In the end, the US economy put up a worse-than-expected number for Q1 GDP growth, but as they say, the past is the past. Spring is in the air and the overall US economy appears in its usual mixed state. With such confusion, the dovish Federal Reserve is not likely to raise rates, even by a token amount – nor does it need to! With Europe (to be precise, Switzerland) issuing ten-year debt at negative rates last month, basically anything looks better on this side of the pond! No need to “normalize” anything as long as Draghi is doing the job for the Fed. Of course, Greece is making his job harder as he does not have the ability (yet) to buy Greek debt at some juicy yields. With the payments due to the IMF in May, Greece will have to come to a decision on whether to cut its bloated government and benefits (the policy anathema of the ruling Syriza party) in exchange for a few billion euro (which may not even last the year) or stop paying interest and principal to conserve funds to meet its political promises but be cut off from future borrowings (at least at low rates). A classic “between a rock and a hard place” situation. China is slowing but that is good news for the markets since the central government will cover the debts of the local governments and keep the stimulus flowing… just ignore the margin debt in the exploding stock market on the way up (Shanghai Composite up 34% in USD terms through April). Oil is still the geopolitical center with the fighting in Iraq moving slowly in the direction against ISIS. Saudi Arabia and Iran are being drawn into a proxy war in Yemen with the pending nuclear negotiations ticking in the background. US production is shrinking slightly but there are plenty of idle rigs and roughnecks to reverse that trend if prices tick high enough (e.g., to $65 per barrel per shale production leader EOG while noting the price at the end of April was just under $60). Finally spring is coming in the Ukraine so the question is whether the Russian offensive will begin in earnest. With a need to get grain and oil prices higher for his trade balance, Putin should be sorely tempted to restart the conflict.

Mix and Match: The US economy is giving something for everyone. For the pessimists, US GDP growth came in at tiny +0.2% annualized rate – not statistically different than zero. The expectations by polled economists was a growth rate of +1.0%, so quite disappointing. Consumer spending was better than expected (especially for automobiles) but corporate and investment spending plummeted on slashed petroleum exploration spending. The trade deficit also came in lower than expected to the levels last seen in the 2008 crisis due to the port strike and the stronger dollar. Q2 expectations are for a recovery from these transitory items (e.g., oil patch spending expected to stabilize, decent weather and no port strike), but we shall see. Same with US Industrial Production for March at -0.6% versus -0.3% expected. Inventory builds were strong in Q1 so consumer spending has to be maintained to prop up GDP. Productivity for Q1 fell 1.9%, the first consecutive quarterly decline since 1993. These factors outline a real risk that the upcoming scheduled revisions to Q1 GDP will be negative, even as much as -0.5% (a swing of -0.7%) per Goldman Sachs.

deficit also came in lower than expected to the levels last seen in the 2008 crisis due to the port strike and the stronger dollar. Q2 expectations are for a recovery from these transitory items (e.g., oil patch spending expected to stabilize, decent weather and no port strike), but we shall see. Same with US Industrial Production for March at -0.6% versus -0.3% expected. Inventory builds were strong in Q1 so consumer spending has to be maintained to prop up GDP. Productivity for Q1 fell 1.9%, the first consecutive quarterly decline since 1993. These factors outline a real risk that the upcoming scheduled revisions to Q1 GDP will be negative, even as much as -0.5% (a swing of -0.7%) per Goldman Sachs.

On the other hand, there are some positive signs for the optimists. Consumer Spending as a separate indicator ended Q1 in March better than where it started, Jobless Claims for the last week in March averaged 282,250 (the lowest since June 2000), private sector pay increased 2.8% annualized for Q1 (the quickest upward pace since 2008), the strong US Dollar has moderated against the Euro in Q2 (supporting future exports), and Existing Home Sales surged +6.1% on a seasonally-adjusted annualized basis. Finally, US factory activity stayed on the positive side per the Purchasing Managers Index.

All-in-all, at this time, the Federal Reserve probably is under no pressure to raise rates even this summer, in my opinion. They may still make a token move or moves by the end of the year, but to my mind, that would be “optional.”

In South American/Caribbean news, Puerto Rico’s legislature rejected a tax-overhaul bill that would have improved their fiscal situation and thus allow for $2.9 billion in new debt to be sold to skeptical investors. With a lack of funding on the table, potential bond buyers are expected to shy away from lending the territory any more money. I suppose the government still is not desperate enough though it expects to run out of funds in three months and S&P lowered their credit rating to CCC+ in April. Mexico on the other hand took advantage of the low interest rate environment to sell another 100-year bond, though this one denominated in Euro. At 4.2% for €1.5 billion, the rate is lower than the current yield on their US 100-year bond (5.3%) and compares well to other recently issued 100-year debt. Given the long-term deficits projected by the US, we too should be selling this ultra-long-dated debt.

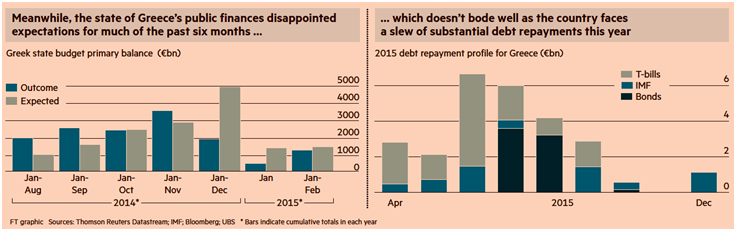

No Resolution on Greek Debt? What a surprise! Greece dithered away April as their negotiators held to a line of modest, if any, compromise – at least in reaching some level that was palatable to the troika. There was a Greek compromise of a sort as the Greek “super-negotiator” Finance Minister Varoufakis was set aside as the lead in favor of the kinder, gentler George Chouliarakis, though Varoufakis is still involved. However, the two sides still failed to connect after a long weekend at the end of April into May so the issues may still be insurmountable. May feels like the month where something is going to happen for a few reasons. First, the IMF said that it would not participate in distributing its portion of the €7.2 billion – which is equal to about half the funds – as Greece is no longer running a surplus before debt service. Next, the Greek Central Bank tried to grab all funds held by municipalities and state agencies (about €2 billion total) to have funds available for salaries at the end of April (about €2.4 billion) and the upcoming IMF payments in May (about €1 billion). Naturally, many of the local governments pushed back and refused to send their funds. Some money was raised of course, and the salaries and the first of the two IMF payments were disbursed. The larger €770 million payment on the 12th is still in question. Looking ahead as the graphic from the FT shows below on

the right, more IMF payments are due (e.g., €1.6 billion in June) and the money has not been coming in since Syriza gained power, as shown on the above graphic to the left. Finally, the Greek banks still are experiencing capital flight as depositors are moving funds out of the country (about €20 billion or 15% of 2014 deposits), forcing the ECB to extend “emergency funding” now equal to about 1/3rd their asset base. Given the low quality of Greek bank loans, the ECB is now more likely to find itself with losses for any bank insolvency, such as one possibly caused by Greece halting debt payments or reverting to the Drachma. Will Varoufakis win the day in the end? A likely outcome from this negotiation avoids default for only a few months, assuming that the IMF does not participate and a new substantial loan package (€30-50 billion) is not granted by the rest of the Troika. With Greek 10-year bonds yielding 10.2% and two-year bonds yielding 18.6% at month-end, the market appears skeptical. S&P downgraded the country to CCC+ (just above default) and Moody’s followed with a cut to Caa2 and a negative outlook. To quote John Dizard of the FT, “Greek government is like a sociology faculty meeting in which the coffee has been spiked with peyote.” In other words, they have no economic training and are trapped in a deep, wild hallucination.

The rest of Europe is doing a bit better though still on shaky ground. German factory orders fell -0.9% in February versus an expected gain of +1.5% – and that was with a relatively weak Euro. Spain has decent economic growth as Q1 GDP was up 0.9% though unemployment is still 23.8%. The latest EU inflation figure is 0% for the twelve months ending in April, which is slightly better than March’s -0.1% and EU unemployment stayed flat at 11.3% in March. The ECB spent €60.3 billion in April buying bonds so is still on track to reach its €650 billion target by year-end. The country weights of debt have stuck to their expected allocation, though again supernationals (e.g., regional banks like the European Development Bank) were a large 12% of the total. The weighted average maturity of the debt in April was notably less than in March, falling from 8.6 years to 8.0 years. Banks generally sold government bonds in March but the data is still unavailable for bond funds and foreign investors. Other notable bond events included Switzerland selling 10-year debt for negative yield (at -0.055%) – the first country to issue at that long of a tenor in negative territory. Also, Poland was the first emerging market to sell any debt at negative yields – CHF (Swiss Franc) 80m for three years at -0.213% yield. In another first, rates are so low that Bankinter SA in Spain has been paying interest on some mortgages denominated in CHF by reducing principal. Also, €221 million of the senior tranche of some European asset-backed securities supported by Spanish loans have stopped paying interest as their benchmark rates turned negative. Overall, two-thirds of euro-denominated investment grade bonds now yield less than 1%. Half of the euro BB rated (AKA junk) bonds are yielding 2%. Clearly, the cost of capital is not a constraint to growth! Q€ is simply distorting the markets… and will continue to do so for the next two years under the current plan.

The sporadic shelling in Ukraine continues despite the “cease-fire” and with the spring fighting season coming up quickly, we wonder if Putin will unleash his hounds to take more territory, ideally at least to connect Russia to Crimea directly. Can Putin resist the temptation? At home, Russia’s GDP fell an estimated 2-4% in Q1 as investment fell -5.3% year-on-year March and retail sales fell -8.7% in March. Therefore, he may feel that his people need a little distraction. Meanwhile the Russian natural gas mega company Gazprom is under investigation by the EU for market abuse and faces antitrust charges. A warning of tit-for-tat? Another issue that could ignite tensions.

Watch What We Do, Not What We Say: Despite high-sounding, confidence-building rhetoric, the Chinese government came out with a number of disappointing figures in April, leading to stepped-up speculation of intensified stimulation. The numbers were generally dismal though somehow the Q1 GDP met expectations of +7.0% annualized. March trade figures noted a sizable contraction of -14.6% year-on-year (versus +8.2% expected) for exports and -12.3% year-on-year (below the -11.3% expected) for imports. Industrial Production was +5.6% (versus +7.0% expected), Raw Steel Output actually fell -1.2%, Retail Sales missed slightly (+10.2% versus +10.9% expected) and Property Investment underperformed in March (+8.5% versus +10.4% for the January/February gain). A list of other economic indicators (e.g., electricity production, cement output and property new starts) all came in lower or negative. Yet, somehow, Q1 GDP beat met the government’s goal. I wonder how that happened.

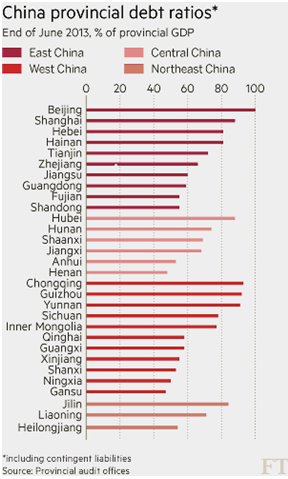

Despite saying that GDP met its goal, the reality is that the Chinese Central Bank further loosening the money supply, or, as some would say, “quantitative easing.” To differentiate their program from the US and Europe’s, we call it “QI” or to paraphrase Wikipedia, “Qi is the central underlying principle in traditional Chinese medicine and martial arts forming part of any living thing… frequently translated as “natural energy”, “life force”, or “energy flow“. The literal translation of “qi” is “breath”, “air”, or “gas”.” Given the explosion in the Chinese stock market (+34% YTD in USD terms), “hot air” or “energy flow” seems quite appropriate in this context. By the time April was over, the central bank lowered reserve requirements by 1% with further cuts expected in base interest rates and reserve requirements during the rest of the year. The last time the reserve requirements were cut by this magnitude was in 2008 at the depths of the financial crisis. This year, there have been two cuts already in the base interest rate and one in the reserve requirements. The other aspect of easier monetary policy is acceleration of refunding and possibly assuming of local and provincial government debts by the central government. As one can see from the chart to the left, a number of provinces on their own have debt ratios over 80% of GDP (i.e., just their debt, not included private or municipal debt). There has been a push to refinance this debt at the current lower rates but it may not be enough. Outright purchases of local debt or indirect purchases via banks may be implemented which would be the type of bond-buying QI program as so familiar in Europe and the US.

further loosening the money supply, or, as some would say, “quantitative easing.” To differentiate their program from the US and Europe’s, we call it “QI” or to paraphrase Wikipedia, “Qi is the central underlying principle in traditional Chinese medicine and martial arts forming part of any living thing… frequently translated as “natural energy”, “life force”, or “energy flow“. The literal translation of “qi” is “breath”, “air”, or “gas”.” Given the explosion in the Chinese stock market (+34% YTD in USD terms), “hot air” or “energy flow” seems quite appropriate in this context. By the time April was over, the central bank lowered reserve requirements by 1% with further cuts expected in base interest rates and reserve requirements during the rest of the year. The last time the reserve requirements were cut by this magnitude was in 2008 at the depths of the financial crisis. This year, there have been two cuts already in the base interest rate and one in the reserve requirements. The other aspect of easier monetary policy is acceleration of refunding and possibly assuming of local and provincial government debts by the central government. As one can see from the chart to the left, a number of provinces on their own have debt ratios over 80% of GDP (i.e., just their debt, not included private or municipal debt). There has been a push to refinance this debt at the current lower rates but it may not be enough. Outright purchases of local debt or indirect purchases via banks may be implemented which would be the type of bond-buying QI program as so familiar in Europe and the US.

Japan still is stumbling with the March retail sales down -9.7% year-on-year versus -7.3% expected. Sequentially, March sales were down -1.9% versus February. In April last year the sales tax was increased so we shall start to see better comparisons in the months ahead but keep in mind it is mostly optics. Fitch (who?) downgraded Japan’s credit rating from A+ to A, citing a lack of structural improvement in the country’s fiscal situation. The first of Japan’s idled nuclear power plants is clear to restart after a local court rejected the last court case blocking the resumption. Sendai 1 will begin to receive fuel in June with a start in July and full operation in August.

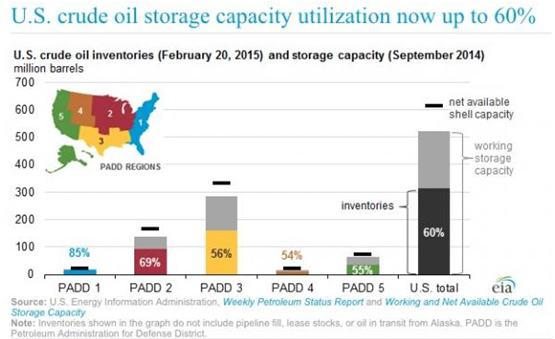

Elasticity and Other Concepts: The price of oil had over a 20% jump in April (basically from under $50 to almost $60) on the cutting of the operating oil rigs in the US as speculators anticipated an oil production slowdown. However, the number of rigs is reaching such a low point that further cuts would be small and uncertain. Also the number of completed but not fracked wells (AKA the fracklog) is holding underground another 300k barrels per day of production. EOG, the US’ largest shale oil and natural gas producer, said in their recent earnings call that $65 per barrel for new wells is profitable for them, indicating that there could easily be a production response in the near future on this price run-up. Looking at the amount of oil already in storage, one sees that it is plentiful and there is room for more in the key PADD 3 zone where there are the majority of the nation’s refineries (see graphic right). There is still suffering as the big oil service companies have announced further cuts – Baker Hughes another 3,500 jobs and Schlumberger an additional 11,000 positions. We saw the first mega-merger in the energy space as Royal Dutch Shell announced their takeover of BG Group for £47 billion, the biggest oil deal in more than a decade. Although BG is dwarfed by Shell in terms of employees (5,100 versus 94,000), its assets are substantial and strategic. The deal would increase Shell’s oil and gas reserves by 25% and production by 20%. Furthermore, the move places Shell as the largest foreign producer in Brazil as well as increasing its position as the largest liquefied natural gas producer at double the size of ExxonMobil. Is it a good deal? If oil moves back to over $70 per barrel, then the deal is considered breakeven so it makes strategic sense to me.

the big oil service companies have announced further cuts – Baker Hughes another 3,500 jobs and Schlumberger an additional 11,000 positions. We saw the first mega-merger in the energy space as Royal Dutch Shell announced their takeover of BG Group for £47 billion, the biggest oil deal in more than a decade. Although BG is dwarfed by Shell in terms of employees (5,100 versus 94,000), its assets are substantial and strategic. The deal would increase Shell’s oil and gas reserves by 25% and production by 20%. Furthermore, the move places Shell as the largest foreign producer in Brazil as well as increasing its position as the largest liquefied natural gas producer at double the size of ExxonMobil. Is it a good deal? If oil moves back to over $70 per barrel, then the deal is considered breakeven so it makes strategic sense to me.

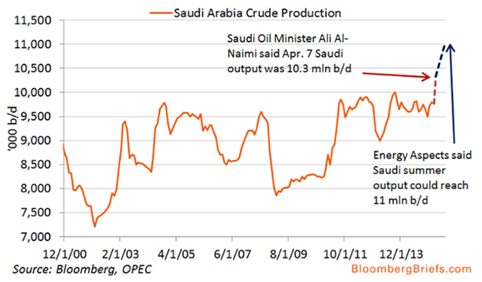

Outside the US, Saudi Arabia and the rest of OPEC are still producing at record levels, despite scattered calls for cuts. Saudi Arabia has plenty of currency reserves to spend on their oilfields. The number of Saudi rigs is up 15% over the last six months and output is poised to head further (see graph on the left).  Iraq announced that they exported the most crude oil in a month in thirty years in April (3.1 million barrels per day versus 2.8 million in March). The important Kirkuk pipeline that connects the Kurdish oil producing region to the export markets in Turkey is now functional, transporting 650k barrels per day (at capacity), up from zero six months ago. However, their largest refinery in Baiji is still the center of fierce fighting with ISIL. On the other side (geographically) of the ISIL fight, Assad of Syria is slowly losing ground as Saudi Arabia, Jordan, Turkey and Qatar are becoming more coordinated in their efforts to back specific rebel groups with training and weapons. ISIL also is keeping up the pressure on Assad while being pressured in Iraq. If Assad continues to lose ground and his backer Iran pulls out, then his regime is likely to collapse in a hurry. Something to watch this year.

Iraq announced that they exported the most crude oil in a month in thirty years in April (3.1 million barrels per day versus 2.8 million in March). The important Kirkuk pipeline that connects the Kurdish oil producing region to the export markets in Turkey is now functional, transporting 650k barrels per day (at capacity), up from zero six months ago. However, their largest refinery in Baiji is still the center of fierce fighting with ISIL. On the other side (geographically) of the ISIL fight, Assad of Syria is slowly losing ground as Saudi Arabia, Jordan, Turkey and Qatar are becoming more coordinated in their efforts to back specific rebel groups with training and weapons. ISIL also is keeping up the pressure on Assad while being pressured in Iraq. If Assad continues to lose ground and his backer Iran pulls out, then his regime is likely to collapse in a hurry. Something to watch this year.

In gold news, India’s imports of the shiny one more than doubled in March from the same period last year from 60 tonnes to 125 tonnes. While gold demand always spikes at this time as it is considered auspicious to give the metal during the key Hindu festival Akshay Tritiya as well as the traditional Indian wedding season, the move year-on-year is impressive. Venezuela on the other hand is selling, having received $1 billion loan backed by $1.7 billion in gold held as collateral (about 15% of their reserves). The interest rate was not disclosed. Kazakhstan continued its gold-buying spree with a 29th straight month of buying – its hoard has doubled over the last three years.

Best of investing!

David Burkart, CFA

Coloma Capital Futures®, LLC

Special contributor to aiSource

Additional information sources: Bloomberg, The Economist, Financial Times, New York Times, Politico, South Bay Research, Wall Street Journal and Zerohedge.