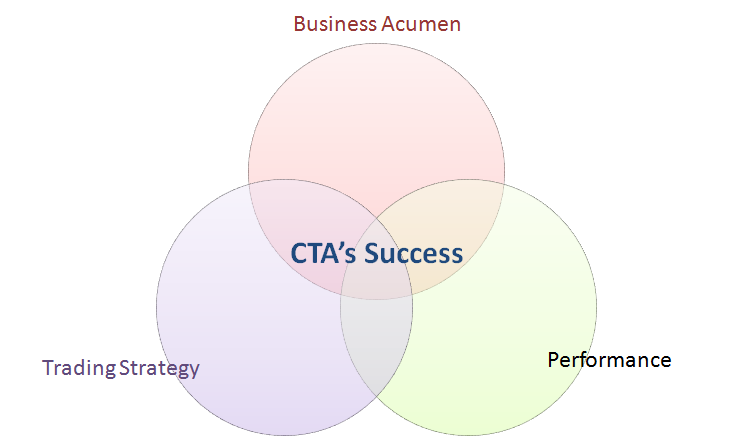

Part of my role at aiSource is to help conduct research and due diligence on emerging CTAs. Over the years, I have spoken to over 200 different CTA managers. Each CTA I speak with has a different trading background, a different trading strategy, and different pedigree. What I have found is that CTAs that are successful over the long-term have three main core competencies (or what I call “ingredients” in the title of this article). I’ll briefly discuss each and explain why these three are most critical to a CTA’s success.

[Good] Performance

A CTA’s performance is perceived to be the most important factor in order for an investor to invest in the strategy. Having a good performance record “opens many doors” for a CTA and allows them to be able to market themselves and their trading strategy. If the numbers look good, the portfolio manager can then explain their trading background and pedigree, which can further solidify their ability to raise assets. A portfolio manager that has great experience and credentials, but a “so-so” track record may find it harder to convince an investor to believe in their trading strategy.

Sound Trading Strategy

While performance numbers are the first item that most investors use to judge a CTA, the next step for most allocators is to learn how those rates of return are being achieved. In a nutshell, having a sound, steady, and unique strategy is a trifecta when winning this category. Conversely, if the performance numbers are good, but you are achieving them by taking inherent risks (such as option selling), or by using a lot of margin (another measure of risk) that could be a reason for a potential investor to discount your performance numbers. The goal for an emerging CTA should be to enter the investor marketplace with a strategy that is slow and steady, and produces returns that do the same…I know, it’s easier said than done.

Business Acumen

While you may think good performance and a good trading strategy eventually lead to a CTA’s success, I would argue that having good business acumen can be the single most important piece to the puzzle. Countless times, I have seen good traders with good performance, unable to succeed because they made careless business decisions. Being a successful CTA is 50% trading strategy and performance and 50% running a business. An owner/operator of an emerging CTA needs to put aside time to speak with prospective investors, prospective investment advisory firms (like aiSource), and continue to update these parties on an on-going basis. Furthermore, while AUM is low, emerging managers should be open to having conversations of alternative fee structures with early investors. If you are good trader, but admittedly not good at running a business, it may serve you well to bring on a partner that can handle all business and operations so you can focus on trading and research.

In my opinion, if you have the above three ingredients as an emerging CTA then it is likely that you will be successful for a very long time. As I mentioned, having a good sense of how to run a business is half the battle, and can many times help cover the weaknesses in your performance or trading strategy. Be willing to admit what you are good and what you are not good at: hire someone to do research, hire someone for marketing, or hire someone to do operations. While the costs of doing all these items can add up, your budget should allow you to operate for a period of up to two years without any revenue.

-Rishab Sharma

Managing Partner