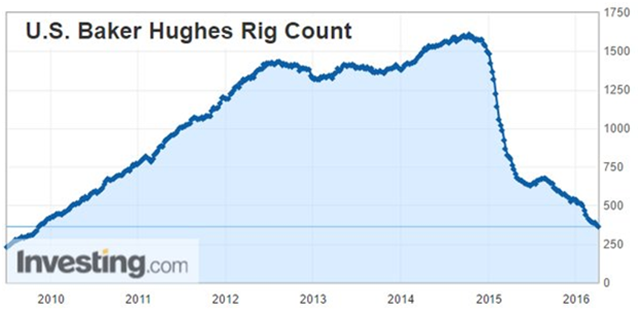

In the end March was a pretty straightforward month in terms of news – central banks were dovish and OPEC was bullish. The ECB led the way with a raft of easing measures including lower (and more negative) interest rates, increased bond purchases, expanded categories of bonds and a restarted bank balance sheet financing (TLTRO II). Nothing was missed in terms of monetary expansion tools apart from handing out cash envelopes. Draghi certainly made up for December’s misdirection. Dr. Yellen and the US Federal Reserve lowered their interest rate projections for 2016, indicating two rate increases for the year. The dovish forecast was supported by soft statements by Janet who also increased the Fed’s concern over foreign events. Indeed, while the projected Q1 US GDP growth was a pretty strong +2.2% at the beginning of March, by the end of March and into April, that number is now an anemic +0.4%. Global growth and China’s policy responses in particular also were considered of concern. Again, if the US is going to raise rates, I would be surprised to see it happening at the April 26th-27th meeting – June would be the soonest and Q2 GPD will have to pick up the pace from Q1. China’s economic activity remains mixed with the pending layoffs from the coal and steel industries as well as other state enterprises hanging over its head. In commodities, energy futures led the way upward for the month for a number of reasons: 1) risk assets caught a bid after the central bank easing, 2) the OPEC and Russia oil production freeze meeting on April 20th in Qatar caught the market’s imagination for eventual cuts and 3) lower US oil and natural gas rig counts in March led to modest production declines – with the hope for more by the bulls. So far in April this bullish spirit has not held, so more volatility seems to be likely.

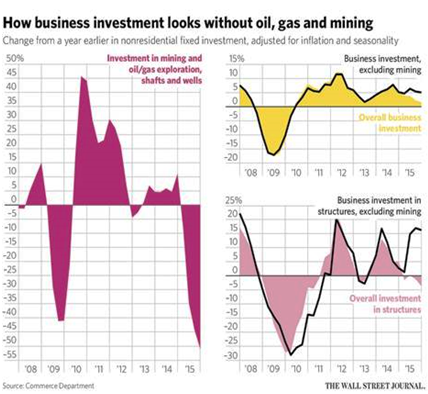

No Pressure: Janet Yellen and the Federal Reserve maintained their no-hurry stance with US economic continuing to show its one-step-forward, one-step-back waffling. GDP growth for Q4 2015 came in at a good +1.4% rate, up from the previous estimate of +1.0%. Personal consumption was responsible for the increase, which is quite positive. However, the Atlanta Fed forecast for Q1 2016 declined sharply in March from +2.2% to +0.4% in early April, again unfortunately on consumer-led behaviors in income growth and spending. Pending home sales are basically flat for the last few quarters, though up strongly month-on-month. The unemployment rate stayed low, rounding up to 5.0% as payrolls increased in March by 215,000 (more than forecast) and February’s figure was revised upward to 245,000. The total labor pool increased to 63.0%, indicating more perceived opportunity. Core average hourly earnings ticked up by +0.3% (versus a forecasted -0.1% drop) though core inflation is still below the Fed’s 2% target at 1.7%. Janet reiterated her cautious tone at the end of the month with concerns over global economic weakness, Chinese policies and willingness to tolerate inflation, depressing markets. She also cited the need for financial markets to stabilize, which I find ironic given that the Fed and other central bank announcements are the most destabilizing force out there. A number of large firms announced layoffs including Boeing (4,500 positions), State Street (7,000), Credit Suisse (6,000 between London and New York) and Deutsche Bank (35,000 globally). A number of these cuts will be through voluntary layoffs or closing open positions, but certainly it is a headwind. Industrial production missed projections by declining (-0.5% versus -0.3% expected) for February and January was revised downward to +0.8% from +0.9%. On the other hand, industrial activity as measured by PMIs recovered into expansionist territory with a 51.8 reading, beating expectations of 50.7. This dichotomy can be explained by the WSJ graph to the right showing the impact of the collapse of investment in energy (graph on left) versus the rest of the investment indicator (the heavy black line above the colored areas on the two graphs on the right side). At some point, this will halt but as long as the US oil and gas rig continues to fall, this measure will be under pressure. Finally, for industrial news, durable goods orders fell in February for the third month in a row, with non-military, non-aircraft orders falling -1.8%, worse than the -0.5% number forecasted. “Data dependency” claims by the Federal Reserve will keep rates low for a long time, even if there are a few token increases this year.

hand, industrial activity as measured by PMIs recovered into expansionist territory with a 51.8 reading, beating expectations of 50.7. This dichotomy can be explained by the WSJ graph to the right showing the impact of the collapse of investment in energy (graph on left) versus the rest of the investment indicator (the heavy black line above the colored areas on the two graphs on the right side). At some point, this will halt but as long as the US oil and gas rig continues to fall, this measure will be under pressure. Finally, for industrial news, durable goods orders fell in February for the third month in a row, with non-military, non-aircraft orders falling -1.8%, worse than the -0.5% number forecasted. “Data dependency” claims by the Federal Reserve will keep rates low for a long time, even if there are a few token increases this year.

In Latin American news, Puerto Rico signed legislation allowing the governor to suspend debt payments for its government and public agencies. Governor Padilla has not begun actual defaulting but the law is in place to halt payments to creditors until January 2017. Somehow I think that negotiations will drag on for longer than that. An Argentine debt debacle in the making. Speaking of which, Argentina threw a monkey wrench into debt negotiations by petitioning the US courts to allow it to issue new bonds while not signing the agreements to pay the old bonds – a clear violation of the original covenants. Bloomberg has a link to copies of the unsigned agreements – who is going to trust the Argentines with the money they need after this ridiculousness? http://www.bloombergview.com/articles/2016-03-25/unsigned-deals-and-roguish-bonds. Good thing that President Macri is scandal-free – or not, as the “Panama Papers” indicate his possible tax evasion. Turning to Brazil, that country continued its downward spiral as exemplified by the retail sales numbers to the right. With regards to the ongoing corruption scandal, President Dilma brought in former President Lula to her cabinet in order to make persecution much more difficult to pursue. Supposedly the Olympic preparations are going to be in place in time though ticket sales are behind projections. If it comes together, it will not be until the end.

spiral as exemplified by the retail sales numbers to the right. With regards to the ongoing corruption scandal, President Dilma brought in former President Lula to her cabinet in order to make persecution much more difficult to pursue. Supposedly the Olympic preparations are going to be in place in time though ticket sales are behind projections. If it comes together, it will not be until the end.

More Q€, More Fun: Draghi delivered the fat checks to the markets and banks at the latest ECB meeting, hitting every button apart from passing out €500 notes on the street. Interest rates on EBC lending and deposits were lowered across the board, monthly Q€ asset purchases were increased from €60 billion to €80 billion, the universe of acceptable purchases was expanded to investment-grade euro-denominated non-bank corporate bonds and a renewed four-year borrowing facility for banks (AKA TLTRO2) with interest rates as low as the ECB deposit rate (current at -0.4%, so banks will be paid by the ECB to borrow for four years). Note that given that core banks tend to have excess liquidity at the ECB, they will lose collectively €450m annually, while peripheral banks (AKA in the PIIGS) tend to borrow, which will benefit them to a possible €1.5 billion in earnings. So France and Germany are effectively massively increasing their subsidies to Spain and Greece. All this doubling down on the Eurozone sounds good in theory but the negotiations with Greece have continued to fester and the Greeks have a €2.3 billion ECB bond repayment due July 20th (and no money with which to do so), we are back to the stressful summers again. Spain at least appears to be recovering with annualized GDP growth up +2.9% and unemployment is lower though still 20.4%. On the other side, they continue to expand their deficit more than expected, with spending outstripping revenues by 5.2% of GDP in 2015, 1% more than agreed to with the EU. 2016’s deficit is also expected to be higher than the 3% target as there is no government from the December elections – voters split their ballots too broadly so neither the left or right can implement an agenda. A new election may be held in June, but the need for it is not reassuring. In other banking/sovereign news, the bondholders of failed Austrian bank Hypo Alpe Adria that handed the province of Carinthia billions of euros in unfunded liabilities rejected a deal with the central Austrian government. Like Greece, this story will not go away as no one wants to be seen as taking a loss. Government credibility is being further undermined though there has been no real consequence so far. But we shall see. Finally, the first non-government entity has borrowed money for negative interest rates –Bank Berlin Hypo issued €500 million discount bonds at -0.162% – yes, the new issue buyers were guaranteed to lose money at maturity in three years.

Economically, there is some decent news. German industrial production for January bounced +3.3%, handily beating forecasts for +0.5% (Eurozone overall was +2.1% for a +2.8% year-on-year figure). Ireland’s Q4 GDP grew at over a +9.0% annualized pace to be up +7.8% for the year and its government issued €100 million of 100-year maturity bonds for less than the current yield for US 30-year debt (2.35% versus the US’ 2.66% yield for a longer maturity). Eurozone unemployment fell to 10.3% in February, the lowest since 2011 – still high but better than the 12% in 2013. Retail sales also have stayed positive on a year-on-year basis as up +2.4% versus +1.9%.

bounced +3.3%, handily beating forecasts for +0.5% (Eurozone overall was +2.1% for a +2.8% year-on-year figure). Ireland’s Q4 GDP grew at over a +9.0% annualized pace to be up +7.8% for the year and its government issued €100 million of 100-year maturity bonds for less than the current yield for US 30-year debt (2.35% versus the US’ 2.66% yield for a longer maturity). Eurozone unemployment fell to 10.3% in February, the lowest since 2011 – still high but better than the 12% in 2013. Retail sales also have stayed positive on a year-on-year basis as up +2.4% versus +1.9%.

The Russian-Ukrainian battlefront continues to simmer – it is a little early for spring offensives but with Russia pulling back from Syria, it is a possibility to see that heat up again. On a more positive note, the infamous Bosnian Serb leader Radovan Karadizic was convicted of genocide by the UN’s International Criminal Tribunal. With only a few more cases to go, including that of military commander Ratko Mladic, the tribunal’s business is almost complete. While the convicted really deserve what they meted out to their victims, the twenty-year judicial process at least defines history and perhaps will give pause to future despots. Take a minute to remember those that faced needless death and violence there and in other areas around the world.

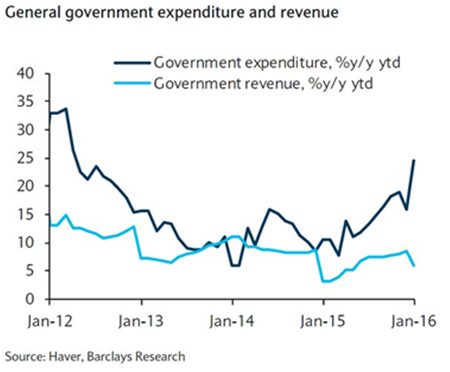

Still Trying to Recover: Asia continues to fight economic headwinds. Chinese exports slumped in February -25.4% year-on-year (versus January’s -11.2% slump) with imports down -13.8% (an improvement over January’s -18%). Retail sales were up +10.2% year-on-year versus 11.0% expected, industrial production +5.4% year-on-year versus 5.6% expected but fixed asset investment rebounded to +10.2% year-on-year, versus +9.3% expected. Government spending has started to widen over revenues as  the graph from Barclays Bank to the right shows – they are spending their trade surplus! Standard and Poor’s and Moody’s reacted to the above by cutting their outlooks for China’s credit rating from stable to negative as the country’s debt load and uncertain policy response raise concerns. China is still projected to grow by 5.5%, a rate that Europe would kill for – but it is one that still demands monetary support from the central government. A wild card are the protests by miners and steelworkers as they lose their jobs – will they overly distract officials from the bigger picture? Will the Rmb 100 billion ($15.4 billion) resettlement fund be sufficient? Something needs to happen fast as the latest bankruptcy was Dongbei Special Steel Group which failed to make a $130 million bond payment and whose former chairman Yang Hua hung himself a few days prior. How much of their $1.06 billion in debt will be recovered? The local province owns 45% of the company and will not just take that hit but also will have to figure out how to quell worker unrest. Finally, Nanjing Yurun Foods Co., China’s second-largest sausage maker (26,000 workers, over $1 billion in debt), and Zibo Hongda Mining Co., an iron ore miner, both said they also defaulted on notes in March.

the graph from Barclays Bank to the right shows – they are spending their trade surplus! Standard and Poor’s and Moody’s reacted to the above by cutting their outlooks for China’s credit rating from stable to negative as the country’s debt load and uncertain policy response raise concerns. China is still projected to grow by 5.5%, a rate that Europe would kill for – but it is one that still demands monetary support from the central government. A wild card are the protests by miners and steelworkers as they lose their jobs – will they overly distract officials from the bigger picture? Will the Rmb 100 billion ($15.4 billion) resettlement fund be sufficient? Something needs to happen fast as the latest bankruptcy was Dongbei Special Steel Group which failed to make a $130 million bond payment and whose former chairman Yang Hua hung himself a few days prior. How much of their $1.06 billion in debt will be recovered? The local province owns 45% of the company and will not just take that hit but also will have to figure out how to quell worker unrest. Finally, Nanjing Yurun Foods Co., China’s second-largest sausage maker (26,000 workers, over $1 billion in debt), and Zibo Hongda Mining Co., an iron ore miner, both said they also defaulted on notes in March.

Japan continued to struggle with industrial production falling -6.2% in January, the largest decline since the tsunami in 2011. Machine tool orders remain at a low level as indicated in the graph to the left. It should be no surprise that Q4 GDP fell an annualized -1.1%, though better than the previous estimate of -1.4%. Japan’s central bank did not add further monetary stimulus in March, sending the Yen higher against the Dollar and a number of other currencies. That will not help its export-oriented sectors. The only “positive” news is that Japan continues to sell 10-year bonds for negative interest rates. Yes, they make more money the more they sell. Of course, there is a loser out there too (the growing elderly population, insurance companies, banks, etc.). In other country news, South Korea’s unemployment rate moved higher than expected, coming in at 4.1% versus 3.8% projected. Hong Kong retail sales are down took a surprising turn for the worse, falling -20% in February year-on-year. The struggle continues.

annualized -1.1%, though better than the previous estimate of -1.4%. Japan’s central bank did not add further monetary stimulus in March, sending the Yen higher against the Dollar and a number of other currencies. That will not help its export-oriented sectors. The only “positive” news is that Japan continues to sell 10-year bonds for negative interest rates. Yes, they make more money the more they sell. Of course, there is a loser out there too (the growing elderly population, insurance companies, banks, etc.). In other country news, South Korea’s unemployment rate moved higher than expected, coming in at 4.1% versus 3.8% projected. Hong Kong retail sales are down took a surprising turn for the worse, falling -20% in February year-on-year. The struggle continues.

How Cheap is Too Cheap? The oil world has its eyes on two places: 1) on Doha, Qatar, for the April 17th OPEC and friends (not US) meeting on whether attendees will agree on an oil production freeze, and 2) on the continuing US oil production / rig count slide that has been in place over the last twelve months. Looking first at Doha, a halt to production growth may be signed off on by the attendees, but critical Iran has already stated that it will not stop production expansions for another million barrels per day (mbpd), i.e., when its production reaches 4 mbpd. Iranian exports are also increasing, hitting 2 mpbd in March versus 1.75 mbpd in February. Russia is gaming its potential freeze level by pushing production to a new post-Soviet high of 10.9 mbpd, its highest level in almost 30 years and with higher exports (+5.1% year-on-year). OPEC itself had a slight increase in oil production in March. Old rivalries will still be on play however; Saudi Arabia stated that it will not freeze unless Iran freezes (but at what level?). Finally, not everyone is coming to Doha – Brazil is one such country (and is planning to add to its supply slightly in 2016) and the US is another (its supply is declining, but slowly). As shown above, the US oil rig count has fallen dramatically (-77.5%) but the production is declining only slowly so far, hitting 9.01 mpbd, which is down -6.0% from last year’s peak (roughly -0.6 mbpd). The US government is predicting more declines in 2017, down to a production level of 8.19 mbpd, given current pricing (still under $40 per barrel in the May WTI Crude contract). If global demand holds up (a distinct possibility given Chinese spending, modest but positive US economic growth and no European or Japanese contraction), then oil may be positioned for a rebound. On the other hand higher oil prices will spur shale drillers to get back to work. Oil inventories in the US are still very high with average imports for the week ending March 25th running at 7.9 mbpd – about 10% higher than a year ago. Foreign barrels are replacing shale barrels, at least in the near term, as overseas shipping costs are lower than the pipeline and rail options to the critical Gulf Coast refiners. Nigerian crude is one beneficiary with March’s average at 559,000 mbpd versus an average of 52,000 for all of 2015. US gasoline demand looks strong so far in 2016 – beating 2015 YTD and the five-year average and range and warm weather could further expand that lead. US oil producers have only modest hedge coverage on per Bloomberg, so the industry is betting on higher prices. Finally, the Obama administration announced that it will not open the southeastern Atlantic coast to drilling due to “competing commercial and military ocean uses.” The chess game plays on…

agree on an oil production freeze, and 2) on the continuing US oil production / rig count slide that has been in place over the last twelve months. Looking first at Doha, a halt to production growth may be signed off on by the attendees, but critical Iran has already stated that it will not stop production expansions for another million barrels per day (mbpd), i.e., when its production reaches 4 mbpd. Iranian exports are also increasing, hitting 2 mpbd in March versus 1.75 mbpd in February. Russia is gaming its potential freeze level by pushing production to a new post-Soviet high of 10.9 mbpd, its highest level in almost 30 years and with higher exports (+5.1% year-on-year). OPEC itself had a slight increase in oil production in March. Old rivalries will still be on play however; Saudi Arabia stated that it will not freeze unless Iran freezes (but at what level?). Finally, not everyone is coming to Doha – Brazil is one such country (and is planning to add to its supply slightly in 2016) and the US is another (its supply is declining, but slowly). As shown above, the US oil rig count has fallen dramatically (-77.5%) but the production is declining only slowly so far, hitting 9.01 mpbd, which is down -6.0% from last year’s peak (roughly -0.6 mbpd). The US government is predicting more declines in 2017, down to a production level of 8.19 mbpd, given current pricing (still under $40 per barrel in the May WTI Crude contract). If global demand holds up (a distinct possibility given Chinese spending, modest but positive US economic growth and no European or Japanese contraction), then oil may be positioned for a rebound. On the other hand higher oil prices will spur shale drillers to get back to work. Oil inventories in the US are still very high with average imports for the week ending March 25th running at 7.9 mbpd – about 10% higher than a year ago. Foreign barrels are replacing shale barrels, at least in the near term, as overseas shipping costs are lower than the pipeline and rail options to the critical Gulf Coast refiners. Nigerian crude is one beneficiary with March’s average at 559,000 mbpd versus an average of 52,000 for all of 2015. US gasoline demand looks strong so far in 2016 – beating 2015 YTD and the five-year average and range and warm weather could further expand that lead. US oil producers have only modest hedge coverage on per Bloomberg, so the industry is betting on higher prices. Finally, the Obama administration announced that it will not open the southeastern Atlantic coast to drilling due to “competing commercial and military ocean uses.” The chess game plays on…

In grain news, Brazil is harvesting its soybean crop at a faster pace than last year so far with the total production of Brazil and Argentina ahead of last year as well. Argentina also will harvest a record 37 million tonnes of corn this year, beating handily previous estimates due to a surge in late planting caused by the lowering of export barriers by President Macri. This production number includes silage (corn for primarily animal feed) but the USDA’s human-food corn estimates are also expected to increase slightly in their upcoming April 12th WASDE report. China also is working through a corn storage glut as it shifts from a stockpiling to subsidy system. An executive at Louis Dreyfus (one of the world’s largest commodities trading companies) said it would take China eighteen months to run off its corn in storage. In the US, farmer planting intentions show an increase in corn acreage for the upcoming season though some could be switched over to soy later. Corn prices may be low, but farmers have bills to pay and cash flow needs could trump profits in the short run. Start feeding those hogs!

Finally, gold came through for Russia which has weathered its fiscal and monetary crisis better than it may otherwise have as its gold buying spree since 2009 bolstered its reserves in time for the recovery of gold from $1,050 per ounce to $1,250.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource

Additional information sources: BAML, BBC, Bloomberg, Deutsche Bank, Financial Times, The Guardian, JP Morgan, PVM, Reuters, South Bay Research, Wall Street Journal and Zerohedge.