All commodity trading advisors, whether discretionary or systematic, use a component of technical or fundamental analysis in their investment strategy. While we have previously written an article on the performance of each type of CTA, this article will discuss the “ins and outs” of each type in more detail. It’s important to understand each type of investment strategy in detail, because it’s likely that most of the CTAs in your portfolio are using one or the other, or a combination of both. First, we’ll go over each strategy separately, and then briefly discuss how both may be used together in combination with one another.

Technical Analysis

In simple terms, technical analysis uses charts to identify price patterns and market trends in financial markets in an attempt to exploit those patterns. There are some common patterns that technicians search for within charts:

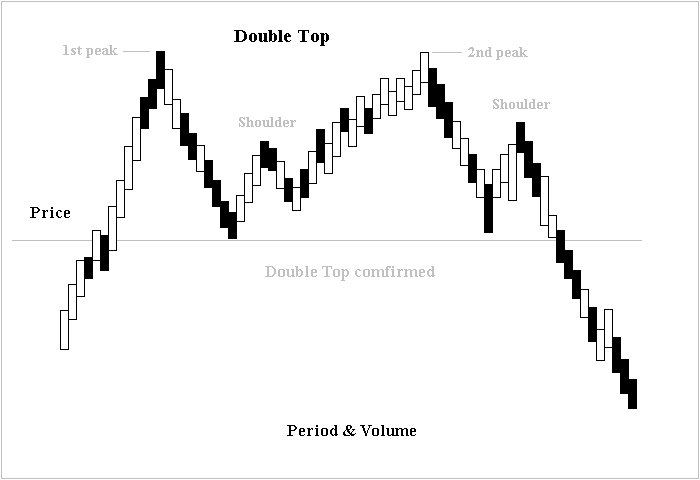

Double Top Formation

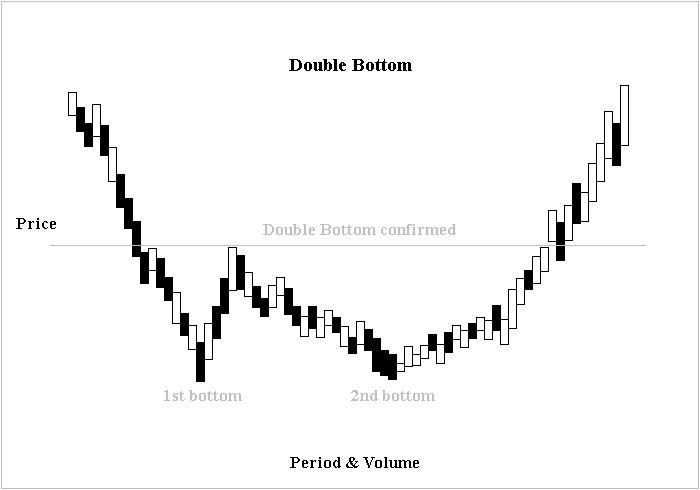

Double Bottom Formation

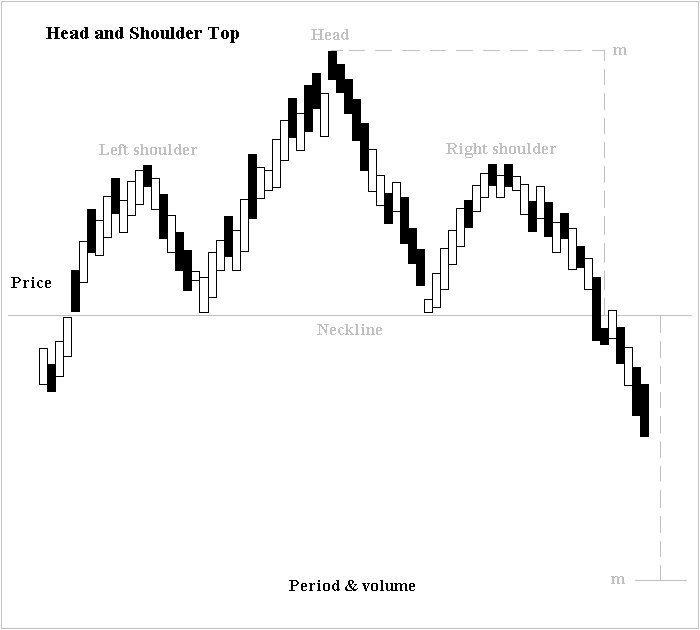

Head and Shoulders Formation

The names of each formation adequately describe each chart type, and it’s easy to see how the “confirmation” confirms the trend, but imagine if the confirmation had not yet taken place. We are looking at the above charts in hindsight, whereas the portfolio manager of a CTA has to look at charts in real-time, and determine if a confirmation has occurred, is about to occur and if they should make a trade in order to capitalize on the anticipation.

In addition to chart formations (as shown above) technicians may also look for relationships between the market’s price and its volume (the number of times the market has traded over a specified period of time). They analyze these relationships through the use of technical indicators, such as, moving averages. The moving average is a line placed over a chart to smooth out short-term fluctuations in price, and to highlight longer-term trends or cycles.

50-Day Moving Average

The white line on the above chart shows the 50-day average of the S&P 500. As you can see the moving average line is plotting a longer-term view of the market along-side the daily bars.

Fundamental Analysis

Fundamental analysis involves studying the underlying factors that drive the price of a financial market. For stocks, fundamental analysis would include studying the company’s financial statements, and its competitive marketplace. In managed futures, fundamental analysis for financial/currency CTAs focuses on the overall state of the economy and considers factors including interest rates, earnings, employment, housing, and manufacturing. For agricultural CTAs in managed futures, fundamental analysis involves crop progress, crop production, weather, storage, imports and exports and cash prices. For CTAs trading the livestock complex, fundamental analysis may involve cattle on feed, imports, exports, and cash cattle/hog prices.

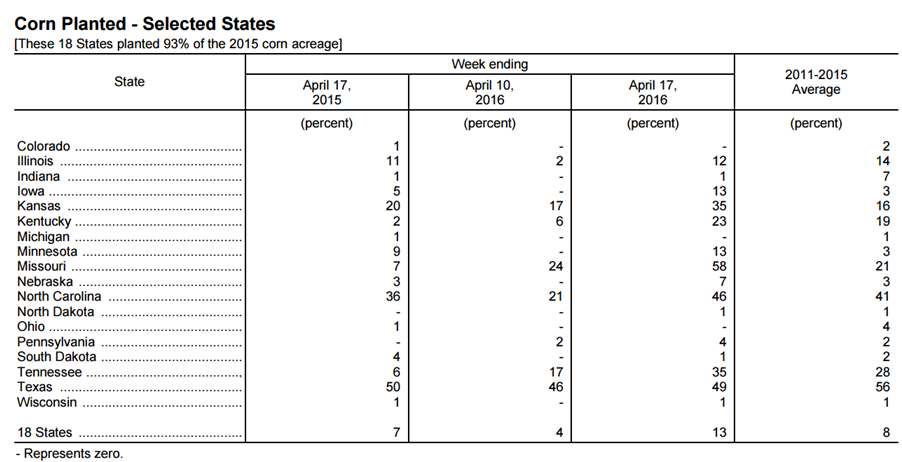

Here is an example of a crop progress report for the corn market. This report is released every Monday during the planting and harvest seasons (generally from Spring to Fall).

Corn Crop Progress

A CTA may utilize a report like the above to make forecasts and determinations on where corn prices are headed. After a forecast has been made, they may place trades in the corn market to capitalize on their forecasts.

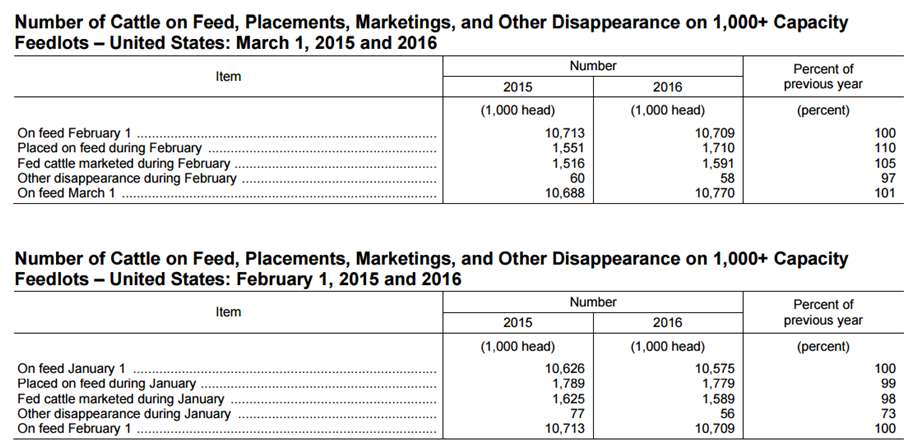

Here is an example of a cattle on feed report that may be utilized by a livestock CTA:

Cattle on Feed Report

A CTA may utilize a report like the above to make forecasts and determinations on where cattle prices are headed. After a forecast has been made, they may place trades in the corn market to capitalize on their forecasts.

CTAs May Use Technical and Fundamental Analysis

While there are CTAs that use only technical analysis for their investment strategy, there are very few CTAs that use only fundamental analysis for there’s. While a fundamental CTA may primarily use only fundamental analysis, they may factor technical patterns into their trading decisions. The opposite is not necessarily true of technical traders; we have seen many instances where technical CTAs only use technical analysis in their trading decisions and no fundamental analysis is considered.