When an investor embarks on their managed futures journey, there is a lot of excitement and anticipation for the first several weeks. Whenever an investor is new to managed futures, they do not know what to expect on a day-to-day basis, therefore, they monitor the performance of their portfolio very closely, so they can fully comprehend how the investment works. During the process of comprehension, investors many times focus on the short-term performance of their portfolios, and lose sight of the historical performance of the portfolio that they chose to invest with (disclaimer: past performance is not indicative futures results). Good performance right out of the gate leads to overexcitement, and poor performance can lead to over analysis.

The most important thing to know as a new managed futures investor is that your portfolio performance for the first three to six months is completely unpredictable. There is no way to know how you will do in the short-term, and therefore it is important to stay invested with the long-term in mind.

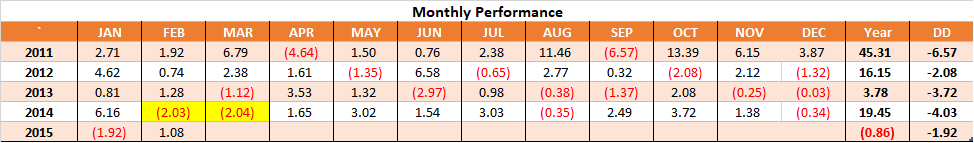

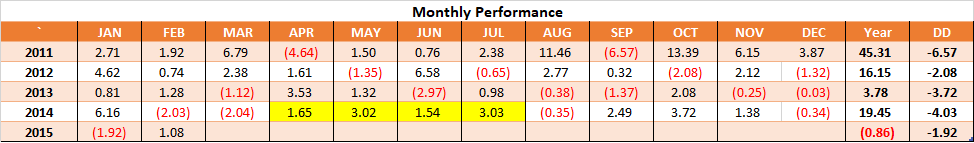

Let’s analyze the returns of a sample portfolio, and see how investing at different times makes a difference on performance:

There is substantial risk of loss in trading commodity futures, options and off-exchange foreign currency products. Past performance is not indicative of futures results.

Looking back with the benefit of hindsight, imagine if an investor had started investing in the above portfolio on February 1st, 2014. They would have experienced two consecutive negative months to start, and would have been -4.00% approximately as of the end of March 2014. Obviously the drawdown may have been larger intra-month in March, but the investor ended down -4.00% as of the end of the month (disclaimer: past performance is not indicative futures results).

Using the same return stream above, let’s see how things would be completely different if the investor began the investment in a different month (using hindsight again).

There is substantial risk of loss in trading commodity futures, options and off-exchange foreign currency products. Past performance is not indicative of futures results.

If the same portfolio had been deployed by the investor in April of 2014, they would have experienced four consecutive months of positive performance, and would have been +8.00% approximately by the end of July 2014. (disclaimer: past performance is not indicative futures results).

Clearly, neither illustration above paints an accurate picture of what should be expected over the long-term in the portfolio. Even six months is not long enough to allow law of averages to come into play, therefore, the longer you stay invested, the more true to history a return stream should be (disclaimer: past performance is not indicative futures results). In our opinion the short-term success of your portfolio is entirely based on luck, and there is no science behind predicting how you will fare in your first four to six months.

Furthermore, when deploying an investment into managed futures, an investor should have the portfolio advisor set realistic expectations of what to expect in terms of returns and drawdowns. If the portfolio is falling outside of the drawdown parameters in the initial months, then modifications are needed immediately.