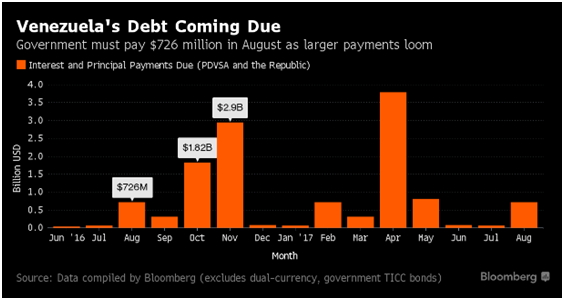

UK’s Brexit quickly faded into memory as the Tories rallied around a new Prime Minister, Ms. Teresa May, who quickly put her government into place. With two years before any renewed panic over what Brexit means and plenty of negotiation to happen in between, the markets moved on. The Turkish coup attempt also could have had an impact but its rapid collapse reassured traders that the oil pipelines from Iraq, Iran, and Georgia (and beyond) to Europe would remain open. However, the purges that have followed threaten to disrupt the geopolitical order and the migrant deal between Erdogan and Europe. Finally, Venezuela has some large debt payments due in August (and then even more in October and November) which it cannot meet – will they be refinanced? Or will its oil production further disintegrate?

In more “normal” news, the US turned in a mixed performance economically but the month ended on a surprise sour note as Q2 GDP rose only by an annualized rate of +1.2%, half the level forecasted only a day or so before by the Fed branches in Atlanta and New York. Between that outcome and the upcoming US elections, Dr. Yellen is not going to consider higher interest rates in the next few months. China is continuing to stimulate its economy with deficit spending and back-door balance sheet write-offs of bad debt held by its banks. Its non-regulated lending (AKA “shadow banking”), is the real problem as that is where most of the credit growth has occurred the last three years. There is no publicized plan on how to address that issue. Japan disappointed in the size of its economic stimulus, though the Yen reacted strongly positive as the central bank expanded its purchases of equities. Europe continued in its slow-growth mode, with its Q€ program starting to run out of quality government bonds – Germany’s new issues are at negative yields and thus are not eligible for purchase. Italian bank Monte dei Paschi di Siena is being forced to raise billions in new equity and sell off bad debt – the prices indicate that all Italian banks are overstating their loan portfolios and more losses are coming. With the Italian government prohibited from directly investing in its banks by ECB rules, the banks have to turn to the market for any fresh capital. Will the deals get done? And at what price? Something for September after the August vacations. Finally, the world of commodities is well supplied and faces tepid global demand. Prices are low and seem to be content to stay there, with a few exceptions.

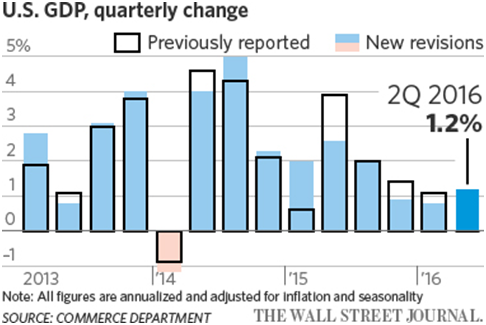

July Surprise: In the face of strong economic data in July, annualized Q2 GDP grew by only +1.2% and Q1 GDP was reduced by +0.3% from +1.1% to +0.8%. The graph to the right however, gives some idea of the revisions that are possible even a few years after the fact (see the switch from Q2 to Q1 of last year). Inventories grew at a much slower pace than expected and private investment also was a strong drag. Consumption, however, maintained its strong pace. July data had various highs and lows. Unemployment maintained a low level as initial claims for benefits dropped to the lowest level in thirteen weeks. Existing home sales held at the same pace as seen over the last eight years (+1.1% in June versus +0.9% expected). Manufacturing output as measured by PMI marked an eight-month high in July with the strongest increase in manufacturing payroll numbers in a year. Industrial production was also up strongly at +0.4% with increase of capacity utilization. On the other hand, US total vehicle sales continued their slide from the end of last year, although just to levels last seen pre-2008. Factory orders also fell in June, though less than expected. Of no surprise was Janet Yellen’s reaction to the news which was to keep rates low for longer. With no meeting in August, the Fed will enjoy the Olympics to their fullest.

+0.3% from +1.1% to +0.8%. The graph to the right however, gives some idea of the revisions that are possible even a few years after the fact (see the switch from Q2 to Q1 of last year). Inventories grew at a much slower pace than expected and private investment also was a strong drag. Consumption, however, maintained its strong pace. July data had various highs and lows. Unemployment maintained a low level as initial claims for benefits dropped to the lowest level in thirteen weeks. Existing home sales held at the same pace as seen over the last eight years (+1.1% in June versus +0.9% expected). Manufacturing output as measured by PMI marked an eight-month high in July with the strongest increase in manufacturing payroll numbers in a year. Industrial production was also up strongly at +0.4% with increase of capacity utilization. On the other hand, US total vehicle sales continued their slide from the end of last year, although just to levels last seen pre-2008. Factory orders also fell in June, though less than expected. Of no surprise was Janet Yellen’s reaction to the news which was to keep rates low for longer. With no meeting in August, the Fed will enjoy the Olympics to their fullest.

In other North American news, the Imperial Bank of Commerce was the first Canadian bank to issue debt at negative rates – €1.25 billion 6-year covered bonds at -0.009% – and the first non-European bank as well. Real estate up north has been on a tear with Vancouver housing prices up about 23% year-on year in June. Looking south, Mexico has  had a rough time of it lately but recent retail sales have been strong at +8.6% year-on-year for month ending June. That was not enough to save the Q2 GDP number from falling -0.3% versus an expected +0.1% for the quarter. As mentioned above, Venezuela continues to hemorrhage money as debt is coming due. With reserves dwindling, Maduro has granted the military control over distribution of food and other goods – is he now just a puppet? How

had a rough time of it lately but recent retail sales have been strong at +8.6% year-on-year for month ending June. That was not enough to save the Q2 GDP number from falling -0.3% versus an expected +0.1% for the quarter. As mentioned above, Venezuela continues to hemorrhage money as debt is coming due. With reserves dwindling, Maduro has granted the military control over distribution of food and other goods – is he now just a puppet? How much authority does he really have? Meanwhile, as the graphs to the right show, more debt is coming due and the funds available to service th

much authority does he really have? Meanwhile, as the graphs to the right show, more debt is coming due and the funds available to service th

em are dwindling – the country canget through year-end 2016 but little past that without assistance (which is not likely given that the country has already pledged its valuable oil output to China). No update on Puerto Rico – still has its huge debts and not paying all of them. With Congress out of session until September, not much is going on.

Summer in Europe – Bailout Season? With Brexit behind it, the UK has to get over the shock. Early indications of economic activity show slowing as manufacturing surveys indicate a contraction (the PMI reports fell below 50 to 47.7), though Q2 numbers show that the UK entered the vote period with strength (e.g., unemployment was at 4.9%, an eleven year low, and Q2 GDP came ahead of forecasts at +0.6% for the quarter, higher than Q1). The IMF slashed its GDP projections for the UK by -0.9 for 2017. In response, the UK took up the gauntlet and at the early August meeting the Bank of England announced new stimulus by cutting its target rate from 0.50% to 0.25% (expected), increasing the size of its Q£ of both government and corporate bonds and adding interest rate protection to bank loans to prompt more lending. We shall see if any of these measures have any real effect.

Meanwhile Europe continued to put out a mixed performance. Overall quarterly GDP growth was only +0.3% in Q2, a decline from +0.6% in Q1. France in particular faltered in its household spending and unemployment. Spain had a strong quarter at +0.7%, though that was off the pace of +0.8% the previous two quarters. The IMF also lowered its 2017 GDP estimate from +1.7% to +1.4% on the Brexit vote as the  UK is assumed to lose full access to the common market. A more probable reason for economic slackness is likely from Italy. Year-on-year industrial production has been flat to negative for four years and June’s number again disappointed. The mountain of bad debts that began in 2009 has reached a tipping point, with venerable Monte dei Paschi di Siena being forced to raise €5 billion in new equity from other banks / outside investors as well as sell off €24 billion in bad debt for an approximate value of €9 billion. €3 billion will come from (and deplete) the government “bad bank” fund but a buyer has to be found for the rest. The other Italian banks took hits as well as MdPdS had over-valued its bad debt – the resulting write-down forced the other banks to write down their loan books as well. While it looks like Italy has dodged a bullet, additional capital requirements could force the bank to take customer deposits to cover the deficits, like in Cyprus. Now that would cause quite a panic.

UK is assumed to lose full access to the common market. A more probable reason for economic slackness is likely from Italy. Year-on-year industrial production has been flat to negative for four years and June’s number again disappointed. The mountain of bad debts that began in 2009 has reached a tipping point, with venerable Monte dei Paschi di Siena being forced to raise €5 billion in new equity from other banks / outside investors as well as sell off €24 billion in bad debt for an approximate value of €9 billion. €3 billion will come from (and deplete) the government “bad bank” fund but a buyer has to be found for the rest. The other Italian banks took hits as well as MdPdS had over-valued its bad debt – the resulting write-down forced the other banks to write down their loan books as well. While it looks like Italy has dodged a bullet, additional capital requirements could force the bank to take customer deposits to cover the deficits, like in Cyprus. Now that would cause quite a panic.

Throwing credibility out the window, the European finance ministers decided to not fine Spain and Portugal for repeatedly missing the EU deficit targets. Now there is little reason for these or any Eurozone member to hold back on deficits. The additional spending should keep their economies from stumbling back into recession, though at the cost of kicking the can further down the road. If Spain could now elect a government, then there may be a chance to move forward. Not likely though. Funny enough, that decision should benefit the ECB because Draghi is running out of German and northern European bonds to buy for his Q€ program (over 63% of German government debt is ineligible for Q€ because the yield is too low. With Berlin now issuing ten-year debt at negative yields, there seems to be little recourse except to buy proportionately more peripheral PIIGS debt).

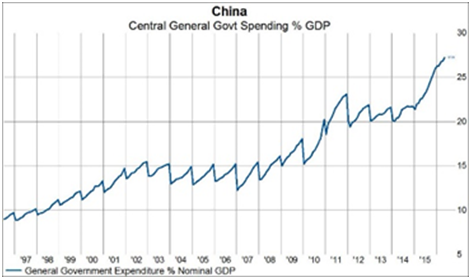

Nothing to See Here – Move Along: China hit its Q2 annualized GDP growth target range with a year-on-year build of +6.7%, right in the middle between +6.5% and 7.0%. Industrial production (+6.2% year-on-year) and retail sales (+10.6% year-on-year) were higher than forecast and previous, though not by a lot. The real increase was in new loans (¥1.38 trillion ($210 billion) versus ¥1.04 trillion ($160 billion)) during June and a government spending increase of 20% in June, primarily in infrastructure (reportedly subway systems). The increase in government spending is apparent in the graph to the right. Private investment actually declined for the second quarter. As an example of state enterprise spending, steel production reached a record high despite promises earlier this year of cutting overcapacity. Gasoline production grew 8.7% in June year-on-year with exports hitting a record high as China dumped bloated inventories (which remain at record highs as of the end of May). These exports are twice the level of a year ago. Obviously employment takes precedence. However, the PMI measures of manufacturing activity

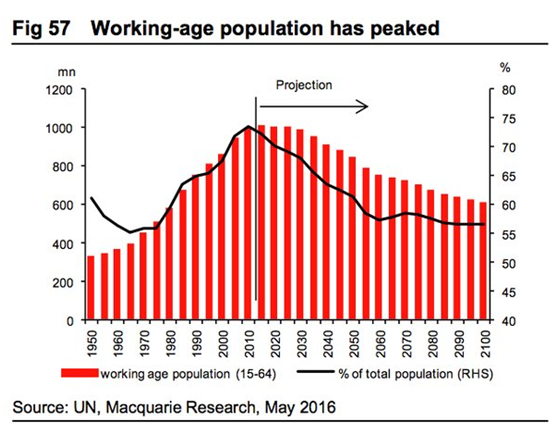

trillion ($160 billion)) during June and a government spending increase of 20% in June, primarily in infrastructure (reportedly subway systems). The increase in government spending is apparent in the graph to the right. Private investment actually declined for the second quarter. As an example of state enterprise spending, steel production reached a record high despite promises earlier this year of cutting overcapacity. Gasoline production grew 8.7% in June year-on-year with exports hitting a record high as China dumped bloated inventories (which remain at record highs as of the end of May). These exports are twice the level of a year ago. Obviously employment takes precedence. However, the PMI measures of manufacturing activity  were disappointing for all this spending as the measure slipped below the expansion line (49.9 versus 50 indicating neutral growth). Also Caixin Media announced that they would discontinue their private PMI survey at the end of September, leaving the government survey as the only marker of activity. More state manipulation, one must assume. If manufacturing can no longer strongly react to government spending (an estimated increase of 10% this year versus 2015), it cannot bode well for China’s trading partners and commodity prices. However, what choice does China have with its population aging rapidly and worker levels set to decline both in relative and absolute terms (see graph to left)? Spend now to stay in power and try to boost productivity over the next few decades as the population tailwind turns into a headwind.

were disappointing for all this spending as the measure slipped below the expansion line (49.9 versus 50 indicating neutral growth). Also Caixin Media announced that they would discontinue their private PMI survey at the end of September, leaving the government survey as the only marker of activity. More state manipulation, one must assume. If manufacturing can no longer strongly react to government spending (an estimated increase of 10% this year versus 2015), it cannot bode well for China’s trading partners and commodity prices. However, what choice does China have with its population aging rapidly and worker levels set to decline both in relative and absolute terms (see graph to left)? Spend now to stay in power and try to boost productivity over the next few decades as the population tailwind turns into a headwind.

Of course Japan is already there and spending away. Or perhaps not as much as the market wants. The Bank of Japan did expand its stimulus by doubling its purchases of its stock market from ¥3.2 trillion (~$316 billion) to ¥6.0 trillion ($592 billion) annually but did not cut interest further than its -0.1% level nor increase its Q¥ of ¥80 trillion ($7.9 billion) of government bond purchases. Abe’s government in turn increased fiscal spending by a “surprise” amount of ¥28.1 trillion ($276 billion), of which ¥7.5 trillion ($74 billion) is actually new money and about 60% of which will be spent in the current fiscal year on projects ranging from direct payments to welfare recipients (approximately $150 per person) to infrastructure building and repairs in the 2016 earthquake area in Kyushu and the 2011 tsunami-damaged region in Tohoku. Politicians need to be seen as doing something, though the benefit may be elusive.

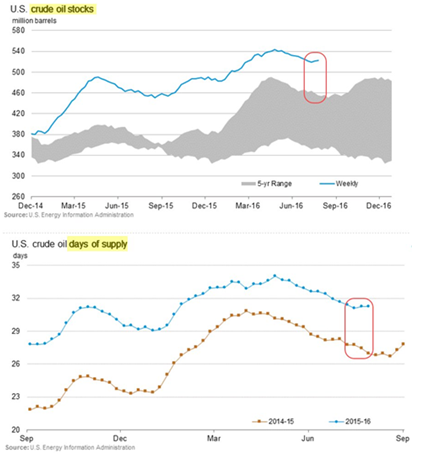

Get Your Oil! Light Sweet Oil! Yes, the world is still awash in oil… and production may even increase (or at least stop falling) in the United States as more rigs are put into play. The US oil-drilling rig count continued its increase from 341 on July 1st to 374 on July 29th as producers could lock in relatively attractive hedges. One of the two other mega-producers, Russia, told Reuters that they are not  discussing coordination with OPEC and that output would continue rise through 2017 (N.B. it is already at thirty-year highs with July’s production at 10.85 million barrels per day). Meanwhile, inventories in the US are burgeoning to record-high weekly levels at more than 230 million bbls since January, while supplies in Asia were so high that even the Singapore trading hub’s considerable storage capacity has proved inadequate, prompting energy owners to lease even more tankers as floating storage. Even war-torn Libya is trying mightily to settle differences and try to export a few cargos. OPEC’s June production of roughly 34 million barrels per day is an eight year record. As can be seen to the left, the absolute level of US oil in storage above ground ready to be processed is at an enormous gap versus the five-year range, and below it there is adequate coverage versus last year. US production may be over a million barrels less per day than the high of last year but imports have increased notably as it is cheaper to bring in crude from Canada, South America or Africa than to pump it out of the ground here. However, production is faltering in Venezuela as the military takes over the government there and suppliers / drillers are not getting paid. A collapse there could trigger a bull reaction but existing inventories should get us through such a situation. Products such as gasoline are also at record levels in the United States, despite corresponding record demand. During one week alone in mid-July, five tanker ships were turned away from the New York Harbor gasoline hub as land depots were full. Asian production is also very strong, particularly independent producers in China which have been very export oriented.

discussing coordination with OPEC and that output would continue rise through 2017 (N.B. it is already at thirty-year highs with July’s production at 10.85 million barrels per day). Meanwhile, inventories in the US are burgeoning to record-high weekly levels at more than 230 million bbls since January, while supplies in Asia were so high that even the Singapore trading hub’s considerable storage capacity has proved inadequate, prompting energy owners to lease even more tankers as floating storage. Even war-torn Libya is trying mightily to settle differences and try to export a few cargos. OPEC’s June production of roughly 34 million barrels per day is an eight year record. As can be seen to the left, the absolute level of US oil in storage above ground ready to be processed is at an enormous gap versus the five-year range, and below it there is adequate coverage versus last year. US production may be over a million barrels less per day than the high of last year but imports have increased notably as it is cheaper to bring in crude from Canada, South America or Africa than to pump it out of the ground here. However, production is faltering in Venezuela as the military takes over the government there and suppliers / drillers are not getting paid. A collapse there could trigger a bull reaction but existing inventories should get us through such a situation. Products such as gasoline are also at record levels in the United States, despite corresponding record demand. During one week alone in mid-July, five tanker ships were turned away from the New York Harbor gasoline hub as land depots were full. Asian production is also very strong, particularly independent producers in China which have been very export oriented.

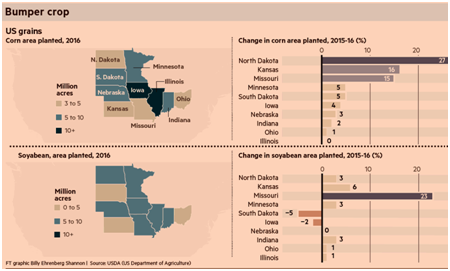

The inventory situation is tighter but not much for grains. Between the increases in corn and soy area under plow (see below) and the continual good weather (yes there was a warm week or two in July but it is summertime), it looks like the US is on-track to produce an excellent harvest. The crop ratings are well above last year and the five year averages – the corn rating is 78% good/excellent versus the average of 58% and the soy is 72% good/excellent versus 57% on average. Just impressive. To be fair, there is still a lot of weather exposure left for soy in particular, but so far, so good. Argentina recently raised its view for the country’s 2015-16 soybean and corn crops thanks to robust yields but trimmed its outlook for the wheat planting area and warned that wet weather could reduce it further. The Agriculture Ministry said it now expects 39.8 million tonnes from the 2015-16 corn crop, up from 37.9 million in its last monthly report, and it forecast 58.8 million tonnes of soybeans, compared with 58 million before. Russia is looking to produce a record wheat crop and the Ukraine is looking good too. There are some stumbles – France’s wheat crop is looking worse than low expectations and Brazil underperformed. Brazil soy looks like 95.6 million tonnes, down 0.6% from the previous–cycle production, largely on disappointing yields caused by dryness. Corn took a 10% production hit there, though partially due to farmer preference for soy this year. However, there were no notable export logistical problems in Brazil this year so it seems that aspect went well (though the jury is out on the Olympics).

average. Just impressive. To be fair, there is still a lot of weather exposure left for soy in particular, but so far, so good. Argentina recently raised its view for the country’s 2015-16 soybean and corn crops thanks to robust yields but trimmed its outlook for the wheat planting area and warned that wet weather could reduce it further. The Agriculture Ministry said it now expects 39.8 million tonnes from the 2015-16 corn crop, up from 37.9 million in its last monthly report, and it forecast 58.8 million tonnes of soybeans, compared with 58 million before. Russia is looking to produce a record wheat crop and the Ukraine is looking good too. There are some stumbles – France’s wheat crop is looking worse than low expectations and Brazil underperformed. Brazil soy looks like 95.6 million tonnes, down 0.6% from the previous–cycle production, largely on disappointing yields caused by dryness. Corn took a 10% production hit there, though partially due to farmer preference for soy this year. However, there were no notable export logistical problems in Brazil this year so it seems that aspect went well (though the jury is out on the Olympics).

In other agricultural commodities, for the first six months of 2016, US production of meat and poultry was larger than posted in any prior year. Good feeder cattle production and weights are keeping up inventory but the export picture looks to be improving for beef and pork. The USDA announced that it is permitting the opening of US markets to Brazilian chilled and frozen beef, not just canned and cooked beef. Individual processing plants have to be USDA certified first before fresh beef can be shipped here. On the flip side, Brazil’s market is now open to US beef, though the current recession there will limit the near-term opportunity. Free(er) markets in this protectionist day-and-age! In softs news, sugar production stepped up and demand has slackened so that market is in better balance, while cocoa tightness is driving chocolate costs higher on low Ivory Coast production. A surplus for the next season, however, is forecasted.

And gold gets the last word as global investor appetite for gold ETFs, futures and physical bars/coins has picked up. Prices hit three-year highs in early July at 1375 or so per ounce in the futures markets, though it has been choppy since then. Nothing like something that hurts your foot when you drop it.

Best of investing!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource

Additional information sources: BAML, BBC, Bloomberg, Deutsche Bank, Financial Times, The Guardian, JP Morgan, PVM, Reuters, South Bay Research, Wall Street Journal and Zerohedge.