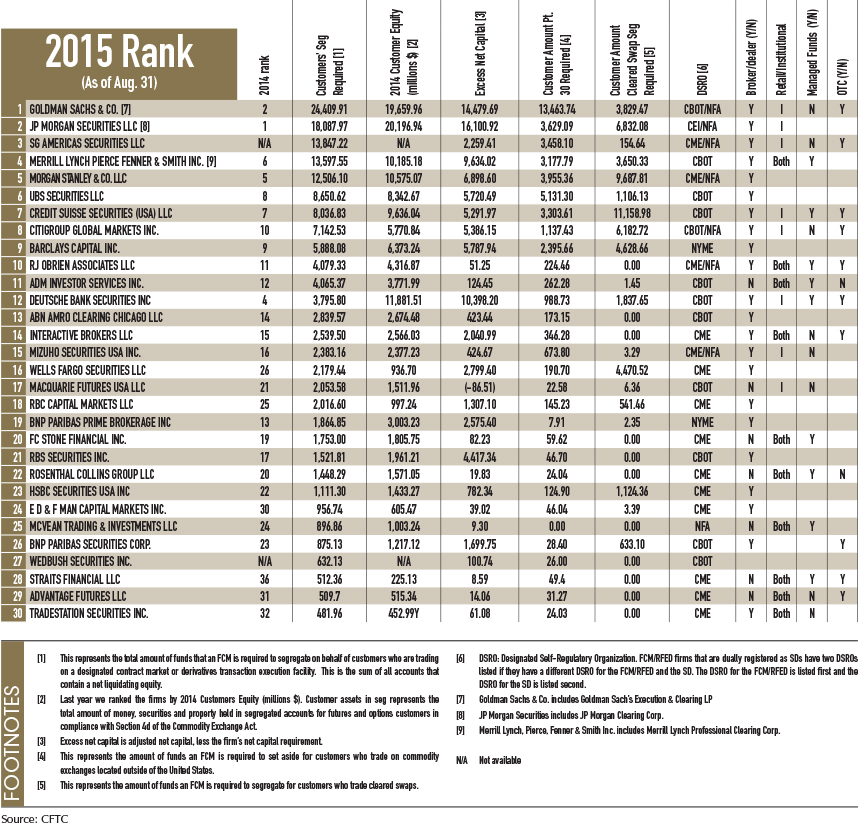

With 2016 right around the corner, we wanted to share with you one of our most popular blog posts: an updated list of the top FCMs. When doing research in selecting a futures commission merchant, or FCM, (i.e. custodian) to house your managed futures portfolio, it can be difficult to find a resource to assist in your decision making process. The best tool the aiSource team has found is the yearly rankings put together by Futures Magazine that rank the Top FCMs each year based on total customer equity. The 2015 rankings by Futures Magazine contains the top 30 FCMs based on customer funds as of August 31st, 2015. Here is the list:

*Courtesy of Modern Trader Magazine

The top ten FCMs on the list are institutional specific FCMs that do not house accounts smaller than $10M in size. FCMs that aiSource uses to house its clients’ accounts all fall between spots ten through twenty: R.J. O’Brien, (#10), FC Stone (#20), Rosenthal Collins Group (#22). R.J. O’Brien is the largest FCM that is available to all types of clients; as of August 31st, 2015, they had $4.1 Billion in client funds. The FCM selection process is different based on the specific needs of each client, and our clients are evenly divided amongst the three FCMs that we use.

Some FCMs that managed futures investors should stay away from are the ones that are not equipped to handle managed futures accounts. In the above chart, in the column second from the right titled “Managed Funds (Y/N),” we can easily see which FCMs do not accommodate managed accounts. Time and time again, aiSource has seen novice investors get attracted by “low commissions,” and open an account with Interactive Brokers (#14) or TradeStation (#30) and face hardship when facilitating the needs of a managed account. Interactive Brokers and TradeStation are both great FCMs, but they are better suited for self-directed traders.

As an independent brokerage/investment advisory firm, aiSource has the ability to house its client accounts at any FCM. We are always looking to develop new FCM relationships and offer those to our clients, but based on our experience, R.J. O’Brien, FC Stone, and Rosenthal Collins Group are some of the best firms at handling managed futures accounts.