% (see left). The forecasted negative economic impact of Brexit seems to be missing so far. The Euro-area Purchasing Managers’ Index for manufacturing and services rose to 54.1 in November, according to IHS Markit, the strongest level in 11 months. In Germany, composite PMI slipped slightly to 54.9, remaining well in expansion territory.

expansion territory.

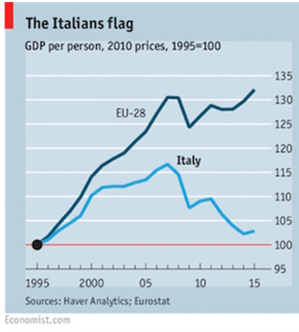

Looking ahead, the ECB is facing a good news / bad news situation. Eurozone inflation is picking up  little by little which eased slightly the pressure to continue their massive QE program (€80 billion a month). On the other hand, Italy’s rejection of political reform on their December 4th referendum underscores the lack of ability to even attempt to attack the country’s malaise. Everyone knows about the government’s 130% debt-to-GDP ratio. More relevant is the declining ability to service that debt as depicted by the graph from the Economist to the left. Without improving GDP per person, how can the country cope with its increasing debt (€120 billion at the end of 1995 to €220 billion at the end of 2015 or an annual increase of 3.1%)? Twenty years of compounding will do that to you. So did the ECB move to taper its €80 billion of bond buying? Italy got its wish; there was a nine-month extension at a reduced rate (€60 billion per month). To address the shortage of some of available bonds, Draghi adjusted the parameters to include more short-term bonds. A reassessment is assumed late next year. The benefits seem elusive – after all, if Italian politicians are able to delay reforms, then they will. Any ramifications will be someone else’s problem.

little by little which eased slightly the pressure to continue their massive QE program (€80 billion a month). On the other hand, Italy’s rejection of political reform on their December 4th referendum underscores the lack of ability to even attempt to attack the country’s malaise. Everyone knows about the government’s 130% debt-to-GDP ratio. More relevant is the declining ability to service that debt as depicted by the graph from the Economist to the left. Without improving GDP per person, how can the country cope with its increasing debt (€120 billion at the end of 1995 to €220 billion at the end of 2015 or an annual increase of 3.1%)? Twenty years of compounding will do that to you. So did the ECB move to taper its €80 billion of bond buying? Italy got its wish; there was a nine-month extension at a reduced rate (€60 billion per month). To address the shortage of some of available bonds, Draghi adjusted the parameters to include more short-term bonds. A reassessment is assumed late next year. The benefits seem elusive – after all, if Italian politicians are able to delay reforms, then they will. Any ramifications will be someone else’s problem.

Russia’s Putin meanwhile is marking time too – waiting to max out his country’s oil production while prices are boosted by the OPEC accord. While Russia paid lip service to cutting production, their amount is modest at best and their reputation of cheating would undermine any long-term price increases. But with Russian retail sales still lagging (-4.4% year-on-year for October, worse than expected and about flat with the previous six months), the economy is still not healthy. Expensive wars in Ukraine and Syria also add to budget pressures. There may be breathing room with President Trump but that is a few months away at best.

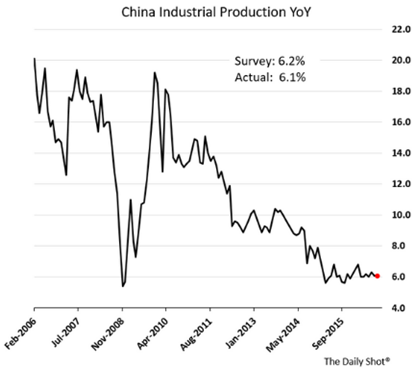

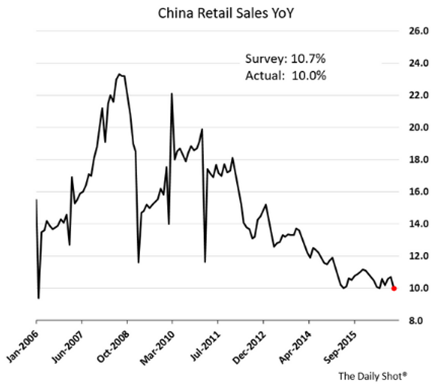

Holding on for Now: China turned in a performance that is still strong by global standards but at best stable by recent history. Industrial production rose +6.1% year-on-year which is flat on a monthly basis and retail sales grew +10.0%, a down-tick on a monthly basis. The graphs to the right demonstrate this leveling off of growth – again great by global standards but leads one to wonder when is the next move down. China continued to sell US treasuries, ending Q3 at $1.157 trillion

still strong by global standards but at best stable by recent history. Industrial production rose +6.1% year-on-year which is flat on a monthly basis and retail sales grew +10.0%, a down-tick on a monthly basis. The graphs to the right demonstrate this leveling off of growth – again great by global standards but leads one to wonder when is the next move down. China continued to sell US treasuries, ending Q3 at $1.157 trillion worth, down $83 billion from the end of June and $89 billion from the end of 2015. Total foreign reserves fell $45.7 billion in October to $3.121 trillion so there has been more pressure on the Yuan as well as government repatriation of funds or stronger outflows by Chinese companies and individuals (though that is strictly regulated). The central government also is directing some local pension funds to transfer funds to the national Social Security Fund, a move that will place an additional $30-60 billion in the stock market in 2017 with a potential $300 billion more if all the local pensions shift their assets (local pensions cannot invest in the stock market while the national one can). One may suspect that this can reflate their stock market (15% off the low this year but still down year-to-date for the CSI 300). Need to prop up that market with more risk! Housing prices are still moving higher (+12.7% year-on-year for the broadest 70-city average, though almost +30% in the top tier). Still bubbling!

worth, down $83 billion from the end of June and $89 billion from the end of 2015. Total foreign reserves fell $45.7 billion in October to $3.121 trillion so there has been more pressure on the Yuan as well as government repatriation of funds or stronger outflows by Chinese companies and individuals (though that is strictly regulated). The central government also is directing some local pension funds to transfer funds to the national Social Security Fund, a move that will place an additional $30-60 billion in the stock market in 2017 with a potential $300 billion more if all the local pensions shift their assets (local pensions cannot invest in the stock market while the national one can). One may suspect that this can reflate their stock market (15% off the low this year but still down year-to-date for the CSI 300). Need to prop up that market with more risk! Housing prices are still moving higher (+12.7% year-on-year for the broadest 70-city average, though almost +30% in the top tier). Still bubbling!

In good news, Japan saw a strong pick-up in its net exports which pushed its Q3 GDP growth to +2.2%, much higher than the forecasted +0.8%. Trade added +1.8% as exports rose and imports fell, implying that the recovery is dependent on external factors, not domestic consumption or business investment. GDP over the previous twelve months is still a lackluster +0.9% however. Also Japan announced a policy of buying unlimited government bonds as ten-year crossed over into positive territory. This policy will keep interest rates low for the foreseeable future – at least until there is some kind of inflation or budgetary concern.

Feeding Frenzy: After keeping markets hanging on a thread, OPEC delivered an agreement to cut oil production by 1.2 million barrels per day (mbpd) to 32.5 mbpd in January 2017 with decreasing production for most members. To get the deal done, Russia had to verbally commit to a decline of 0.3 mbpd and other non-OPEC producers (e.g., Mexico, Oman, Kazakhstan) also pledged to make cuts to get to a total of -1.8 mbpd in 2017. The non-OPEC agreement is supposed to be hammered out on December 10th so more to come. Russia (and OPEC/oil producing countries generally) are notorious cheaters and there was obvious gamesmanship to spike production going into the meeting. In fact, Russia and OPEC production hit their respective all-time highs (11.2 and 34.2 mbpd, respectively)! Notable also at the meeting is that Iran still has room to raise production (see graph above), Libya and Nigeria do not have to cut (battles with insurgents are suppressing production) and Indonesia was kicked out of OPEC as it a net importer not exporter. Outside of the meeting, there has leaked some other side deals / exceptions. Venezuela has 500,000 bpd of heavy crude that it claimed it was exempt from cutting and Saudi Arabia and Kuwait agreed to resume oil output from their Neutral Zone fields (which are exempt also). This could lead to output of 300,000 bpd coming back online in late first quarter to second quarter 2017. Venezuela is also borrowing up to $2.2 billion from China to expand production by 277,000 bpd at the fields that they jointly manage. Finally, Iran has been signing agreements to expand or maintain production with major oil companies – Shell, Total and China’s CNPC all have permission to explore oil and gas fields. Obviously this is not a 2017 or even a 2018 event, but the

OPEC delivered an agreement to cut oil production by 1.2 million barrels per day (mbpd) to 32.5 mbpd in January 2017 with decreasing production for most members. To get the deal done, Russia had to verbally commit to a decline of 0.3 mbpd and other non-OPEC producers (e.g., Mexico, Oman, Kazakhstan) also pledged to make cuts to get to a total of -1.8 mbpd in 2017. The non-OPEC agreement is supposed to be hammered out on December 10th so more to come. Russia (and OPEC/oil producing countries generally) are notorious cheaters and there was obvious gamesmanship to spike production going into the meeting. In fact, Russia and OPEC production hit their respective all-time highs (11.2 and 34.2 mbpd, respectively)! Notable also at the meeting is that Iran still has room to raise production (see graph above), Libya and Nigeria do not have to cut (battles with insurgents are suppressing production) and Indonesia was kicked out of OPEC as it a net importer not exporter. Outside of the meeting, there has leaked some other side deals / exceptions. Venezuela has 500,000 bpd of heavy crude that it claimed it was exempt from cutting and Saudi Arabia and Kuwait agreed to resume oil output from their Neutral Zone fields (which are exempt also). This could lead to output of 300,000 bpd coming back online in late first quarter to second quarter 2017. Venezuela is also borrowing up to $2.2 billion from China to expand production by 277,000 bpd at the fields that they jointly manage. Finally, Iran has been signing agreements to expand or maintain production with major oil companies – Shell, Total and China’s CNPC all have permission to explore oil and gas fields. Obviously this is not a 2017 or even a 2018 event, but the  foundation is being laid.

foundation is being laid.

In this hemisphere’s oil news, Canada’s national government approved two pipeline projects to expand existing export capacity (one to the west coast to shipment to Asia and the other to the US). While the first would strategically reduce the dependence on the US and improve access to potentially more lucrative markets, the battles with local governments and environmentalists has only begun. While the oil shale opportunity is well known (or at least assumed), the USGS confirmed that the Permian Basin is truly enormous. Mapping just a portion of the field, the Wolfcamp formation, the USGS found that it contains 20 billion barrels of oil ($900 billion worth at mid-November prices), 16 trillion cubic feet of natural gas and 1.6 billion barrels of gas liquids. Again, the size of the field in general is known but the opportunity became a little more solid. And yes, the US is also increasing its production with more rigs coming on line as the OPEC maneuvers have increased prices, allowing for more profitable hedges (see graph to the right). In natural gas news, the US became a net exporter in October on a monthly basis, helped by liquefied natural gas going to China (for the second time this year). While still small, the number of cargoes is increasing at an impressive rate. Also at record pace is the amount of gasoline exports with surplus inventories heading to Canada, Egypt and Caribbean floating storage.

known but the opportunity became a little more solid. And yes, the US is also increasing its production with more rigs coming on line as the OPEC maneuvers have increased prices, allowing for more profitable hedges (see graph to the right). In natural gas news, the US became a net exporter in October on a monthly basis, helped by liquefied natural gas going to China (for the second time this year). While still small, the number of cargoes is increasing at an impressive rate. Also at record pace is the amount of gasoline exports with surplus inventories heading to Canada, Egypt and Caribbean floating storage.

In nuclear news, Iran has been called out twice by the US and the International Energy Agency for breaching limits twice in its heavy water stockpile. With an impending Trump presidency that has been critical of the deal, this could turn into heightened tension in 2017. Also, a 36,000 tonne steel shield is in place over the collapsing concrete cover of the Chernobyl nuclear power plant. An interesting legacy of the 30-year-old disaster is the building of a giant solar power plant in the radioactive zone by two Chinese companies. It would fully replace the one gigawatt of power that the old nuclear plant was generating (about 10% of Ukraine’s electricity requirement at the time) and reduce dependence on Russian natural gas imports – a win-win! Also the first new nuclear reactor in twenty year in the US began production of electricity at the end of November.

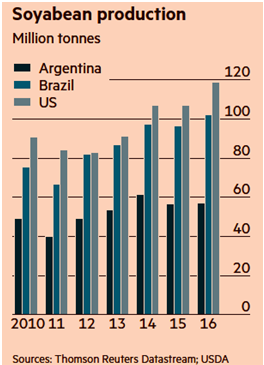

Grain prices have been up recently but production numbers still look strong. Soy production in the US and Brazil moved markedly higher last year and Ukraine had record total grain production this year. Russians have planted the largest area in seven years (boding well for 2017) and also harvested record crops in 2016. Chinese grain output is set to drop by 2.5% by 2020 as its government is withdraws severely polluted or no-longer-productive land out of service.

last year and Ukraine had record total grain production this year. Russians have planted the largest area in seven years (boding well for 2017) and also harvested record crops in 2016. Chinese grain output is set to drop by 2.5% by 2020 as its government is withdraws severely polluted or no-longer-productive land out of service.

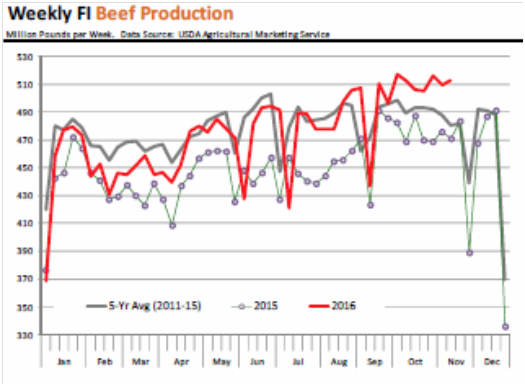

US beef production is running well ahead of last year and the average, though exports are too, absorbing the additional supply (for now – though sales have started to follow the seasonal decline). A similar story can be found in hogs – there is plenty of meat  but the export situation is strong (though deteriorating on a forward-looking basis).

but the export situation is strong (though deteriorating on a forward-looking basis).

In metals, copper is on a price ramp – the best in five years as speculators rushed in. Fundamentally, supplies are still ample and China’s growth is still slowing however. Prices are still well below their $10,000 peak ($5,825 at month-end) however. Will we build an electrified wall? In precious metals, gold is loved by Russia which has stepped up its purchases as a recovery in the ruble and lower prices made the shiny one more attractive. Someone still believes in diversification it seems!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource

Additional information sources: BAML, BBC, Bloomberg, Deutsche Bank, Financial Times, The Guardian, JP Morgan, PVM, Reuters, South Bay Research, Wall Street Journal and Zerohedge.